“I have been working in the federal system for 3 years and will retire within the next 5 years. I am 62. I have a good amount of money in the 403b from my previous employer, 25 years’ worth. Are there any disadvantages/advantages in rolling over my 403b into the TSP? Thank you for your time and podcast!” – Dee.

Did you ever think that you would have SO MANY financial accounts? Or, that your personal financial situation would become so complex?

Checking Accounts

Savings accounts

Brokerage accounts

401(k) and/or 403(b) accounts

IRAs

ROTHs

TSP

HSA

FSA

Money Market

Credit Union

How many accounts should you have as you enter retirement?

Many Federal Employees we work with know that retirement will be a significant change, and they want that process to be as simple as possible.

What surprises most Feds when they retire is the adjustment to ONE payment from OPM. While working, most Federal employees are paid every two weeks. Every two weeks, they log into their bank account and see their paycheck is deposited. When you retire from federal service and are eligible for a pension, your pension by OPM once a month.

This little detail can be a big adjustment for federal employees when they retire.

Additionally, more than their FERS pension may be required to cover their monthly expenses. If your FERS Pension doesn’t cover your monthly expenses in retirement, you will need to identify what that shortfall is. We call this your retirement income “gap” – the difference between what you earn in retirement and what you need.

Retirement income gaps are oftentimes filled with personal savings from retirement accounts.

Many federal employees have several retirement accounts and need help knowing which account to withdraw money from.

Not only do federal employees need to identify their retirement income gap and determine which retirement accounts to use to fill that gap, but they also need to be mindful of the tax ramifications.

Should you consolidate retirement accounts?

Before you consolidate retirement accounts, you must first assess potential tax implications.

One of the greatest myths that retirees believe is that their taxes will be lower in retirement. This is only sometimes true for everyone.

As a federal employee, you should have a 10-year tax plan as you approach retirement. By determining what your retirement income gap is, your resources to fill that gap, and the tax implications of taking funds out – you will be able to make finanical decisions that do not jeopardize your ability to live comfortably in retirement.

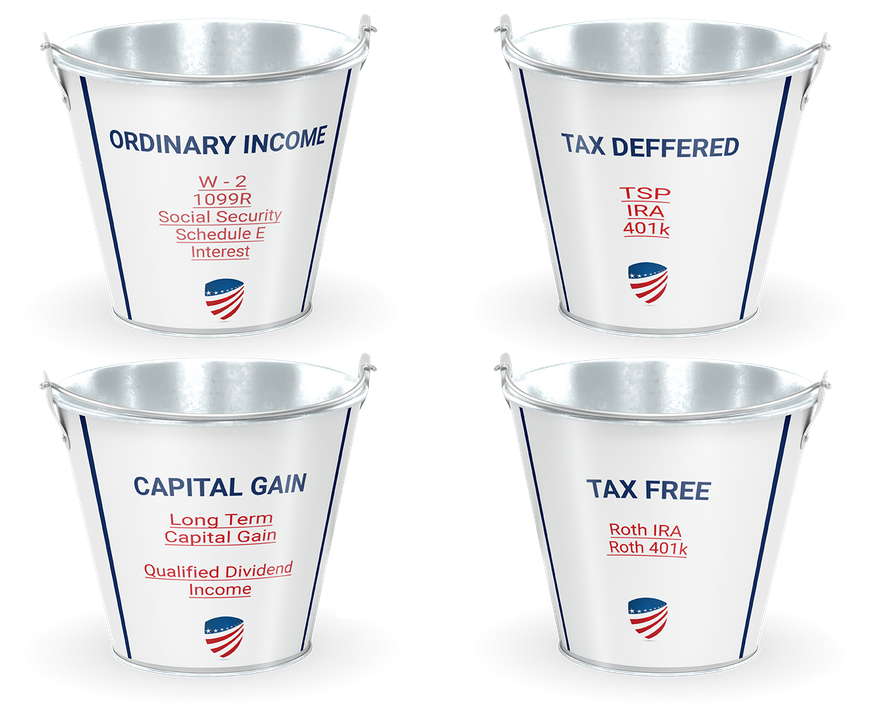

There are four types of tax categories that every federal employee should monitor:

Tax-Deferred Accounts in Retirement

As a federal employee, you must remember that a significant portion of your retirement savings was placed in the Tax Deferred category.

As a federal employee, you can delay paying taxes for some future period by deferring your salary into the tax-deferred account in the Thrift Savings Plan. While different, 401(k) and 403(b) plan work similarly because you can defer the taxes until later, when you withdraw the money. At the time in which you make a withdrawal from the tax-deferred retirement account, that money is subject to ordinary federal income taxes at the tax rate you are in for that year.

If you have contributed most of your retirement savings into tax-deferred accounts, understanding the withdrawal strategies is critical to your long-term financial success.

Too often, we have seen retirees make irreversible decisions about their TSP without understanding the tax consequences.

Should you Rollover your TSP?

Words are important. While some words seem like they same as others, they are not always synonymous.

This is one of the reasons that when we help federal employees plan for the retirement, we want to be very careful about the words that we are using.

There is a difference between an annuity and a pension.

There is a difference between a postponed retirement and a deferred retirement.

There is a difference between a Rollover and a Transfer.

What is a Rollover?

A rollover of a financial account is to extend a financial agreement. When it comes to retirement accounts, a rollover is often used to describe the action taken when you take funds from one retirement account and deposit them into another retirement account.

We have had federal employees share their stories, in which they have been dramatically financially impacted by the consequences of not understanding the difference between asking the TSP office to do a rollover vs. a transfer.

Many federal employees have elected, once they are retired, to move their TSP to an Individual Retirement Arrangement (IRA) because of the greater flexibility that IRA’s allow for. The TSP is a phenomenon tool during your accumulation stage but often times lacks the flexibility that retirees need when their retirement income comes from their pension and personal retirement accounts, like the TSP.

For example, if Bob’s TSP has $500,000 in it and he calls the TSP office to request a Rollover to his IRA here is what is going to happen.

The TSP cannot provide Bob with financial advice. To provide people with financial advice, you must be licensed to do so. The TSP office is going to do exactly what Bob requests because it’s Bob’s account.

When Bob initiates the rollover of $500,000 to Bob’s IRA, the TSP office will withhold $100,000 (20%) of Bob’s TSP money and send that to the IRS as an estimated payment. The TSP office is required to withhold 20% and send it to the IRS, you cannot opt out of this action.

When Bob receives his TSP check in the mail, he will have a check made out to him for the amount of $400,000 ($500,000 less the $100,000 in taxes as an estimated payment).

Bob then has 60 days to deposit the check into his IRA. The amount that Bob needs to deposit into his IRA is $500,000. If he does not deposit all $500,000 (even though $100,000 was sent to the IRS), he will be taxed on the amount that he did not despoil. Bob will pay ordinary income taxes on whatever amount less than $500,000 he deposits.

This is how easy it is to make a mistake in retirement that can have significant impact on your long term financial planning.

The TSP is a tool. An IRA is a tool. You need to know how and when to use those tools and your strategy and the words that you use, matter.

Difference between a Rollover and a Transfer

A transfer is different from a rollover. A transfer is when one custodian transfers money to another custodian.

When a transfer takes place, the custodian is not required to withhold money to send to the IRS because you as the depositor are not in receipt of those funds.

With a Rollover, the check was mailed to you personally. The IRS wants to ensure that you pay taxes so they require the TSP to withhold 20% as an estimated tax payment. Be mindful that 20% is an estimated tax payment. If you are in a higher tax bracket, your tax liability could be higher.

With a Transfer, the funds are transferred institution to institution.

When we help the federal employees that we work with design retirement plans, we like to be involved in this process. Having someone help guide you through complex topics like account consolidation in retirement can make or break your financial plan.

Account Consolidation in Retirement

Upon retiring, many federal employees like to streamline their retirement as much as possible. For many, this means consolidating their accounts so that they have less to monitor in retirement.

When we work with Feds to consolidate retirement accounts, we want to make sure that we are doing so around tax planning and retirement income goals.

If we can start by indemnifying what your gap is, determine what your taxable situation is currently and could be in the future then we have a better understanding of which “lever to pull and when.”

No one works their entire lives to build a complex retirement plan. Consolidation could help but only if your layering that with an overall tax planning strategy as well.