“Hello, I am a retired 58 yr old federal employee that retired after 34 years of service. My wife and I are looking at buying a trailer and horse camping around the US. I have both a traditional TSP and a ROTH TSP. I want to know if there are any penalties if I withdraw $100,000 from either of my TSP accounts. I know any money from my traditional account will be taxed, but I was concerned about any penalties the IRS would impose.” Charles

As a Federal Employee, your eligibility to retire under the Federal Employee Retirement System (FERS) is determined by your age and number of years of creditable service. In most cases, you must reach your Minimum Retirement Age (MRA) to receive a full retirement benefit.

There are four categories of benefits in the FERS Basic Benefits:

- Immediate Unreduced Retirement,

- Early,

- Deferred, and

- Disability retirement.

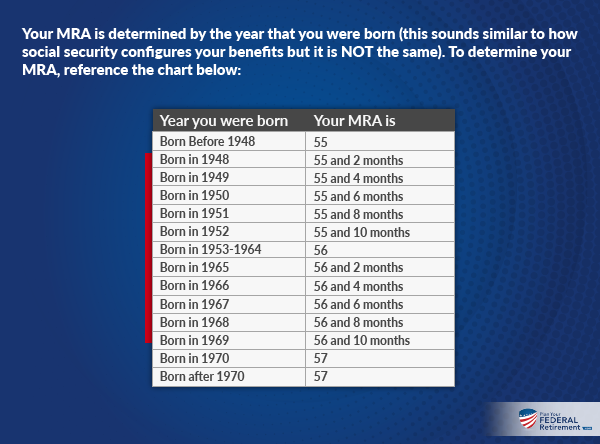

Your MRA is determined by the year that you were born (this sounds similar to how social security configures your benefits but it is NOT the same). To determine your MRA, reference the chart below:

| If you were born | Your MRA is |

| Before 1948 | 55 |

| In 1948 | 55 and 2 months |

| In 1949 | 55 and 4 months |

| In 1950 | 55 and 6 months |

| In 1951 | 55 and 8 months |

| In 1952 | 55 and 10 months |

| In 1953-1964 | 56 |

| In 1965 | 56 and 2 months |

| In 1966 | 56 and 4 months |

| In 1967 | 56 and 6 months |

| In 1968 | 56 and 8 mo |

| In 1969 | 56 and 10 mont |

| In 1970 and after | 57 |

Immediate Unreduced Retirement

In order to qualify for an immediate, unreduced retirement you must meet the following criteria:

| Your Age | Number of Years of Qualified Service under FERS |

| 62 | 5 |

| 60 | 20 |

| MRA | 30 |

| MRA | 10 |

Early Retirement

Some federal employees want to retire before they are eligible for an immediate unreduced benefit. This is available under an early option however, it comes with penalties associated with it.

What is really important about Charles’ question, and what confuses many federal employees, is that to make the determination as to whether or not the penalty applies means looking at Age AND Years of Creditable Service.

If you want to retire and have at least 10 years of creditable service, you can do so but receive a permanent penalty of 5% for every year that you are younger than age 62.

For example, if you separate from service at age 57 and have 10 years of service, you will receive a 5% permanent reduction in benefits for every year that you are under age 62.

62 Full Eligibility

61 5% Penalty

60 5% Penalty

59 5% Penalty

58 5% Penalty

57 5% Penalty

25% Permanent Penalty

Having ten years of service is only PART of the equation. Do not forget that to retire from FERS with 10 years of service you need to calculate your age into that equation.