“Is there a 10% penalty for signing up for $1,250 monthly straight withdrawal (not an annuity) from the TSP if I retire at my MRA @ 56 (but will not be 59 1/2)” – Paul.

The Thrift Savings Plan (TSP ) is an important component in your retirement planning. When it comes to making contributions to the TSP, as a Federal Employee, it is rather straightforward.

While a phenomenal accumulation tool, the TSP Withdrawal Penalties are different than investments in the private sector.

As a Federal Employee, it is important for you to understand some of the rules and planning techniques involved in making withdrawals or distributions so that you do not incur TSP Withdrawal Penalties.

In this question, Paul is asking about retiring at his Minimum Retirement Age. As a Federal Employee, your MRA determines your eligibility for a full, unreduced retirement pension. There are several parameters when it comes to determining your pension benefits. For example, under FERS, employees are eligible at age 62 with five years of service, 60 with 20, MRA with 30 or MRA with 10 – but with a reduced benefit.

When you retire at MRA and 30 years of Creditable Service, you potentially have three resources. These are your Pension, your FERS Supplement, and your TSP without a penalty.

How the TSP Component Works

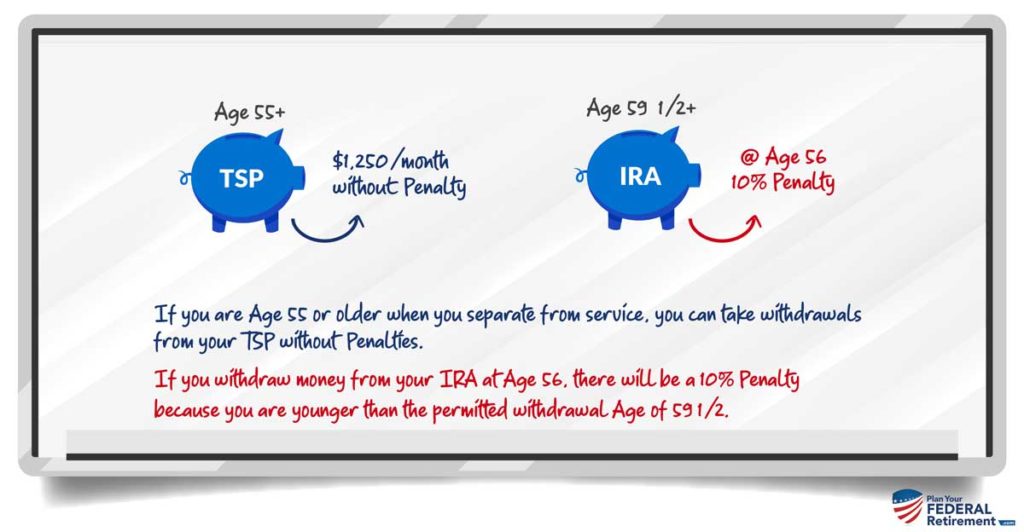

If you are age 55 or older when you separate from service, you can take withdrawals from your TSP without penalties. The key concept here is that in order to not have penalties you have to be age 55+ and be separating from service.

If you are Special Provisions which includes Law Enforcement, Air Traffic Control, and Firefighters, you have a different age. For those who are special provisions, the age is 50 to make penalty-free withdrawals when you separate from service.

TSP Withdrawal Penalty is Not the Same As Your IRA

Remember, the Thrift Savings Plan is different than an investment vehicle in the private sector, like an Individual Retirement Account.

The TSP has different withdrawal features than the private sector so it is important to understand the difference. TSP Withdrawal Penalties are based on your age and separation from service.

If you transfer the money from your Thrift Savings Plan to your Individual Retirement Account and go to make a distribution, you may incur the 10% penalty for having done so before reaching age 59 1/2.

In Paul’s question, he wanted to make a withdrawal from this TSP at age 56. Providing that Paul had achieved his MRA and 30 years of creditable service, he would be permitted to do so from this TSP account.

Federal Employees Make Mistakes

But YOU Don't Have To

- Forgetting to Check Your Beneficiary Designations

- Expecting Pension Check to Arrive in 30 Days After Retiring

- Not Knowing the Difference Between SCD vs. RSCD

- Completing Retirement Paperwork Incorrectly

- Failing to Prepare Financially for Retirement

- Failing to Understand Tax Consequences

- Getting Bad Advice

Click below and learn how to avoid making them yourself