“Can I withdraw my FERS to use as a down payment for purchase of Real Estate?” – Tracey.

When Federal Employees use their retirement benefits to buy a home or pay off a mortgage when they retire, they often end up making a catastrophic financial decision that can devastate their retirement plan.

Purchasing a home is often the most expensive purchase that a consumer will make. A monthly mortgage payment can be 30% or more of your monthly income. When you retire and potentially transition to a period in which your earnings will be less, that payment can feel even more significant.

When we meet with federal employees and start discussing their retirement income and cash flow, one of the decisions they wrestle with is whether or not to pay off their current mortgage or purchase a home using their retirement savings.

Tracey has asked whether or not they can use their FERS Retirement for a down payment on a home.

As a Federal Employee, your retirement is a three-legged stool that consists of three parts: your FERS Pension, Thrift Savings Plan (TSP), and Social Security.

While you work, you contribute each paycheck to your FERS Pension and Social Security. You can optionally contribute to the TSP. While contributing to the TSP via payroll deductions is “optional,” we strongly encourage federal employees to maximize their retirement savings by contributing to this account. Most federal employees’ FERS retirement pension and social security will not be enough retirement income to sustain them through retirement – even if they do not have a mortgage.

As a retiree, you do not want to be house rich and cash poor.

Your FERS Retirement Benefit (FERS “Annuity” or Pension)

The Office of Personnel Management (OPM) calls your FERS Pension an “Annuity.” We call it a pension so that you do not confuse your retirement benefit with annuities offered through the TSP or the private sector.

Your FERS pension consists of two parts.

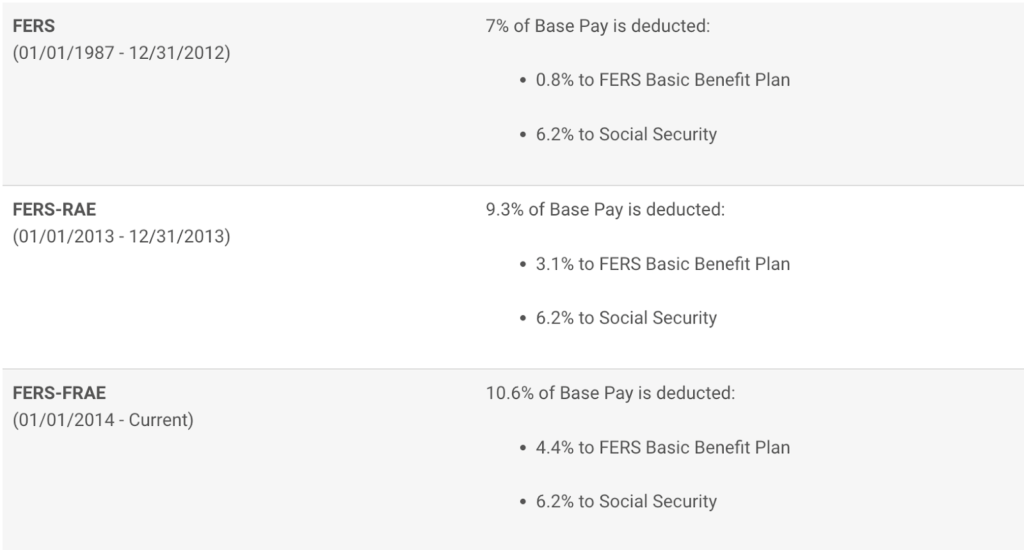

Depending on your start date, your contribution will be either 0.8%, 3.1%, or 4.4% to FERS. The chart below breaks this down based on your start date to show how much is going to the FERS Basic Benefit Plan and how much is going to Social Security:

How much does my agency contribute to my FERS Retirement Benefit?

The rate that your agency will contribute to your FERS has historically increased over the years as the actuarial analysis of the pension costs has increased.

As of October 1st, 2020, the rate at which your agency is responsible for contributing to your FERS is 17.3% if you were a Regular employee hired before January 1st, 2013, and 15.5% if you were hired on or after this date.

If you are part of a special category of employee – including but not limited to an LEO, firefighter, Air Traffic Controller, or Congressional employee – your agency will contribute a higher percentage to your FERS. If you are a regular employee of the USPS, your agency will actually contribute slightly less to your FERS.

Can I withdraw my FERS Pension before retirement?

Yes, Federal Employees can withdraw their contributions to the FERS Pension. The money that you contribute to your FERS Retirement Benefits is always yours.

However, there are significant consequences to withdrawing your pension contributions, and we almost never recommend that our federal employee clients do this. If you withdraw your federal employee contributions to your retirement benefits, you could jeopardize your retirement contributions, maximizing growth and potentially your health insurance benefits as a federal employee contingent on how you made your withdrawal.

If you withdraw money from your FERS retirement, you are withdrawing the time and money in which you contributed to your years of creditable service.

No, we do not think Tracey should withdraw his or her retirement contributions from the FERS retirement system to make a down payment on a home based on the information provided.

This leads us to the next question that most federal employees ask: should they use their TSP to make a down payment, pay off a mortgage or purchase another home in retirement?

Using your TSP to pay off your mortgage.

Would you believe that throughout a person’s lifetime, they will live in or own seven homes?

- The home you grew up in.

- Your first apartment/condo.

- Your Starter Home.

- The biggest home you will ever live in (just as the kids all move out).

- Your retirement “dream” home.

- What you downsize into to reduce upkeep.

- Assisted living home.

Most people will reach retirement age somewhere near their peak earning years. As they prepare to retire and recognize that their income will be reduced, they want to move in and settle into that retirement “dream” home. Often, it can also mean relocating back home or to a place where the presumed cost of living is far less.

This is normally when we have a lot of conversations with Federal Employees who try to convince us that they are not like most people and plan to live in their retirement dream home until the Good Lord takes them away. Until something happens when they can no longer upkeep such a large home.

A spouse passes, an injury occurs, and they get lonesome being so far from family – there are many reasons why your forever home may not be where you are forever.

Using your TSP to pay off your retirement home could have a financial impact that you are unprepared for.

Your retirement benefits as a federal employee consist of your FERS pension, TSP, and social security benefits which are often taxable sources of income each year.

Taxes as a Federal Employee Retiree You Should Consider

As a Federal Employee, your TSP (for the most part) is tax-deferred.

That means the monies accumulated in this investment have not yet been taxed.

When you made a contribution (put funds in) to your traditional TSP, you did so on a pre-tax basis. This is often done so you have less taxable income during your working years.

Here is a simplified example of what that could look like:

Example: $100,000 base salary.

– 18,000 Employee Contributions to a Traditional TSP

= $82,000 Taxable income on your W-2

As those funds within the account grew, they did so on a tax-deferred basis.

Roth TSP contributions are different as they are taxed when you make the contribution (so no tax deduction) however, the growth of the Roth TSP investments grows tax-free if you meet certain rules.]

Look around the dinner table tonight and see if you set a place for your beloved Aunt IRS (Internal Revenue Service).

You may not have thought about her yet, but we promise you, when you pull those funds out of the traditional TSP, she will want a seat at the table.

The US uses what you can call a “progressive” tax system; the more money that you earn, the more you pay in taxes.

When you make a distribution (take money out) of your TSP, your taxable income was just increased by the amount you withdrew from your traditional TSP.

Making a large distribution like this could quickly escalate the tax bracket that you are in.

All great information, but how does it work? Well, let’s walk through an example.

We began talking about paying off a mortgage of $300,000, which we will continue with here in this example to see how one such example might work.

Let’s say you are a Married Filing Joint couple with a gross income of $150,000.00.

We will keep this simple and say that under the Tax Cuts and Job Act (TCJA) you have a standard deduction of $24,000.00. This brings the taxable income to $126,000.

($150,000 – $24,000 = $126,000)

Based on the above, the marginal tax bracket is 22%. (https://apps.irs.gov/app/withholdingcalculator/index5.jsp)

But remember, we just made a $300,000 distribution from the traditional TSP (taxable) to pay off your home.

The $300,000 has to be added to your income for the year! But it gets even stickier…

Here is where most people get into a sticky situation. When you make a distribution from your TSP, Aunt IRS slides on over and takes her 20% at that moment (The TSP is required to withhold 20% as a tax ‘estimate’ when you take a withdrawal from the TPS in most cases).

That means that you withdrew $300,000, but Aunt IRS collected $60,000.00 – the TSP office is obliged to make this 20% withholding of tax payment

automatically for you.

That is not even the sticky part…

20% was an estimate. The TSP office does not know or review your tax return, so they estimate 20% (because that is what is required of them), but that may not be what you owe, it could be more.

Let’s work this out: you have $150,000 of joint income, and now you have an additional $300,000 for a combined income of $450,000.00. In this scenario, you receive the standard deduction under the TCJA of $24,000. Your taxable income is now $426,000.

($150,000 + $300,000 – $24,000 = $426,000)

What tax bracket under our progressive tax system are you now in? Where you may have been in a 22% tax bracket, you are now in a 35% tax bracket with the addition of the TSP distribution.

Where you owed $19,599 in federal income taxes (before you took out the TSP funds), you now owe $100,479.00 in federal income taxes. This example shows you owing almost $80,880 of additional taxes (100,479-19,599=80,880).

You made a $300,000 withdraw from the traditional TSP to pay off your home but you net around $219,120 ($300,000 – $80,880= $219,120.00).

If your goal was to pay off your home with $300,000, you needed to withdraw closer to $425,000 from your traditional TSP.

($425,000 + 150,000 = 575,000. 575,000 – 24,000 = 551,000 taxable income)

$551,000 taxable income is approx 144,229 taxes owed. $144,229 – 19,599 = 124,630 additional taxes due to the TSP distribution.

$425,000 (TSP distribution) – $124,630 (taxes on TSP distribution) = $300,370

(Net from TSP)

You started wanting to retire the $1,610.00 monthly mortgage payment and spent $124,630.00 to do so.

Understanding how taxes impact your retirement is crucial to your financial success. There are many moving components to your retirement planning, and you want to make sure that you have a complete picture before moving the puzzle pieces around that.