“Firstly, you are a GREAT information source regarding FERS retirees-to-be ! THANK YOU!!! Does “MRA plus 10” apply to my situation?, and if so, what would be my monthly Pension amount be if I put in for my Retirement now at my current age of 60? I was one of the “ORIGINAL” FERS Employees, starting on February 6, 1984. I worked until April 17, 2001, with a High-3 of approximately $100,000 (at GS-13, Step 10 for each of my final 6 years, before resigning from Federal service at age 42 years old). With a BirthDate of December __, 1958, my MRA is listed at age 56. I am now 60 years old. Can I receive the reduced Retirement (reduced at a rate of 5/12 of 1% per month for every month before age 62) NOW, or do I have to wait until I turn 62 years old to receive Retirement benefits? -JohnIt can be really confusing to understand your years of credible service, minimum retirement age and what types of unreduced annuities that you are eligible for.

Immediate Retirement Eligibility Requirements for FERS

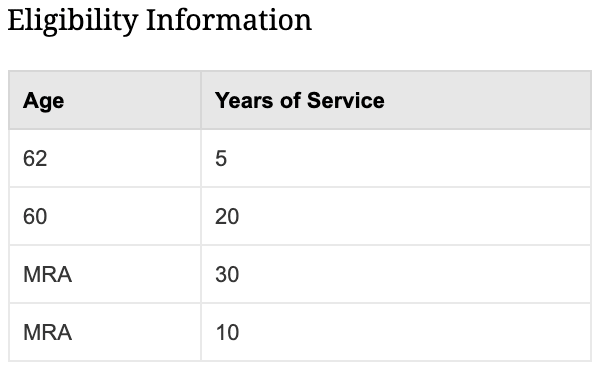

In order to apply for an immediate unreduced annuity (pension) under the Federal Employee Retirement System (FERS) you have to pass through one of these three gates:- Minimum Retirement Age (MRA) with 30 years of Federal Services,

- Age 60 with at least 20 years of Federal Service or,

- Age 62 and 5 years of Federal Service.

MRA+10 FERS Retirement Eligibility Requirements

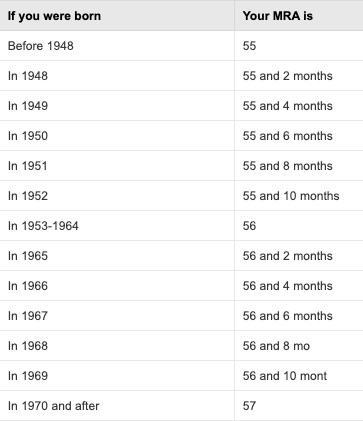

Your Minimum Retirement Age (MRA) is based on your date of birth, for FERS. Here is how to find your MRA under FERS:

With 17 years of service, does John qualify for an MRA+10 Retirement?

Even though John has 17 years of Federal Service, he did not reach his Minimum Retirement Age (MRA) before leaving Federal Service. John, you have to meet your MRA and have 10 years of Federal Service to qualify for an MRA +10 retirement. To avoid a reduction in your FERS Pension, you can postpone payment of your retirement benefits until you meet one of the qualifications we mentioned:- Minimum Retirement Age (MRA) with 30 years of Federal Services,

- Age 60 with at least 20 years of Federal Service or,

- Age 62 and 5 years of Federal Service.

$100,000.00 High Three FERS *17% (represents your 17 years of credible Federal Service)$17,000 a year in FERS retirement income or, $1,416.66 a month GROSS. Keep in mind, this is before healthcare, survivor or other deductions like taxes. If John, at age 60 tried to begin his pension income now, instead of waiting until age 62, he will experience a permanent reduction in his FERS annuity benefits. In his example, the reduction for starting 2 years early would be 10% – permanently. Now, this doesn’t apply to John’s situation but for other Feds reading this article listen closely, In order to keep your Federal Employee Health Benefits (FEHB) in retirement, you must leave Federal Service while being eligible for immediate retirement. Meaning you must have met one of the qualifications we have been discussing,

- Minimum Retirement Age (MRA) with 30 years of Federal Services,

- Age 60 with at least 20 years of Federal Service or,

- Age 62 and 5 years of Federal Service.

Federal Employees Make Mistakes

But YOU Don't Have To

- Forgetting to Check Your Beneficiary Designations

- Expecting Pension Check to Arrive in 30 Days After Retiring

- Not Knowing the Difference Between SCD vs. RSCD

- Completing Retirement Paperwork Incorrectly

- Failing to Prepare Financially for Retirement

- Failing to Understand Tax Consequences

- Getting Bad Advice

Click below and learn how to avoid making them yourself