“I have about 1,300 hours of sick leave. What is the best advice on what to do with those hours as retirement nears for me? Thanks“ – Steve

First a little background: On October 28, 2009, President Obama signed legislation that allows federal workers who retire under the Federal Employees Retirement System (FERS) to receive credit for sick leave when they retire. Since around 1970, CSRS workers have been able to apply their accumulated unused sick leave toward retirement. That gave them months, in some cases years, of “extra” service. It’s a good deal and Congress did that to cut down on investigations of what appeared to be that many long-time, previously healthy employees were using their sick leave rather than losing it. So the system was changed. During the early part of the 2000’s this was dubbed, “the FERS Flu.” Today, sick leave is credited towards a FERS retirement, in the same way as it is under the CSRS benefit.

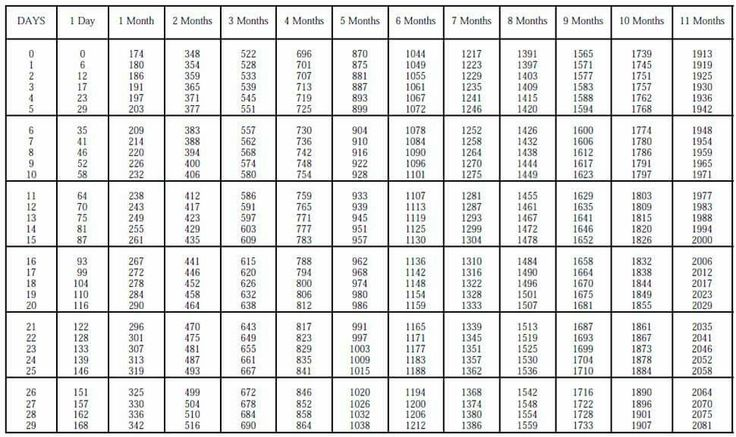

Using OPM’s Retirement Facts #8, conversion chart, you can see that 2,087 hours is equivalent to 1 year and in the case of Steve, his 1,300 hours is equivalent to 7 months and 15 days of additional service credit. (When the number of hours is between two numbers on the chart, i.e. 1299 and 1304, use the higher number for the conversion).

Here you can see how the sick leave credit increased Steve’s federal service from 30 years and 5 months to 31 years and 1 month or a total of 8 months of additional credit.

Example: | Years | Months | Days | |

Total Service 30 years, 5 months, 18 days | 30+1 | 5+1 | 18 | |

Sick Leave (1,300 hours) | + | 7 | 15 | |

30 | 13* | 33* | ||

Years and months for Calculation | 31 | 1 | 3 |

With credit for sick leave, this retirement is computed with an additional 8 months of service:

8/12 x 1% (or 1.1%) x $100,000

Years / months of service x factor x high-three average salary

Sick leave credit | X | Factor (1.0% or 1.1%) | X | High-three average salary | = | Value of sick leave in retirement |

8/12 | X | 1.0% | X | $100,000 | = | $666.67 / year |

Steve’s salary is $100,000 per year. If you divide your annual salary rate by 2087 hours you get your hourly pay rate, or in Steve’s example, an hourly rate of $47.91.

If Steve were to stay on the payroll to use his 1300 hours of sick leave, he would be paid a total of $62,283 ($47.91 x 1300).

In addition, Steve would earn additional sick leave while using it and at the end of the time, he would also receive credit for this time in the retirement computation.

It would take 93 years of receiving $666.67 / year extra retirement benefit to equal $62,283!

Unfortunately, sick leave is only granted for:

- personal medical needs

- family care or bereavement

- care of a family member with a serious health condition

- adoption-related purposes

Final thoughts:

- If you are sick, use your sick leave before retiring.

- If you are far from retirement, remember that your sick leave is your short-term disability insurance.

- Financially, sick leave is worth more to use it than to add it to your retirement.

- If you have a valid reason, use it.