“Just wondering if you ever give advice to widows/widowers. I believe we are in a unique situation that I seldom find addressed anywhere.” – Valerie

FERS Survivor Benefits: When You Lose a Spouse Who Was a Federal Employee

In this article, we want to address FERS Survivor Benefits and what you as a Widow/Widower should think about the first 12 months after you lose a spouse.

The loss of a spouse is devastating. Whether the death is sudden or a result of a long term illness, we are not prepared for the days that follow.

One day you are married and part of a “we”; a collective couple that planned and discussed things, together. The next you are a grieving widow or widower. The world rushes by in this state of perpetual motion and you feel like you’re submerged underwater just fighting to get to the top and breathe again.

There is this period of time when you lose someone that people want to be of use. It is overwhelming. They want to help. They walk-up saying things like, “I don’t know what to say,” or “They’re in a better place,” and, so on. And you smile, accept their condolences but in your heart, you want to scream things like, ‘No! A better place would be here, here with me!”

But you do not. Instead, you accept graciously and feel the weight of fatigue. You are tired.

Tired of carrying the weight of your own grief. Tired of the social pressure of needing to make the person trying to provide comfort, feel better.

Immediately following the loss is the “busy” work. The feeling that you need to “do” something. Those that want to help you through the situation begin to ask questions like,

This is the exact moment that you as the survivor need to enter into the Decision Free Zone.

Decision Free Zone

No permanent deicsions.

After a significant loss, no big decisions should be decided upon in the first twelve months. That is what the decision free zone is.

You may be thinking, “but I need to…”

There is an urgency that you need to “do” things after you lose a spouse. As Financial Planners, we are aggressive about ensuring our Federal Employee clients know that after a tremendous loss, they need to enter the decision free zone whenever possible.

You need to allow yourself to experience loss; to grieve. That is what you “need to do”. However, you do not need to make permanent financial decisions after losing a Federal Employee spouse.

No decisions that are irreversible. Do not sell the house or purge your home of your deceased loved one’s belongings. Do not make any other decisions that you will not be able to take back later.

Many times we visit with our clients who have very well intentioned friends or family members staying with them after the loss of their spouse so that they are not alone. Those friends and family members want to be of use so they offer to help in ways that they think are useful: like cleaning out your deceased spouses clothing from the dresser and closet.

I am not quite sure where the urgency others feel to purge the home from a deceased spouse comes from but it does come.

It is one thing to box contents up if that is what YOU feel, as the FERS Survivor, to do but not because others tell you that is what you need to do.

We have worked with our clients who have succumbed to the well intended actions of others who found that in the months to come, a small treasure or token was discarded that had sentimental value. This couldn’t be undone.

When your spouse passes, and they were employed by the Federal Government, there are some “things” that you can do.

Beneficiary Designations and Death Certificates

FERS Survivors will want to request multiple, certified copies of the death certificate. Anytime that you make a claim for the FERS Survivor Benefits you will need to enclose a certified copy of the death certificate.

We recommend that for simpler estates that have less than 6 financial accounts associated with them, that you request around 6 copies of the certificate. For estates that have more than 6 account(s) you will need 12 or more.

Assets transfer by Title first. This means that if the asset has a beneficiary listed, and they should, that your asset will transfer to that person first.

Even if you have a Will or Trust that states otherwise. Assets always transfer by title first.

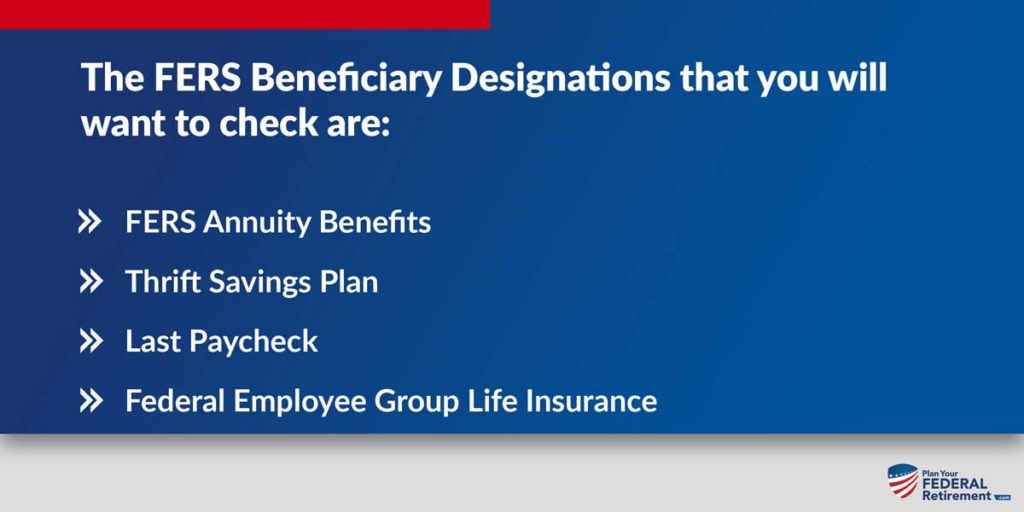

There are several beneficiary designations that are applicable to just FERS Employees.

FERS Survivor Benefits: Beneficiary Designations

FERS Employees have four main beneficiary designations that as a survivor you are going to want to check.

If your spouse has passed while employed under the Federal Employee Retirement System (FERS) and has been employed, with creditable service, you will qualify for the basic employee death benefit. These benefits can also apply to natural or adopted children in some situations.

The basic benefit can provide as much as 50% of the deceased’s salary as well as a one-time payment.

FERS Survivor Benefits Applying for Benefits

As a widow(er) there are two forms that you will want to complete to start the process with the Office of Personnel Management as well as your spouse’s agency.

Standard Form 3104

Standard Form 3104(B)

If your spouse was a retiree at the time of their passing, The Standard Form 3104 will need to be completed.

If your spouse was employed with the Federal Government at the time of their passing a Standard Form 3104(B) is to be completed.

This form will begin the process of establishing your FERS Survivor Annuity. The Office of Personnel Management (OPM) is to process the form and they do a phenomenal job of helping Widow(er)’s through the process.

While OPM is great at providing assistance that doesn’t mean that you should forget to keep a detailed log of who you talked to, what they said, and when you spoke with them. In case your point of contact changes, you will want to have good notes. So much is confusing during times of grief that it is imperative to ensure that you help yourself by keeping a good log.

Once you complete the SF-3104 forms, whichever may apply, you will begin to receive a litany of paperwork.

At that time remember, decision free zone – if you are still in it then make sure you speak with an unbiased, third party that is preferably a Financial Professional who works with Federal Employees. You will want someone who understands the benefits, your options and how to help you navigate through making decisions if you have to.

Just keep in mind, above all else, no irreversible decisions during the first 12 months. Give yourself a moment to come through the fog, to have time and perspective.

Nothing magical occurs after 12 months when you lose someone you love. The pain of losing a loved one is still there.

Once you exit the decision free zone, you can then make decisions with a little more distance from the blunt trauma of loss that occurs. You can make your own decisions, better understand what is right for you versus someone else’s opinion of what they think you are going through.

So, I guess Valerie to answer your question – we do give advice to Widow(ers). We do help them through the most difficult stages of their lives and better understand how to make decisions and more importantly, recognize when they shouldn’t.

If you want to avoid some of the mistakes that you can make during the retirement process, check out our 7 Retirement Mistakes.

We seen the mistakes that people (and even some professionals!) can make, and we want to help you avoid them. Click the button below to learn more.

7 CRITICAL MISTAKES

Federal Employees make

✗ Forgetting to check your beneficiary designations

✗ Expecting pension check to arrive in 30 days after retiring

✗ Not knowing the difference between SCD vs. RSCD

✗ Completing retirement paperwork incorrectly

✗ Failing to prepare financially for retirement

✗ Failing to understand tax consequences

✗ Getting bad advice

Click the button below and learn how to avoid these mistakes while planning YOUR retirement