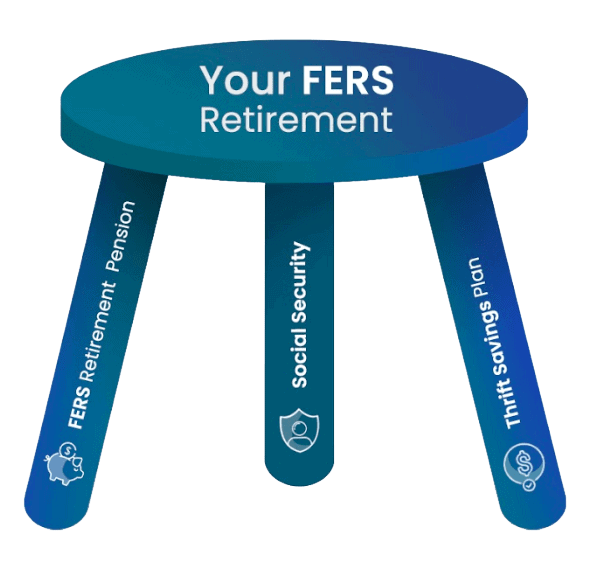

When we talk about your FERS Retirement, we’re really talking about several different benefits. FERS (Federal Employees Retirement System) has three main components:

- Basic FERS Retirement Pension

- Social Security

- Thrift Savings Plan (TSP)

Your FERS pension and Social Security will be fixed dollar amounts. But the money you get from your TSP will depend on how much you contributed and how well you managed the money.

As a FERS, you have a chance to take a more active role in managing your own retirement than CSRS do. But, that means you need to stay up-to-date on your benefits.

First – let’s talk about FERS Retirement eligibility rules. Then we’ll take a closer look at each leg of your FERS Retirement …

When Can I Retire Under FERS?

In order to retire under FERS – you must have reached a certain age and have enough years of creditable service.

What age? And how much creditable service? It depends on the type of retirement rules you go out under.

Your eligibility to retire depends on…

- Your Age

- Your Years in Service

- What Type of Retirement You Choose

Ex: For a regular Immediate FERS Retirement, you must have reached your Minimum Retirement Age (MRA) and have at least 30 years of creditable service. But you could also qualify if you are at least age 60 at retirement with 20 years of service, or be at least age 62 with 5 years of service.

There are several different types of FERS Retirement, each with their own requirements of age and years in service.

Click here to take a closer look at the different eligibility rules for FERS retirement.

Leg #1) Your Basic FERS Pension

Sometimes people will call your FERS pension a FERS annuity. Even OPM calls it an annuity. But to avoid confusion with other annuities (ex: an annuity from TSP, or annuities from insurance companies) we’re going to be using the term pension when we talk about your FERS retirement.

Every pay period, the government takes out a small portion of your pay to put towards your FERS pension. For most FERS, it is 0.8% of your basic pay. But your pension is not based on this amount.

Your FERS pension is a defined benefit program. “Defined Benefit” means the amount you *get* is defined or fixed. It doesn’t matter how much money you contributed – the monthly income from your pension will be a fixed amount based on certain factors.

Once you retire, you can receive a basic monthly pension for the rest of your life.

How Much Will My FERS Pension Be?

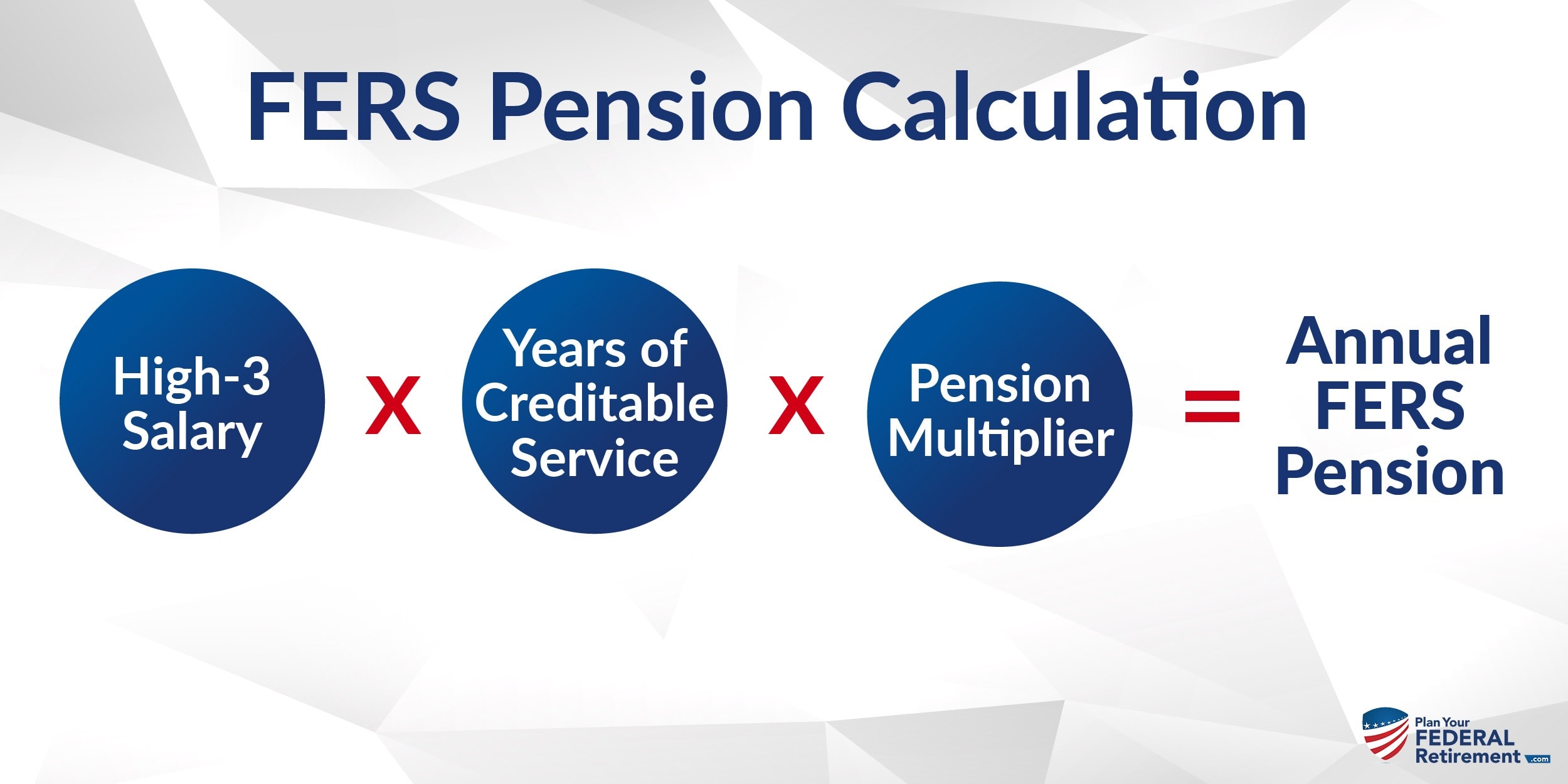

In order to calculate your basic FERS retirement pension, you will need to know three things…

- Your High-3 Salary

- Your Years of Creditable Service

- Your Pension Multiplier

Your FERS pension is calculated by taking…

FERS Pension Calculation

The calculation looks simple. But the complexity comes in how you calculate your High-3 Salary, and what really counts towards your Years of Creditable Service.

Click here to learn more about how each part of your pension formula is calculated and see examples of FERS pension calculations.

Common Mistake:

Planning with Gross monthly pension amount - but not calculating the Net.

To Avoid This Mistake: Take time to estimate your NET Pension

Gross vs. Net FERS Pension

Once you calculate your gross pension – it’s important to look at your net number.

One of the most common mistakes I see federal employees make is that they plan based on their gross pension – not on the net.

They calculate their pension, but they forget to look at the amount that they’ll really ‘take home’ each month. Some will remember to factor in the cost of their FERS survivor annuity – but that’s just one reduction.

There may be as many as 7 reductions to your FERS pension! Click here to learn more about the reductions to your FERS pension.

Leg #2) Social Security for FERS

Employees covered under the Federal Employee Retirement System (FERS) are typically eligible to receive Social Security benefits when they retire.

How Much Social Security Will I Get?

Every pay period, the Federal Government takes out 6.2% of your basic pay to put towards Social Security. But just like your FERS retirement pension, your Social Security benefit is not exactly based on your contributions – it is based on other factors.

The amount of Social Security you receive depends on the amount of money you’ve earned over the years and how long you have been working in a job that contributes to Social Security (most do).

The easiest place to find out how much you can expect to receive in Social Security used to be your Social Security Statement. But in recent years the Social Security Administration only mails statements to workers over age 60. If you do not have a paper statement, you can view your statement online. Go to Social Security’s website. You can create a mySocialSecurity account and view your statement online.

Special Benefit for FERS Retiring Before Age 62

There is a special benefit for some FERS retiring before age 62. It’s called the Special Annuity Supplement, but more commonly known as the FERS Supplement.

Social Security is an important part of the FERS Retirement package – but what about FERS who retire before they could even draw Social Security?

The FERS Supplement is designed to help bridge the money gap for certain FERS who retire before age 62. It will supplement a portion of your missing Social Security income until you reach age 62. But not all FERS are eligible to receive the Supplement. Click here to learn more about the FERS Supplement.

Leg #3) Thrift Savings Plan for FERS

The Thrift Savings Plan (TSP) is a special account for Federal Employees. The TSP was created as part of the Federal Employees Retirement System in 1986. Most government employees (FERS and CSRS) are eligible for the TSP – even those hired before it was created.

The TSP allows you to save pre-tax dollars in a special personal account. You can choose how to invest those dollars – although your choices are limited to the specific TSP funds.

With your FERS retirement pension and Social Security, you will receive fixed amounts. But with your TSP, the amount you receive depends on how much you put in and how well you managed the money.

Your TSP contributions are optional and separate from your FERS pension.

Many FERS are eligible for the TSP match – where the government and your agency contribute money to your TSP account.

Are You Missing Something?

As you know, the FERS retirement system is complex. And while your HR department is there to help, *YOU* are responsible for your retirement.