“I am 66 and currently a full time federal employee. I have a two children under the age of 26. I would like to continue to provide them coverage under my BCBS federal health insurance until they become 26. If I retire and apply for Medicare Parts A and B, can I continue with my BCBS health insurance family plan once I apply for Medicare?” – Catherine

Retirement While Still Providing for Family Members

One of the challenging conversations that we have with our Federal Employee clients is when they are about to retire. They ask how they can balance their desire to be retired with the feeling to still be able to provide for their family.

When you are the person who has been financially supporting another, you are acutely aware the decisions you make regarding your career do not just impact yourself.

Those decisions have consequences for others too.

The last thing that you want to go into retirement feeling, is that you are no longer able to help your spouse or kids the way that you have before. That you are unable to provide for them.

Adults who have experienced illness, injuries or disabilities first hand, or through people they know, are profoundly aware of how important health insurance is to have and maintain.

Our children, “adult” or not, can be less aware of how important maintaining health insurance is.

Especially when they face paying a monthly premium.

Federal Employees often maintain coverage on their children until the age of 26, as allowed by the Affordable Care Act.

In this article we will discuss whether or not your dependents can continue FEHB coverage once you enroll in Medicare.

Federal Employee Health Benefits (FEHB)

The best benefit that you have as a Federal Employee is your Federal Employee Health Benefits (FEHB); we cannot say that enough. If anyone ever tells you to discontinue your FEHB, that should be the first sign they most likely do not understand Federal Employee Benefits.

Run away from this person. If you cannot run, back up slowly and do not take their advice.

There is always an exception to every rule. But we seldom see a reason why a Federal Employee who is eligible should discontinue their Federal Employee Health Benefits in retirement.

As a Federal Employee, you have a lot of flexibility to choose a health care plan that suits you and your families needs. You can choose from plans like:

- High Deductible plans that offer catastrophic risk protection with higher deductibles,

- Health savings/reimbursable accounts,

- Fee-for-Service (FFS) plans and their Preferred Provider Organizations (PPO) or,

- Health Maintenance Organizations (HMO).

The majority of Federal Employees that we work with elect to enroll in a Blue Cross Blue Shield (BCBS) health insurance plan. We often receive questions specifically related to whether or not a Federal Employee should continue their health care coverage with BCBS once they are eligible to enroll in Medicare.

We will make mention of BCBS here speaking to the majority. However, this will apply to any health insurance carrier you are enrolled with.

Medicare for Federal Employees Who Maintain FEHB

Medicare is a Health Insurance Program available to citizens of the United States who are:

- 65 years of age and older,

- People (selectivley) with disabilities who are under 65 years of age and,

- People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant).

Throughout your working career, as a Federal Employee or otherwise, you pay into Medicare via Medicare taxes. This is deducted from your earned income and will appear on your Leave and Earnings Statement.

If you worked for more than 10 years, then you have probably paid into Medicare sufficiently. Because of this, there will probably not be an extra cost when you apply for Part A at age 65.

Medicare consists of four major parts or “types of coverage” for enrollees: Hospitals, Doctors, Supplemental Coverage and Medications. It is important to understand the various parts because they comprise your overall medical needs. While Part A does not normally have a cost, the other parts have premiums associated with them.

Medicare Part A is referred as your Hospital coverage. Part A includes coverage for hospitals, hospice and skilled nursing facilities. You should think of this coverage as “brick and mortar”. Part-A covers the facilities mentioned above but does not include coverage for the doctors.

Medicare Part B is referred to as “doctor services”. Part B includes coverage for eligible physicians, outpatient care and some home health services. This coverage does cost and the premium is contingent on your income. Once you enroll, this will often be deducted from your social security income.

Medicare Part C is referred to as “Medicare Advantage”. Part C allows you to enroll in medicare plans for additional coverage. Participants can enroll in a Medicare plan of their choice. There is a premium for this coverage.

Medicare Part D is referred to as the “Drug Plan”. Part D includes prescription drug coverage. There is a premium for this coverage.

What is critical to understand about enrolling in Medicare.

Once you have retired, enrollment in Medicare Part A is mandatory. However, Part B, Part C and Part D are optional.

It is optional for you to chose to enroll. However, if you enroll late you can face severe penalties when choosing to waive this coverage.

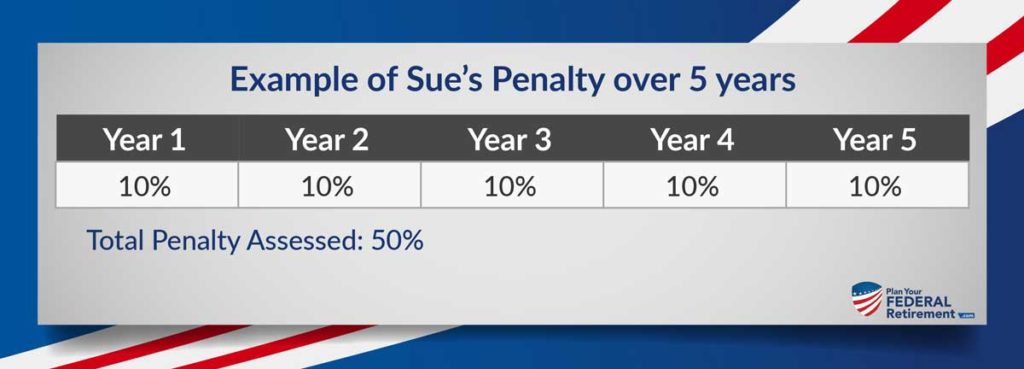

If you are eligible to enroll in Medicare Part B and elect not to, you will pay a 10% permanent penalty for each 12 month period you delayed enrolling. For. The. Rest. Of. Your. Life. As long as you continue Part B coverage, you have to pay the penalty for not enrolling.

Let’s look at an example of what a Federal Employee couple who elects not to enroll in Medicare Part B may run into:

Bob and Sue are ready to retire at age 64 from Federal Service. They are maintaining their FEHB in retirement.

At age 65, they enroll in Medicare Part A but elect not to enroll in Medicare Part B. They do not feel that they need the additional coverage. Since they are retirees and on a fixed income, they do not want to pay the premium expenses for the coverage. Besides, Bob and Sue have an active lifestyle and have been relatively healthy their entire lives.

At age 70, health care changes occur and modify covered physician and outpatient care expenses within their BCBS plan. While not debilitating, Sue has been experiencing some chronic illness that has left her not quite herself. Under their BCBS plan, Bob and Sue realize the outpatient care will not be covered.

They submit their medical bills to Medicare. The Medicare office informs them that they have Part A which covers hospitalization but does not cover their outpatient care. The Medicare office tells them they will need to contact BCBS for coverage.

Bob and Sue spend days calling and going back and forth with health insurance companies. One company told them to contact the other for coverage. It is then that Bob and Sue came to the realization that the outpatient care Sue needed will not be covered by either.

Sue contacts the Medicare office and they inform her that yes, the outpatient care will be covered under Medicare Part-B.

After Bob and Sue talk they decide they need Part-B. They will have to adjust their monthly expenses to cover the Part-B premiums which they think is manageable.

While on the phone with a Medicare representative they are informed the premium is now subject to late enrollment penalties. This is due to Sue waiving the coverage when she was first eligible at age 65. For each year Sue waived coverage, she is subject to a 10% penalty.

It is critical to understand how Medicare and your FEHB benefits work together. Even if you have FEHB as a Federal Employee and choose to maintain that coverage into retirement.

Do not be “penny wise and pound foolish” when it comes to making permanent, financial decisions.

FEHB Eligibility

As a full time Federal Employee, you are eligible to enroll in FEHB. There are exclusions for some positions, including part time and intermittant employees.

If you meet the requirements to do so, as a retiree, you are eligible to maintain FEHB throughout your lifetime. The requirements to maintain FEHB in retirement are:

- You must be eligible for an immediate pension (annuity) and,

- Been continuously enrolled in FEHB for 5 years prior to your pension (annuity) starting.

Federal Employees frequently ask us if their continuous coverage counts if they have been enrolled as a spouse. The answer is yes. As long as you have been enrolled under FEHB, as a participant or a spouse, you are eligible to maintain FEHB coverage in retirement.

FEHB Continuation of Coverage for Family Members In Retirement

Under the Affordable Care Act (often referred to as “Obamacare”) children, until the age of 26, are permitted to remain insured under their parents health insurance coverage.

A child dependent is defined as:

- Legally adopted children,

- Recognized natural (born out of wedlock) children and,

- Stepchildren.

To qualify as a step-child, a couple must be legally married. Domestic partnership does not qualify a dependent for eligibility for coverage in FEHB if the child is not naturally born to the Federal Employee.

FEHB Continuation of Coverage for Family Members Once You Enroll in Medicare

It is necessary for a Federal Employee who continues FEHB into retirement to enroll in Medicare Part A and elect in Part B, C, or D coverage.

Minor children, under the age of 26, will not lose their health care coverage. However, this is only if you enroll in Medicare and remain enrolled if FEHB.

If you have a FEHB Family Plan and maintain the coverage, the coverage for your family remains the same after you enroll in Medicare.

Health Insurance companies, like Blue Cross Blue Shield, offer Medicare plans that you will most likely not want to consider if you are maintaining a family plan in retirement. These plans do not normally make sense for a family with a younger spouse and/or dependent children but are designed to work complimentary to Medicare.

One Response

My spouse is the federal retiree and also 65. He carries BCBS to cover me, I am younger and serves as a supplement for him with Medicare. Our costs for premiums, I am sure is more than we would pay when we are both on Medicare with a supplement. Can we have separate specific insurance coverage?