One of the questions that Federal Employees frequently ask us is how they can convert some of their Thrift Savings Plan (TSP) dollars into the ROTH component of the TSP.

As a Federal Employee or member of the armed services, there are so many advantages to actively participating in the TSP. Amongst them is that you can select how you want your contributions treated for federal income tax purposes. There are two choices: Traditional and ROTH.

Traditional vs. ROTH Contributions

Traditional contributions are “pre-tax” contributions and designed for tax-deferred treatment. Meaning, the monies that you contribute in this capacity are not taxed until you withdraw them. Monies in your traditional component of the TSP are subject to Required Minimum Distributions (RMDs). This means that when you reach age 70 1/2 you will have to take a calculated amount of monies out of this investment vehicle. If you don’t, you risk incredibly significant fines for not doing so.

Conversely, you can also make contributions to the ROTH component of your TSP which are after-tax. Meaning, the monies that you put in are taxed today at your current rate so that when you withdraw them later in retirement, you can do so tax-free providing that you satisfy the Internal Revenue Services (IRS) requirements. ROTH investment contributions are not subject to RMDs because you already paid tax on the money you put in.

In the world of private investments, outside of the TSP, a popular strategy was to take monies previously placed in a Traditional Individual Retirement Account and convert them to a ROTH Individual Retirement Account. Through a strategy called a Roth Conversion, investors took the funds from the Traditional IRA and converted them to the ROTH IRA, so that they could pay taxes on the monies at their current rate and take advantage of the “tax-free” status of these accounts earmarked for later in life.

Converting a Traditional IRA to a ROTH IRA

The TSP does not allow for ROTH conversions.

The TSP will allow you to change the tax status of your contributions from Traditional to ROTH which will affect contributions moving forward. However, the TSP does not allow for retroactive changes; you cannot change the monies you already allocated into the traditional tax status (tax-deferred) to the ROTH status (tax-free).

You can change your TSP contributions from tax-deferred to the ROTH by logging into your TSP account online and selecting to do so.

What options do you have if you are younger than 59 1/2? Well, not many when it comes to converting funds from your traditional TSP to a ROTH. However, if you are separated from service or over age 59 1/2 there is a unique planning method you could explore.

Transferring TSP to IRA

If you are separated from service or you have reached age 59 1/2 you can transfer, TRANSFER – NEVER ROLL OVER, some of your TSP funds into an Individual Retirement Account. Caution: Strike the word “Rollover” from your vocabulary and be leery of anyone who uses this term with you. Rollovers are not bad but you have to understand how they work. They are not synonymous with the word “transfer.” When you roll over an account, the agency — in this case, the TSP office — takes your funds and withholds 20%. They send those withholdings to the IRS. Then, the TSP office sends you the 80% balance of what you requested. Within 60 days, you must put 100% of those funds (including the 20% that now sits with the IRS) into a retirement account.

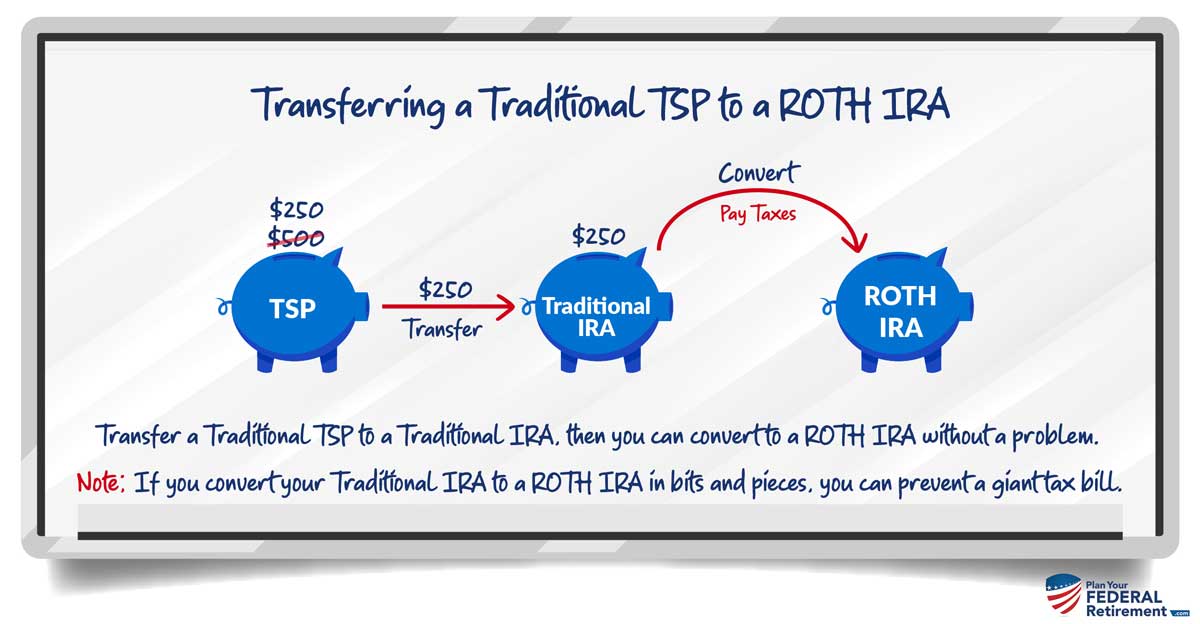

Transferring Traditional TSP into a ROTH

If your end goal is to take all or a portion of your traditional TSP and move it into a ROTH, here is a strategy that you can consider after properly weighing the tax consequences and understanding the operational order.

If you are separated from service or have reached age 59 1/2, you are allowed to make an in-service withdraw or distribution from your TSP. You can transfer the appropriate portion into a traditional IRA. Once the funds are in a traditional IRA, you can convert the funds to a ROTH IRA. Keep reading about taxes below. In this process, there are 3 accounts open: TSP, IRA, and ROTH IRA.

Now, before you get too excited and want to convert 100% of your monies into a tax-free account, remember, the money that you are converting is taxable when you convert it. As a helpful financial planning tip, you do not have to convert all at once. Consider staging the conversion over several years or when it is most tax advantageous to do so.

When you begin to take your FERS Pension and Social Security, those income taxes are taxable. Could you choose a time period BEFORE you draw those to make a conversion? If one spouse retires sooner than the other and you experienced a decline in your tax status, could you do it then? If you experience a decline in the markets and anticipate that in time those investments will go back up, is that a good time to convert? You want to carefully conduct a tax analysis to determine what your tax bracket is and the most advantageous amount to convert to a ROTH.

No “Undo” Button

Please remember that under the Tax Cuts and Job Act there is no longer an “undo” button on the ROTH Conversion. Once you convert those funds, there is no going back. You may want to consider waiting until the Fall time period to conduct a ROTH Conversion just so you have time to most accurately anticipate your taxable earnings for that year.

Happy Planning!