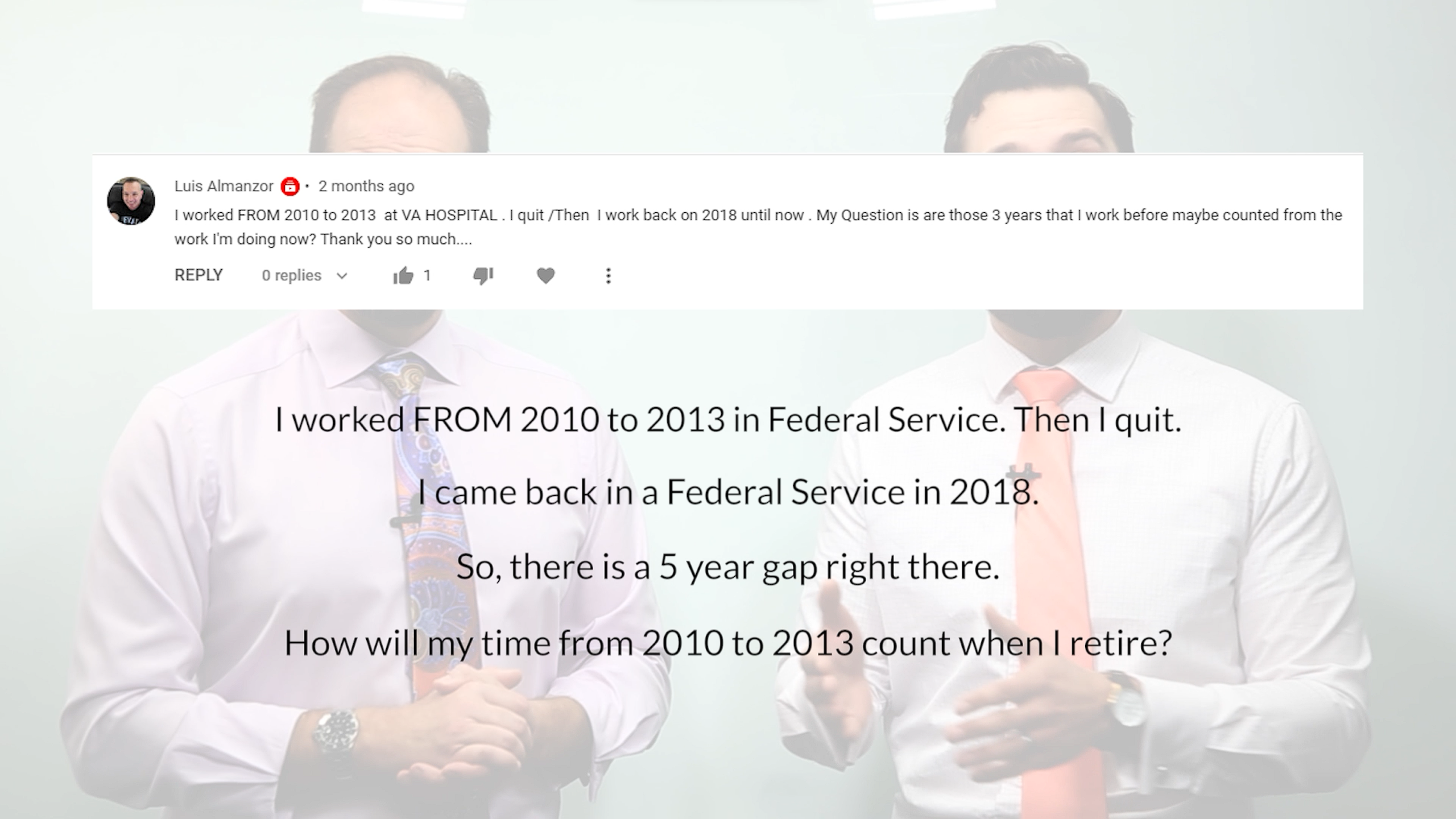

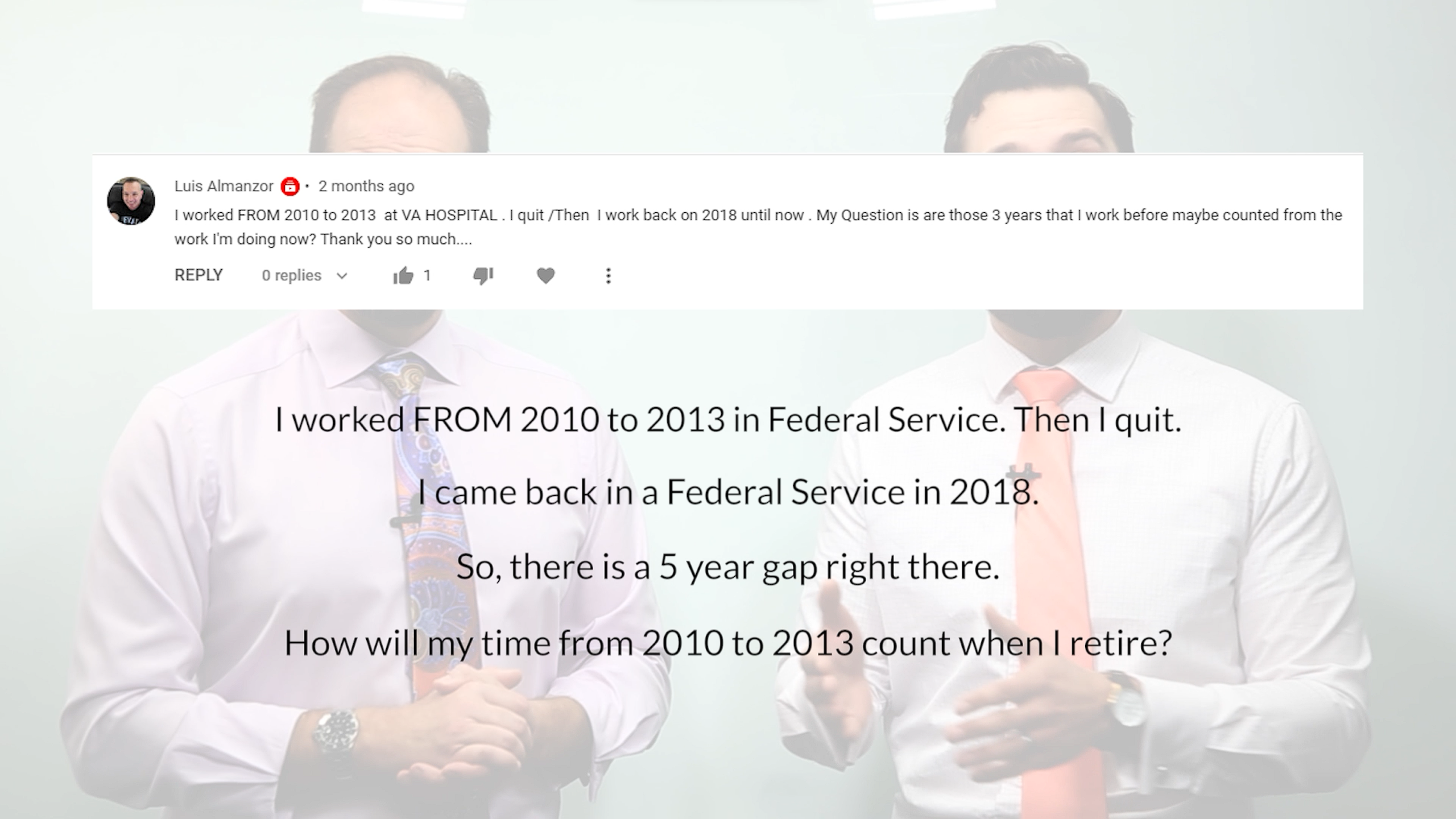

You Ask, We Answer – 5 Years Gap

“I worked from 2010 to 2013 at VA Hospital. I quit/and then I work back in 2018 until now. My question is are those 3

“I worked from 2010 to 2013 at VA Hospital. I quit/and then I work back in 2018 until now. My question is are those 3

“If I erroneously select an annuity from the TSP instead of a withdrawal from it, can I reverse that option? Thanks.” – Orlando. https://www.youtube.com/watch?v=8T69Yxmht-k Listen,

“Greetings, I am retired from the Army after 20 years as a Staff Sergeant. I am currently a GS 14 with 11 years under FERS.

”I have gotten conflicting information about my lump sum annual leave. I plan on retiring on 12/31/21. I know that I will get my lump

“How do I know when it’s worth it to withdraw (refund) my FERS contribution when I leave the Fed workforce? if I have less than

“I have about 1,300 hours of sick leave. What is the best advice on what to do with those hours as retirement nears for me?

https://youtu.be/GZdmjDOuNlY “I am a 35-year USPS employee and am planning on retiring this year. I am 58. I have heard about the backlog of retirement

As a Federal Employee, your High-3 average salary refers to the average of the highest three consecutive years of base pay earned. This is calculated

Action items for maximizing your retirement. Listen to the Full Episode: Enjoy the show? Use the Links Below to Subscribe:

More and more federal employees are thinking about retiring at the end of the year, and while we’ve already gone over the best times to

How is my benefit calculated? In order to calculate your FERS pension, you will need to know your creditable years of service as well as

Learn the important differences between retiring at 60 and retiring at 62. Listen to the Full Episode: Enjoy the show? Use the Links Below to

“I worked from 2010 to 2013 at VA Hospital. I quit/and then I work back in 2018 until now. My question is are those 3

“If I erroneously select an annuity from the TSP instead of a withdrawal from it, can I reverse that option? Thanks.” – Orlando. https://www.youtube.com/watch?v=8T69Yxmht-k Listen,

“Greetings, I am retired from the Army after 20 years as a Staff Sergeant. I am currently a GS 14 with 11 years under FERS.

”I have gotten conflicting information about my lump sum annual leave. I plan on retiring on 12/31/21. I know that I will get my lump

“How do I know when it’s worth it to withdraw (refund) my FERS contribution when I leave the Fed workforce? if I have less than

“I have about 1,300 hours of sick leave. What is the best advice on what to do with those hours as retirement nears for me?

https://youtu.be/GZdmjDOuNlY “I am a 35-year USPS employee and am planning on retiring this year. I am 58. I have heard about the backlog of retirement

As a Federal Employee, your High-3 average salary refers to the average of the highest three consecutive years of base pay earned. This is calculated

Action items for maximizing your retirement. Listen to the Full Episode: Enjoy the show? Use the Links Below to Subscribe:

More and more federal employees are thinking about retiring at the end of the year, and while we’ve already gone over the best times to

How is my benefit calculated? In order to calculate your FERS pension, you will need to know your creditable years of service as well as

Learn the important differences between retiring at 60 and retiring at 62. Listen to the Full Episode: Enjoy the show? Use the Links Below to

“I worked from 2010 to 2013 at VA Hospital. I quit/and then I work back in 2018 until now. My question is are those 3

“If I erroneously select an annuity from the TSP instead of a withdrawal from it, can I reverse that option? Thanks.” – Orlando. https://www.youtube.com/watch?v=8T69Yxmht-k Listen,

“Greetings, I am retired from the Army after 20 years as a Staff Sergeant. I am currently a GS 14 with 11 years under FERS.

”I have gotten conflicting information about my lump sum annual leave. I plan on retiring on 12/31/21. I know that I will get my lump

“How do I know when it’s worth it to withdraw (refund) my FERS contribution when I leave the Fed workforce? if I have less than

“I have about 1,300 hours of sick leave. What is the best advice on what to do with those hours as retirement nears for me?

https://youtu.be/GZdmjDOuNlY “I am a 35-year USPS employee and am planning on retiring this year. I am 58. I have heard about the backlog of retirement

As a Federal Employee, your High-3 average salary refers to the average of the highest three consecutive years of base pay earned. This is calculated

Action items for maximizing your retirement. Listen to the Full Episode: Enjoy the show? Use the Links Below to Subscribe:

More and more federal employees are thinking about retiring at the end of the year, and while we’ve already gone over the best times to

How is my benefit calculated? In order to calculate your FERS pension, you will need to know your creditable years of service as well as

Learn the important differences between retiring at 60 and retiring at 62. Listen to the Full Episode: Enjoy the show? Use the Links Below to

“I worked from 2010 to 2013 at VA Hospital. I quit/and then I work back in 2018 until now. My question is are those 3

“If I erroneously select an annuity from the TSP instead of a withdrawal from it, can I reverse that option? Thanks.” – Orlando. https://www.youtube.com/watch?v=8T69Yxmht-k Listen,

“Greetings, I am retired from the Army after 20 years as a Staff Sergeant. I am currently a GS 14 with 11 years under FERS.

”I have gotten conflicting information about my lump sum annual leave. I plan on retiring on 12/31/21. I know that I will get my lump

“How do I know when it’s worth it to withdraw (refund) my FERS contribution when I leave the Fed workforce? if I have less than

“I have about 1,300 hours of sick leave. What is the best advice on what to do with those hours as retirement nears for me?

https://youtu.be/GZdmjDOuNlY “I am a 35-year USPS employee and am planning on retiring this year. I am 58. I have heard about the backlog of retirement

As a Federal Employee, your High-3 average salary refers to the average of the highest three consecutive years of base pay earned. This is calculated

Action items for maximizing your retirement. Listen to the Full Episode: Enjoy the show? Use the Links Below to Subscribe:

More and more federal employees are thinking about retiring at the end of the year, and while we’ve already gone over the best times to

How is my benefit calculated? In order to calculate your FERS pension, you will need to know your creditable years of service as well as

Learn the important differences between retiring at 60 and retiring at 62. Listen to the Full Episode: Enjoy the show? Use the Links Below to