“If my TSP beneficiary is currently my Trust, then upon my death, will that transfer be made by a one time full payment -20% for taxes?

If so would it be better to have my spouse named beneficiary? It is going to the trust now, mainly for the reason that if we both pass, then some will go to charitable contributions and some to my two children. If she is the beneficiary and we both pass, then my kids get it all and our charitable gets nothing… which we don’t want.” – Bradley.

Estate Planning is one of the very first areas of a Federal Employee’s financial plan that we dive into. A lot of times when we hear the words, “Estate Planning” we think that it does not apply to us because we are not wealthy enough to justify having an “estate.” That isn’t the reality though, especially for Federal Employees.

As a Federal Employee, your estate planning is necessary to ensure that you do not unintentionally disinherit your spouse (causing them to permanently lose their health insurance!) or, create triggering mechanisms that cause EXCESSIVE taxation upon your death.

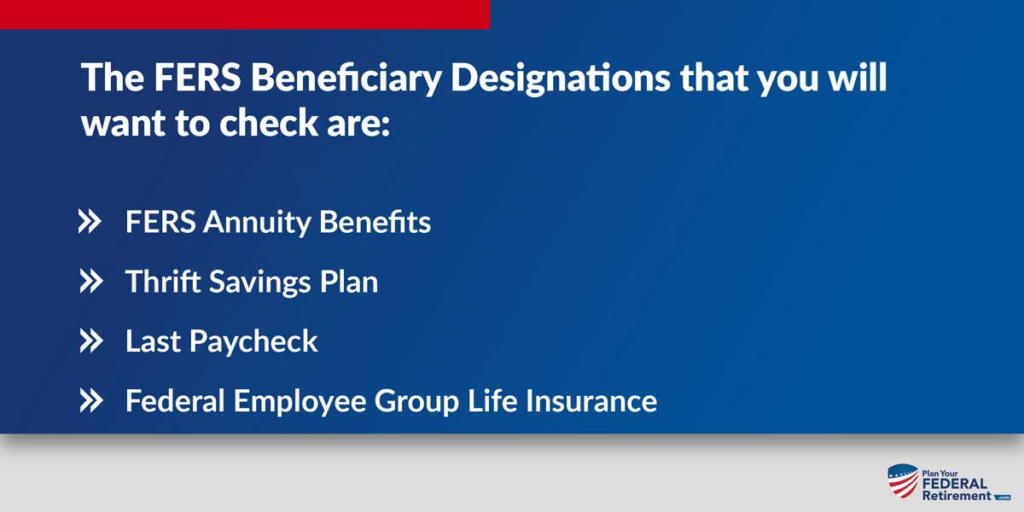

Beneficiary Designations that Federal Employees Should Know:

As a Federal employee, you have several,

- Assets are transferred by Title first. This means that if the asset has a beneficiary listed, and they should, your asset will transfer to that person first.

- Even if you have a Will or Trust that states otherwise. Assets are always transferred by title first.

- There are several beneficiary designations that are applicable to just FERS Employees.

Having a Trust as your TSP Beneficiary

Assets are transferred by title first. Whoever you have listed as your primary beneficiary (or beneficiaries – there can be more than one!) is where your asset will be transferred to upon your death irrespective of what your Will or Trust states.

Oftentimes, like with Bradley, we see Federal Employee clients ask us if their Trust should be the beneficiary of their TSP?

There are several types of Trusts but we are going to ASSUME that Bradley is referencing that he and his wife have created an Irrevocable Living Trust. Not all Trusts operate the same so it is important that you work with an attorney that specializes in estate planning to ensure that you create the type of Trust that best suits your needs. We also recommend that you have your attorney and financial planner work with you to ensure that your estate plan and your FERS Benefits are working in concert.

Why have an Irrevocable Living Trust?

Revocable Living Trusts are used to avoid probate and to protect the privacy of the trust owner(s), generally a husband and wife, and beneficiaries of the trust as well as minimize estate taxes.

Within the Trust, you can appoint several different people or entities to act in various capacities, either in conjunction with one another or independently. Most Trusts are going to want you to establish three important roles:

(1) the Grantor (also known as the “Settlor,” “Trustor,” or “Trust-Maker”) who establishes the trust,

(2) the Trustee (also known as the “Executor” or “Trust Manager”) who is given the responsibility to manage the assets of the trust in accordance with its instructions, and

(3) the Beneficiary who receives beneficial enjoyment of the trust’s assets under provisions and circumstances as set forth in the instrument.

Most of our Federal Employees have the following assignment of roles within their Trusts:

Role | Relationship |

Grantor | Husband and/or Wife |

Trustee | Adult Child(ren), Sibling, Family Friend, Bank of Institution that acts as Trustees |

Beneficiary | Children, Grandchildren and Charities |

Revocable LIVING Trusts

That second word, “Living” means that we have to breathe life into the Trust. More specifically, you have to place assets into the Trust for it to be alive.

A few examples of assets that people like to place in Revocable Living Trusts are expensive boats, airplanes, vehicles, bank accounts, real estate, and investment accounts.

Now here is where we see people make really egregious mistakes – they update their beneficiary designations – remember as a Federal Employee you have several – to put the Trust as their Primary Beneficiary and the Trust did not have language specifically addressing how retirement accounts would be handled.

This is a catastrophic mistake if done incorrectly. Here is the reason, let’s say Bob and Sue are happily married and finish signing for their Revocable Living Trust. They contact the Thrift Savings Plan (TSP) office and since Bob is a Federal Employee, request a beneficiary change form. Bob updates his primary beneficiary, removing Sue as his primary beneficiary, and puts the Trust in her place.

Bob dies and the TSP office processes the claim packet submitted by Sue. As they review Bob’s beneficiary designations they discover that Bob has left his Trust as his 100% Primary Beneficiary. TSP processes the request because assets transfer by title first – the Trust is entitled to the balance of Bob’s TSP account. In this example, we will say that Bob’s TSP account on the date of his death was $1,000,000.

The Revocable Living Trust does not have language within the Trust specifically designed to handle the transfer of retirement assets.

The TSP office transfers 100% of the balance of his TSP account to the Trust. At that time, the TSP is taxed at the Trust Level.

Remember, the United States uses a Progressive Tax System. That means that the Trust will be taxed at one of the highest levels in this scenario, almost 40%.

$1,000,000 X 40% = $400,000 Tax Bill, thank you for your patriotism.

How devastating would losing 40% of Bob’s TSP in this fashion be to his widow? Would that have real, financial implications for Sue?

Updating Beneficiaries on the TSP

Here, had Bob and Sue been our clients we would be reviewing the Revocable Living Trust and ensuring that the documents contained language to handle retirement accounts. We would work with Bob and Sue’s attorney and discuss their benefits under FERS to help advocate for everything to work in concert.

Next, we would have told Bob and Sue that we would want the primary beneficiaries on each of their retirement accounts, like the TSP, as the spouse. Under current tax law, spouses can transfer assets from the decedent to the surviving spouse without creating a tax problem.

The Revocable Living Trust would be Bob and Sue’s contingent beneficiaries most likely. Now, upon Bob’s death, the $1,000,000 from the TSP can be disbursed in accordance with the long-term financial plan designed for Sue, as the surviving spouse, and any other identified beneficiaries.

If you have questions on how your benefits need to work in concert with your Estate Plan, please contact our office and ask to schedule time with one of our federal employee benefits specialists.

You owe it to your surviving spouse to ensure this is done correctly.