One of the most frequent questions that we receive from FERS Employees is how do they apply for the FERS Supplement.

If you searched online for hours, going deep into the 3rd or even 4th pages of Google and other search engines, and have not been able to find out how do not worry. We are going to help.

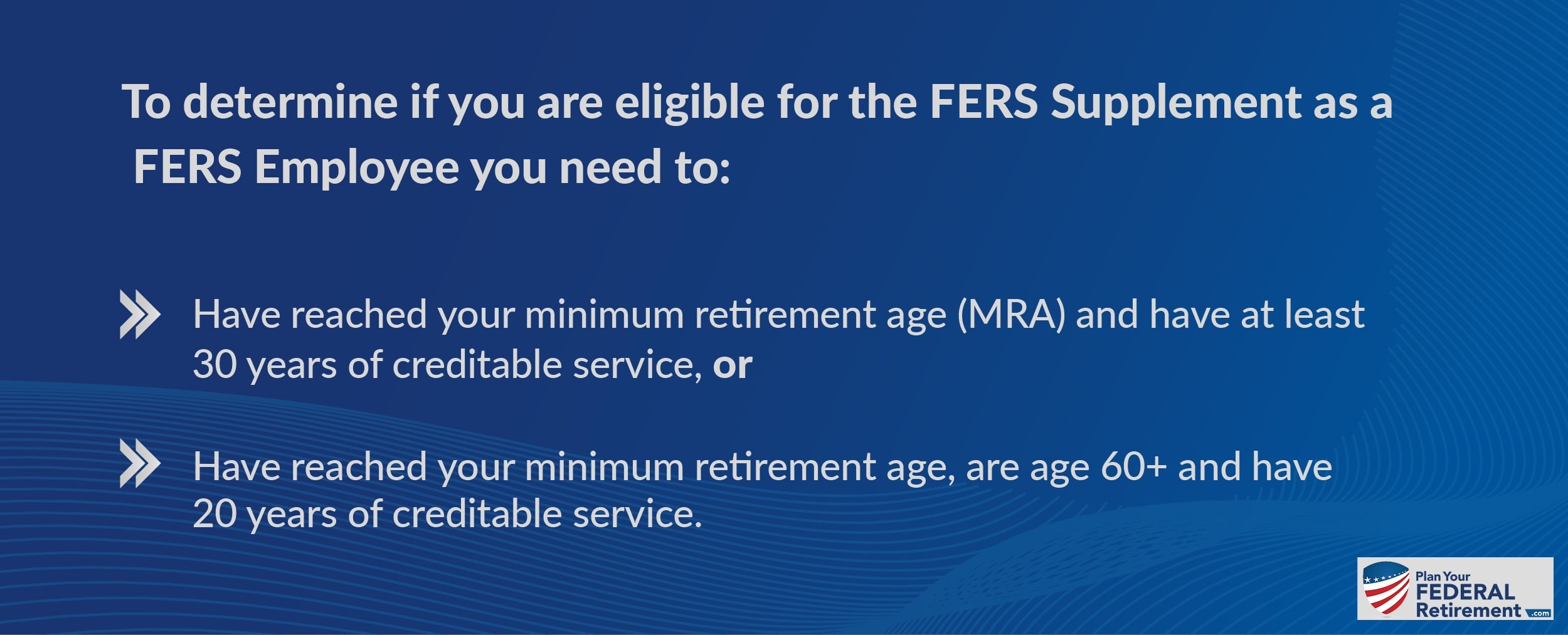

Are you eligible for the FERS Supplement?

As a FERS Employee, you may be eligible to receive the FERS Supplement. The Supplement is additional, monthly, fixed income. It begins at your retirement and lasts until you have reached age 62.

At age 62 you first become eligible to receive social security benefits so the Supplement will stop. However, just because you are eligible to receive your social security benefits when your Supplement stops, that does not necessarily mean that you should apply for social security at age 62.

If you start social security at age 62 you will do so at a permanently reduced rate versus if you had waited until you reached your Full Retirement Age (FRA) or older.

How is the Supplement calculated?

The Office of Personnel Management (OPM) calculates your FERS Supplement.

When you go to retire, if you do so before you have reached age 62 and you are eligible for the FERS Supplement, then OPM will calculate your Supplement income based off a portion of your age 62 social security benefit. The calculation is done based on your age 62 social security benefit, not your social security benefit when you reach your Full Retirement Age (FRA).

How to apply for your FERS Supplement

Actually, you do not apply for your FERS Supplement.

There is no website or online application to apply for the FERS Supplement.

If you are eligible to receive the FERS Supplement in retirement than you will receive the allotment automatically. You do not have to “apply”.

Likewise, you do not have to cancel or stop your FERS Supplement at age 62. That will cease when you reach age 62 automatically as well.

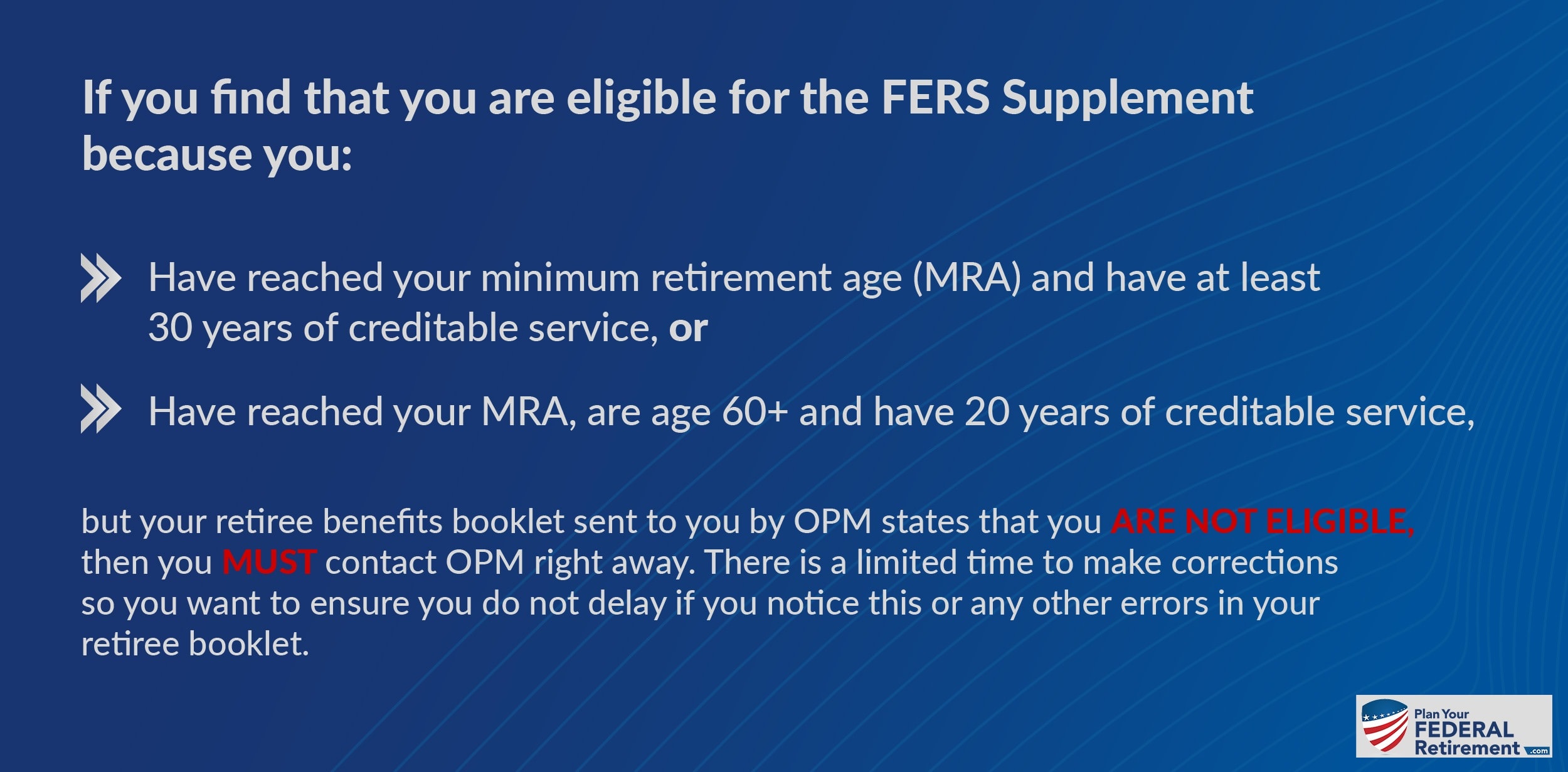

However, once you retire you may want to confirm that OPM has your particular file flagged as eligible for the FERS Supplement.

How to verify your FERS Supplement Enrollment

When you retire from Federal Service, you will receive a small retirement booklet in the mail.

The booklet looks like a piece of junk mail; we cannot tell you how many people throw out their retirement benefits booklet confirming their FERS Retirement information from OPM because they mistook for nothing of consequence.

Contained with your FERS Retirement booklet from OPM you will see confirmation of your eligibility to receive the FERS Supplement. The OPM mails you the booklet after they finalize your retirement, a process called certifying your retirement.

On average it takes OPM around 3-9 months to process FERS Retirement files.

The booklet contains all of the information about your retirement to verify its accuracy. You will see your gross, net pension as well as all of the deductions and survivor benefits. Additionally, you will see your FERS Supplement verification.

You have a limited amount of time after you have retired from the Federal Government to ensure the accuracy of your FERS information. To verify that you will receive the FERS Supplement, review your Retiree benefits booklet that OPM has sent you via post.