#121 The Untold Story of Survivor Benefits: Protect What Matters Most

Listen to the Full Episode: Planning for the future involves understanding what happens to your benefits after you are no longer here. In this podcast

Effective Tax Planning can help you minimize your tax liability and maximize your retirement income. We guide you through understanding the tax implications of your federal benefits, TSP withdrawals, and other retirement income sources.

Explore these topics to build a solid foundation for your retirement. For deeper insights, don’t forget to check our podcasts and articles!

Listen to the Full Episode: Planning for the future involves understanding what happens to your benefits after you are no longer here. In this podcast

Listen to the Full Episode: Are you considering early retirement under VERA? Before you make a decision that could affect your benefits for years to

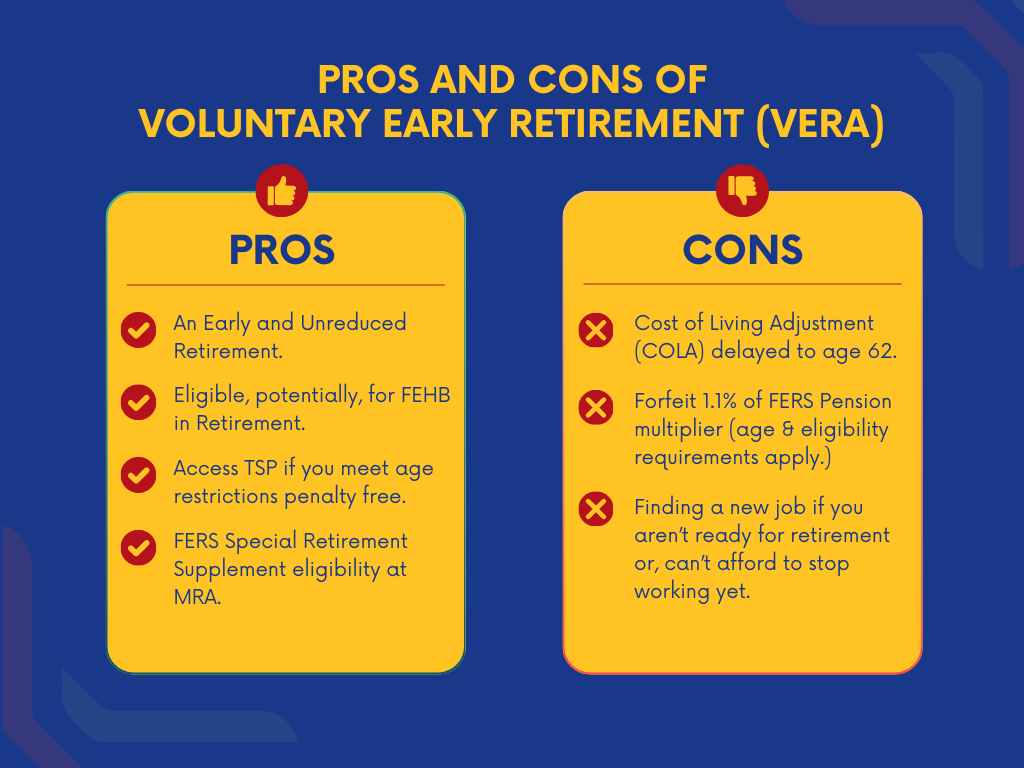

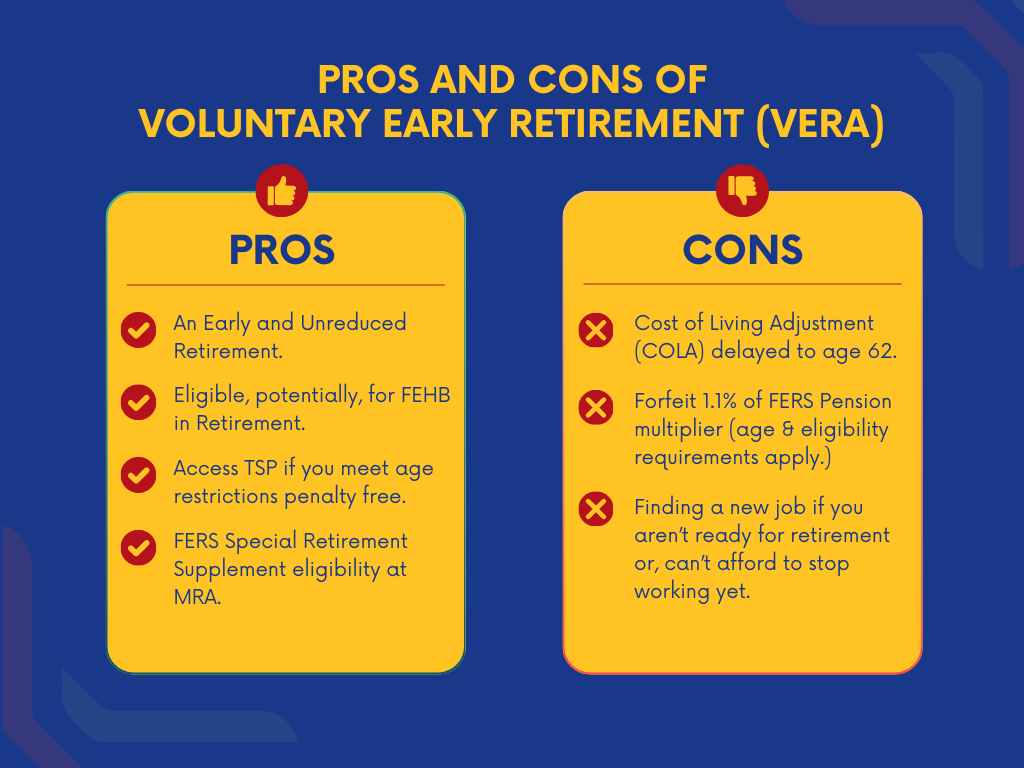

Are you a federal employee considering Voluntary Early Retirement Authority (VERA)? This comprehensive guide breaks down eligibility, benefits, and financial impacts, including how VERA affects your pension, health insurance (FEHB), and Thrift Savings Plan (TSP). Learn the key steps to avoid costly mistakes, understand your FERS Special Retirement Supplement, and maximize your retirement benefits.

🎙 Watch our YouTube Podcast for expert insights.

📚 Join our “Retire Right” On-Demand Class to make informed decisions.

Read now to take control of your federal retirement!

What should Federal Employees facing the Fork in the Road do? As a Federal Employee Benefits expert, my primary advice—though not intended to be self-serving—is

https://youtu.be/EQqQhWMzTKs Federal Employees need to know what to anticipate if they choose to accept the Deferred Resignation package issued January 2025 to civilian federal employees.

Listen to the Full Episode: What does a Reduction in Force (RIF) or job change mean for your federal benefits and retirement plans? These transitions

Listen to the Full Episode: What impacts will the latest tax law changes, Social Security projections, and market uncertainties have on your FERS retirement benefits

Listen to the Full Episode: Are you ready to unlock the secrets to a stronger TSP in 2025? In this podcast episode, Christian and John

Listen to the Full Episode: Ready for retirement but still trying to figure out what comes after the paycheck? In this podcast episode, Jamie and

Listen to the Full Episode: How can Qualified Charitable Distributions in Retirement help you give strategically and reduce taxes? In this podcast episode, Christian and

Listen to the Full Episode: Ready to secure your federal retirement? In this podcast episode, Micah and Christian discuss essential steps to secure your federal

Listen to the Full Episode: Navigating federal retirement benefits can be complex, but understanding FERS contribution rates is key. These rates determine your eligibility, pension

Listen to the Full Episode: Understanding how to navigate taxes in retirement is crucial for preserving your hard-earned income. From Roth conversions to Qualified Charitable

Listen to the Full Episode: Planning for your retirement requires a solid understanding of your options. Discover the best strategies for managing your Thrift Savings

Hello PYFR team! I love the podcast and appreciate it and all the resources you offer. My question is about taxes on the pay-out of

Listen to the Full Episode: It is time to discuss retirement planning, cash flow management, and potential retirement expenses! In this special episode, Micah leads

Listen to the Full Episode: Are you ready to retire without looking back? Let’s discuss essential strategies for retirees to help ensure they can enjoy

My husband was retired in May of 2020 at age 65 after 20 years of service with the FBI. We kept our health, vision and

Listen to the Full Episode: Listen to this week’s recap episode with Sierra Steele and learn about the most common things clients miss when talking

Listen to the Full Episode: This episode is all about some interesting real-life client stories in the world of retirement planning that happened during this

Listen to the Full Episode: Planning for the future involves understanding what happens to your benefits after you are no longer here. In this podcast

Listen to the Full Episode: Are you considering early retirement under VERA? Before you make a decision that could affect your benefits for years to

Are you a federal employee considering Voluntary Early Retirement Authority (VERA)? This comprehensive guide breaks down eligibility, benefits, and financial impacts, including how VERA affects your pension, health insurance (FEHB), and Thrift Savings Plan (TSP). Learn the key steps to avoid costly mistakes, understand your FERS Special Retirement Supplement, and maximize your retirement benefits.

🎙 Watch our YouTube Podcast for expert insights.

📚 Join our “Retire Right” On-Demand Class to make informed decisions.

Read now to take control of your federal retirement!

What should Federal Employees facing the Fork in the Road do? As a Federal Employee Benefits expert, my primary advice—though not intended to be self-serving—is

https://youtu.be/EQqQhWMzTKs Federal Employees need to know what to anticipate if they choose to accept the Deferred Resignation package issued January 2025 to civilian federal employees.

Listen to the Full Episode: What does a Reduction in Force (RIF) or job change mean for your federal benefits and retirement plans? These transitions

Listen to the Full Episode: What impacts will the latest tax law changes, Social Security projections, and market uncertainties have on your FERS retirement benefits

Listen to the Full Episode: Are you ready to unlock the secrets to a stronger TSP in 2025? In this podcast episode, Christian and John

Listen to the Full Episode: Ready for retirement but still trying to figure out what comes after the paycheck? In this podcast episode, Jamie and

Listen to the Full Episode: How can Qualified Charitable Distributions in Retirement help you give strategically and reduce taxes? In this podcast episode, Christian and

Listen to the Full Episode: Ready to secure your federal retirement? In this podcast episode, Micah and Christian discuss essential steps to secure your federal

Listen to the Full Episode: Navigating federal retirement benefits can be complex, but understanding FERS contribution rates is key. These rates determine your eligibility, pension

Listen to the Full Episode: Understanding how to navigate taxes in retirement is crucial for preserving your hard-earned income. From Roth conversions to Qualified Charitable

Listen to the Full Episode: Planning for your retirement requires a solid understanding of your options. Discover the best strategies for managing your Thrift Savings

Hello PYFR team! I love the podcast and appreciate it and all the resources you offer. My question is about taxes on the pay-out of

Listen to the Full Episode: It is time to discuss retirement planning, cash flow management, and potential retirement expenses! In this special episode, Micah leads

Listen to the Full Episode: Are you ready to retire without looking back? Let’s discuss essential strategies for retirees to help ensure they can enjoy

My husband was retired in May of 2020 at age 65 after 20 years of service with the FBI. We kept our health, vision and

Listen to the Full Episode: Listen to this week’s recap episode with Sierra Steele and learn about the most common things clients miss when talking

Listen to the Full Episode: This episode is all about some interesting real-life client stories in the world of retirement planning that happened during this

Listen to the Full Episode: Planning for the future involves understanding what happens to your benefits after you are no longer here. In this podcast

Listen to the Full Episode: Are you considering early retirement under VERA? Before you make a decision that could affect your benefits for years to

Are you a federal employee considering Voluntary Early Retirement Authority (VERA)? This comprehensive guide breaks down eligibility, benefits, and financial impacts, including how VERA affects your pension, health insurance (FEHB), and Thrift Savings Plan (TSP). Learn the key steps to avoid costly mistakes, understand your FERS Special Retirement Supplement, and maximize your retirement benefits.

🎙 Watch our YouTube Podcast for expert insights.

📚 Join our “Retire Right” On-Demand Class to make informed decisions.

Read now to take control of your federal retirement!

What should Federal Employees facing the Fork in the Road do? As a Federal Employee Benefits expert, my primary advice—though not intended to be self-serving—is

https://youtu.be/EQqQhWMzTKs Federal Employees need to know what to anticipate if they choose to accept the Deferred Resignation package issued January 2025 to civilian federal employees.

Listen to the Full Episode: What does a Reduction in Force (RIF) or job change mean for your federal benefits and retirement plans? These transitions

Listen to the Full Episode: What impacts will the latest tax law changes, Social Security projections, and market uncertainties have on your FERS retirement benefits

Listen to the Full Episode: Are you ready to unlock the secrets to a stronger TSP in 2025? In this podcast episode, Christian and John

Listen to the Full Episode: Ready for retirement but still trying to figure out what comes after the paycheck? In this podcast episode, Jamie and

Listen to the Full Episode: How can Qualified Charitable Distributions in Retirement help you give strategically and reduce taxes? In this podcast episode, Christian and

Listen to the Full Episode: Ready to secure your federal retirement? In this podcast episode, Micah and Christian discuss essential steps to secure your federal

Listen to the Full Episode: Navigating federal retirement benefits can be complex, but understanding FERS contribution rates is key. These rates determine your eligibility, pension

Listen to the Full Episode: Understanding how to navigate taxes in retirement is crucial for preserving your hard-earned income. From Roth conversions to Qualified Charitable

Listen to the Full Episode: Planning for your retirement requires a solid understanding of your options. Discover the best strategies for managing your Thrift Savings

Hello PYFR team! I love the podcast and appreciate it and all the resources you offer. My question is about taxes on the pay-out of

Listen to the Full Episode: It is time to discuss retirement planning, cash flow management, and potential retirement expenses! In this special episode, Micah leads

Listen to the Full Episode: Are you ready to retire without looking back? Let’s discuss essential strategies for retirees to help ensure they can enjoy

My husband was retired in May of 2020 at age 65 after 20 years of service with the FBI. We kept our health, vision and

Listen to the Full Episode: Listen to this week’s recap episode with Sierra Steele and learn about the most common things clients miss when talking

Listen to the Full Episode: This episode is all about some interesting real-life client stories in the world of retirement planning that happened during this

Listen to the Full Episode: Planning for the future involves understanding what happens to your benefits after you are no longer here. In this podcast

Listen to the Full Episode: Are you considering early retirement under VERA? Before you make a decision that could affect your benefits for years to

Are you a federal employee considering Voluntary Early Retirement Authority (VERA)? This comprehensive guide breaks down eligibility, benefits, and financial impacts, including how VERA affects your pension, health insurance (FEHB), and Thrift Savings Plan (TSP). Learn the key steps to avoid costly mistakes, understand your FERS Special Retirement Supplement, and maximize your retirement benefits.

🎙 Watch our YouTube Podcast for expert insights.

📚 Join our “Retire Right” On-Demand Class to make informed decisions.

Read now to take control of your federal retirement!

What should Federal Employees facing the Fork in the Road do? As a Federal Employee Benefits expert, my primary advice—though not intended to be self-serving—is

https://youtu.be/EQqQhWMzTKs Federal Employees need to know what to anticipate if they choose to accept the Deferred Resignation package issued January 2025 to civilian federal employees.

Listen to the Full Episode: What does a Reduction in Force (RIF) or job change mean for your federal benefits and retirement plans? These transitions

Listen to the Full Episode: What impacts will the latest tax law changes, Social Security projections, and market uncertainties have on your FERS retirement benefits

Listen to the Full Episode: Are you ready to unlock the secrets to a stronger TSP in 2025? In this podcast episode, Christian and John

Listen to the Full Episode: Ready for retirement but still trying to figure out what comes after the paycheck? In this podcast episode, Jamie and

Listen to the Full Episode: How can Qualified Charitable Distributions in Retirement help you give strategically and reduce taxes? In this podcast episode, Christian and

Listen to the Full Episode: Ready to secure your federal retirement? In this podcast episode, Micah and Christian discuss essential steps to secure your federal

Listen to the Full Episode: Navigating federal retirement benefits can be complex, but understanding FERS contribution rates is key. These rates determine your eligibility, pension

Listen to the Full Episode: Understanding how to navigate taxes in retirement is crucial for preserving your hard-earned income. From Roth conversions to Qualified Charitable

Listen to the Full Episode: Planning for your retirement requires a solid understanding of your options. Discover the best strategies for managing your Thrift Savings

Hello PYFR team! I love the podcast and appreciate it and all the resources you offer. My question is about taxes on the pay-out of

Listen to the Full Episode: It is time to discuss retirement planning, cash flow management, and potential retirement expenses! In this special episode, Micah leads

Listen to the Full Episode: Are you ready to retire without looking back? Let’s discuss essential strategies for retirees to help ensure they can enjoy

My husband was retired in May of 2020 at age 65 after 20 years of service with the FBI. We kept our health, vision and

Listen to the Full Episode: Listen to this week’s recap episode with Sierra Steele and learn about the most common things clients miss when talking

Listen to the Full Episode: This episode is all about some interesting real-life client stories in the world of retirement planning that happened during this