“Hello. Thank you for providing such informative information. I am a widow benefit; at age 60 if I retire and can later switch to my higher SS benefit, am I still eligible for the Special Supplement? Even gov’t planners at my office don’t seem to know this answer. HELP! Thanks again. With kind regards,” – DeAnna”

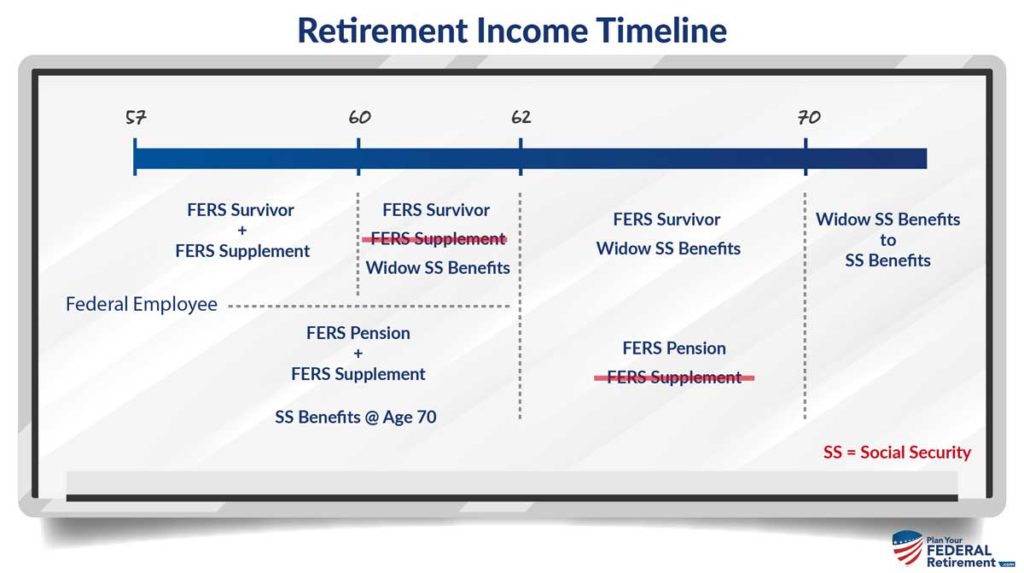

Retirement Income Timeline

DeAnna is asking a really great, complicated question. On the surface, the question seems rather easy but there are so many moving parts to it that often times it can leave people confused.

We have visited with so many widows(ers) that have been chasing answers about how their benefits work in conjunction with their deceased spouses that we completely understand DeAnna’s frustration, “HELP!”.

DeAnna, we hear you… loud and clear and you are not alone. We help Federal Employees who are having difficulty understanding how their benefits work in conjunction with their bigger financial plan: like coordinating social security benefits.

Let’s start by thinking of your life in a timeline. We begin at age 0 and we like to draw the plan all the way out to age 100.

Fast forward through years 0-29; as we hope you made just enough questionable decisions to put you on a good path in your later years. 🙂

Years 30-50 we are really in the thralls of our working lives. In some cases we are raising families, climbing ladders, buying homes and really trying to get our lives together.

Then, somewhere around age 50, we start really, really thinking about how we would rather not work forever. We begin to have friends and mentors retire from the workforce and it makes us start thinking about retirement planning. Not just theoretically but now we want to put pen to paper. We want to start developing a plan.

When we lose a spouse during this period of time, the retirement planning changes. The meaning, feeling of freedom and security begins to shift and makes us a little more uncertain how everything works. It can make us unsure if we are coordinating everything properly.

If we think about DeAnna (whose age I don’t know regrettably) as age 57 – she is in this retirement planning stage. With the loss of her spouse, that means she must now coordinate in addition to not only her benefits, but FERS Survivor benefits as well.

Money is constantly in motion and the coordination of benefits between agencies is difficult. It is difficult for one person to understand. Yet, DeAnna alone is trying to navigate that and what it means to be the “FERS Survivor”.

So let’s dive into an example and see if we can help answer the question.

Age 57 to 60 Retirement Income Timeline for FERS Survivor Benefits and Social Security Widow’s Benefits

In our example, DeAnna is age 57. She is a FERS Employee and is a widow to a former FERS Employee. Deanna is receiving her spouses FERS Survivor Pension but is also eligible to receive her spouses FERS Supplement.

Survivor FERS Supplement (Spousal Annuity Supplement)

If you’ve recently lost a spouse who was a federal employee, you may be eligible for a spousal annuity supplement. Here’s what you need to know:

Eligibility: You’re entitled if you’re currently receiving a spouse survivor annuity and are under 60 years of age. You should also be entitled to Social Security survivor benefits due to your spouse’s federal employment when you reach age 60, and not currently eligible for Social Security benefits based on your own disability.

Key Notes: If you’re entitled to Social Security benefits as a mother or father because a child is in your care, not applying for those benefits could affect your annuity supplement.

Your own Social Security earnings won’t affect your eligibility for the spousal annuity supplement.

Service Requirements: Your spouse must have had at least 5 years of credible civil service and one full calendar year of service under the Federal Employees Retirement System (FERS).

Important Considerations:

Service from January 1 to December 30 or 31 counts as a full “calendar year” of service. However, military service does not count towards this if there was also one full year of civilian service under FERS.

If your spouse was a disability annuitant, receiving a spousal annuity is still possible, unless they retired with less than 5 years of service. In such cases, you might be ineligible for the annuity supplement.

Not sure if you qualify? This is a great time to schedule one on one time with a FERS Benefit Specialist to go through your personal situation.

Social Security Widow’s Benefits

Widow(ers) are entitled to receive the FERS Supplement of their former spouse as long as the former spouse met their Minimum Retirement Age.

Many Federal Employees are eligible to retire from the Federal Government before they are eligible to begin their Social Security benefits. That is to say, the FERS Supplement is provided to those FERS Employees who meet the requirements up until they reach age 62 when they are first eligible to begin Social Security.

HOWEVER, the Social Security Benefits for Widow(ers) begin at age 60 – not age 62. Therefore, a Widow(er) who is receiving the FERS Supplement as a Survivor will continue to do so until they reach age 60. At age 60, they are eligible to apply as a Widow(er) with the Social Security Administration for benefits on behalf of their former spouse.

At age 60, you as the survivor can choose to claim your social security benefit or half of what your spouse’s social security benefits would have been. But because you are not able to turn on social security for yourself at age 60, your former spouses is higher by default.

HOWEVER, remember that social security is subject to earnings limitations. If you elect to turn on your Widow(er) social security income, then you are subjected to those earnings limitations. The earnings limitations are around $17,000 a year.

As a result, if you earn an income higher than the annual limit, then for every $2.00 above the earnings limit you make, the Social Security Administration will reduce your social security income by $1.00.

Your FERS Pension and Supplement After FERS Survivor Benefits

If you are a Federal Employee as well, then once you have reached your eligible retirement state you are eligible to receive your FERS Pension and your FERS Supplement.

If you are receiving FERS Survivor benefits, your FERS benefits are not impacted or offset. Therefore, you are able to receive your FERS Pension as well as your FERS Supplement.

As a FERS Employee, the FERS Supplement for you will begin when you retire with an unreduced immediate pension and will end when you reach age 62. At age 62 you are eligible to receive social security benefits at a reduced rate.

Social Security Widow(er) Benefits Planning From Age 60 to Age 70

One consideration that a survivor could make is to elect to take the Widow(er) Social Security benefits at age 60. For example, to delay your own social security benefits until age 70.

At this time they have reached their maximum benefit and then you can begin to draw your benefit and stop your Widow(ers) benefits.

This provides you, a FERS Survivor, with your Survivor Pension, Widow(er) Social Security Benefits, and your FERS Pension up until age 70.

At age 70, this provides you with your Survivor Pension, your Social Security Benefits, and your FERS Pension.

Federal Employees Make Mistakes

But YOU Don't Have To

- Forgetting to Check Your Beneficiary Designations

- Expecting Pension Check to Arrive in 30 Days After Retiring

- Not Knowing the Difference Between SCD vs. RSCD

- Completing Retirement Paperwork Incorrectly

- Failing to Prepare Financially for Retirement

- Failing to Understand Tax Consequences

- Getting Bad Advice

Click below and learn how to avoid making them yourself

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

One Response

I am retiring from federal service on December 30, 2022. I am 60 years old and plan to apply for surviving spouse benefits when I turn 61 on February 8, 2023. My wife’s social security payments at $1770 per month stopped when she died on 10/19/2019. I was informed that I could collect 75% of the gross amount for $1905 per month or $1428 per month. Would this amount be reduced if I collect more than $1000 per month from the FERS pension along with the annuity supplement? My annual salary is $54,574 and my service computation date is 06/20/1999. My sick leave balance is about 305 hours or 38 days of sick leave. What would the estimates be for what I would collect for retirement. in monthly payments?