Sometimes this is simply called regular FERS Retirement or Voluntary Retirement. FERS Immediate Retirement is the most common type of retirement under the Federal Employee Retirement System (FERS).

You are eligible for an immediate voluntary FERS Retirement if you have the right combination of age and years of creditable service. There are three combinations of age and service.

To be eligible for FERS Immediate Retirement you must have at least…

- Reached your MRA with 30 years of creditable service (MRA+30) …or…

- Be at least 60 with 20 years of creditable service (60+20) …or…

- Be at least 62 with 5 years of creditable service (62+5)

So the sooner you started working for Uncle Sam (the more creditable service you have) – the earlier you can retire.

These are the minimums – so if you have reached your Minimum Retirement Age (MRA) and have 35 years of service that’s fine. You aren’t forced to retire when you reach your MRA with 30 years of service – but once you do you now have the option to retire if you also have enough creditable service.

If you meet these qualifications – you are eligible to start receiving your pension. (But be prepared – it might take many months to get your first check)

If you will have at least 20 years of creditable service and will be at least 60 years of age at retirement… you need to know about the 10% bonus for retiring at 62 with 20+ years of service.

“What if I Don’t Meet These Qualifications?”

If you haven’t met these requirements – you may be eligible for other types of retirement under FERS.

Be sure to check out MRA+10 Early FERS Retirement. I think it’s worth it to be familiar with all of the different rules for FERS Retirement – even if it takes some time. It’s always important to understand your options.

Visit our page that lists the most common types of retirement under the Federal Employee Retirement System – and see if you qualify for another type of FERS Retirement.

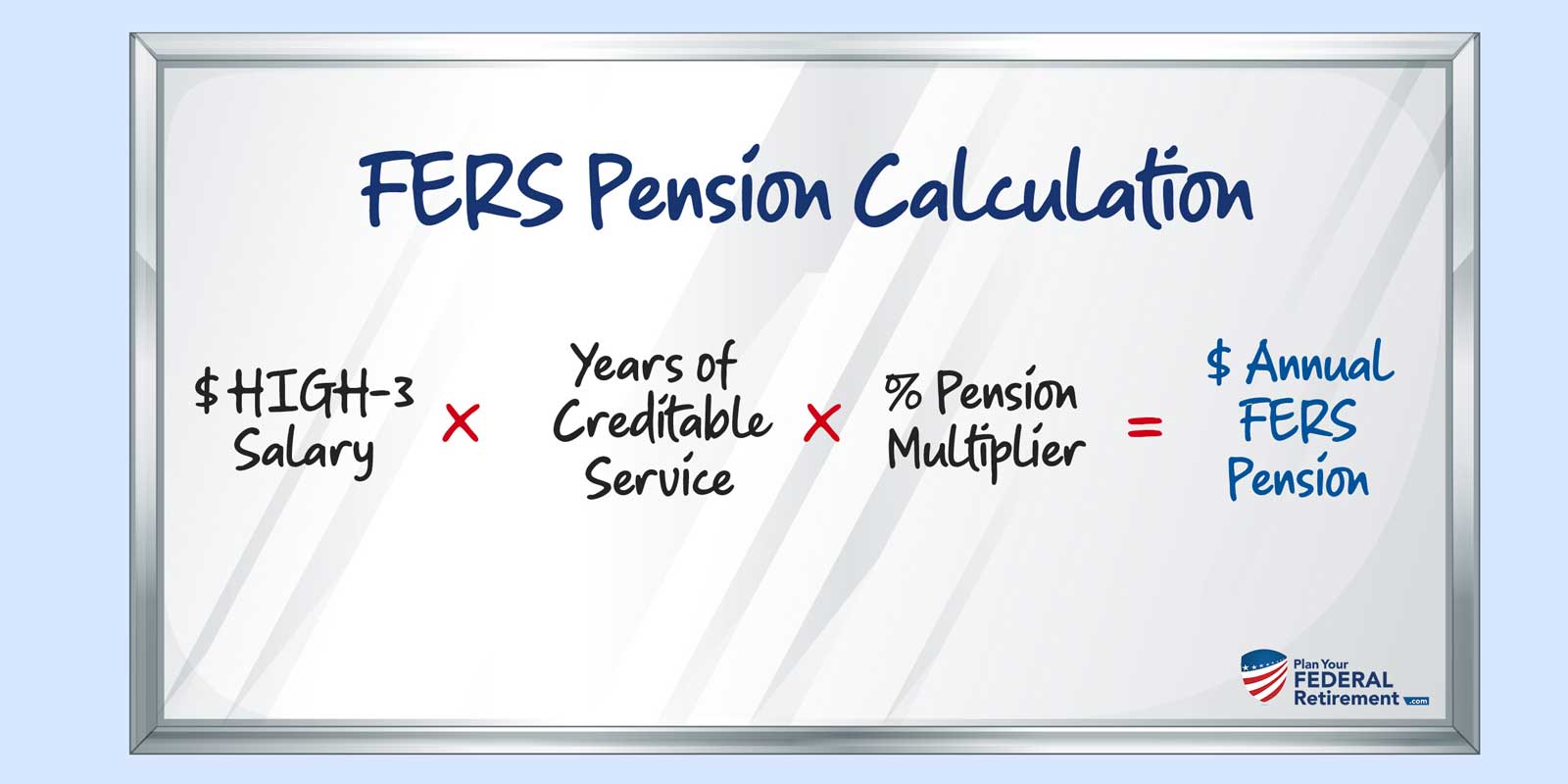

FERS Pension Calculation for Immediate Retirement

Your FERS pension is calculated based on three factors:

- Your High-3 Salary

- Years of Creditable Service and

- A Pension Multiplier (which here is 1%)

Here’s how they come together in the FERS retirement pension formula…

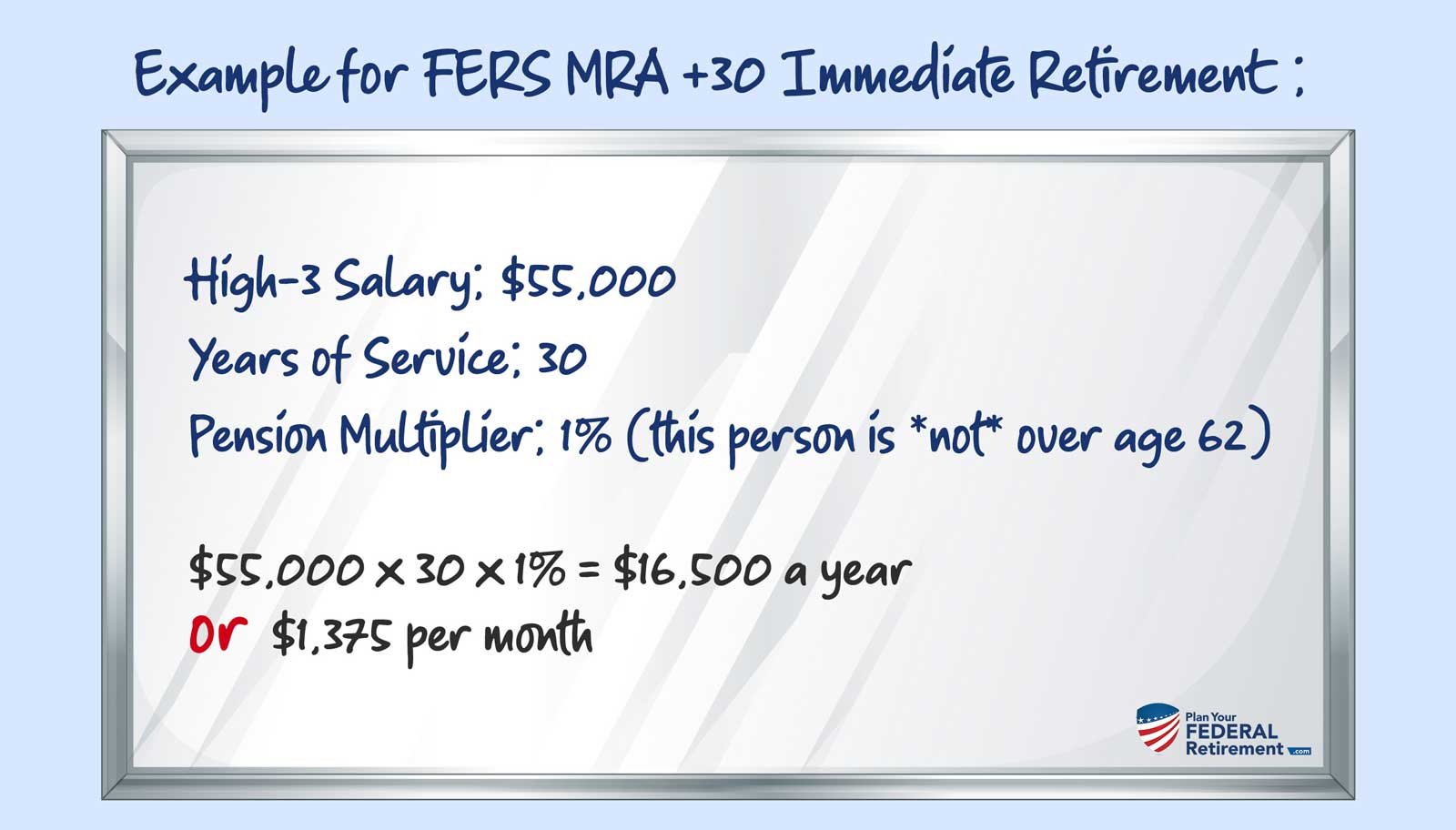

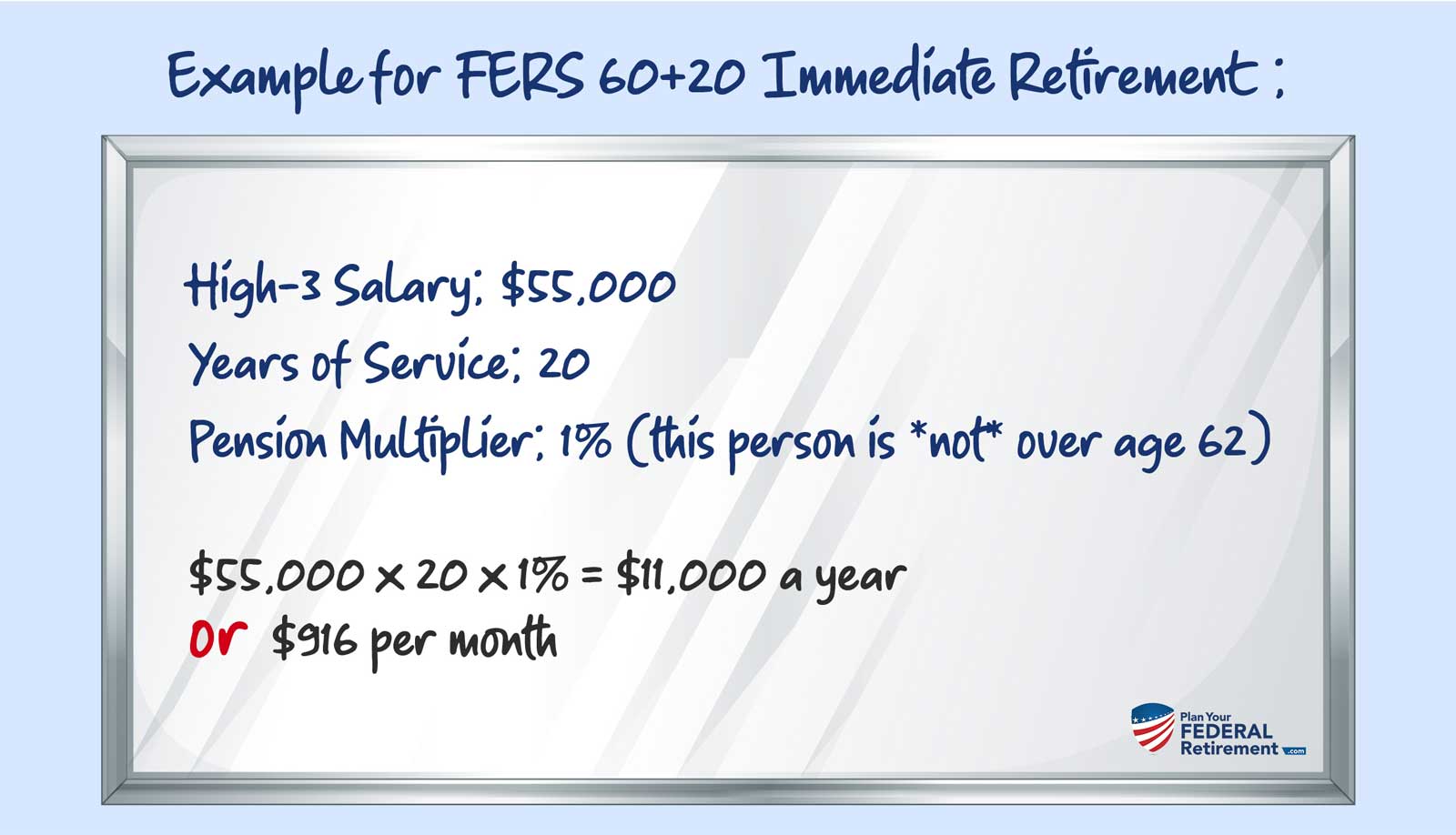

Now let’s look at a few sample FERS Retirement pension calculations for Immediate FERS retirement.

These all use the same formula listed above – but we’re just going over more examples of that same formula for different lengths of service. We’ll look at someone going out with MRA+30, 60+20, and 62+5.

***If retiring with 20 (or more) years of service an age 62 or older – your pension will be higher… learn more about the 10% bonus for 62+20 retirement.

***If retiring with 20 (or more) years of service an age 62 or older – your pension will be higher.

Example for FERS 62+5 Immediate Retirement:

High-3 Salary: $55,000

Years of Service: 5

Pension Multiplier: 1%

$55,000 x 5 x 1% = $2,750 a year

………………………………or $229 per month

Gross vs. Net Pension

We’ve just walked through a few examples of how your pension might be calculated. But it’s important to keep in mind that these figures are only talking about your ‘gross’ pension – not the ‘net’.

Your FERS pension will be reduced by the cost of a survivor annuity, FEHB, taxes and more by the time it gets to you. Learn more about the difference between your *Gross* and *Net* FERS Pension

To learn more about how your FERS pension is calculated – including how to determine your High-3 and your years of creditable service take a look at our main page about FERS retirement pension calculations.

When Do I Get My First Pension Check?

When you retire under Immediate Retirement – you are eligible to start receiving your FERS pension/annuity within 30 days.

Even though you *can* start receiving your check in 30 days… that doesn’t mean that you *will*.

I can tell you from my experience working with Federal Employees, it often takes several months to receive your first check. And it’s also important to know that your first checks will typically only be for 60% – 80% of the amount you’re expecting.

Find out how long you might have to wait for your first retirement check.

Planning Your Federal Retirement?

If you’re planning your retirement – then you know how complex the federal retirement system can be. There are so many rules, exceptions, and moving parts and pieces. It can feel overwhelming, but you can do it. Just make sure you understand *all* of your benefit choices *before* you separate from service.

We seen the mistakes that people (and even some professionals!) can make, and we want to help you avoid them. Click the button below to learn more.

7 CRITICAL MISTAKES

Federal Employees make

✗ Forgetting to check your beneficiary designations

✗ Expecting pension check to arrive in 30 days after retiring

✗ Not knowing the difference between SCD vs. RSCD

✗ Completing retirement paperwork incorrectly

✗ Failing to prepare financially for retirement

✗ Failing to understand tax consequences

✗ Getting bad advice

Click the button below and learn how to avoid these mistakes while planning YOUR retirement