“I will retire in 2021 at 59 1/2 with 31 years of service. My pension will be over $4,000 a month and I have no bills but, I currently rent in DC. I have almost $500,000 in my TSP right now and I would like to move to FL or SC.

Would it be a smart move to take up to $225,000 out of my TSP to buy a home and not have a mortgage or should I not touch that money when I retire?

I wasn’t planning on using it right away but the idea of a mortgage in retirement makes me nervous. Thank you.” – Debbie

If my mortgage is $300,000 and my TSP is >$300,000 shouldn’t I just pay it off with my retirement savings?

On the surface – this seems like a pretty simple equation in which you take one pot of savings, your TSP, and pay off one large piece of debt, your mortgage.

Often, the example we get from clients is something like this:

$300,000 TSP Balance

-$300,000 Mortgage

$0.00 Balance

Using your TSP to pay off your mortgage can cause intended tax consequences that can be hazardous to your wealth.

Making room for Aunt IRS

As a Federal Employee under the Federal Employee Retirement System (FERS) your source of retirement income is a “three legged stool”

When you consider these three legs of your retirement:

- FERS Pension,

- TSP and,

- Social Security Income

You need to consider which of these are taxable?

As a Federal Employee, your traditional TSP is tax-deferred. For this, we are not talking about any ROTH Contributions, just your traditional TSP with yours and your employers contributions.

That means, the monies accumulated in this investment have not yet been taxed.

When you made a contribution (put funds in), to your traditional TSP, you did so on a pre-tax basis.

This is often done so that you have less taxable income during your working years. This is also a good tax planning strategy for some people.

Here is a simplified example of what that could look like:

Example: $100,000 base salary.

– 18,000 Employee Contributions to a Traditional TSP

= $82,000 Taxable income on your W-2

As those funds within the account grew, they did so on a tax-deferred basis.

[Roth TSP contributions are different as they are taxed when you make the contribution (so no tax deduction) however the growth of the Roth TSP investments grows tax-free if you meet certain rules.]

Look around the dinner table tonight and see if you set a place for your beloved Aunt IRS ( otherwise known as the Internal Revenue Service).

You may not have thought about her yet, but we promise you, when you pull those funds out of the traditional TSP she is going to want a seat at the table.

The United States uses what you can call a “progressive” tax system; the more money that you earn, the more you pay in taxes.

When you make a distribution (take money out) from your TSP, your taxable income will increase by the amount that you withdrew from your traditional TSP.

Making a large distribution like this could quickly escalate the tax bracket that you are in.

All great information but how does it work? Well, let’s walk through an example.

We began talking about paying off a mortgage of $300,000 which is what we will continue with here in this example so that we can see how one such example might work.

Let’s say that you are a Married Filing Joint couple who has a gross income of $150,000.00.

We will keep this simple and say that under the Tax Cuts and Job Act (TCJA) that you have a standard deduction of $24,000.00. This brings the taxable income to $126,000.

($150,000 – $24,000 = $126,000)

Based on the above, the marginal tax bracket is 22%. (https://apps.irs.gov/app/withholdingcalculator/index5.jsp)

But remember, you just made a $300,000 distribution from the traditional TSP (which is taxable) to pay off your home.

You will need to add $300,000 to your income for the year! But it gets even stickier…

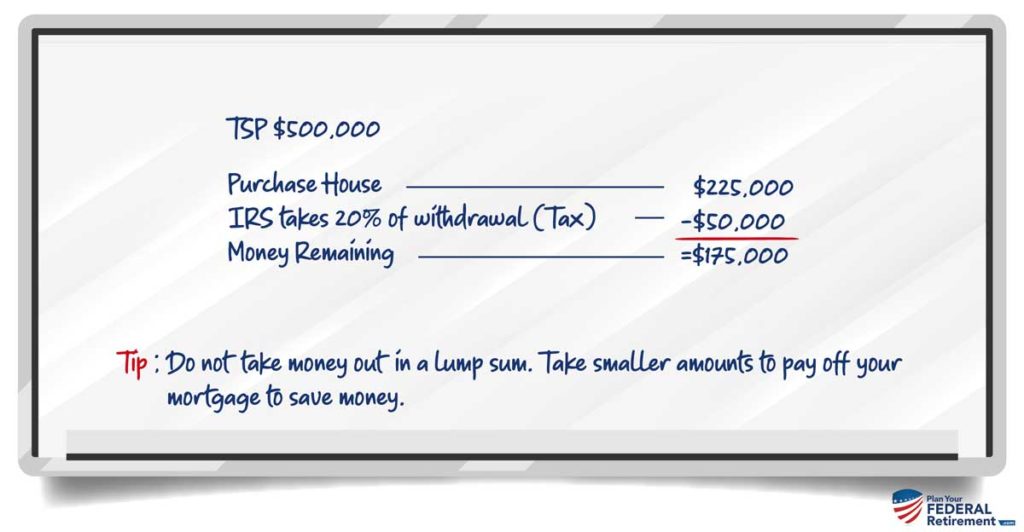

Here is where most people get into a sticky situation. When you make a distribution from your TSP, Aunt IRS slides on over and takes 20% at that very moment (the TSP is required to withhold 20% as a tax ‘estimate’ when you take a withdraw from the TPS in most cases).

So when you withdraw $300,000, Aunt IRS collects $60,000.00 – the TSP office is obliged to make this 20% withholding of tax payment

automatically for you.

That is not even the sticky part…

20% was an estimate. The TSP office does not know or review your personal tax return so 20% is just an estimate (because that is what is required of them). This may not be what is actually owed, it could be more.

Let’s work this out: you have $150,000 of joint income and now you have an additional $300,000 on top of that for a combined income of $450,000.00. In this scenario, you receive the standard deduction under the TCJA of $24,000. Your taxable income is now $426,000.

($150,000 + $300,000 – $24,000 = $426,000)

What tax bracket under our progressive tax system are you now in? Where you may have been in a 22% tax bracket you are now in a 35% tax bracket with the addition of the TSP distribution.

Where you owed $19,599 in federal income taxes (before you took out the TSP funds), you now owe $100,479.00 in federal income taxes. This example shows you owing almost $80,880 of additional taxes (100,479-19,599=80,880).

You made a $300,000 withdraw from the traditional TSP to pay off your home but you net around $219,120 ($300,000 – $80,880= $219,120.00).

If your goal had been to pay off your home with $300,000 than you really needed to withdraw closer to $425,000 from your traditional TSP.

($425,000 + 150,000 = 575,000. 575,000 – 24,000 = 551,000 taxable income)

$551,000 taxable income is approx 144,229 taxes owed. $144,229 – 19,599 = 124,630 additional taxes due to the TSP distribution.

$425,000 (TSP distribution) – $124,630 (taxes on TSP distribution) = $300,370

(Net from TSP)

W. O. W.

You started off wanting to retire the $1,610.00 per month mortgage payment and spent $124,630.00 to do so.

Percentages

For the last several years, mortgage interest rates have been at historical lows. So low that they can compare to post World War II interest rates.

The National Bureau of Economic Research tells us that in 1945 interest rates bottomed out at 4.5% and remained no higher than around 5% until 1956.

There is a good chance that people were able to lock in or refinance their homes when interest rates were in the 3% – 5% range.

As a FERS employee, look at your portfolio earnings over the last ten years. Have you averaged more than 3.5% as a rate of return?

You may need to evaluate if making an extensive distribution from your TSP makes financial sense for you personally?

All investments are exposed to risk so it is important, particularly as you move into retirement, that you and your financial planner assess what makes the most long-term planning sense for you and your family.

WHEN WE SIT DOWN WITH OUR FEDERAL EMPLOYEE CLIENTS, WE LOOK AT TWO SIDES OF THE COIN: MONEY AND EMOTION.

You need to work with your financial planner to do the same.

Look at all the variables and see which solution makes the most financial sense for you. When you do so, try to extract your feelings about having a mortgage in retirement from the question. If you are having difficulty making a non-emotional decision, consult with your Financial Planner so they can provide objective, dispassionate insight.

If you are commit to pay of your mortgage, then consider doing it over a period of time rather than making one lump sum payment. Retiring the debt does not have to be done in one year. Think about staging larger payments to retire the debt over a period of time vs., all at once. Assess your income tax brackets and make good, long-term planning decisions.

If you find yourself saying, “But when I retire I am going to be in a lower tax bracket so this does not apply,” I want to stop you there. Right thought in theory but in reality, is it going to work that way?

Ask yourself two questions:

1. Do you think taxes will be lower or higher in the future?

2. How many sources of retirement income do you have and how many of those are tax-free?

You may retire and income is decreasing, but for most federal employees, sources of income are all tax–deferred.

- Traditional TSP – Tax-Deferred,

- FERS Pension – Tax-Deferred,

- Social Security – Tax-Deferred,

- Traditional IRA’s – Tax-Deferred.

Understanding, as a federal employee, how critical financial planning and tax planning are when you go to retire is imperative to your success.

Take your time and don’t allow yourself to make emotional decisions without first running through the complete scenario.