“If I started in the NAF system in 1996 and then converted to GS in 2008 we were told it would count towards retirement. From doing my research only my GS time will count. Thank you was trying to figure out my pension” – Jeanne.

If your FERS Pension is 30% LESS than you estimated, what changes would you need to make to your daily life?

Federal Employees too often enter retirement anticipating that their pension income is going to be far higher than it is. Over-estimating your retirement is 100% avoidable if you take these important steps first.

As a Federal Employee, here is what you absolutely must do to accurately estimate your FERS Pension income – BEFORE YOU RETIRE.

Terms You Need to KNow to Calculate your FERS Pension

In this article, we are doing to talk about a few key terms. In order for you to have the best understanding of those terms, we want to take a moment to define them before you read further:

- “Annuity” – The Office of Personnel Management refers to your pension as an “Annuity.” Because there are several insurance products in the private sector called annuities that we do NOT want you to confuse your pension with, we call your pension just that – a pension.

- “High Three” or “High-3” for FERS: Your “high-3” average pay is the highest average basic pay you earned during any 3 consecutive years of service. For most Feds, these three years are usually your final three years of federal service but may not have to be.

- Creditable Service: This is the time that actually counts towards your pension benefits. Do not confuse this time with your service computation date (sick leave), which is calculated differently.

How to Calculate your FERS Pension

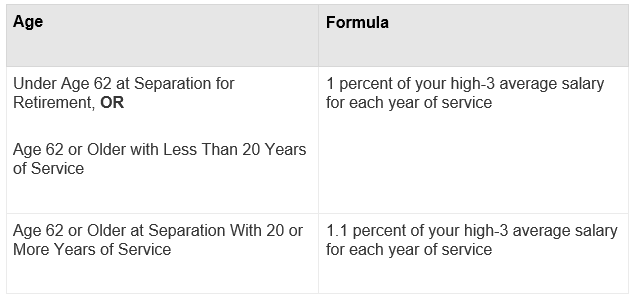

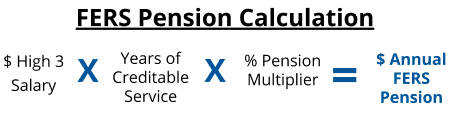

Formula to Calculate Your Non-Disability, FERS Pension:

Your FERS Pension / Retirement Income Calculation

Your gross FERS pension is calculated based on three things…

- Your High-3 Salary

- Years of Creditable Service

- Pension Multiplier

To calculate your FERS Retirement Income, you take the:

Retirement Pro Tip: Before you retire, obtain a copy of all of your Standard Form 50s from every agency that you have worked for.

Your creditable service is the most complex part of the FERS pension calculation.

How does OPM calculate your creditable service?

By looking at your SF-50s.

You get an SF-50 each time there is a change in your job or pay. You get at least one SF-50 a year, but sometimes more. If a problem with one of your SF-50s or one went missing, it will impact your creditable service, which could impact her retirement income, like in Jeanne’s situation.

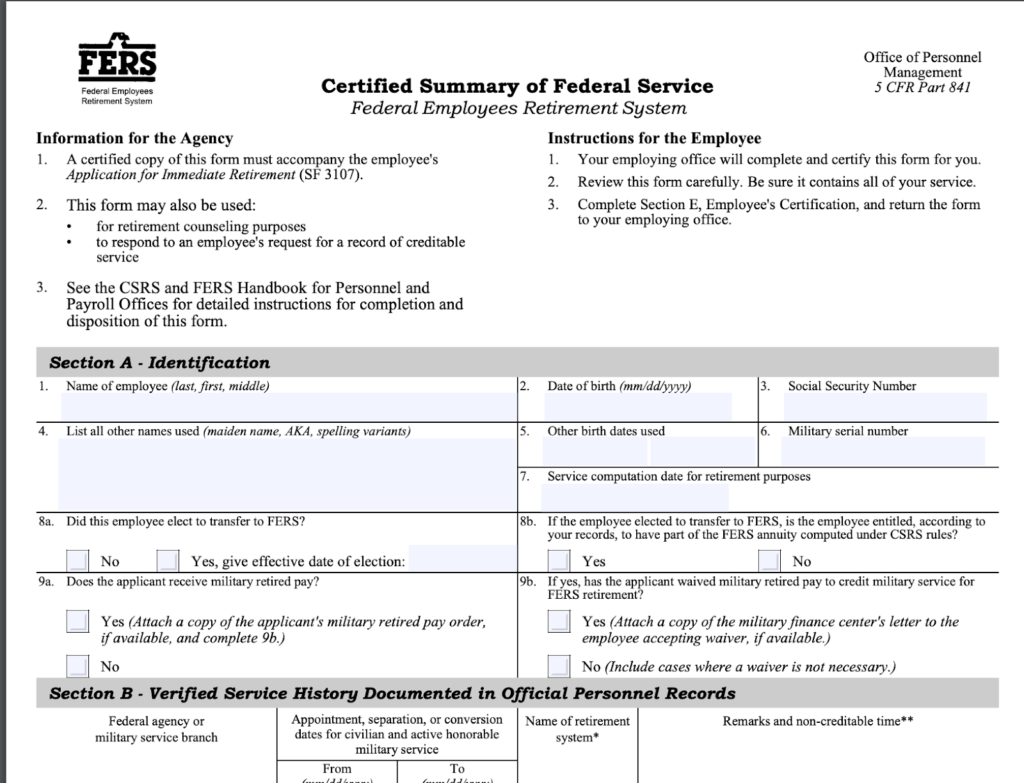

How to get a copy of your Retirement Service Computation Date

If you are a Federal Employee and would like to review your retirement service computation date, according to the Office of Personnel Management has down you can request a Certified Summary of Federal Service from your Human Resources department.

Even if you do not plan to immediately retire the form is used, “to respond to an employee’s request for a record of creditable service.” Give your HR some time to complete your Certified Summary of Federal Service Form; it can take them several days to complete if not a few months.

Pro Tip: do NOT fill this form out yourself. You already know what your service history is, we want to make sure what you know about your service history and what OPM has down are aligned.

Once you have your Certified Summary of Federal Service Form returned, you can see what OPM has down as your Retirement Service Computation Date.

Definitively knowing your Retirement Service Computation Date is how to avoid miscalculating what you anticipate your retirement pension benefits to be once you retire from Federal Service.

If you have questions about your Federal employee benefits and want to schedule a time to discuss them with one of our federal employee benefits specialists, please schedule your appointment here.