“My strategy is to leave my TSP untouched and “will” it to my spouse” – Mike

As Financial Advisors who work with Federal Employees, we are often trying to help Feds address two really, really important underlying questions that they have about their retirement:

Question 1: “Do I have enough money to retire?” and,

Question 2: “Will my spouse have enough to live on if I pre-decease them?”

In this FERS Federal Fact Check, we are going to dive into how decisions you make today, while you are alive, can impact a surviving spouse.

By the end of this article on TSP Survivor Benefits, we will address not only Mike’s question about, “willing” a TSP to a spouse but we are also going to discuss some of the most overlooked tax implications that come up when one spouse passes before the other.

How Assets Transfer Upon Death

To begin answering Mike’s question about “willing” his TSP to his spouse we need to pause and first understand how assets transfer upon one person’s death.

Assets transfer by title first. This is so important to remember because not understanding how this works can have devastating, irreversible consequences.

Understanding that assets transfer by title first is so vital to a Federal Employee, and their spouses, financial health that this is the very first area we address when meeting with our clients. We don’t stop there, we revisit the conversation every single year to ensure that what you want to have happened today, while you are alive is exactly what will happen when you pass.

Often we think of the word “Titles” as it pertains to ownership as having to do with motor vehicles. Who owns the car? The title states who owns the car.

But Title designations pertain to a myriad of other assets too. A title is a document that shows legal ownership to a property or asset. Being married does not necessarily grant you the right of ownership to that asset if your spouse passes.

Rather, during your spouse’s lifetime,, they must make a Beneficiary Designation to that asset. The transference of some assets, like motor vehicles, can be outlined in a Last Will and Testament and executed accordingly upon your passing.

Retirement assets, like the TSP, are different through. Retirement assets must have a beneficiary designation associated with them. If they do not, for whatever reason, the asset could be tied up in probate.

Contingent on the state that you live in, probate isn’t always “bad” but it is costly, public and time-consuming. Not to mention, when it comes to your TSP it can be avoidable with a few simple planning techniques.

If you fail to have your assets properly titled and the beneficiary designations correct, the financial asset is “frozen” – 100% inaccessible – while the probate process is pending.

During the probate process. There is a cost to probate whether or you have legal representation or not. The cost is contingent on the State that probate occurs in.

During the probate process, the courts will work towards authenticating if there were a Last Will and Testament valid and in place for the decedent.

If there is a Last Will and Testament, the court will authenticate an Executor of the Estate to carry out tasks like dividing assets, paying off debts, and tidying up financial affairs.

If there is not a Last Will and Testament in place well, the court will still appoint an Executor but it could take a bit longer to determine what the deceased would have wanted.

Don’t leave it to the courts to guess at what you would have wanted.

Next, in probate, your Executor may have to post a Bond. A Bond acts as an insurance policy that will kick in to reimburse the estate in the event the executor commits mistakes that would damage the estate.

The Executor then will be charged with the responsibility of locating all of the assets. At this time, the Executor will also be tasked with having to determine the value of the asset upon the decedent’s date of death.

Once this has inventory and valuation happens, the Executor will need to first pay off all debts owed by the departed.

Once the debts are paid to creditors, the IRS is going to want a final tax return as well.

Finally, and only then are the assets divided up amongst those that the Last Will and Testament appoint OR, if there isn’t a Last Will and Testament in place, the court determines.

If that doesn’t sound like fun – let me be clear, it isn’t. Not only are the survivors trying to handle their own grief and deal with the loss of a loved one but now there is confusion and frustration on top of that.

When it comes to your TSP, it can also be avoidable.

If you do NOT leave a survivor listed on your TSP beneficiary form than your TSP will transfer in accordance with the Statutory Order of Precedence.

The court will determine that in order of precedence your TSP will go to:

- To your current legal spouse;

- If none, to your child or children equally, and to the descendants of deceased children;

- If none, to your parents equally or your surviving parent;

- If none, to your appointed executor or administrator of your estate;

- If none, to your next of kin who is entitled to your estate under the laws of the state in which you resided at the time of your death.

TSP Beneficiary Designations

Your TSP is a Retirement Asset and is able to facilitate two types of beneficiaries: Your primary beneficiary and your contingent beneficiary.

Primary Beneficiaries

If you are legally married your spouse will need to be your primary beneficiary.

If you choose someone other than your spouse, your spouse will need to sign the paperwork in front of a Notary authorizing another individual to be the beneficiary of your TSP.

You can designate one or more persons, a corporation, trust, legal entity, or your estate to receive your TSP account in the event of your death.

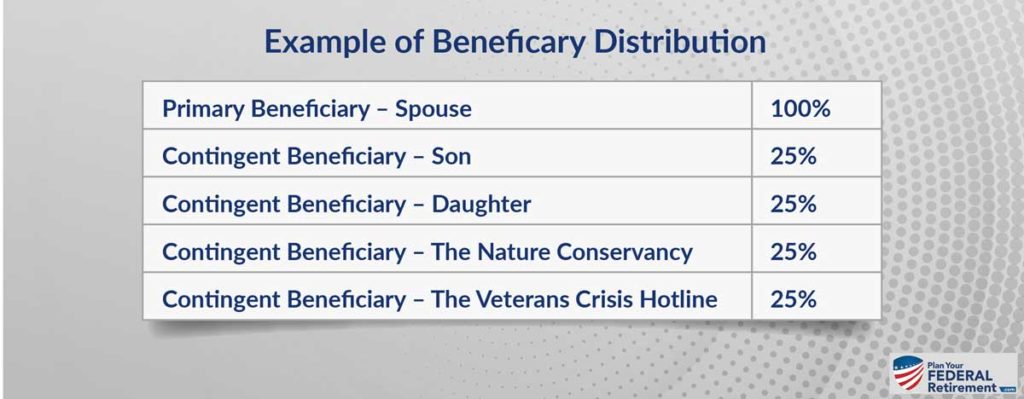

You will have to indicate the share of your account that you would like each beneficiary to receive. You can have as many as you would like as long as the total percentage is 100% – I will provide a few examples below.

Contingent Beneficiaries

If the primary beneficiary’s share of your account was unable to transfer to them for whatever reason, you can designate contingent beneficiaries.

In most cases, individuals like to ensure that their spouses are left as their primary beneficiaries and children as contingent.

You can leave as many contingent beneficiaries as you would like as long as the final result is that 100% is accounted for and it does not have to be a biological relation.

Some people like to use not for profit organizations as a way to implement tax planning strategies upon passing as well.

Here is an example if someone wanted to leave their TSP to their spouse as a survivor and the account for their children and philanthropic wishes as well.

If you are unsure who you Beneficiaries on your TSP are and want to check to ensure that your survivors are taken care of, you can log into your TSP Account online. You can also change your beneficiaries with the TSP office by completing their form.

Now that we understand how the order of operations works for your TSP Survivors, let’s dive into somewhat most Federal Employees that we come across completely forget about – tax planning.

After all, the only thing in life that is certain is death and… taxes.

Taxes on TSP for Survivors

There are four “Tax Buckets” that you need to be aware of overall as a tax-payer:

When you are working and earning wages, your wages are taxed as Ordinary Income (we think this is the worst type of tax out of all these buckets).

One of the options that you have while employed with the Federal Government is to defer some of your earned wages into the traditional TSP. You make a contribution and your employer make a contribution.

These monies are tax-deferred. That means when they were earned, from your salary, you did not pay federal income taxes on the money – you instead, opted to put it into the traditional TSP.

The monies would then only be taxed when you withdrew them later in life, presumably in retirement where you are hoping that your tax rate will be lower.

The Problem with “Willing” Your Spouse your TSP

Mike’s plan is to “Will” his wife his TSP as his survivor if he were to predecease her.

Remember, in the mode of operations that means that he is not making her the primary beneficiary but instead defaulting to the use of his Will.

If Mike has another person listed on his TSP forms, say a parent from when he first started Federal Service whomever that person listed, no matter how old the form or what Mike’s Will or Trust says – the TSP will transfer to whoever is on the beneficiary form.

But let’s say that Mike does not have anyone alternatively listed and that he is going to default to using his Will.

As the survivor, when Mike passes and his wife receives his TSP via his Last Will and Testament she has to make some decisions that are going to impact her financially.

Mike’s wife will have two options on how she wants to receive the TSP monies as the survivor.

Choice 1: She can choose to have the monies in one lump sum.

Choice 2: She can choose to take the monies out over 5 years.

If we put some dollars behind this decision and say that the value of Mike’s TSP is $500,000 the choices look like:

Choice 1: a Lump sum of $500,000 is added to his wife’s taxable income that year.

Choice 2: $100,000 is added to his wife’s taxable income over 5 years.

Either way, these monies that have been tax-deferred for so long are not going to be subjected to ordinary income taxes – the worst type of tax!

Yet alone if she lives in a state with an Income Tax on top of that. If either choice celebrated her tax bracket to 30+% that would mean that the IRS would receive 1/3 of your TSP.

TSP Survivor Choices

We began this article talking about the importance of beneficiary designations and we did so because so often when we meet with people we almost ALWAYS discover beneficiary designations improperly set up.

These choices have real financial consequences for your survivors.

You must check your beneficiary designations and we believe you should do so annually.

If Mike ensures that his wife is left as the Primary Beneficiary on his TSP, now she has some room to make planning decisions when it comes to her TSP Survivor benefits:

- She can keep the money in your name and access it as a survivor or,

- She can transfer the asset to her name and choose how she withdraws those monies according to her financial plan.

Understanding and knowing how your benefits work and what the real consequences of the words/choices we use are so important to us as a company.

That is why we love taking your questions, from real Federal Employees and helping increase knowledge.

We also recommend going through our 7 Retirement Mistakes – be prepared for the future and know what to avoid during your retirement process.

We seen the mistakes that people (and even some professionals!) can make, and we want to help you avoid them. Click the button below to learn more.

7 CRITICAL MISTAKES

Federal Employees make

✗ Forgetting to check your beneficiary designations

✗ Expecting pension check to arrive in 30 days after retiring

✗ Not knowing the difference between SCD vs. RSCD

✗ Completing retirement paperwork incorrectly

✗ Failing to prepare financially for retirement

✗ Failing to understand tax consequences

✗ Getting bad advice

Click the button below and learn how to avoid these mistakes while planning YOUR retirement