I am considering leaving federal civilian employment after 14 years, which includes 8.5 years of military service. I read that I can still draw the annuity and TSP at retirement age if I leave all of my money in place. I also read that I can continue to contribute to the TSP through my new job. What are some potential pitfalls or unknowns I could face should I take a higher paying private sector job but want to keep my federal retirement benefits? I am 50 years old and I will complete the military buyback payments before I resign. Thank you!

It is great that Marlon noted that he will complete his military deposit before he leaves federal service. When he claims his deferred retirement, it will be based on both his civilian as well as his military service for a total of 14 years of “creditable” service that will be used to compute his deferred retirement benefit. He will be eligible to begin receiving his retirement as early as age 57, but he may want to delay his application to begin his benefit at age 60. Let’s find out why!

FERS Calculation:

1% x high-three average salary x years / months of creditable service

If Marlon begins receiving his deferred retirement at age 57, his MRA, he will incur a permanent 25% reduction of his FERS benefit. It would be wise for him to consider waiting until age 60 to begin receiving his benefit to avoid this substantial reduction to his retirement. He will not be entitled to the FERS supplement or reinstatement of his insurance since he is not eligible to receive an immediate retirement when he separates at age 50.

Minimum Age | Minimum Service | Age Reduced? |

MRA (55 – 57) | 30 years | No |

MRA (55 – 57) | 10 years | Yes |

60 | 20 | No |

62 | 5 | No |

Reduction is based on how far under age 62 at the time retirement is claimed.

5% / year

5/12 of 1% / month

Example: Age 57 = 25% reduction (permanent)

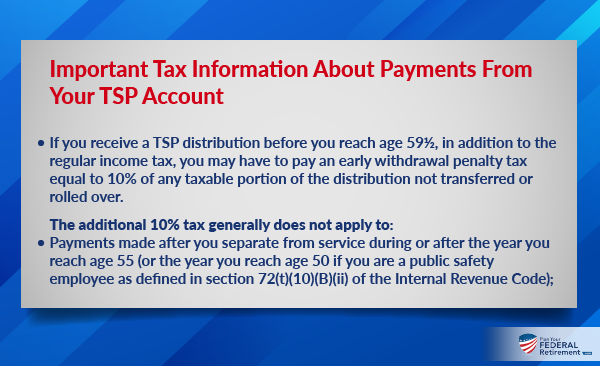

Marlon is leaving federal service at age 50, well before the year he reaches age 55. He will need to be careful if he decides to make a withdrawal from his TSP account before reaching age 59 ½.

Important Tax Information About Payments From Your TSP Account

- If you receive a TSP distribution before you reach age 59½, in addition to the regular income tax, you may have to pay an early withdrawal penalty tax equal to 10% of any taxable portion of the distribution not transferred or rolled over. The additional 10% tax generally does not apply to:

- Payments made after you separate from service during or after the year you reach age 55 (or the year you reach age 50 if you are a public safety employee as defined in section 72(t)(10)(B)(ii) of the Internal Revenue Code);

Marlon may use one of these other ways to access his TSP account after he stops working if it is before he reaches age 59 ½. The first option of an annuity and the last option of equal payments over his life expectancy could provide the income that he may need until he is eligible to withdraw periodic withdrawals as needed or a different dollar amount that meets his needs for income. Of course, if he is over age 59 ½ when he begins to withdraw his funds, he will be able to withdraw using any method including electing a specific dollar amount each month or transferring some or all of his TSP to an IRA.

- annuity payments;

- automatic enrollment refunds;

- payments resulting from total and permanent disability;

- payments resulting from death;

- payments made from a beneficiary participant account;

- payments made in a year you have deductible medical expenses that exceed 7.5% of your adjusted gross income;

- payments ordered by a domestic relations court; or

- substantially equal payments over your life expectancy

One Last Thing…

Marlon also mentioned something else, that is important to clarify. When he leaves federal service he will no longer be able to contribute to his TSP, however, his new employer is likely to offer an employer-sponsored savings plan for retirement such as a 401(k). Once he leaves his private-sector career and can access the funds in this plan, he may transfer those funds to his TSP account. It is important not to close your TSP after you leave federal service so that you will be able to consolidate your qualified retirement savings in the TSP if you decide that you want to keep some or all of your savings in the TSP during your retirement years.

FERS Information for Former Employees

Are you weighing an important decision and would like to talk to someone? Consider a personal consultation.