TSP Contribution. My spouse recently changed her TSP contribution because her friend told her to. She currently has: L2030 80%, C-Fund 10% and S-Fund 10%. She will retire in 4-yrs. Would you agree that it would be in her best interest to go: G-Fund 70%, C-Fund 20%, and S-Fund 10%. I’m a novice with the market but the L-2030 already contributes into both the C & S funds.” – Rudy

What is the ideal allocation of the TSP?

Allocating your TSP, according to your co-worker, we see this application more than we care to.

We call this the “water cooler theory.” Meaning, you get to visit with your co-worker about the TSP, and one party is or has done better than the other, so the other party changes their allocations to match.

One person does not know which options to choose and asks a co-worker they trust for advice.

When a Federal Employee listens to a co-worker for investment advice, they need to first think about a few crucial aspects of what the TSP is, how it works, and what it is designed to do.

What is the TSP designed to do?

Hopefully, your allocations within the TSP are designed to keep up with the cost of inflation in retirement and provide funds to support you during your non-working years.

Often people think of the TSP as a goal line, “when I have X amount of dollars in my account, then I can retire…” this way of thinking can be problematic.

Investments fluctuate. Markets can be volatile, and it can take years for them to recover, often 5+. Setting a goal line, a definite number for your TSP, doesn’t account for the market’s ebb and flow. Your TSP, even in retirement, will fluctuate, and that can be good and bad.

When markets are going up, it feels pretty good! When markets are declining, it doesn’t feel good.

Remember, the TSP was not deisgned to get you “to” retirement. The TSP was designed to get you “through” retirement.

Your TSP should be allocated in a manner that incorporates your life expectancy.

That is why it is critical to remember our 5-year rule for your TSP so that we do not make emotionally based, potentially devastating financial decisions.

The 5 Year TSP Rule

Money that you need to spend to support your lifestyle within the next 5 years does not belong invested in the stock market.

We strongly believe in this rule so we will say it a little louder for the people in the back, “Money that you need to spend to support your lifestyle within the next 5 years does not belong invested in the stock market.”

Markets fluctuate, and when they do, those who do not have a financial plan often make emotionally fueled financial decisions about their investments.

For example, remember June 2008, when the markets declined by almost 20%?

How many Federal Employees were racing to their computers to transfer money into the G fund AFTER the markets had already sustained losses.

Or, as we might say, how many Federal Employees locked in their losses during that time-period because they did not have a financial plan for retirement and were not prepared to weather market downturn?

After 2008, we spoke with several Feds who extended their retirement by YEARS because of the losses they suffered in 2008 during the Global Financial Crisis.

When did the markets finally start showing signs of healthy recovery?

- 2009

- 2010

- 2011

- 2012

- 2013

5 years later, the markets were recovering. Of course, one can never predict the future, and all markets are volatile, but having a plan in place as to how you will deal with the market downturn WHEN it happens is critical to your financial health.

Allocating Your TSP

You should allocate your TSP in accordance to your investment objectives and time horizon. Here is what we mean by that…

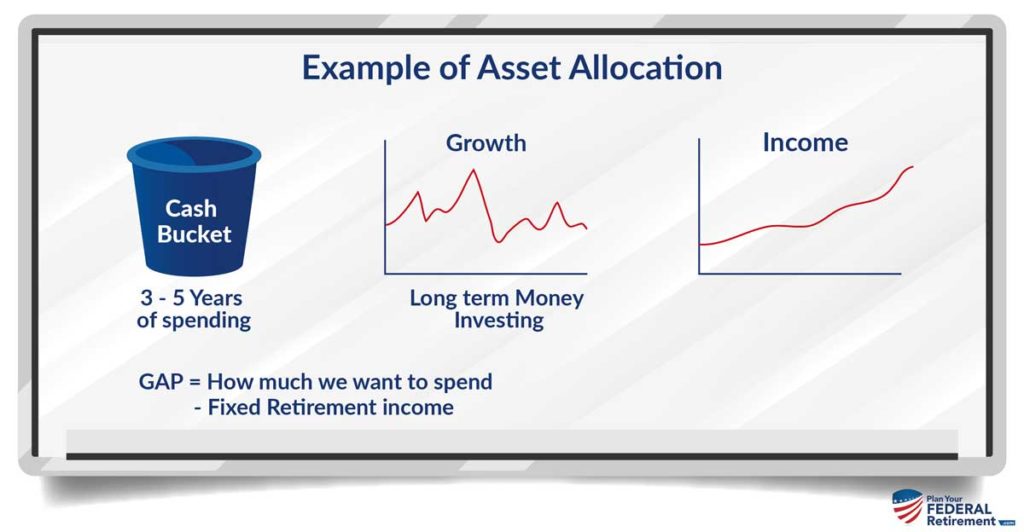

Since we do not know you, Rudy, or your wife, we cannot give you specific investment advice. We can share with you our strategy for Federal Employees that we call the “Bucket” approach so that you can begin to understand the theory about how to invest based on what the TSP is designed to do: help supplement your lifestyle and keep up with inflation THROUGH retirement.

The Cash Bucket

You guessed it, money that you need to spend in the next 5 years does not belong invested in the stock market.

Instead, we like to see this in cash.

The pushback that we get from people when we talk about this is that “well, it doesn’t make hardly interest when it is in cash.”

Correct.

It also isn’t subject to market fluctuations either.

What is your GAP? You have your retirement pension, your Social Security, but there will be a gap between what you receive and what you need or want as your lifestyle. This is where the TSP comes in to supplement.

Whatever that “gap” number is for the next 3-5 years we want to see in cash, not invested.

The Growth Bucket

The growth buckets are normally within the TSP, the C, S, and I funds. They fluctuate often. They experience both growth and contractions overtime.

The growth bucket should feed into the cash bucket to replenish it.

This allows your investments to have time to recover during downturns.

How much of your portfolio should be allocated between the C, S, and I funds on several factors: your Gap, your objectives, and of course, your risk tolerance levels.

We don’t give blanket advice, so we won’t be able Rudy to provide you with specific investment advice here.

The Income Bucket

This bucket is dividend-paying stocks primarily. A strong allocation of companies that provide dividends to shareholders.

Dividends are not guaranteed, so do not confuse the word “income,” thinking that it will be indefinite. Companies can and will change their dividends over time.

We discuss this strategy a lot in our 3-Critical Concepts Course for Federal Employees.

3-Critical Concepts Course for Federal Employees

Whether you are a FERS federal employee still a few years away from retirement who wants to make sure you understand all of your benefits and how they fit into your retirement puzzle – or you’re getting ready to retire in less than a year and you want to be sure you’re not missing anything – you want to be sure you watch this webinar series.

When you watch all the videos in this workshop – you’ll be several steps ahead of most Federal Employees who have no idea they’re missing these critical concepts.

There are 3 videos in the series and each video is designed to build on the one before it.

You’ll want to watch all the videos to make sure you’re not missing one of these critical concepts in your federal retirement planning.