“My husband and I both had careers with the National Park Service. He carried the family insurance for us. He retired in 2021 and did not select me for survivor benefits since I also worked for the federal government. I now want to resign and defer or postpone my retirement until I meet the minimum age. I am 54 (3/10/69). If my husband dies before me, do I still keep federal health benefits with a deferred retirement? What would happen if he does before I reach the minimum age for my deferred retirement?” – Dana.

Your BEST FERS Benefit Is…

Your Federal Employee Health Insurance (FEHB) is your BEST benefit as a Federal Employee in FERs.

Keeping your health insurance in retirement is an important consideration for Federal Employees looking to retire from service.

Dana is asking a GREAT question about the nuances of federal employee benefits and this is a great time to hit on a few of those important considerations. In this article we will break down the differences between a Deferred and Postponed retirement as well as how federal employees keep their health insurance in retirement.

Postponed or Deferred Retirement

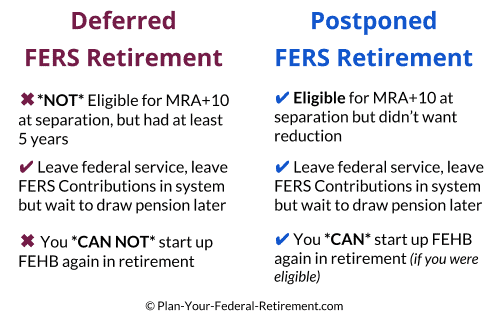

When it comes to understanding the difference between a Deferred or a Postponed retirement from Federal Service, you need to understand which of the two you are eligible for.

The first factor you have to take into consideration is your Mimium Retiremetn Age (MRA). Your MRA is based on your year of birth. Your MRA is NOT the same as your Full Retirement Age (FRA) that social security uses to determine your eligibility for social security benefits.

Rather, your MRA is determined by:

The second consideration you need to take into account is how many creditable years of service you have as a Federal Employee.

Creditable service under FERS usually includes

- Federal covered service, that is, service in which the individual’s pay is subject to FERS retirement deductions, such as service under a career or career conditional appointment,

- Unused Sick Leave under FERS can be used to increase an individual’s total creditable service for annuity computation purposes only;

- Federal service performed before 1989, where an employee’s pay is not subject to retirement deductions, such as, service under a temporary appointment, as long as a deposit is paid. There are a few exceptions to the rule that the service must have been performed before 1989. Those exceptions are:

- Part-time, Intermittent, Temporary “PIT” service performed abroad after December 31, 1988, and before May 24, 1998, under a temporary part-time or intermittent appointment pursuant to sections 309 and 311 of the Foreign Service Act of 1980.

- Service performed under the Foreign Service Pension System

- Service as a Senate Employee Child Care Center worker

- Service as a volunteer or volunteer leader in the Peace Corps

- Service as a VISTA volunteer

- Service before 12/31/1990 with either the Democratic or Republican Senatorial Campaign or National Congressional Committees

- Service before 12/21/2000 with the Library of Congress Child Development Center

- Service as a Senior Official

- Congressional Employees that do no elect program coverage and are subject to the Social Security Amendments of 1983

- Service performed under a Federal Reserve Bank Plan

- Non-appropriated fund instrumentality (NAF) service under P.L. 107-107 that can be used for title to an annuity under the FERS, but not in the computation

- CSRS refund service that flips to FERS” (opm.gov)

Next, you must also LEAVE the contributions that you have made to the Federal Employee Retirement System in place. Each pay period, you and your employer contribute to the FERS Pension (OPM calls this an annuity, but we call it a pension so that it is not confused with annuity products which are insurance).

When you leave federal service, you can elect to take your contributions out and receive those funds back. Or, you can leave the contributions in the FERS System (HIGHLY RECOMMEND) in case you ever return to Federal Service or want to optimize your retirement benefits later.

Determine what type of retirement you are eligible for.

To Postpone your retirement from federal service, you must be eligible for an immediate retirement. This means you have to be eligible for MRA + 10.

To do a Postponed FERS Retirement – you must …

- Have reached your MRA before you separate

- Have at least 10 years of creditable service

Biggest difference between a Deferred and a Postponed retirement is that only in a postponed retirement can you keep your Federal Employee Healht Benfits (FEHB).

To answer Dana’s question, “if my husband dies before me, do I still keep federal health benefits with a deferred retirement? “ we need to address the qualifications for federal employees to continue health insurance in retirement.

To be eligible to continue your health benefits enrollment into retirement as a federal employee, you must:

- Have retired with the ELIGIBILITY of an immediate pension; and,

- Have been continuously enrolled (or covered as a family member) in any FEHB Program plan for 5 years of service immediately preceding retirement, or if under five years, for all service since your first enrollment opportunity.

To keep health insurance in retirement, a federal employee must retire with the ELIGIBILITY of an immediate pension; you do not have to take the immediate pension but you do have to meet the qualifications for eligibility. That means, if Dana were to postpone her retirement and she met the MRA + 10 years of creditable service qualifications, she has passed the first test to keeping her health inusrance in retirement. However, there is a SECOND qualificaiton that Dana must meet as well.

Dana has to be covered under FEHB for 5 years or, since she was first eligible to enroll in health insurance. Dana does NOT need to be on her own plan but she does have to be enrolled.