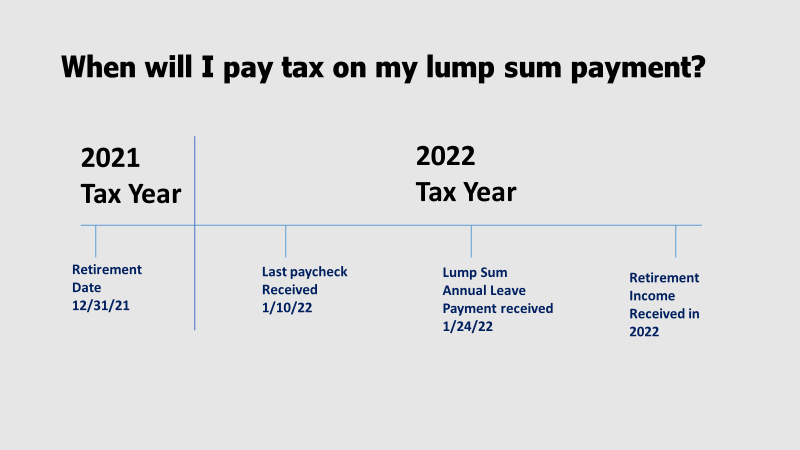

”I have gotten conflicting information about my lump sum annual leave. I plan on retiring on 12/31/21. I know that I will get my lump sum A/L payment a few weeks into 2022. Will the IRS count this as income for the tax year 2021 or 2022?

Also, will taxes on the lump sum A/L be deducted the same way as my regular income or will there be a single 20% deduction as with traditional TSP withdrawals following retirement?” – Geoffrey

If you have recently retired, the following discussions covering annual leave, voluntary contributions, and community property may apply to you.

Annual leave: A payment for accrued annual leave received on retirement is a salary payment. It is taxable as wages in the year you receive it.

What is deducted from my lump sum annual leave payment?

- Federal income tax

- State income tax (if applicable)

- FICA tax (Social Security tax of 6.2% up to $147,000 in 2022)

- Medicare tax 1.45%

Generally, a lump-sum payment will equal the pay the employee would have received had he or she remained employed until expiration of the period covered by the annual leave.

For example:

- 400 hours, GS 12/10 Washington, DC 2021:

- Annual rate: $113,362 / 2087 = $54.32 / hourly rate x 400 = $21,728

- 400 hours GS 12/10 Washington, DC 2022:

- Annual rate: $116,788 / 2087 = $55.96 / hourly rate x 400 = $22,384

- $22,384 2022 rate – $21,728 2021 rate = $656 additional payment based on 2022 general pay increase (minus taxes, of course!)