I worked for the federal govt for 11 years. I was born in 1960 January. I was 56 at the time of separation. Need to know if postponement to a longer time than age 62, will accrue in further enhancement of any benefits. Is there any age beyond waiting is not worthwhile.

Kahlid is asking about a type of retirement called MRA + 10. Here’s what the Office of Personnel Management has to say about this type of retirement:

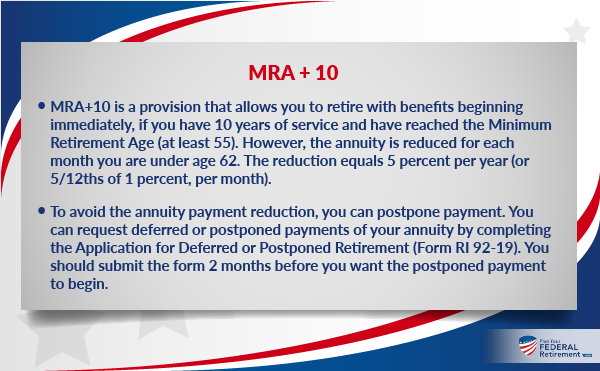

MRA + 10

- MRA+10 is a provision that allows you to retire with benefits beginning immediately, if you have 10 years of service and have reached the Minimum Retirement Age (at least 55). However, the annuity is reduced for each month you are under age 62. The reduction equals 5 percent per year (or 5/12ths of 1 percent, per month).

- To avoid the annuity payment reduction, you can postpone payment. You can request deferred or postponed payments of your annuity by completing the Application for Deferred or Postponed Retirement (Form RI 92-19). You should submit the form 2 months before you want the postponed payment to begin.

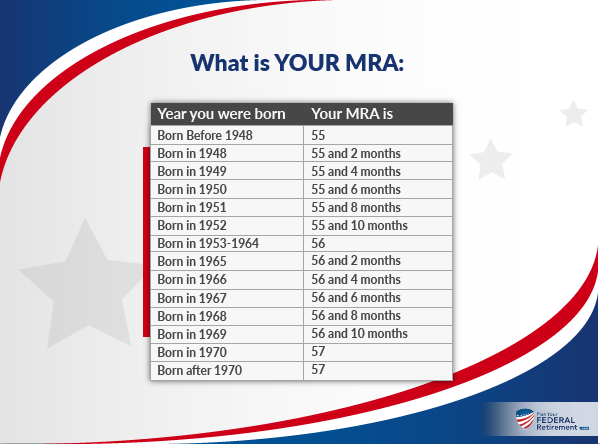

What is YOUR MRA:

The Example:

Length of Service: 11 years

Age at separation: 56 (MRA)

Formula:

1% x High-Three Average Salary x Length of Service

1% x $80,000 x 11 years = $8,800 / 12 = $733.30 / month

To calculate the MRA + 10 reduction, multiply the FERS basic benefit by the applicable factor from the following chart.

$8,800 x .7042 (age 56) = $6,196.96 / 12 = $516.40 / month

Things to Consider:

- If you claim the benefit before age 62, reduction is permanent.

- Claiming benefit allows possible reinstatement of health and life insurance benefits which may be a consideration for taking the reduced benefit before age 62.

- There is no need to delay past age 62 as there is no further increase. The exception might be if you thought you might return to federal service. If you come back before claiming your retirement, you may reinstate your past service and sick leave credit. If you retire first, you would be considered a reemployed annuitant which would make it more difficult to reinstate the past service and have your new retirement include that service time.

- Former employee dies prior to claiming deferred retirement may have a spousal survivor annuity payable if…

- They left with 10 or more years of creditable service (at least five years of civilian federal service).

- The service for which withholdings or deposits remain in the Retirement fund. In other words, they did not take a refund of retirement contributions.

- The surviving spouse was married to you at the time of your separation from Federal service.

- Your surviving spouse may elect to receive a lump-sum payment of your retirement contributions in lieu of the survivor annuity benefit.