“Hello Micah,

I am so glad that I happened onto your website. I have read a lot of material and have watched a lot of podcasts. Because of your solid, genuine advice, I have passed your contact information onto some High School Classmates that will be retiring within 5 years.

I’m sure that you all have covered this at some point…I have just not seen it yet. From https://www.opm.gov/retirement-services/publications-forms/csrsfers-handbook/c051.pdf on Page 10 (PDF Page 12) at “”E. Earnings in Year 1. General Rule of Separation””, I am left with the impression that retiring in December is not as good as retiring in January.

I know that you and Tammy have discussed, many times, the best times to retire, but do not remember a discussion about the above. If January is better than December in order to extract a larger FERS Supplement between MRA and 62 and this has not been discussed yet, then I figured I should at least share this information with you all as a way of saying “”thanks”” for all the good your are influencing for retiring Federal Employees. If December is still better, then I’m confused and, if/when you have time, would appreciate clarification on the confusion that others out there might also be confused.

Again, thanks for all you do. I hope you’re enjoying and looking forward to the great weather you all experience this time of year.” – Steve

Steven passes along some really valuable information for Federal Employees in this week’s FERS Federal Fact Check. What we love about Steve’s question on whether or not it is better to retire as a Fed in December or January is that it really illustrates so many of the complexities of your retirement benefits.

We are excited to break these down with you!

FERS Retirement “The three-legged retirement stool”

You may have heard your retirement referred to as a three legged stool (a phrase we coined in 2008 because it best illustrates how your FERS retirement is balanced and because it is one of the few objects we can draw, financial planners… not artists).

Your FERS Retirement consists of:

- FERS “Annuity” which is really your Pension

- Social Security

- Thrift Savings Plan

Each of these legs of your retirement stool has different age-related milestones that are important to note.

FERS “Annuity” which is really your Pension: if you were born on or after 1970, your Minimum Retirement Age is age 57. That is the minimum age that you need to be to retire from the federal government with an unreduced immediate pension.

Social Security has three ages that most retirees should familiarize themselves with. At age 62 you are first eligible to draw -with a permanent penalty imposed – your social security benefits. At your full retirement age you can withdraw, penalty free, your retirement benefits. Or, you can delay your benefits until age 70 and receive an increase in your benefits for doing so.

The Thrift Savings Plan (TSP) allows retirees to make retirement distributions as early as age 55 providing that you are retired and no longer working for the federal government. If you are still employed with the federal government you will need to wait until you reach age 59 ½ to make a distribution that is penalty free.

What About the FERS Special Retirement Supplement

You may have noticed that there are some “gap” years outlined above. If you are eligible to retire when you reach your minimum retirement age, 57 for those born after 1970, you are not eligible for social security benefits until you reach age 62. That is a 5-year gap in your retirement income sources.

Because retirees who retire before age 62, are not eligible for social security benefits the Federal Government provides Federal Employees with a FERS Special Retirement Supplement.

The FERS Special Retirement Supplement is designed to act as a bridge between when you retire and when you are first eligible for social security benefits. Remember, just because you are eligible to take social security at age 62 does not necessarily mean that you should. There are severe penalties for starting social security early at age 62 vs your full retirement age.

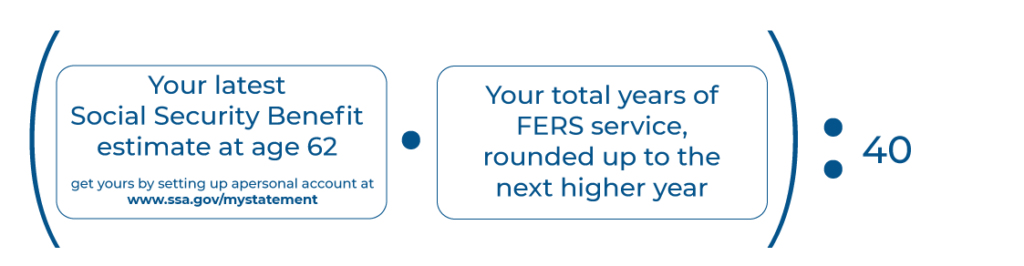

How to Calculate your FERS Special Retirement Supplement

Your FERS Special Retirement Supplement is not a guarantee of what your social security benefits will be but the government’s best guess. There are factors that are unique to you that may alter your benefit amount. For example if you will continue working full or part time in retirement and contribute more into your retirement benefits with the social security office.

In order to receive the FERS Special Retirement Supplement you must retire under a full, immediate retirement.

Eligibility for FERS Special Retirement Supplement means that you have one of the two following in place:

- MRA + 30 Years of Creditable Service or,

- Age 62 + 20 Years of Creditable Service.

The longer that you work, the more FERS Special Retirement Supplement you will receive. The problem is, you have to work longer!

December vs. January for FERS Retirees

Federal Employees love to maximize their retirement benefits from their service with the federal government. The problem is that often, they are so focused on maximizing their benefits that they delay retirement beyond the point that life, health and potential life spans make retirement “enjoyable.”

Those first few years of retirement we like to call the “go-go years.” This is hopefully when you are young and capable enough to really live retirement to its fullest. We want our clients to be able to travel, plan adventures, spend time on the river or garden beds doing what they love. We want to plan a retirement date around what makes the most sense for them as a person to retire instead of a specific date.

We build financial plans based on what the client needs and then devise a plan that works for them. Most of the time, we recommend not retiring in January because based on where you live geographically you may find that the beginning of the year is dark, cold and not ideal. Instead, we look at retirement in Spring when the thought of no longer going to work so that you can enjoy long summer days may make more emotional sense.

One Response

Hi. I would like to retire at age 60 (delayed benefit) is fine. I have worked for TSA since 2008. Is this possible? Best advise please