“When Am I Eligible to Retire?”

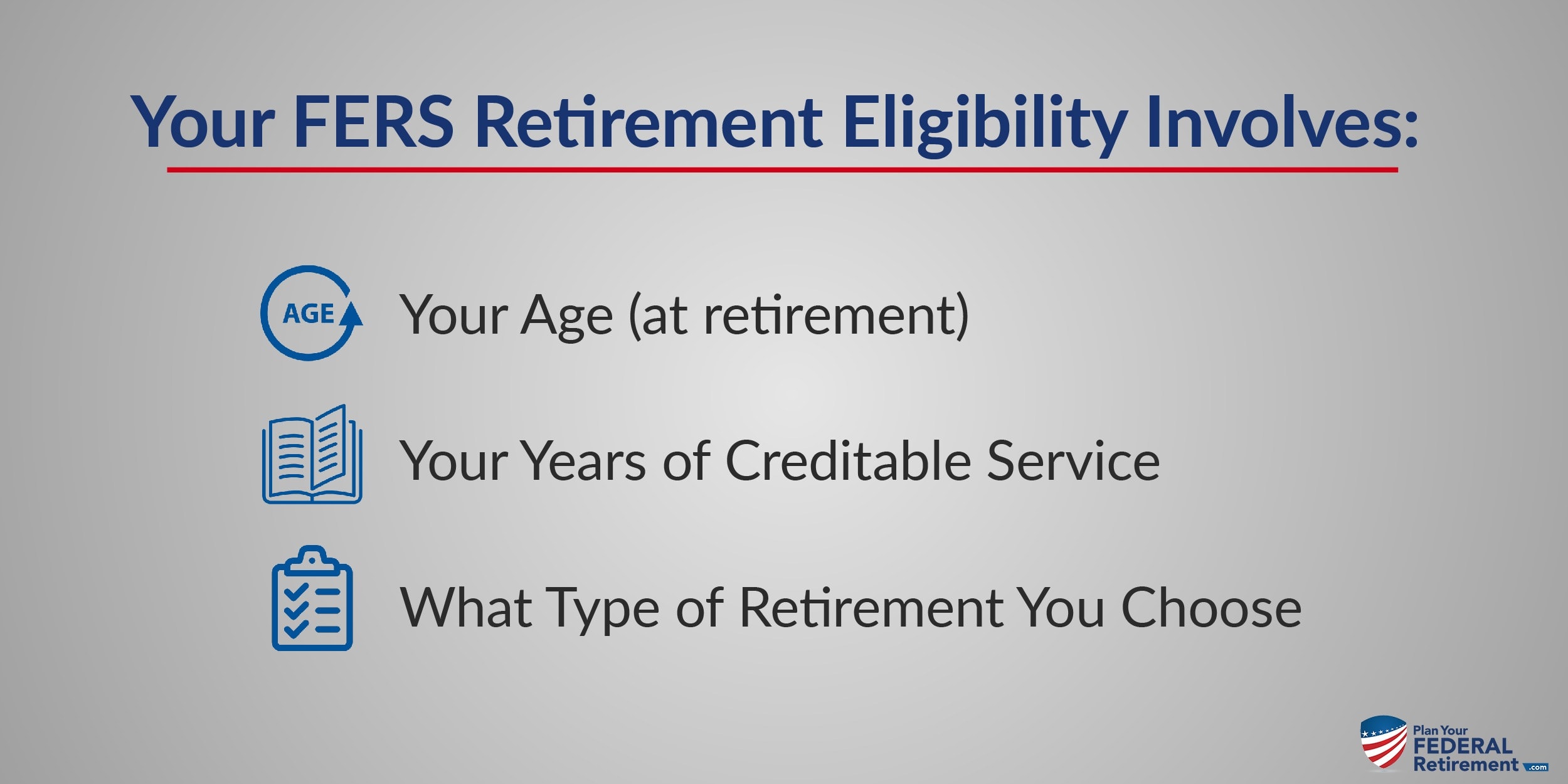

There are many different sets of rules for FERS retirement eligibility. Many federal employees start planning their retirement by calculating their pension. But before you try to calculate your FERS pension – the first question to ask yourself is “Am I eligible to retire?”

What age? …And how much creditable service?

That depends on the type of retirement rules you go out under. There are several different types of FERS Retirement, each with their own requirements of age and years in service. Let’s take a closer look at the rules for FERS retirement eligibility…

But First: What’s Your Minimum Retirement Age?

Several of the FERS retirement eligibility rules involve reaching your “MRA” or Minimum Retirement Age. Ex: having reached your MRA with 30 years of service.

MRA is a specific age between 55 and 57. And your MRA is based on the year you were born. So before we get into each type of retirement, it would be good to know your own Minimum Retirement Age (MRA).

Your MRA depends what year you were born in. Example: If you were born in 1950, your MRA is 55 years and 6 months. But if you were born in 1965, your MRA is 56 Years and 2 months.

While MRA is important to know – some rules for retirement do reference a specific age, ex: age 60 or 62. It’s just helpful to know what your MRA while we review the different types of retirement rules. Click here for more info on determining your own MRA.

FERS Retirement Eligibility Rules

Here are the most common types of retirement for the Federal Employee Retirement System (FERS):

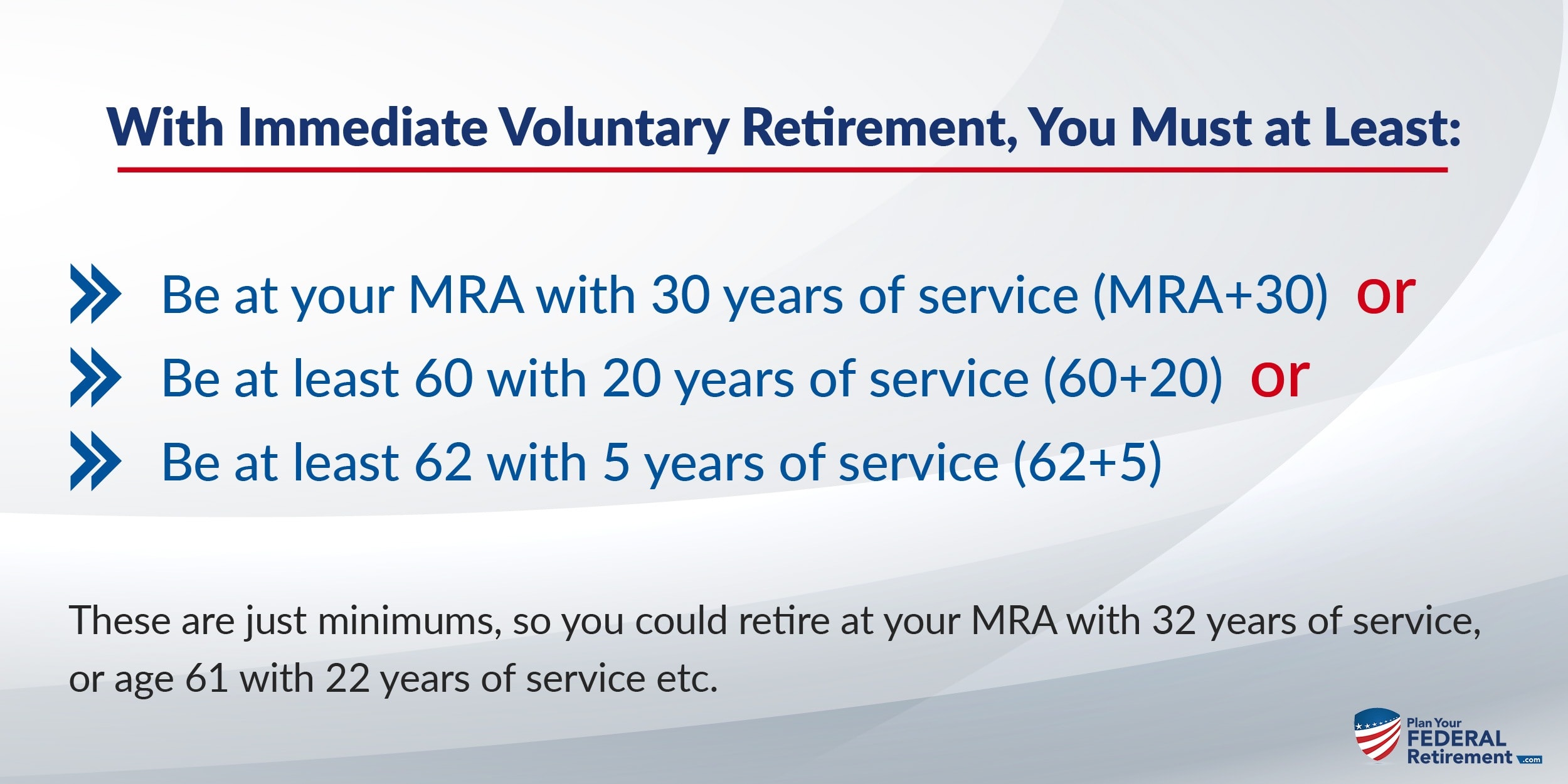

Immediate Voluntary FERS Retirement

You might also call this regular FERS Retirement. OPM calls this ‘voluntary’ retirement. We’re using the term immediate here to distinguish this type of voluntary retirement from postponed retirement and deferred retirement. If you qualify for immediate retirement, you’re eligible to receive your pension within 30 days (although odds are it will take months – so be prepared).

Immediate Voluntary FERS Retirement w/10% Bonus

If you retire at age 62 with 20 or more years of service, your pension will be calculated at a higher rate. Under the regular FERS retirement rules – your pension multiplier is 1%. But if you go out at age 62 (or later) with at least 20 years of service, your pension multiplier is 1.1%. That’s a 10% bonus on your pension.

Click here to learn more about getting a 10% bonus on your FERS pension for the rest of your life.

FERS MRA+10 Retirement

If you’ve reached your MRA, and have at least 10 years of creditable service, you can retire under MRA+10 rules. Sometimes this is called early retirement – but this is different from an ‘early out’. Let’s just call it MRA+10 retirement.

With MRA+10, you have the option to go out earlier than regular rules for FERS ‘immediate voluntary’ retirement. However, your pension will be reduced for every month you retire before age 62. The reduction is 5% per year (or 5/12ths of 1% per month).

Click here to learn more about FERS MRA+10 Retirement and to see examples of the pension reduction.

Postponed & Deferred FERS Retirements

Another alternative for those who qualify for an MRA+10 retirement, but don’t want to take the reduction in pension is a *Postponed* retirement. This is different from a *Deferred* retirement.

If you are looking to leave federal service before you qualify for a regular immediate retirement – you’ll want to know more about the*BIG* difference between a Postponed and Deferred FERS Retirement.

Early Voluntary FERS Retirement (Early Out)

If your agency is going through a Reduction in Force (RIF), you may be offered an Early Out Retirement. With this type of FERS retirement – the requirements are lowered to allow people who might not otherwise be eligible to retire to take advantage of an Early out… but you might be subject to a reduction… and you might not be financially prepared to retire.

Click here to learn more about Early Out Retirement.

Involuntary / Discontinued Service Retirement

There are different rules for involuntary retirement depending on the situation. Depending on your situation – and the choices you make – you may or may not be eligible for a pension. And there may also be times (as ironic as this sounds) that you can choose between a voluntary and involuntary retirement. There are so many details and exceptions here – that if this is your situation – you should carefully read and understand Chapter 44 of OPM’s CSRS / FERS Handbook.

- <h3 “=””>FERS Disability RetirementIf you have worked at least 18 months in Federal service and become disabled while working for the Federal Government, you may be able to retire (no matter your age) under a Disability Retirement.

Click here for more information on Disability Retirement.

Which Type of FERS Retirement is Right For You?

It’s worth your while to become familiar with the different types of FERS retirement eligibility rules. Especially *before* you retire.

You may be eligible for more than one type of retirement – and it’s important to choose the best set of rules for your personal situation.

Or perhaps you’re close to being eligible for a better set of rules – but you won’t know that unless you fully understand all of the choices.

For example: What if you’re currently planning on retiring with 20 years of service at age 61 1/2? Would you stay another 6 months in order to get the 10% bonus on your pension? Maybe… maybe not – but I think it’s always better to know your full options before you make your decision.

Another example might be if you’re thinking about separating from service before your eligible to retire. Maybe you have 9 years of service, and you’re a year away from your MRA. If you go out now – it’s true that you can do a deferred retirement – but you should know that if you stick it out one more year and separate you could go out on a postponed retirement which has the huge bonus of picking up FEHB again in retirement. But you can’t make that choice if you don’t know your options.

Thinking about Retirement?

FERS Retirement eligibility rules can be overwhelming – but they’re a critical part of your retirement plan. If you’re thinking about retirement, you’ll want to check our 7 Retirement Mistakes.

We seen the mistakes that people (and even some professionals!) can make, and we want to help you avoid them. Click the button below to learn more.

7 CRITICAL MISTAKES

Federal Employees make

✗ Forgetting to check your beneficiary designations

✗ Expecting pension check to arrive in 30 days after retiring

✗ Not knowing the difference between SCD vs. RSCD

✗ Completing retirement paperwork incorrectly

✗ Failing to prepare financially for retirement

✗ Failing to understand tax consequences

✗ Getting bad advice

Click the button below and learn how to avoid these mistakes while planning YOUR retirement

One Response

I am 66 yrs old with 33 yrs of service. Is that considered full retirement ?