Listen to the Full Episode:

It is crucial to be hyper-intentional when it comes to your retirement! How big of a change can your sick leave make? And how important is this subject when choosing the best day for your retirement?

In this episode, we detail some tweaks you can make to your retirement plan to get all the benefits you earned. Do you know how sick leave can affect your retirement calculations? Join Christian and Micah in clearing out the difference between the annual leave concept versus retiring with sick leave.

When you retire and have annual leave hours, you get paid out. So it would be best if you are also intentional about how the sick leave hours will add to that equation. Thinking of this is very important. Once you have chosen the best date for retirement, we can alter it based on sick leave or even yearly leave. Should we burn our annual leave? Should we burn our sick leave? What makes the most sense to do it? Which one is worth more? Get all your answers today and make the best of your retirement benefits!

What We Cover:

- Should you have your sick leave for retirement?

- Should you pick your retirement date based on your sick leave calculation

- How does sick leave count for retirement

- Counts as years/ months/ days towards your pension computation NOT your eligibility.

- Where do they turn their sick leave into Years and months for retirement.

- Is it different than annual leave, this has a carry forward of 240-ish hours each year

- Sick leave is unlimited

- Mistakes that are made around sick leave:

- Not counting it correctly

- Trying to get every penny out of your benefits

- Should you burn your sick leave

How to Convert Sick Leave | Sick Leave Chart

Resources for this Episode:

- Christian Sakamoto

- https://plan-your-federal-retirement.com/what-to-do-with-1500-hours-of-fers-sick-leave-at-retirement/

Ideas Worth Sharing:

'Hey, let's maximize the benefits or at least make sure you're not missing out on anything.' – Micah Shilanski Share on X

'So that's what we have to be thinking about is as your sick leave accrues is we know that your pension is always going to be based on your years and months of creditable service.' – Christian Sakamoto Share on X

'If you just retire, then you turn your sick leave and what will happen automatically, well it increases your pension which is great, but you don't get paid for right so you get one of the two benefits on the sick and the annual leave side you… Share on X

Enjoy the show? Use the Links Below to Subscribe:

Full Episode Transcript

With Your Hosts

Micah Shilanski and Christian Sakamoto

You can spend. You can save. What is the right thing to do? Federal benefits, great savings plans too. You can save your own way, with help from Micah and Tammy. You can save your own way. Save your own way.

Micah: Welcome back to another amazing episode of The Plan Your Federal Retirement podcast. I’m your host Micah Shilanski. And with me we have a an advisor Christian Sakamoto joining us yet again on the podcast. So Christian, excited to have you again, bud. How you been?

Christian: Great. Really good. And happy new year. Again, I can’t say that enough. It’s another exciting year. It always seems like the years go by pretty quick. But if we’re intentional about what our goals are, and one of the things we’re going to be doing into this new year and our resolutions and all that, whatever you want to call it. That’s my focus, and that’s what I’m going to be working on right in this january month is being intentional with my career and also the other other other goals that we have in life in life personal and professional. So I want to encourage our listeners to do the same.

Micah: Fantastic love it. You know, Christian, I know one of the things that kind of comes up as we’re going through things as people are looking at retirement as they’re looking at planning, etc. Is a Sick leave question, right? And they’re saying, it’s the beginning of the year, at least when we’re airing this podcast. It’s the beginning of the year, and now I’m thinking of retiring at the end of this year or maybe the end of next year, etc. And how much should I base my retirement date on my sick leave? What are your thoughts on that?

Christian: That’s a great question. And one of the things that we’re looking at when we’re working with our federal employees who are thinking about their retirement when to retire, is let’s pick this soon as state for eligibility purposes and and lifestyle purposes that we would want to retire right let’s get that out of the way versus what’s the soonest date that we would want to retire. And then once we get there, once we have that date, we can maybe tweak it depending on sick leave or maybe even annual leave. If we need to, but I would much rather have our our listeners and our federal employees really be intentional with what’s the what’s the soonest date that I want to retire and then less focused on the actual nuances of well, if I retire January 1 versus December 31, and all those little details, but in today’s episode, that’s what we want to get go into our those details so that you can make that tweak to your date if we need to.

Micah: You know, that’s really important. I love that being intentional about your retirement date, right? So often this is a mistake that we can all make. We get so fixated on the minutia. We get so fixated on these little details. Hey, I need to make sure I get every penny of benefits out of this. And therefore I’m going to do a b and c and we’re missing the bigger picture which is retirement. Now look, don’t get me wrong. We want you to get all of the benefits in which you’ve earned and get those into retirement. But let’s not be pennywise and pound foolish about retirement. We pick the retirement date Christian and forgive me I know you’ve heard me say this a bunch I’m sure our listeners have as well. I live in Alaska and clients are like I want to retire on December 31 Because it is the best day of the year to retire well we can debate that but let’s just go with that in a concept. Well fantastic for all of these reasons you’re gonna have as much annual leave is going to be accrued, you’re going as much sick leave is going to be accrued all of these other things and you retire on December 31. And guess what? On January 2, it’s dark and cold, right? You want to retire. And some plants are like yes, because I’m going to travel I’m going to do these things etc. But maybe it’s not the best thing for you. Maybe a March or April date is going to be better. So I like that about the bigger focus first is let’s make sure we have a bigger focus in mind. And then let’s back the benefits into it to make sure we’re not missing something because sometimes things will come up where a client is going to be on the borderline of getting a different benefits and if they worked a few more months easy one is between excuse me doing 61 and 62. Right. I had a client at one point in time that was 61 years and she’s gonna retire at 10 months of federal service. Well, as our listeners probably know, she was a very savvy, they make it a 62 while you’re still working as a federal employee with 20 years of creditable service for retirement, then you get an extra 10% bump in your pension. So is that whoa, hold that time I’ll break so if you wait too long months, you’re gonna get a permanent 10% bump in your pension for her it makes sense to do that. Now, if somebody’s 58 who I don’t know if I tell you to wait an extra four years to get that bump but a couple months it would so let’s be hyper intentional about what’s the retirement focus then we start overlaying the benefits and saying, Hey, let’s maximize the benefits or at least make sure you’re not missing out on anything.

Yeah, I love it. Well, let’s first talk about how we’re calculating sick leave into retirement. Essentially, what does that look like if you retire with sick leave out and I know that’s a question that will come up in client appointments. So let’s transition and talk about that.

Micah: Yeah, absolutely. So this is something that definitely comes up is what’s the difference on the sick leave side versus the annual leave side? Right because yeah, two different things. Christian, would you walk us through a little bit on the annual leave concept versus the sick leave concept? Then we’ll start talking about how it works different for retirement. Sounds good?

Christian: Yeah, absolutely. When you retire and you have annual leave hours, that gets paid out to you. You know, the first couple of weeks after you retire as a lump sum up your annual leave gets paid out to you as a lump sum when you retire. However, sick leave, instead of it being this annual or this lump sum payment. What they’ll do is they’ll add up the hours and convert that to days, months, maybe even year or a year of creditable service for your retirement, that that’ll get added to your pension calculation. That’s for sick leave. So that’s what we have to be thinking about is as your sick leave accrues is we know that your pension is always going to be based on your years and months of creditable service. So we have to be intentional with how the sick leave hours will add to that equation. So for example, if you had, let’s say 20 years of creditable service and five months, so 20 years and five months of credible service, and you also have sick leave hours that add up to seven months of credible service. They would calculate your pension based on the 20 years and five months of your credible service. time working in the government plus the five the seven months of sick leave so that you would have 21 months as a moving into your pension how they would calculate your pension.

Micah: Well, that increases so if someone is looking at their LTS right now leave any statement and it says great I have 1000 hours of sick leave just for discussion. Well, there’s 2080 hours in the year. So do I just automatically cut that in half and say that six months or how do I turn those hours of sick leave into years, months and days?

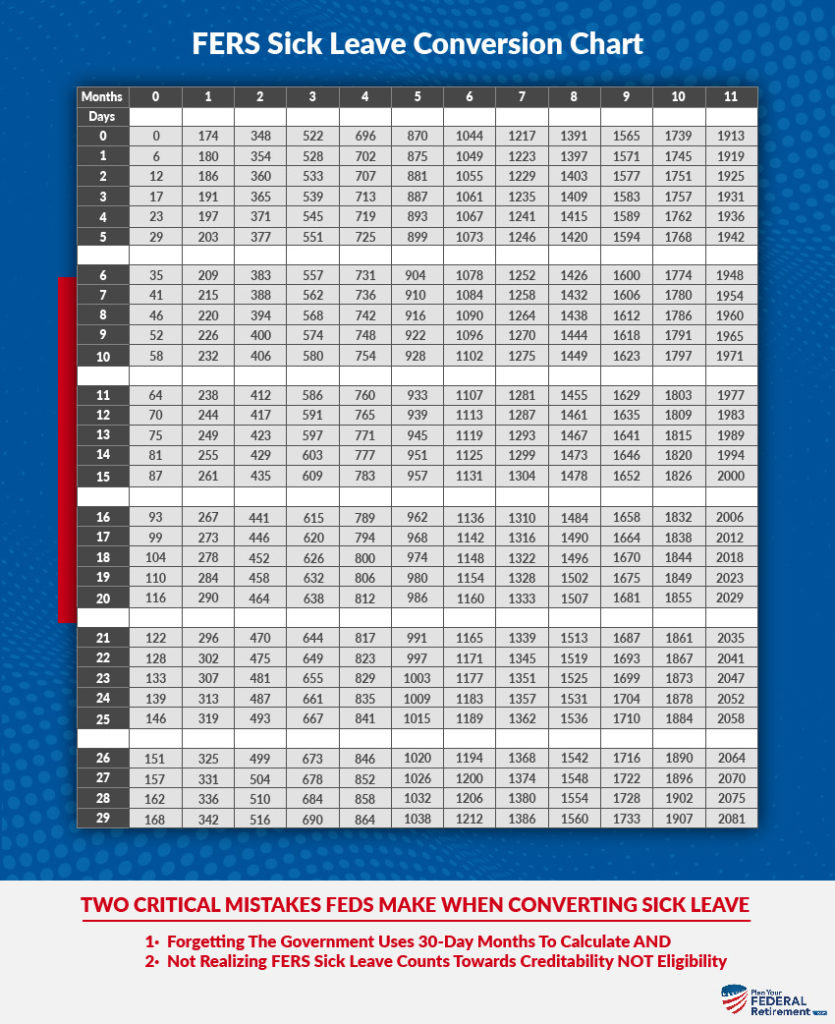

Christian: Great question. There’s actually a chart for this. So if you were wanting to get a free eye exam, this would be the chart to go and look at because there is a lot of different numbers on it. And what it’s called is the first sick leave conversion chart or the 2087 charts because in one year, there’s 2087 hours. So we have this chart on our website PlanYourFederalRetirement.com and we can link that in the show notes description as you can see this conversion, but it’s a chart that looks at all right, depending on how many sick leave hours we go across and see how many months that is and we go down to see how many days that is. That would determine based on let’s say 1000 hours, if you had 1000 hours, then you would have gone on the chart and looking at it now. Five months and 23 days of creditable service.

Micah: Yes, that’s really important. So again, we’ll go there and go to our website, PlanYourFederalRetirement.com/69 is the 16th episode and then that will link directly to the pond and we’re going to put a chart on there for you as well free eye exam. I love that comment. But it’s going to turn it into that years, months and days. Now, keep in mind as Chris was talking about with the sick leave, there’s two parts whenever we’re calculating your pension number one eligibility for retirement and number two, your pension computation. Now OPM calls it an annuity computation. Don’t worry, I just think LBM is wrong. So we’re going to call it an it a pension. Because an annuity is something you get from an insurance company and it can be confused with a tsp annuity, other things etc. So we’re going to call your federal benefit always your pension. So whenever we’re looking at pension, we’re always looking at those two things, eligibility and computation and those are not the same thing. So when you’re adding this up, you gotta add up your years, months and days of boots on the ground federal service, plus any military time that you’ve bought those two things count for your eligibility. So if we’re meeting our standard MRA plus 30, minimum retirement age, plus 30 years of federal service, so let’s say it was 57 You got to be 57 to be able to retire. You have 30 years of federal service. Okay. Why have three components now, which make up my length of service, I have my boots on the ground time, potentially military buyback time, and then my annual sick leave that comes into place. So with those three things, we got to make sure we know which council which category, only the ground time and the military time are going to count towards the thirty years that I have to have to be eligible to retire no my sick leave will increase my pension computation. So it means I’m gonna get paid for it which is fan freakin tastic. But you’re not going to be held for In fact, this is kind of a throwback in time back to the non foreign area equity retirement assurance act is when this all change because there was a satisfying as or versus who’s going to know when you’re sick leave did not count for your retirement. And in fact, if you didn’t use it, you lost it. And so Christioan was really sad during this period of time, because what we found is federal police would work for 23 years in federal service in like a year, two years before they would retire. They would get deathly ill they would get and burn all of their sick leave. Yeah, it was horrible. They burned all of the sick leave but then as soon as they retired, miraculously they were cured. First flu was gone. Of course that was a joke, kind of. In the Northwest Area gave me time to transact in that period of time. That’s when all of those rules changed. And in that time now or sick leave counts towards your pension, which is fantastic. Just understand the difference in those rules. So you don’t get caught up thinking oh basically makes me eligible for retirement because it does not.

Christian: Yeah, super important distinction, because going back to our first point, when we’re planning your month and date, we have to figure out first for eligibility purposes. What’s going to make the most sense when when would be the as soon as that it would make the most sense of so for example, if we want to keep our health insurance in retirement, we have to know what are those thresholds? Is it an MRA with 30 years of critical service is age 60 with 20 is at age 62. With five maybe it’s an MRA plus 10 retirement we’re going to postpone right there’s a lot of little details here that we have to first figure out from eligibility. And so to make this point, the sick leave gets added to your pension, but not for eligibility purposes. We still have to meet those requirements, with boots on the ground time and bought back military time, not for sick leave hours that are added later to the calculation of your pension.

Micah: You got to know one oddity because keep in mind there’s virtually an exception for every rule right? You just got to know where they are. The only thing that sick leave will help you be eligible for is the is the 62 and 20 Bonus retirement if as you were talking about earlier, right if you make it to 62 plus 20 years of federal service, you were eligible for that increased 10% bonus is super cool factoid that let’s say you only had 19 and a half years of federal service between boots on the ground in military time, but you had six months of sick leave. Are you in your 62 and retiring that six month a sick leave does make you eligible for that 62 and 20 bonus which is fantastic. We there’s a special letter out from OPM that talks about that and how that works. And that’s kind of the only time that I’m aware of that sick leave helped make you eligible for something so it’s fantastic.

Christian: Yeah, that’s great.

Micah: Christian, one of the questions that we get all the time is, you know, should we burn our annual leave? Should we burn our sick leave? Like what makes the most sense to do it? This is coming from like a genuine client question says, hey, look, I gotta take time off for surgery. Should I use my annual leave or should you use my sick leave right? So it’s a qualified time that they’re taking off and they could choose to use it for each one, which one is worth more? Well, your annual leave Christian, as you pointed out, you’re gonna get a lump sum paycheck for right so you’re gonna get paid for all of that amount. So if you use your leave and it extends your retirement, well, you’re getting the best of both worlds, because not only are you getting a paycheck, but it’s extending your length of federal service, which is going to increase your pension. So that’s the way that I look look at both of these if I have an opportunity to burn my sick leave because it will increase my length of federal service. That makes a lot of sense to do because now I get the best of both worlds. Now I get to increase my length of service which increases my pension plus you’re burning out sick leave and you’re getting paid for it. If you just retire, then you turn your sick leave and what will happen automatically, well it increases your pension which is great, but you don’t get paid for right so you get one of the two benefits on the sick and the annual leave side you get paid for it. So you get a lump sum check which is fantastic but it does not increase your pension. So you’re giving up something each one of these so what is my ideal is long as everything lines up in a super legit will then fantastic use one of those to increase your length of federal service. And now you’re getting the best of both worlds. The only other caveat that I like to put on that one is the benefit that you could have with annual leave depending on your savings depending on where you’re at. It’s going to take OPM months to process your retirement. In fact, we had one client retire the beginning of the end of last year 12/31/2021. December like a week before Christmas is when he got his of 2022 is when he got his opium adjudication paperwork that says good news. Your your pension is adjudicated, that means finalized. The bad news is they did it wrong. So now we’re going back to OPM to fix the issues. So he had to wait 12 months before his pension was finalized. He had to wait about five or six months before he started getting his interim pay. Now we need to go back and change some things with his pension. Why do I bring this up? This goes back to one of our previous episodes we talked about cash flow cash flow is so important. How long is it going to take from when you retire to an OPM is going to start sending you a retirement check? What’s your savings look like? That could be a really good reason. You want to bank up your annual leave so you can have that lump sum pot of money so you can help bridge that gap.

Christian: Yeah, yeah, good point. Wow. That’s That’s incredible. 12 months just to do it wrong. Not good.

Micah: Yep. Yep. So that’ll be something I said. I said, great news. And he said, What do you mean great news. It’s a great news. We found it within the window. We’re going to go to them and we’re going to communicate with this and there’s there’s a couple things that are wrong with it. We’re going to be able to fix a couple of them the other ones a bit of a long shot but but we’re going to work to the best we can.

Christian: Yeah, yeah, good. Oh, good. We’re helping them alright.

Micah: So Christian, this is really the importance of sick leave, right? Understanding how it adds to your federal benefits, where to use it, where to use it, etc. The only other thing I like to throw in here and sick leave is this is definitely a mental health thing. as well. And not to throw that out lightly. But sometimes I have clients that don’t want to burn any additional leave period, regardless of their state. And you know what, sometimes you got to look at this and say, Why do we have sick leave, right? We have sick leave in order to take those sick days in order to get that recovery time. Maybe it’s most important to do that. And also kind of think of this as almost like a short term disability buffer that you have right here. If God forbid something happens to you, this is your kind of bank in reserve. So I do like clients to to use it. I was like them to save it if they don’t need it, right. So use it intentionally be hyper focused and what that intent is that makes sense.

Christian: Yeah, yeah, absolutely. Well, one of the things I’m thinking about too with sick leave is when it’s calculated, we talked about when we look at the chart, figuring out well, how many months and days does it actually add up? But looking at it from let’s say you reached. So when we’re doing the calculation for your pension, we add up the time that you’re working boots on the ground, plus any buyback military time plus any time for sick leave. And this is where for our listeners who really want to be intentional when to retire. What’s the I guess the best day to look at it? We have to look at it from that days. If they don’t equal one month, they get rounded down. So if we added up your time boots on the ground, I’d say was 20 months and to use my example earlier 20 years and five months and then we added up all the the months and days of sick leave. And that added to be seven months if you had those two added together be 21 years. But then if you had like a few more days of that because of sick leave, well just know it’s going to be the 20 years and zero months it wouldn’t be added or rounded up to 21 years and one month so it gets rounded down is the only point that I wanted to make this that’s a great point.

Micah: I’m so glad you brought it up because it’s definitely a mistake that we see that employees make is they want to get the most out of every single thing in their pension and they miscalculate how sick leave is calculated in there. They missed it by a day and also they lose an entire month. Because if you go to retire with 32 years and 30 days and you think it’s spot on, but it’s actually 29 days and not 30 you don’t get the month credit you go back that entire month. So like so don’t be greedy with this, right? I would rather leave a little bit of ours on the table to make sure you get a full month then try to calculate it down to the penny. In fact, we will not calculate this right now and we’re always going to need a cushion because we want to make sure you get the most in retirement and it’s just not worth the risk in my opinion.

Christian: Yeah, yeah, I’ve seen that too. So I percent agree.

Micah: Well Christian, this podcast is all about action items for our listeners to be able to take and implement stuff this week to help improve them and improve where they’re at with planning their retirement. So why do you think a good asset to keep up our listeners is?

Christian: First thing going back to the retirement date is really knowing what your retirement date is going to be and here we are in January and it’s a good time to be thinking about our goals for the year is a good time to be thinking about our retirement date. And then once we have that date we can factor in how sick leave will increase the pension but as we talked about before, it’s not going to count towards eligibility. So actually I’m again figuring out when is that date that we want to retire and then again looking at for sick leave. How is that going to add to the pension. y

Micah: You know as one of these I want to be really intentional about stating we’ve been saying you’ve been intentional a lot so I want to be intentional in our podcasts. We have a goal to help over 1 million federal employees plan their retirement, and we can’t do that without you. So you’re gonna hear me say this a lot this year, but we really appreciate you listening. We appreciate your feedback. We have that listener survey, please make sure you took that as well. We want to get your feedback. We also want you to share this information, get it out there help people plan their retirement, the more federal employees that are armed with great information, the more successful they are going to be planning their retirement and that’s on your shoulders. That’s on your ability to help these people. So thank you so much. The other thing I would say is come up with a plan on how you’re going to lose your security, right. And I like to have things written down because if I just leave in my mind, they’re slowly going to change over time. So write it down. How are things going to how are you to apply the user and what you’re planning to use? You’re simply how much do you want to use every single year? How much do you want to carry forward? Then let’s be intentional about spending that time with family taking those vacations using that sick leave as appropriate if you guys need to, but know what these numbers are? Guys, thank you so much for listening another great episode. Christian, I really appreciate you how you being on the podcast and helping this out. so thank you so much.

Micah: Awesome. Well, until next time everybody happy planning.

Christian:Happy planning.

Hey, before you go, a few notes from our attorneys. Opinions expressed

herein are solely those of Shilanski & Associates, Incorporated, unless

otherwise specifically cited. Material presented is believed to be from

reliable sources, and no representations are made by our firm as to other

parties, informational accuracy, or completeness. All information or ideas

provided should be discussed in detail with an advisor, accountant, or legal

counsel prior to implementation.

Content provided herein is for informational purposes only and should

not be used or construed as investment advice or recommendation

regarding the purchase or sale of any security. There is no guarantee that

any forward-looking statements or opinions provided will prove to be

correct. Securities investing involves risk, including the potential loss of

principle. There is no assurance that any investment plan or strategy will be

successful.