Is your spouse eligible for FEHB into your retirement from Federal Service?

The Federal Employee Health Benefit (FEHB), is one of the best benefits that federal employees have.

If you do not think so, ask anyone who does not have FEHB, they will be happy to tell you how great your FEHB insurance is.

One of the questions that we are often asked by Federal Employees is in regards to their Federal Employee Health Benefits (FEHB). More specifically, about coverage options for their spouse once the Federal Employee retires from government service.

Let’s dive into the rules of FEHB and what makes your spouse eligible or ineligible for coverage.

Federal Employee Health Benefits and Your Retirement

One feature of FEHB that is extraordinary is that as a Federal Employee in the Federal Employee Retirement System (FERS) you are able to keep and maintain your FEHB once you retire from Federal Service. Not only do you get to maintain this coverage but the Federal Government will continue to maintain approximately 72% of the premium (for most Feds). To do so, however, the federal employee must meet two eligibility requirements.

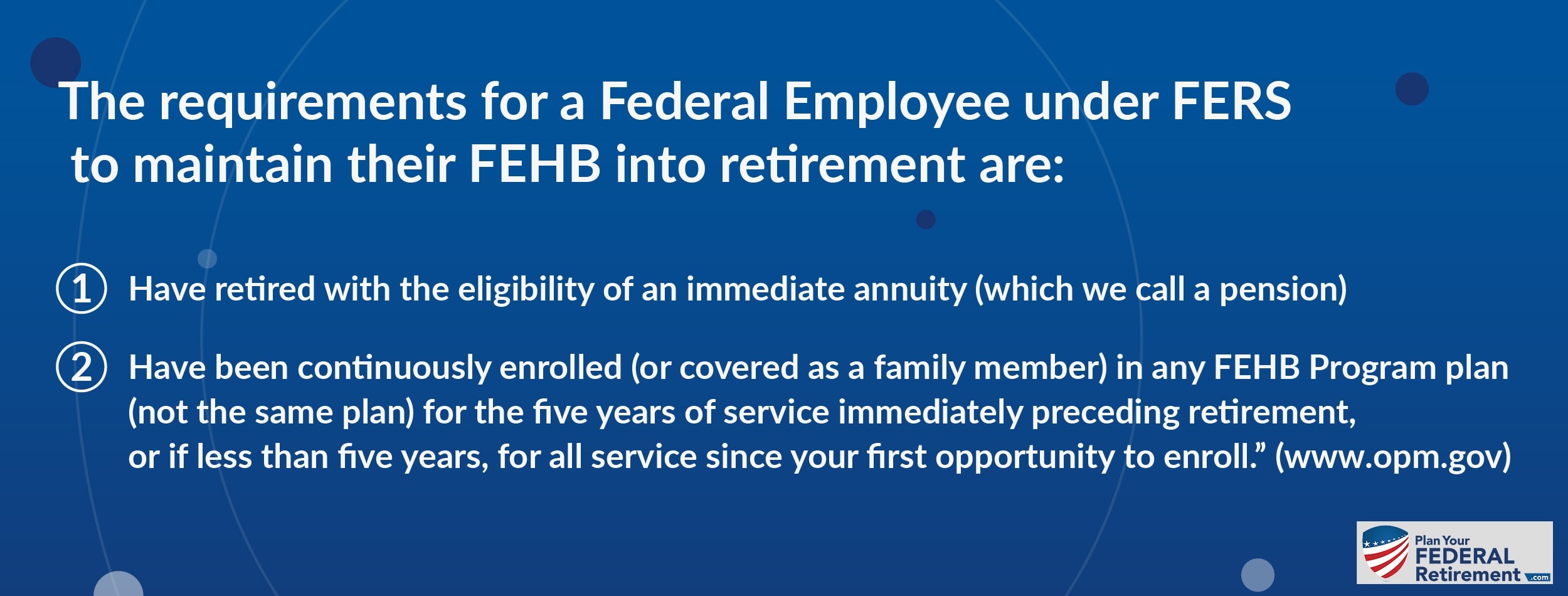

The requirements for a Federal Employee under FERS to maintain their FEHB into retirement are:

- “(1) Have retired with the eligibility of an immediate annuity (which we call a pension)

- (2) Have been continuously enrolled (or covered as a family member) in any FEHB Program plan (not the same plan) for the five years of service immediately preceding retirement, or if less than five years, for all service since your first opportunity to enroll.” (www.opm.gov)

These requirements apply to the Federal Employee but what about your Spouse? Is your spouse eligible for FEHB into retirement?

Can your spouse keep FEHB in retirement?

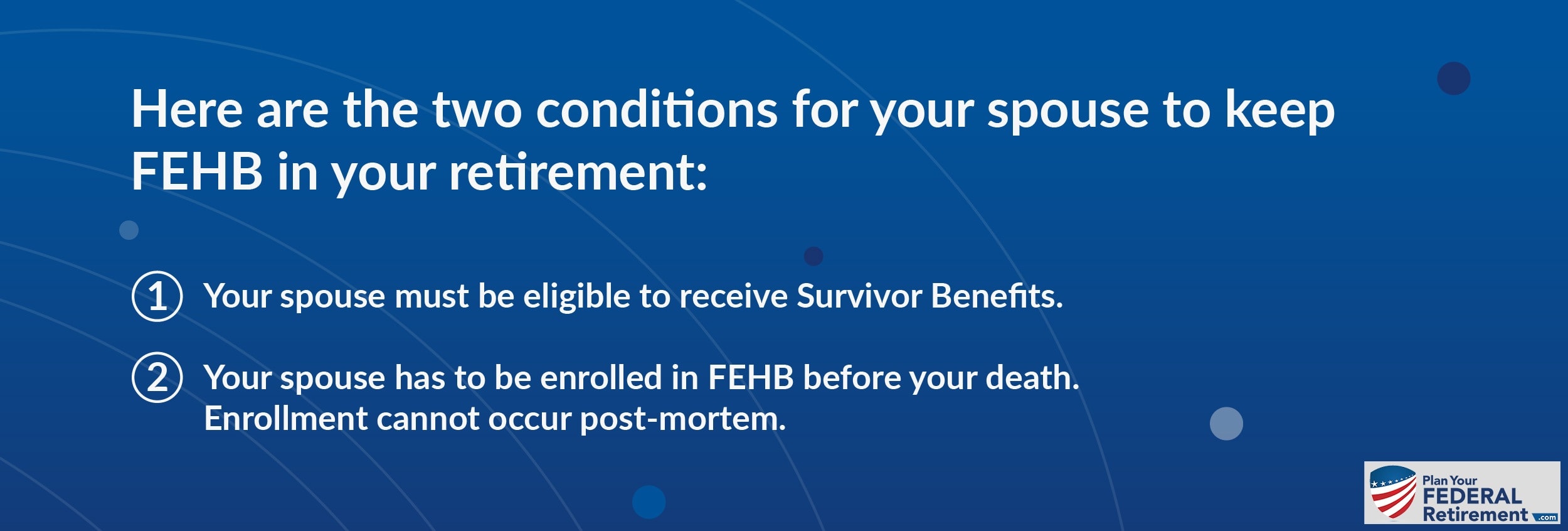

For your spouse to continue to have coverage under FEHB in retirement, they have two conditions. It is really important to keep these two conditions in mind because many Federal Employees are unaware of them.

Here are the two conditions for your spouse to keep FEHB in your retirement:

- Your spouse must be eligible to receive Survivor Benefits.

- Your spouse has to be enrolled in FEHB before your death. Enrollment cannot occur post-mortem.

Let’s discuss some critical planning points on these two conditions so that as a Federal Employee you can hopefully navigate your complex benefits system a little better and make informed planning decisions.

Survival Benefits

You must make your spouse eligible for survival benefits in order for them to receive FEHB into retirement. This is so critical to understand. When you go to retire from the Federal Government you are going to have to make selections in regards to your benefits. Some of those selections will pertain to those you leave behind.

Health insurance is one of them. You have to elect that your spouse receives a survival benefit in order for them to receive FEHB into your retirement. There are several options to choose from in regards to what and how much benefits you want them to receive if they were to survive you but if you elect for them not to receive anything, you will compromise their ability to maintain their FEHB in retirement.

If you predecease your spouse, you must have selected for them to receive a survivor benefit.

This is why it is so important to complete all of your beneficiary designations. Click here to learn more about your beneficiary designations!

Enrolled in FEHB Prior to Your Death

Unlike the Federal Employee, who is required to be registered for five years before retirement, spouses do not have this time obligation. However, they do have to be enrolled before you die.

These conditions become particularly crucial if the Federal Employee predeceases the non-Federal Employee spouse.

As the Federal Employee, not having your beneficiary designations in order could be hazardous to your spouse’s health or, at least their health insurance coverage. By not having your spouse enrolled if you predecease them, then the FEHB benefit dies with you.

This particular point is so critical to understand because too often we have sat down with a widow or widower and discussed what benefits they are eligible for after their Federal Employee spouse has passed away. Amongst those topics is always FEHB. Too often we have seen, prior to working with our firm, a Federal Employee enroll in a Single coverage plan (just for themselves) because their non-federal employee spouse had coverage with their employer. When the Federal Employee passes, life changes for the survivor. In dramatic ways often times. Most of the time we see widows and widowers reconsider their careers and staying with their current employers. Health care coverage becomes a big part of that decision and it is always a travesty when we work with such individuals and explain that they are not covered under FEHB so now, they have to make other arrangements for health insurance. It’s a travesty because health insurance is expensive and often times, private plans just are not as nice as FEHB is.