Nick poses a great question worth exploring a little more in depth. The question asks about how several variables in the Federal Retirement System work together. Nick lets us know that he has at least 5 years of creditable services. During his 5 years of creditable services, his average high three salaries were $185,000.00. When Nick retires, he is going to be older than age 59 so he wants to know what portion — if any — of his pension is subject to income taxes and how much his federal pension will be.

Rules of Eligibility

When we look at retiring from the Federal Government under FERS, you have to meet the rules of retiring with an immediate pension first.

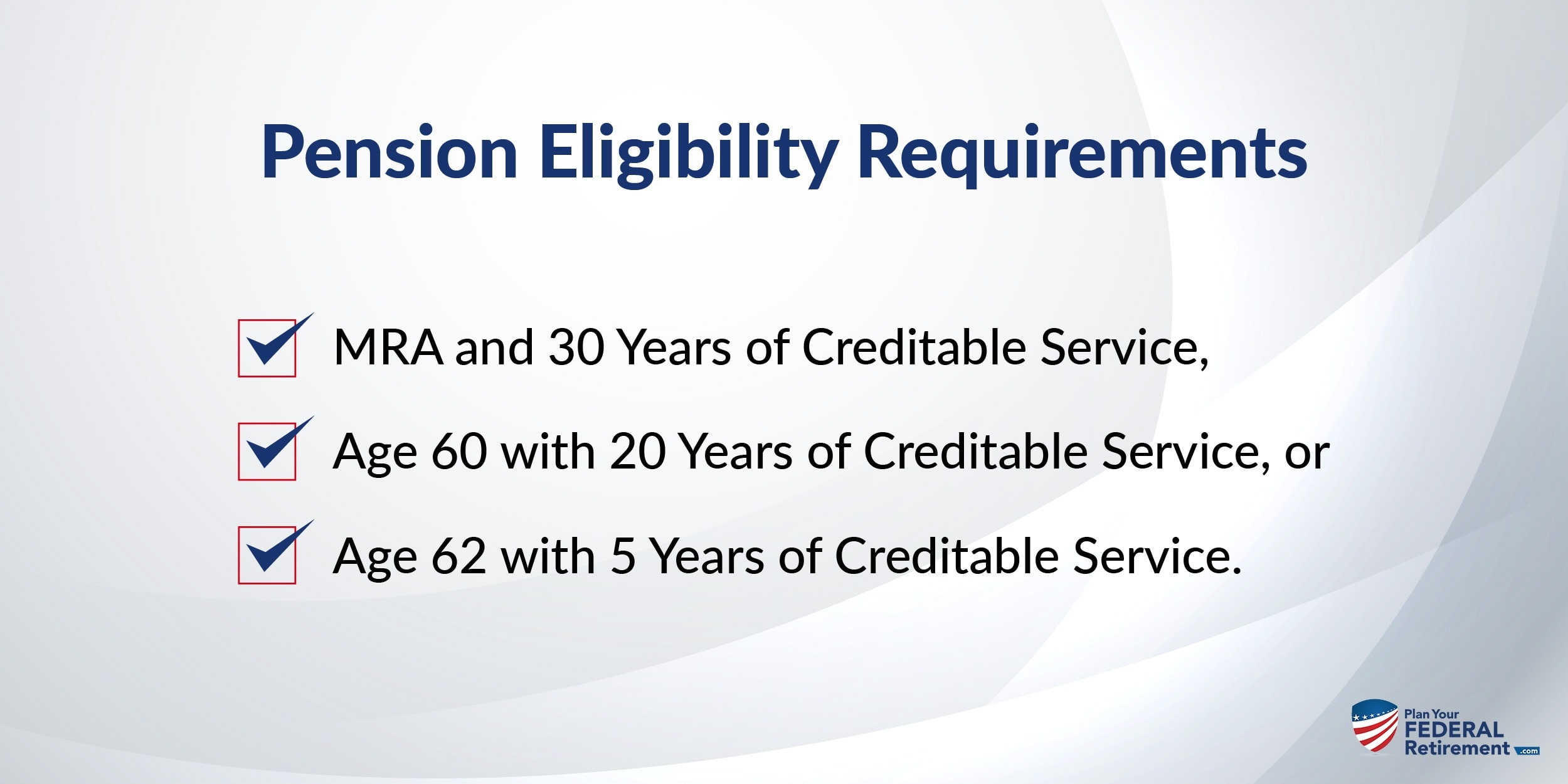

To be eligible for an immediate federal pension under FERS you have to meet one of these requirements:

MRA is your Minimum Retirement Age. Your Minimum Retirement Age (MRA) is based on your date of birth.

The Office of Personnel Management (OPM) determines your MRA based on your date of birth. Here is a quick guide which is also available on OPM’s website:

| If you were born | Your MRA is |

|---|---|

| Before 1948 | 55 |

| In 1948 | 55 and 2 months |

| In 1949 | 55 and 4 months |

| In 1950 | 55 and 6 months |

| In 1951 | 55 and 8 months |

| In 1952 | 55 and 10 months |

| In 1953-1964 | 56 |

| In 1965 | 56 and 2 months |

| In 1966 | 56 and 4 months |

| In 1967 | 56 and 6 months |

| In 1968 | 56 and 8 mo |

| In 1969 | 56 and 10 months |

| In 1970 and after | 57 |

If you have achieved your MRA, the next step is to review the length of your Creditable Service. If you are curious about how to determine what OPM considers Creditable Service, we recommend that you request a FERS Benefits Estimate from your Human Resources Department. Keep in mind that generating a FERS Benefits Estimate can take some time so be patient with your HR.

Also keep in mind that if you retire at the MRA with at least 10, but less than 30 years of service, your benefit will be reduced by 5 percent a year for each year you are under 62. This is true in all cases unless you have 20 years of service and your benefit starts when you reach age 60 or later.

If You Haven’t Achieved Your MRA + 30 Years of Service

If you know straight off that you will not have achieved your MRA + 30 years of service, you may still be eligible for an immediate retirement if you have age 60 with 20 Years of Creditable Service or, age 62 with 5 Years of Creditable Service.

In Nick’s case, he has 5 years of service and will be age 59 when he retires. He doesn’t qualify for an immediate retirement based on those rules. So, now we need to look at other factors to see what — if any — benefits Nick would receive.

$185,000.00 High Three for 5 Years of Creditable Service

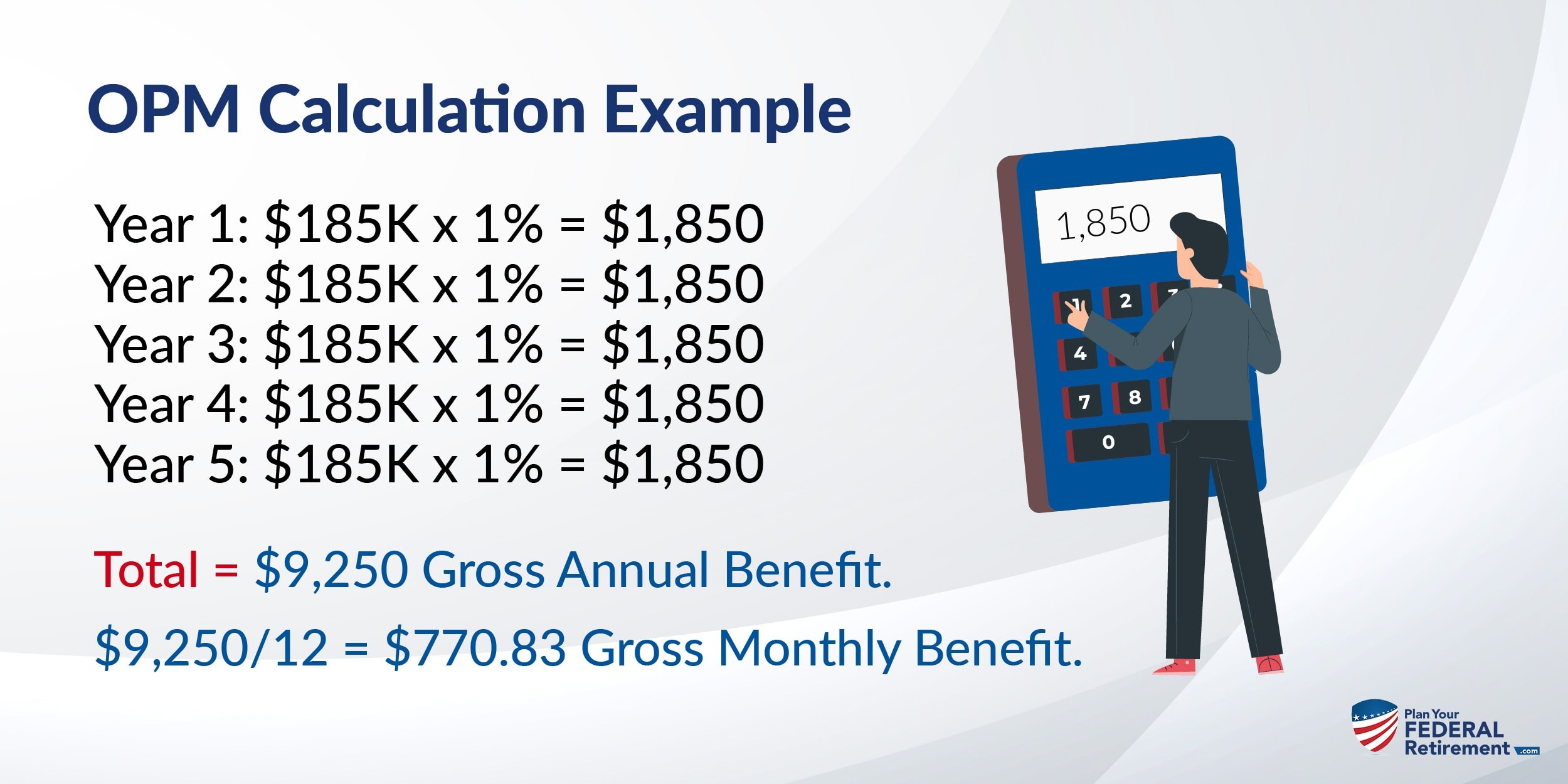

For every year of Creditable Service, the FERS puts 1% of your annual income towards your future federal pension income.

Step 1: determining the pension income with 5 years of creditable service.

If Nick works for 5 years where every year represents 1% towards his Federal Pension, that is a total of 5%. His annual income is $185,000.00. 5% of $185,000 would be roughly $9,250.00.

Year 1: $185,000.00 * 1% = $1,850.00

Year 2: $185,000.00 * 1% = $1,850.00

Year 3: $185,000.00 * 1% = $1,850.00

Year 4: $185,000.00 * 1% = $1,850.00

Year 5: $185,000.00 * 1% = $1,850.00

Total = $9,250.00 gross annual benefit.

Step 2: OPM divides by 12 months of the year and rounds down.

The $9,250.00 that Nick earned from his 5 years of Creditable Service is $9,250.00 gross, annually. OPM will then take the annual benefit and divide by 12 to represent a calendar year, January – December. This determines the gross monthly benefit.

$9,250 / 12 = $770.83

OPM will round this number down to $770.00 a month, gross FERS benefit.

Step 3: Age eligibility.

If Nick retires at age 59, he doesn’t meet the requirements to retire for an immediate pension. However, Nick does have some options so as not to lose his FERS pension benefit if he retires at age 59 with 5 years of Creditable Service.

Deferred Retirement

| Age | Years of Service |

|---|---|

| 62 | 5 |

| MRA | 30 |

| MRA | 10 |

KEEP IN MIND that when you take a Deferred Retirement you give up your best benefit as a Federal Employee – Your Federal Employee Health Benefits (FEHB) as well as Federal Employee Group Life Insurance. If you have already accounted for health insurance or life insurance in another manner, maybe this does not matter to you but please be cautious because your benefits as a FERS are remarkable and you do not want to make a decision that compromises those without all of the knowledge as to how your benefits play into your greater financial plan.

If you wanted to keep those benefits you would have to continue to work until you have reached age 62.

Federal Employees Make Mistakes

But YOU Don't Have To

- Forgetting to Check Your Beneficiary Designations

- Expecting Pension Check to Arrive in 30 Days After Retiring

- Not Knowing the Difference Between SCD vs. RSCD

- Completing Retirement Paperwork Incorrectly

- Failing to Prepare Financially for Retirement

- Failing to Understand Tax Consequences

- Getting Bad Advice

Click below and learn how to avoid making them yourself