FERS Go Bag: Mapping Retirement – Navigating the Landscape

Item 5: Mapping Retirement – Navigating the Landscape One of my favorite lines is from Alice’s Adventures in Wonderland by Lewis Carroll. It comes from

FERS Go Bag: Who Are You Going to Call?

Item 4: Who are you going to call? Come on, 1980’s babies, where are you: who are you going to call? No, who? Remember when

FERS Go Bag: FEHB – Your Best Benefit as a Federal Employee

Item 3: FEHB – your best benefit as a federal employee Federal Employee Health benefits are hands down the best benefits for federal employees—so good

FERS Go Bag: Your Official Personnel File

Item 2: Your Official Personnel File You need a complete and thorough copy of your Official Personnel File (OPF) in your FERS Go Bag—all of

Should You Retire at 60 or Wait Until 62?

Hello, at age 57 years and two months, I separated from federal service for a civilian job after serving 5.3 years and buying back 17.2

Can I Keep My Spouse’s FEHB Coverage in Retirement Without Survivor Benefits?

My wife is a federal employee and will retire next year. She is going to be 50 years old. I am going to be 58

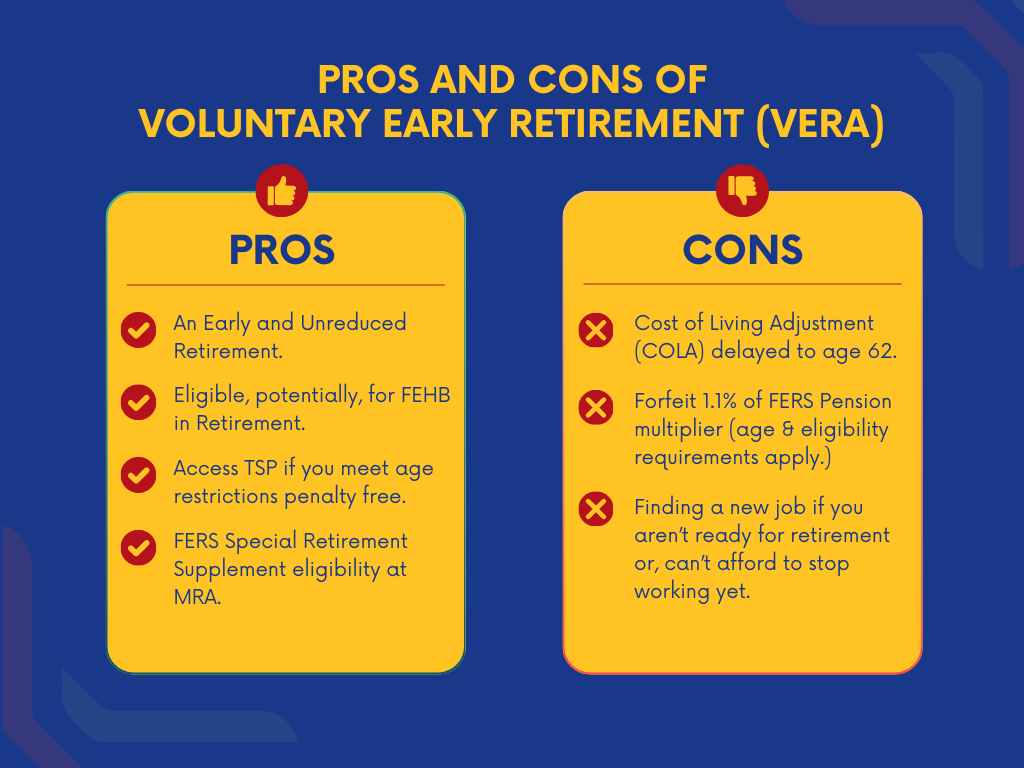

VERA-Retirement-Guide-Federal-Employees

Are you a federal employee considering Voluntary Early Retirement Authority (VERA)? This comprehensive guide breaks down eligibility, benefits, and financial impacts, including how VERA affects your pension, health insurance (FEHB), and Thrift Savings Plan (TSP). Learn the key steps to avoid costly mistakes, understand your FERS Special Retirement Supplement, and maximize your retirement benefits.

🎙 Watch our YouTube Podcast for expert insights.

📚 Join our “Retire Right” On-Demand Class to make informed decisions.

Read now to take control of your federal retirement!

Fork in the Road: Frequently Asked Questions

What should Federal Employees facing the Fork in the Road do? As a Federal Employee Benefits expert, my primary advice—though not intended to be self-serving—is

Fork in the Road: A Comprehensive Guide to Deferred Resignation for Federal Employees

https://youtu.be/EQqQhWMzTKs Federal Employees need to know what to anticipate if they choose to accept the Deferred Resignation package issued January 2025 to civilian federal employees.

Understanding Tax Implications for Survivor Benefits

Need help with federal employee survival benefits. I looking for specific help with my wife’s survivor FERS and Death Benefits. My wife worked for the

Does Buying Back Military Time Affect Your CRSC?

Hi, my name is Eric. I am calling because I have a question about buying back my military time. I am retired from the from

Understanding the Impact of Lump Sum Annual Leave on Your FERS Supplement

Hello. My name is Joyce and I am trying to determine the best date to retire either december 31st or january 11th 2025 at the