“I am so grateful that you put your information out on podcasts and email. This really benefits the federal govt employee and I share your information on these topics all the time, I entered the US Army Reserves in 1991 and then entered the US Government as a civilian in 2003. At that time when I did enter government service I did buy back about a year’s worth of active duty time from the Reserves. Now I am retired from the US Army Reserves in 2021 with 30 years and won’t collect my retirement until I am 60. In the meantime I have been a fulltime US government civilian for the last 20 years while I was serving in the US Army reserves. Does it make sense to buy back my additional reserve time from 2003-2021 since I have been in the government. Am I even allowed to buy back US Army reserve time while being in the federal service at the same time? Thank you” – Jeff.

Does it make sense to buy back my military time now that I am a Federal Employee?

If you have military time but do not receive a military pension, you can buy back your military time to count towards your creditable service for federal retirement.

What is a Military BuyBack for Federal Employees?

Before working as a civilian for the Federal government, you may have had time in the United States Armed Forces (military). Many military personnel are discharged from service before eligibility for military retirement.

If you were in the military but do not receive a pension and take a position with a federal agency, you can most likely make a military service deposit or, “buy back your military time.”

Why should I buy back my military time?

You earned it! Just because you left service before receiving a military pension does not mean that you should allow that time to go by the wayside.

When you buy back your military time, you can Retire Earlier from Federal Service and/or Increase your FERS Pension.

Buying your military time back counts towards your years of creditable service. It doesn’t, of course, change the age that you can retire. Having 10 years of military service won’t turn you from age 47 to age 57, but it could mean you go from 10 years of creditable service to 20 years of creditable service.

How does buying back my military time increase my pension?

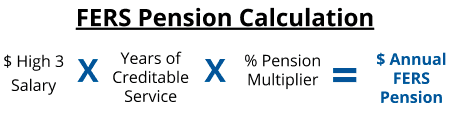

Your FERS Pension consists of:

- Your High-3 Salary

- Years of Creditable Service

- Pension Multiplier

FERS Retirement Pension Formula

When you add your Years of Creditable Service to your FERS Pension Calculation, having purchased your military time back, you can potentially increase your annual FERS Pension amount.

What will it cost me to buy back my military time?

We seldom see scenarios where it would not make financial sense to buy back military time. However, cutting a check to make a military service deposit will cost you.

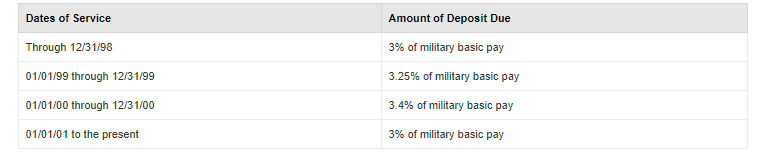

In order for you to purchase your military time, the calculation will depend on your dates of service.

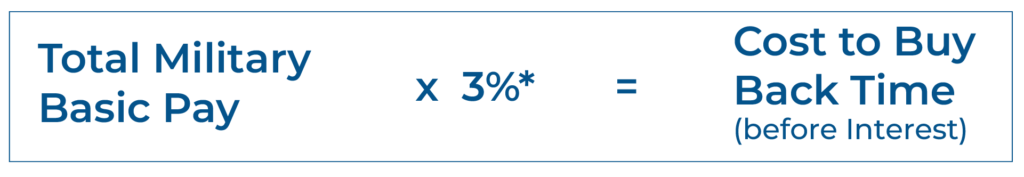

The formula to calculate your military buy-back is:

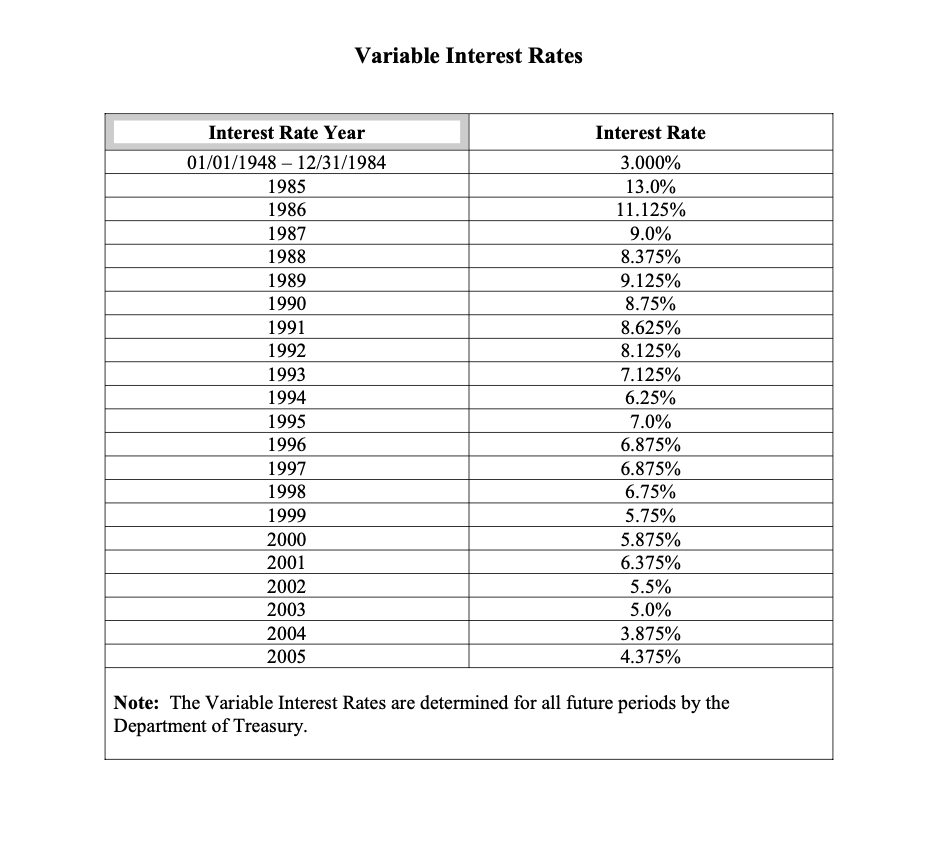

What interest rate will I be charged to buy back my military time?

The variable interest rate that you will be assessed, is determined by the Department of the Treasury. Here is an example of some historic rates:

How to buy back your military time or, make a deposit for military service as a Federal Employee.

As a federal employee, you can make an Application to Make Service Credit/FERS by completing Standard Form 3108.

We recommend making a deposit for military service as a Federal Employee sooner rather than later. First, the sooner that you make your deposit the less the interest accumulates. Secondly, waiting until you’re within 6-12 months of retirement could be problematic. It takes time to verify your request and approve your application. If you wait until you’re close to the date that you are going to retire, you could experience delays.

Note: The office of personnel management cannot send you, your pension until AFTER your Application to Make Service Credit/FERS (military buy-back) is compelted.

If I was in the Reseces, does my military time count towards my retirement?

Your time as a Reservist could count towards your federal employee creditable service time for pension benefits. The Uniformed Services Employment and Reemployment Rights Act of 1994(USERRA) covers individuals who perform duty in the “uniformed services” such as the National Guard, Public Health Service, etc.

Your agency will calculate your deposit based on your military earnings or, alternativley the deposit can be calculated based on the retirement deductions the employee would have paid on the civilian salary during that same time period if it is less.