Tax season is upon us, and for many, it is a scary time. With so many opinions floating around, it is hard to decipher between what is fact and what is simply a misconception. So today Tammy and Micah will be discussing common mistakes made when it comes to taxes and how to avoid them this year.

Listen in as they discuss the importance of getting ahead of your taxes so that you are better prepared when your taxes are actually due. You will learn the importance of considering every pension you receive, where child support fits into your taxes, and more.

What We Cover:

- Common misconceptions around taxes.

- The four different buckets when it comes to taxation.

- The importance of going over your employee contribution.

- Why you must consider every pension you receive for taxes.

- Where alimony and child support fit into taxes.

Resources for this Episode:

Ideas Worth Sharing:

Sometimes, it’s a matter of re-learning what you thought you knew.– Tammy Flanagan Share on X

We see so many people make mistakes when it comes to taxes, and it is generally not because of what they didn’t know but what they think they know that just ain’t so. – Micah Shilanski Share on X

It’s not a simple as the old days when you got one pension check and that was it. –Tammy Flanagan Share on X

Listen to the Full Episode:

Enjoy the show? Use the Links Below to Subscribe:

Full Episode Transcript

With Your Hosts

Micah Shilanski and Tammy Flanagan

You can spend. You can save. What is the right thing to do? Federal benefits, thrifts, savings plans, too. You can save your own way, with help from Micah and Tammy. You can save your own way, save your own way…

Micah Shilanski: Welcome back to the Plan Your Federal Retirement Podcast. I’m your cohost Micah Shilanski, and with me as usual is the amazing Tammy Flanagan. Tammy, how are you doing, ma’am?

Tammy Flanagan: I’m just fine, Micah. Good afternoon, good morning, whatever time of the day it is where you are. I know we’re in two different time zones, so wherever you’re listening from, you’re probably in a different time zone from either one of us.

Micah Shilanski: That’s right, we got that coast to coast coverage going on.

Tammy Flanagan: That’s right.

Micah Shilanski: Tammy. We wanted to get together, and ’tis the season to talk about taxes. Now, as you pointed out as we were in our pregame, very few people get excited about taxes. Unfortunately, I am one of those people that gets super excited about taxes. So, I will try not to geek out too much, but this is something that affects all of us, not even while retired, but while we’re working. And so many times, Tammy, we were talking about before, we see people make mistakes when it comes to taxes. And it’s generally not because it’s what they didn’t know, it’s what they think they know, that just ain’t so, that creates tax problems.

Tammy Flanagan: Yeah. Because then you have this preconceived notion, like you thought you understood it, and then when you find out the truth, sometimes it’s hard to wrap your mind around it because you already thought you understood it. So, sometimes it’s a matter of relearning what you thought you knew. So, this will be a good one. I’m looking forward to learning something myself, and helping to get some questions answered that I hear all the time, over and over again, both at seminars, and also when I work with individual clients.

Micah Shilanski: Yeah, and this is one of the things that I really try to take, no matter what I’m learning, I try to put my mindset at all right, what assumptions am I making? Let me not jump ahead of the speaker, let me listen to what’s going on and seeing what value I can pick up, to make sure I don’t have these wrong assumptions. Regardless if this is taxes, your retirement estimate, how your TSP works, your payroll deductions that happen, your first supplement. I mean, we could go on and on about assumptions that people make.

So, before we jump too much down the tax bandwagon of things, Tammy, why don’t we slow down and talk about… I really get excited about the tax buckets. I’m a big buckets kind of guy in planning. But you have four different buckets whenever we talk about taxation. You have ordinary income tax, which is the worst type of tax to pay, because it’s the highest. We have a tax deferred bucket, which is going to be like your TSP and IRA, you’re deferring taxes to a later time. You have capital gains taxes, and then you have my favorite bucket, which is tax-free. Can you even say that without smiling? I mean, tax free. Just the way it rolls off.

Tammy Flanagan: That’s a good one. I like tax-free. I don’t know much about taxes, but I know what free means.

Micah Shilanski: Yeah, that’s right. You’ve got to put them together. So, whenever we’re doing tax planning, that’s one of the things you got to look at, is what buckets are going to be there. And then you have to know what your taxes are. So, that’s kind of the context that we’re going to put some of these questions in. But Tammy, you got a question from a listener recently that was talking about their retirement check, and how much of their retirement check was taxable or not.

Tammy Flanagan: Right. Because when you retire from the government, whether you’re under the old civil service system, or whether you’re under the FERS system, which is, we call it the new system, but it’s been around for over 30 years. But either way, you pay into that retirement fund every payday that you work, because they withhold, whether it’s 7% or 0.8% or something in between, the agency you work for is withholding retirement contributions that you’ve already paid taxes on. Those are after tax deductions. So, it makes sense that when you retire and you start collecting that retirement benefit, that part of that benefit is going to be tax-free.

In the good old days, the first three years, generally, sometimes 18 months, 18 months to three years, used to be totally tax-free. So, that’s when everybody would cash out their savings bonds, and any taxable income, would happen during that wonderful tax-free period. And then we had tax reform of like 1986, I think it was, and that’s when those contributions, the IRS thought, well, or Congress I guess thought, why don’t we spread those out over your lifetime, so we get a little money back on taxes every single year, starting with the first year that you retire? So, that caused some confusion, and we’re trying to figure out now, how do we determine that tax-free portion of our retirement? And I guess you shouldn’t get too excited, Micah, because it’s not a huge portion that’s tax-free.

Micah Shilanski: No.

Tammy Flanagan: But it’s something, we’ll take anything.

Micah Shilanski: Exactly. We like the tax-free, this is going to be this small little drop in the bucket when it comes to the dollar amount in size. So, I always tell clients, whenever I’m doing planning for clients and saying, great, what’s their income in retirement, under FERS, I just say all of your pension is taxable. Because it makes math simple, and the reality is 99% of your pension is taxable under the FERS retirement. So, it’s okay to take that as an estimate.

In reality, the way that it works, Tammy, just as you’re saying, your contribution, you get to come out over your life expectancy. No, not what do you deem your life expectancy, as the IRS already has that set for you, and a portion of your income is to going to be tax-free. OPM takes care of a decent amount of this on new retirees, when they have on their on your 1099R, it’ll say gross distribution, then it will say taxable amount. But there’s a box that you really need to make sure you’re filling out inside of there, which is your employee contribution. That’s going to be on your 1099s, that needs to make sure it gets communicated to your tax preparer, in TurboTax or whatever tax software you use. Because the tax software should be looking at that as well, and making sure you don’t overpay your taxes. It’s important to pay 100% of your tax bill, but you don’t have to leave a tip.

Tammy Flanagan: That’s right. And the amount that you get tax-free can vary also, if you’re electing survivor benefits, because then it’s spread over the life of you and your spouse. So, there’s a different formula if you’re single or if you’re filing jointly. And the other place you’ll hear about this, or read about this, is when you first retire, and I know a lot of people have just recently retired, we had a huge number of retirements at the end of 2020. And so, once OPM finishes your claim, they’re going to send you a booklet. Some people call it the blue book, because the type on it is blue. But it tells you about how much you paid in retirement contributions. It tells you about federal income tax, it gives you a little bit of a heads up about this general rule for claiming that tax-free portion. So, there’s information out there on it, you just have to read it and utilize it, to actually file your tax return.

Micah Shilanski: All right. So, important things, let’s talk about retirees. And we’re going to jump back and talk about employees as well. For retirees, it’s really important you take an active stance in knowing what your taxes are going to be, especially if this is your first year of retirement. Because OPM is going to get the number wrong. Now, OPMs calculations are not wrong, I don’t want to blame them in this aspect of it, but there’s a big difference what happens when you become employee to retire, right, Tammy? When you’re working, you’re getting one to two paychecks that are coming in. But when you retire, all of a sudden you could get multiple paychecks. You could have one or two pensions coming in, you could have the first supplement, you could have social security for one or two checks, you could have a military retirement, an IRA, TSB distribution. Before we know it, that’s four to eight different places that are sending you money every single month.

Tammy Flanagan: I’ll take it.

Micah Shilanski: And they don’t talk to each other. That’s right, you’ll take it.

Tammy Flanagan: That’s right, they don’t talk to each other. And nobody knows how many different sources of retirement income you have except you. Because OPM isn’t aware that you’ve claimed social security, or you haven’t, or that you have a second career or you don’t. So, you really need to factor this all in when you do your taxes. It’s not as simple as the old days, where you got one pension check and that was it. But today, FERS retirees, like you said, can have six, seven, eight different sources of income, depending on how many different little careers they’ve had, how many times they’ve contributed to 401ks or IRAs. So yeah, it can get complicated, but you gather all your documents and add them all up, and then you’ll have a better idea of where you stand.

Micah Shilanski: And you need to do this before next year, so if you retired in January, you don’t need to be doing this in January of 2022, figuring out what your tax bill is. You may not like the number you see. With our clients, we want to get ahead of it. We do taxes at least twice a year. So, if I had a client just retired, once they get their blue book, their retirement book, I’m not going to do much before they get it, because who knows how long OPM’s going to take to process your pension and all the other payments, et cetera. So, I’m going to wait until I have the data. Once I get the blue book, Tammy, I’m going to go back and do a tax calculation for our clients, and find out if OPM is withholding enough TSP, social security, et cetera.

If not, you have a couple of choices. Number one, you could choose to have more withhelds. You could two, choose to pay a balance at the end of the year, that’s going to be there. Generally, that’s a bad idea, because it becomes larger, you might have penalties, et cetera. And the third option is you could make quarterly payments. Now Tammy, one of the things we do with our clients, and I’d love to know your thoughts on this, kind of think of it as a pro tip, whenever they’re making quarterly payments, we have them change the dollar amount each quarter. So, if they need to make a thousand dollar quarterly payments, quarter one is 1,001, quarter two is 1,002, quarter three is 1,003, then a 1,004, right?

Tammy Flanagan: I love it.

Micah Shilanski: Yeah.

Tammy Flanagan: Because then you don’t forget. Because I do that myself, and I’m like, did I pay it in September? I can’t remember, I hope I did. So, then you know.

Micah Shilanski: Which quarter was it for? It was all 1,000 bucks. Did the IRS lose the check? Which one did they lose? All of those things. Make it simple, change the dollar amount by a dollar each time.

Tammy Flanagan: Yeah, then you can look at your bank statements, see what you’ve done.

Micah Shilanski: Perfect.

Tammy Flanagan: I like that tip, I’m going to use it.

Micah Shilanski: All right. As long as Tammy gets a tip out of it, I’m happy.

Tammy Flanagan: Why do you think I’m doing this with you? I got to learn too.

Micah Shilanski: Well, I learn a ton from you, so it’s perfect. So, that’s the really important part about taxes, is understanding what your tax bill is, and then getting ahead of it for our retirees.

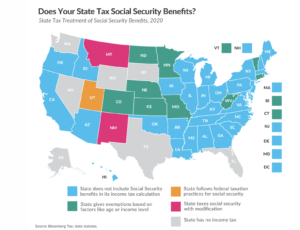

Tammy Flanagan: And for some of our folks listening, they not only have to worry about federal income tax, but they got to worry about state income tax. They’re not as fortunate as you and I, who live in tax-free states. The majority of the country does pay state income tax, so that’s another whole issue that you have to be concerned about. Because a lot of times, OPM does not automatically withhold state income tax. You can ask them to, but they don’t do it first thing. TSP will not withhold state income tax. Social security will not withhold state income tax, although there’s very few occasions where you might have to pay state income tax on social security, but there’s a few. If you live out in the Midwest, there’s a few States there that will tax you, West Virginia, a few New England states, so they’re out there. So yeah, it’s very important to be aware of not only the federal level, but also the state level.

Micah Shilanski: And if you’re curious about if your state taxes your social security or not, you can jump on our website on this episode, planyourfederalretirement.com/17. One, seven, because it’s our 17th episode, and that will, we’re going to put a map up there directing you to what states do and do not tax your social security. So, that would be a great thing to take a peak at. Again, don’t make an assumption just because your state has a low-income tax or whatever, you’re not going to be taxed. Know the answer.

Tammy Flanagan: And then also check with your state tax website. Because I think there was one change in state tax laws, and I don’t know which state it was for 2021, or it might have been even for last year, because the latest chart we got is 2020. 2021 really hasn’t been out there yet. So, always double check that as well, even though we’re given a nice recent reference.

Micah Shilanski: Right, absolutely. So Tammy, we talked about state retirements, so social security may be taxed. TSP is not going to withhold any income. OPM probably is not going to hold anything for state income tax. So again, these are quarterly payments that you are going to have to make. Anything else our retirees should be thinking about on their taxes?

Tammy Flanagan: Well, the other thing, you had mentioned about OPM might be underestimating the tax withholding. The other thing, you and I both see this all the time, is when the employee goes to their agency to get a retirement estimate. That’s way off too. Because like you said, it’s going to be… Usually I’ll see like a $5,000 retirement with $150 for federal income tax, that’s just not right. No, one’s going to only owe $150 if your retirement benefit’s 60,000 a year. So, be sure that you’re aware that… Take that with a grain of salt, do your own tax planning, or talk with someone who understands taxes better than you do, if you don’t want to do it yourself.

Micah Shilanski: Yeah. And even my clients that do a really good job preparing their own taxes, I always recommend, say, Pub 721 has a ton of information. Or when you make a big life change, go hire a CPA, go hire attorneys. No, we don’t get paid for any of that stuff. Go make sure you’re doing it correctly, instead of finding out years later and having to make some pretty painful mistakes.

Tammy Flanagan: Right, yeah. Because most people have never retired before, and you’re going to have, like you said, multiple sources of income. It’s not just one paycheck with a W2. Now, you’re getting 1099s, you’re getting different sources of income, different forms of income. So, it does get confusing. It gets a little more complicated, at least the first year until you kind of get into the rhythm of what income you’re going to have? What are you turning on right now? Are you taking social security, are you not? So yeah, there’s a lot to it. Plus, a lot of people have a second career. So, now you throw some income, whether it’s self-employment, or wages, or 1099 income, that’s another thing that can add to the complexity.

Micah Shilanski: Not only does it add for our retirees, to the complexity of their tax situation, but Tammy, this could affect their first supplement as well, right? If they retired, I’m going to say early, right? If they retired before 62, and they’re eligible for that first supplement, earned income, so working income could reduce that.

Tammy Flanagan: That’s right. And that’s what a lot of people want to know, because there are a lot of folks, especially when we get to law enforcement or firefighters, people who tend to retire pretty early, and a lot of them will plan a second career. It might be self-employment, it might be working for a contractor, who knows? But they do have to report that income to OPM. And so whenever you’re filling out the form for declaring how much income you had in your post retirement life, OPM wants to know about any earned income. And so, what’s earned income, what isn’t? What are some of the things you have to report, and what are some of the things you don’t?

For instance, today I had a client who wants to do home renovations, remodel homes, flip a house, like all the shows I love to watch on TV. And so, he wanted to know, “Is that going to affect my first supplement? If I make a profit when I sell one of these houses, is that earned income?” And we were talking about this before we started recording, and it’s a maybe. Maybe it is, maybe it isn’t. What are some of the things he should think about, do you think?

Micah Shilanski: There’s a lot of questions inside of there. So, the first thing is I’m just going to talk to the construction side of it right here, is the first thing that’s going to be out there, is the IRS says if you own a home and you live in it as your primary resdience for two out of the last five years, you can sell it. And the first quarter million dollars per person, so if you’re married, that’s $500,000, gain is a hundred percent tax-free. So, if he buys it for 300,000, it grows to $500,000, that’s a $200,000 gain. They lived in it for two out of the last five years, they can sell it and pay zero income taxes. You see a lot of builders do this, build spec homes, et cetera. So, that could be an option.

The other option that could be there is they could do with the capital gains, I’m buying a, quote, I’m using air quotes, “Investment property,” quote, and they’re putting money into it. Then they’re going to sell it, and they want to capital gains tax. The nice part about capital gains tax is two things, is one, it’s lower than your ordinary income tax, should be really about half, sometimes not as much, but it’s a lot lower than your ordinary income tax, which is beautiful. And then number two, it does not affect your first supplement. So, that’s beautiful, right?

Tammy Flanagan: Investment income.

Micah Shilanski: As investment income. Option number one, if it’s tax-free, it doesn’t affect your supplement, beautiful. If it’s capital gains, it doesn’t affect your supplement, which is beautiful. But number three, this is where you got to be careful, depending on how he’s running it, the IRS could say that this is a business. It is not a capital gains venture endeavor that he’s doing. And in that case, any income he makes would be taxable income as a business. And a business, now that will affect your first supplement. So, a big thing is making sure you’re setting up correctly from the beginning.

Tammy Flanagan: Right. And then the other thing I get when it comes to reporting earnings for the first supplement, is sometimes you’ll retire, you get your supplement and then something happens, your spouse passes away. So, now you’re either getting a survivor annuity, or you might be getting widow’s benefits from social security and you’re not yet 62. So, does that count against it? No, you can receive widow’s benefits, you can receive survivor benefits, and you’ll still continue to receive your first supplement. So, that’s not earned income, you didn’t earn that income. So think of it that way, is it a paycheck? Is it wages? Is it salaries? Is it self-employment income? If it’s any of those, yes, that will count against you. But other types of unearned income does not count. However, what about alimony and child support?

Micah Shilanski: Got to careful on that one, because my ex-spouses will say they earned that income, so our terminology here is a little different. When we’re saying earned income, that’s how the IRS deems it. Do you have to pay self-employment tax or payroll taxes on it? Really, that’s the definition of earned income. But no, child support, alimony payments, et cetera, do not count from the first supplement aspect of things. However, they may count depending on income. Child support is not an includable income item if you’re receiving it, you don’t get a deduction on your tax return if you’re paying it. However, alimony, depending on when you were married in your divorce decree, it could be taxable income, or it could be tax-free. That law changed a couple years ago, 2018, I think off the top of my head, is when that law changed. So, it depends on when you were divorced, but either way, it doesn’t count against your first supplement, but you may have to pay taxes on that money.

Tammy Flanagan: Yeah, it gets a little confusing, so sometimes you have to ask for help or Google. Google it up, and sometimes if you’re lucky, you’ll get the right answer.

Micah Shilanski: Well, Tammy, team let’s make a little transition. Let’s talk about our active federal employees that are out there and listening, because there’s several tax planning things that are there. Now, the first thing I would say, if you’re still working as an active federal employee, don’t get away from tax planning. We’re only talking the highlights of things that people should be thinking about, but especially while you’re working, one of the things I tell clients all the time is saying, look, it’s really hard to beat the IRS one year at a time. If I look in January over the last 12 months, and say what was my income? How do I lower my taxes? I don’t have a lot of tools.

But if I step out, and all of a sudden I look through the windshield versus the rear view mirror, I start looking out into the future about the next five or 10 years. Ooh, I have a lot of tax planning opportunities, even if you’re employed, to beat the IRS at hundreds, if not thousands of dollars, legally, by properly structuring things. So, making sure that you’re looking at this is really important.

Tammy Flanagan: Yep, and I think that the pre-retirement stage, if not, even the mid-career stage, is really when you’ve got to make some of these decisions. Because the one question I get a lot is, “Do I do the Roth TSP? Do I do the pre-tax TSP? Do I need the tax savings now, or will I need it better later? Is Congress going to change the tax rules? We have to base it on what we know today.

Micah Shilanski: Right. And we know Congress is going to change the law. We know that’s going to happen, we just don’t know when or what it’ll be.

Tammy Flanagan: Right. We can’t base our decisions on what we don’t know, but sometimes as you said right up front at the beginning of this broadcast, is you want that tax-free bucket. And one of the ways to get it, is to put money in a Roth IRA or Roth TSP, or even a health savings account is another place to get a tax-free bucket. So, those are some things I’ve been telling people to consider setting aside so that in their retirement years, they don’t always have to pay tax on their distributions from these different savings accounts.

Micah Shilanski: And I kind of look at it a couple different ways. Tammy, I agree with you a hundred percent, those are great things that you should be looking at. And we can look at it a few different ways, of saying okay great, what’s your tax rate now? And just philosophically, do you think that taxes… Let’s say your tax rate’s 22%. Cause that’s probably where a decent amount of listeners are at. So if your tax rate is in 22%, what’s called marginal tax rate that’s there, historically, is that a high, medium or low tax rate? Well, historically, that is a low tax rate, historically taxes are dramatically higher. Right, tammy?

Tammy Flanagan: That’s right, yeah. As much as I don’t believe it, but I do believe it because it’s true, we’re in a period of time where taxes are really historically at all time low. And they have really nowhere to go. But up according to what I’ve been hearing, and according to the fact that, isn’t there going to be an expiration of some big law coming up?

Micah Shilanski: The Tax Cuts Jobs Act expires in 2025. So in 2026, so if Congress does nothing, then in 2026 our tax rates will go back to what they were. And for the vast majority of people, that means a tax increase that they are going to have to pay. So Tammy, going back to your comment, plan for what we know. If we know taxes are going up in the future, just based on current law, awesome. What decision should I make? Should I accelerate some of the income I’m getting? Maybe not all of it, but should I take some of my IRA account and do a Roth conversion, pay a little bit of taxes now to have that growth tax-free? Should I fund Roth? Should I fund HSAs, Roth TSPs, et cetera?

These are questions you need to have every single year, in deciding where your money needs to go. Jumping on my soapbox here real fast, we talk in the investment world about diversify, diversify, diversify. Diversification is key. Guess what? That’s the same in tax planning. It’s not diversification to put a hundred percent of your money in the TSP, then go buy the GFCS and I funds. Okay, that’s one form of diversification, but we need the other ones as well.

Tammy Flanagan: Right? So, it’s just not the different funds you’re investing in. It’s also tax diversification.

Micah Shilanski: Yes. Huge, huge benefits there. So, working or retired, this applies to you both. What’s your tax bill going to be for 2021? And then how do you lower it, and does it make sense to? What’s your tax bill going to be for the next 10 years?

Tammy Flanagan: Yeah. I just thought of something else, Mike. Because when there’s two of us, if I’m married, our income is different than when there’s one of us. So, sometimes when a married couple becomes a widow or widower, that’s another time you’re going to face some major changes in your tax situation. It can affect Medicare premiums, it can affect how you’re going to take distributions from your savings accounts. So, there are several times both during a career and also into retirement, when you really have to do some pivoting on tax planning. Because things are going to change, whether it’s Congress changed it, or your life changed.

Micah Shilanski: Absolutely. You know, Tammy, before we transition to action items, also mentioning for the active employees, one of the things just to remember is that FICA payback. Because there was that, I’m using air quotes again, “Payroll tax holiday,” deferment might be a better word, that took place at the end of 2020. And now, federal employees are having to pay that money back for payroll taxes.

Tammy Flanagan: Right, yeah. The only thing I haven’t heard yet, and maybe somebody could fill us in, that we don’t know what happens to the people who retired the end of 2020. Because they also owe that money back, but they don’t have a paycheck to deduct it from. So, we’re wondering, are they going to get billed for it? I haven’t heard from anybody yet who received a bill, or had it taken out of their annual leave lump sum. So, it’ll be interesting to find out how the retirees who recently retired have to repay that tax holiday savings that they got. Maybe they’ll forget about it, maybe the IRS won’t remember.

Micah Shilanski: Maybe it’s a real holiday. I don’t know, yet to be determined. All right, Tammy, let’s transition to some action items for our listeners. Because it’s not just about us bantering back and forth and having a good time, we want you to take action in your retirement to improve your odds, and a successful retirement.

So, I’ll go first. First action item, Tammy, that I would say, is our listeners need to know what their 2021 tax bill is. That’s this year, not last year. That’s what you’re working on right now, I know. But you need to figure out what your tax bill is going to be for this year, and then say, hey, is there anything I can do about that?

Tammy Flanagan: Yes, because now you have the whole year ahead of us to make those changes. So, I would say for tax planning purposes, because I’m mostly all about pre-retirement folks, is that they really need to take a good hard look. I always see this all the time where somebody is looking at the gross amount of their retirement income, where we should be looking at the net. And the problem with that is we don’t know how to calculate our tax estimates.

So, you can use their software on the IRS website, believe it or not, called a tax withholding estimator. You can Google it, it should come right up as the first entry on Google. And that’s one way to estimate, at least on the federal level, your taxes. Or have your tax preparer, like you said, instead of running your 2021 income, run it as your retirement income. So, if you know you’re retiring, even if it’s the end of this year, but you want to have a better idea of what your net income is, give those numbers to your tax preparer, and have them help you figure out what your withholdings should be.

Micah Shilanski: Yeah, I think it’s really important. So, actually earlier this morning, Tammy, I was on a webinar with about 400 advisors, and we’re going through teaching them, how do you do tax planning and making sure you’re effective with clients? And my co-host decided to, positively, but blindsided me a little bit with a tax return and says, “All right Micah, here’s an actual tax return redacted, and you have 10 minutes to lower their taxes and to add value.” So, it was super fun. It was great, and we came through with almost a dozen different things that that person could do on their tax returns. So, the reason I’m sharing this with you, is 99 times out of a hundred, there’s always a way that you can improve your personal tax situation.

So, after you know what your taxes are for 2021, after you’ve looked at these things, do something about it. Can you go through your return and say, great, how do I lower my taxes in the future? Not just today. And if you that’s okay, this isn’t your area of specialty. Go find someone that can. Know what your options are so that you can be empowered to make the best retirement decisions for you.

Tammy Flanagan: Yep. Use the tools that are out there. Besides even the IRS estimator, there’s also tools you can use on OPM’s website, on TSPs website. They kind of address, maybe it’s not the depth that you want, but at least it gives you some surface information about what are we going to withhold from your checks? Are we going to withhold state income tax? And get familiar with what the withholdings are going to be once you do retire. Because sometimes, you have to take care of that yourself with the estimated tax payments.

Micah Shilanski: Yep, and you do not want that to be an unwelcome surprise in a year. Because I promise, the IRS will not forget about it. You just may not like the timing of when they send you the letter.

Tammy Flanagan: Right. And also keep in mind, there are some tax friendly benefits. Because I always say that social security is pretty tax friendly, since most states don’t tax it and you get at least a portion of it tax-free, you don’t want to get all of it tax-free, because if you do that means that’s your only income, but it would be nice to get at least 15% of it tax-free. And a lot of our retirees are in that bracket, where that’s what they get, is tax-free social security.

Micah Shilanski: That’s right, perfect. Well, if you want more information about the things we talked about, we’re going to have some articles and some content to what we talked about on our website, planyourfederalretirement.com/17. Or you can just email us, [email protected], mention episode 17 and we will go ahead and send you that information. Tammy, thank you so much again for joining me. I had a ton of fun.

Tammy Flanagan: It’s fun. This is one I was afraid to do, but I’m glad we did it, and I learned something new. Thanks, Micah.

Micah Shilanski: Perfect, thank you Tammy. And until next time, happy planning.

Hey, before you go, a few notes from our attorneys. Opinions expressed

herein are solely those of Shilanski & Associates, Incorporated, unless

otherwise specifically cited. Material presented is believed to be from

reliable sources, and no representations are made by our firm as to other

parties, informational accuracy, or completeness. All information or ideas

provided should be discussed in detail with an advisor, accountant, or legal

counsel prior to implementation.

Content provided herein is for informational purposes only and should

not be used or construed as investment advice or recommendation

regarding the purchase or sale of any security. There is no guarantee that

any forward-looking statements or opinions provided will prove to be

correct. Securities investing involves risk, including the potential loss of

principle. There is no assurance that any investment plan or strategy will be

successful.