The Thrift Savings Plan is the third-best benefit that you have as a Federal Employee under FERs. The first, is your Federal Employee Health Benefits followed by your pension when you retire.

What we love about the Thrift Savings Plan (TSP) is that it is easy to use and low cost. There are two types of accounts that you can have with the TSP office,

- Traditional TSP and,

- Roth TSP

Traditional TSP

The contributions that you and your agency make to the Traditional TSP are tax-deferred. Meaning, those funds have never been taxed.

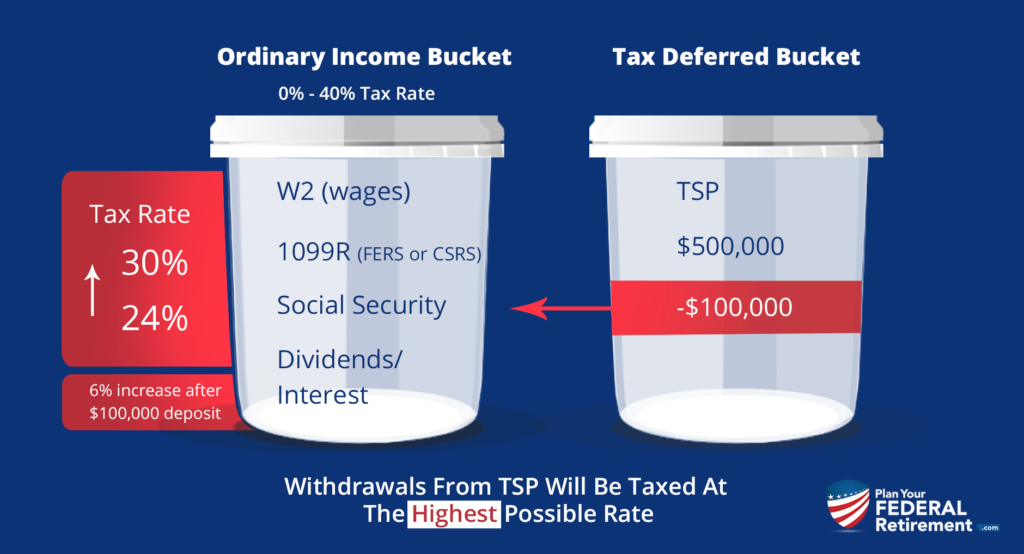

When you retire and make distributions from your TSP, the money that you withdrawal will be subject to US Federal Income Tax. The amount that you are taxed from your TSP withdrawals depends on your income tax rate. Remember, when you make a withdrawal from the TSP that money is added to other forms of income that you have that are subject to income tax for the current year. Other forms of income include the majority of your pension, most of social security, outside employment, etc.

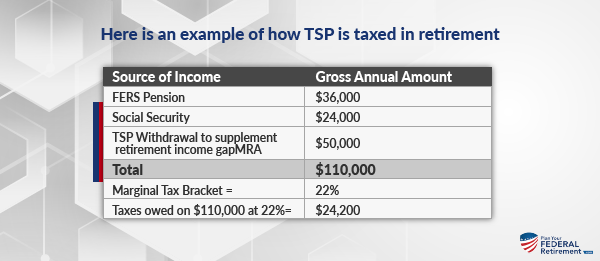

Not understanding how the TSP is taxed in retirement is one of the greater challenges that Federal Employees face when cash flow planning and tax planning.

Here is an example,

Source of Income | Gross Annual Amount |

FERS Pension | $36,000 |

Social Security | $24,000 |

TSP Withdrawal to supplement retirement income gap | $50,000 |

Total | $110,000 |

Marginal Tax Bracket = | 22% |

Taxes owed on $110,000 at 22%= | $24,200 |

You need to carefully plan your distributions from your TSP to supplement your retirement income gap so that you do not bump yourself into a greater tax bracket than you originally anticipated when planning for retirement.

The United States uses a progressive tax system. That means that the more money that you earn, the more taxes that you pay.

This is the number one reason that we discourage most of the Federal Employees that we work with NOT to take money out of their TSP in order to pay off their home. There are several reasons why paying off your mortgage by using your TSP does not make good financial sense.

In our example, we used just one person’s income. However, if you are married make sure that you account for your spouse’s income sources as well.

The Traditional TSP is subjected to Required Minimum Distributions. That means when you reach the qualifying age, you have to make withdrawals from your non-taxed accounts. A good average to assume is about 6% of your entire tax-deferred accounts. This is a mandatory requirement and the fine is pretty steep – 50% penalty for not taking the Required Minimum Distribution when you were supposed to. As an example, if you were required to take $12,000 out of your tax-deferred accounts and did not do so on time, the penalty is $6,000 PLUS you still have to take out the $12,000 – ouch!

ROTH TSP

Contributions that you made to your ROTH TSP account were taxed at the time that you made them. That allows the contributions and the earnings to grow income tax-free.

This is the power of the ROTH – pay taxes today at the rate you are already familiar with instead of later when you do not know what the tax rate will be.

However, you need to keep in mind that your agency’s contributions are always deposited into the Traditional TSP. Agencies cannot make ROTH contributions.

Keep in mind that to be tax-free you had to have had the ROTH TSP for greater than 5 years and you’re age-qualified to make a distribution.

Paying off my mortgage (house) with my TSP

This is one of the most important questions that we help our Federal Employee clients navigate through as they prepare for retirement.

The reasons that most people have told us that they want to use their TSP to pay off their mortgage are:

- I would have more money month to month in retirement if I did not have a mortgage to pay.

- If I retire and my house is paid off, I don’t have any other bills or debt.

- I was always taught that when you retire, you want to pay off your mortgage.

Most of the time – the math doesn’t add up. The reasons above are certainly valid but they’re emotional, not financial.

Something that we like to do with our clients is pencil out the math. We look at what withdrawing enough money from their TSP would mean in terms of tax liabilities compared to the mortgage interest on their home.

If cash flow is a concern in retirement, you need to be having these conversations with your Financial Planner now to discuss methods that can help you feel more comfortable about retirement but also not be detrimental to your long-term financial health.