#131 The Government Is… What Can You Control?

Listen to the Full Episode: Is your financial plan ready for unexpected changes? In this episode, Micah and Jamie highlight the importance of taking charge

Effective Tax Planning can help you minimize your tax liability and maximize your retirement income. We guide you through understanding the tax implications of your federal benefits, TSP withdrawals, and other retirement income sources.

Explore these topics to build a solid foundation for your retirement. For deeper insights, don’t forget to check our podcasts and articles!

Listen to the Full Episode: Is your financial plan ready for unexpected changes? In this episode, Micah and Jamie highlight the importance of taking charge

Listen to the Full Episode: Is “buy and hold” really the best strategy for retirement investing? In this podcast episode, Micah and Christian explore why

Listen to the Full Episode: Think you know how your FERS pension, Social Security, or military retirement will be taxed? Think again. In this episode,

Listen to the Full Episode: What does retirement really look like beyond the financials? In this podcast episode, Micah and Floyd discuss what life is

Listen to the Full Episode: Tax season can be overwhelming, but federal employees can stay ahead with the right strategies. In this podcast episode, Micah

Listen to the Full Episode: It’s crucial to evaluate your TSP decisions as you approach retirement. Understanding the various benefits associated with your TSP can

Listen to the Full Episode: Understanding your TSP withdrawal options is essential for a successful retirement. In this podcast episode, Micah and Christian break down

Listen to the Full Episode: Estate planning involves more than just creating a will; it’s about ensuring financial security, protecting your loved ones, and

Listen to the Full Episode: Planning for the future involves understanding what happens to your benefits after you are no longer here. In this podcast

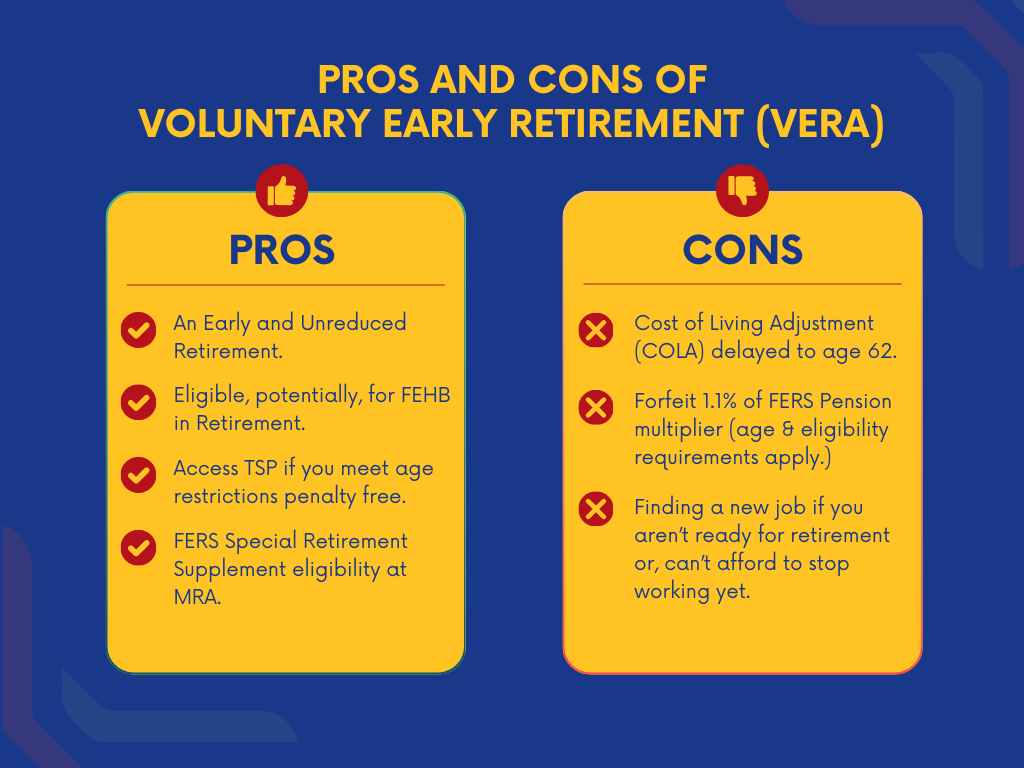

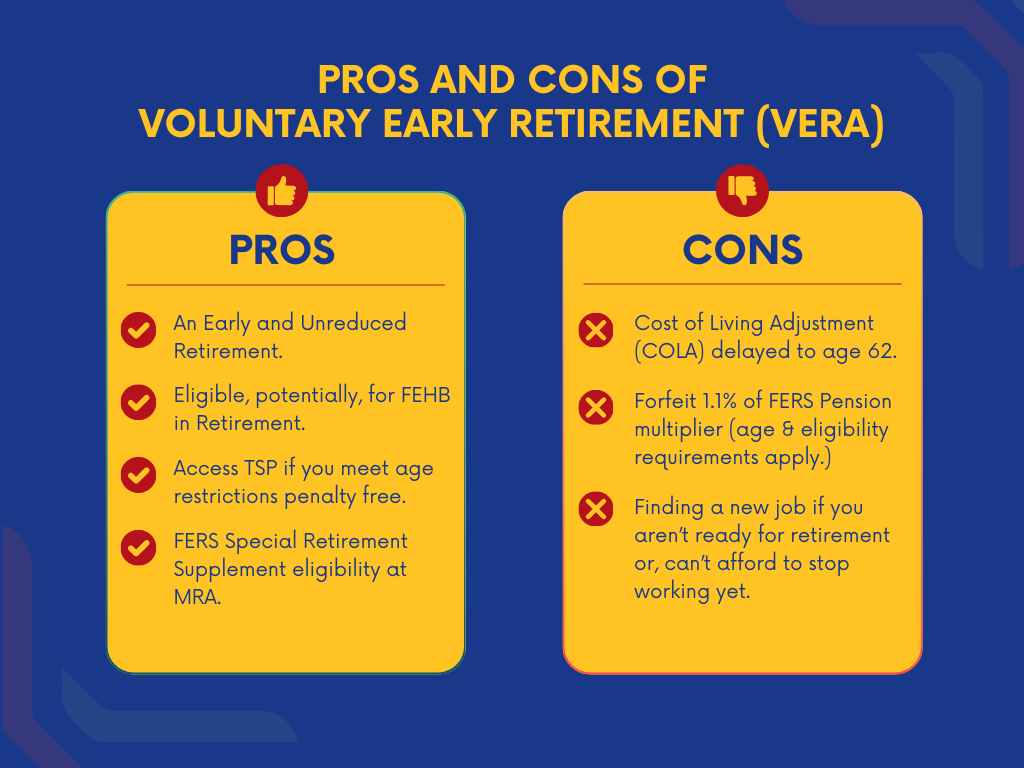

Listen to the Full Episode: Are you considering early retirement under VERA? Before you make a decision that could affect your benefits for years to

Are you a federal employee considering Voluntary Early Retirement Authority (VERA)? This comprehensive guide breaks down eligibility, benefits, and financial impacts, including how VERA affects your pension, health insurance (FEHB), and Thrift Savings Plan (TSP). Learn the key steps to avoid costly mistakes, understand your FERS Special Retirement Supplement, and maximize your retirement benefits.

🎙 Watch our YouTube Podcast for expert insights.

📚 Join our “Retire Right” On-Demand Class to make informed decisions.

Read now to take control of your federal retirement!

What should Federal Employees facing the Fork in the Road do? As a Federal Employee Benefits expert, my primary advice—though not intended to be self-serving—is

https://youtu.be/EQqQhWMzTKs Federal Employees need to know what to anticipate if they choose to accept the Deferred Resignation package issued January 2025 to civilian federal employees.

Listen to the Full Episode: What does a Reduction in Force (RIF) or job change mean for your federal benefits and retirement plans? These transitions

Listen to the Full Episode: What impacts will the latest tax law changes, Social Security projections, and market uncertainties have on your FERS retirement benefits

Listen to the Full Episode: Are you ready to unlock the secrets to a stronger TSP in 2025? In this podcast episode, Christian and John

Listen to the Full Episode: Ready for retirement but still trying to figure out what comes after the paycheck? In this podcast episode, Jamie and

Listen to the Full Episode: How can Qualified Charitable Distributions in Retirement help you give strategically and reduce taxes? In this podcast episode, Christian and

Listen to the Full Episode: Ready to secure your federal retirement? In this podcast episode, Micah and Christian discuss essential steps to secure your federal

Listen to the Full Episode: Navigating federal retirement benefits can be complex, but understanding FERS contribution rates is key. These rates determine your eligibility, pension

Listen to the Full Episode: Is your financial plan ready for unexpected changes? In this episode, Micah and Jamie highlight the importance of taking charge

Listen to the Full Episode: Is “buy and hold” really the best strategy for retirement investing? In this podcast episode, Micah and Christian explore why

Listen to the Full Episode: Think you know how your FERS pension, Social Security, or military retirement will be taxed? Think again. In this episode,

Listen to the Full Episode: What does retirement really look like beyond the financials? In this podcast episode, Micah and Floyd discuss what life is

Listen to the Full Episode: Tax season can be overwhelming, but federal employees can stay ahead with the right strategies. In this podcast episode, Micah

Listen to the Full Episode: It’s crucial to evaluate your TSP decisions as you approach retirement. Understanding the various benefits associated with your TSP can

Listen to the Full Episode: Understanding your TSP withdrawal options is essential for a successful retirement. In this podcast episode, Micah and Christian break down

Listen to the Full Episode: Estate planning involves more than just creating a will; it’s about ensuring financial security, protecting your loved ones, and

Listen to the Full Episode: Planning for the future involves understanding what happens to your benefits after you are no longer here. In this podcast

Listen to the Full Episode: Are you considering early retirement under VERA? Before you make a decision that could affect your benefits for years to

Are you a federal employee considering Voluntary Early Retirement Authority (VERA)? This comprehensive guide breaks down eligibility, benefits, and financial impacts, including how VERA affects your pension, health insurance (FEHB), and Thrift Savings Plan (TSP). Learn the key steps to avoid costly mistakes, understand your FERS Special Retirement Supplement, and maximize your retirement benefits.

🎙 Watch our YouTube Podcast for expert insights.

📚 Join our “Retire Right” On-Demand Class to make informed decisions.

Read now to take control of your federal retirement!

What should Federal Employees facing the Fork in the Road do? As a Federal Employee Benefits expert, my primary advice—though not intended to be self-serving—is

https://youtu.be/EQqQhWMzTKs Federal Employees need to know what to anticipate if they choose to accept the Deferred Resignation package issued January 2025 to civilian federal employees.

Listen to the Full Episode: What does a Reduction in Force (RIF) or job change mean for your federal benefits and retirement plans? These transitions

Listen to the Full Episode: What impacts will the latest tax law changes, Social Security projections, and market uncertainties have on your FERS retirement benefits

Listen to the Full Episode: Are you ready to unlock the secrets to a stronger TSP in 2025? In this podcast episode, Christian and John

Listen to the Full Episode: Ready for retirement but still trying to figure out what comes after the paycheck? In this podcast episode, Jamie and

Listen to the Full Episode: How can Qualified Charitable Distributions in Retirement help you give strategically and reduce taxes? In this podcast episode, Christian and

Listen to the Full Episode: Ready to secure your federal retirement? In this podcast episode, Micah and Christian discuss essential steps to secure your federal

Listen to the Full Episode: Navigating federal retirement benefits can be complex, but understanding FERS contribution rates is key. These rates determine your eligibility, pension

Listen to the Full Episode: Is your financial plan ready for unexpected changes? In this episode, Micah and Jamie highlight the importance of taking charge

Listen to the Full Episode: Is “buy and hold” really the best strategy for retirement investing? In this podcast episode, Micah and Christian explore why

Listen to the Full Episode: Think you know how your FERS pension, Social Security, or military retirement will be taxed? Think again. In this episode,

Listen to the Full Episode: What does retirement really look like beyond the financials? In this podcast episode, Micah and Floyd discuss what life is

Listen to the Full Episode: Tax season can be overwhelming, but federal employees can stay ahead with the right strategies. In this podcast episode, Micah

Listen to the Full Episode: It’s crucial to evaluate your TSP decisions as you approach retirement. Understanding the various benefits associated with your TSP can

Listen to the Full Episode: Understanding your TSP withdrawal options is essential for a successful retirement. In this podcast episode, Micah and Christian break down

Listen to the Full Episode: Estate planning involves more than just creating a will; it’s about ensuring financial security, protecting your loved ones, and

Listen to the Full Episode: Planning for the future involves understanding what happens to your benefits after you are no longer here. In this podcast

Listen to the Full Episode: Are you considering early retirement under VERA? Before you make a decision that could affect your benefits for years to

Are you a federal employee considering Voluntary Early Retirement Authority (VERA)? This comprehensive guide breaks down eligibility, benefits, and financial impacts, including how VERA affects your pension, health insurance (FEHB), and Thrift Savings Plan (TSP). Learn the key steps to avoid costly mistakes, understand your FERS Special Retirement Supplement, and maximize your retirement benefits.

🎙 Watch our YouTube Podcast for expert insights.

📚 Join our “Retire Right” On-Demand Class to make informed decisions.

Read now to take control of your federal retirement!

What should Federal Employees facing the Fork in the Road do? As a Federal Employee Benefits expert, my primary advice—though not intended to be self-serving—is

https://youtu.be/EQqQhWMzTKs Federal Employees need to know what to anticipate if they choose to accept the Deferred Resignation package issued January 2025 to civilian federal employees.

Listen to the Full Episode: What does a Reduction in Force (RIF) or job change mean for your federal benefits and retirement plans? These transitions

Listen to the Full Episode: What impacts will the latest tax law changes, Social Security projections, and market uncertainties have on your FERS retirement benefits

Listen to the Full Episode: Are you ready to unlock the secrets to a stronger TSP in 2025? In this podcast episode, Christian and John

Listen to the Full Episode: Ready for retirement but still trying to figure out what comes after the paycheck? In this podcast episode, Jamie and

Listen to the Full Episode: How can Qualified Charitable Distributions in Retirement help you give strategically and reduce taxes? In this podcast episode, Christian and

Listen to the Full Episode: Ready to secure your federal retirement? In this podcast episode, Micah and Christian discuss essential steps to secure your federal

Listen to the Full Episode: Navigating federal retirement benefits can be complex, but understanding FERS contribution rates is key. These rates determine your eligibility, pension

Listen to the Full Episode: Is your financial plan ready for unexpected changes? In this episode, Micah and Jamie highlight the importance of taking charge

Listen to the Full Episode: Is “buy and hold” really the best strategy for retirement investing? In this podcast episode, Micah and Christian explore why

Listen to the Full Episode: Think you know how your FERS pension, Social Security, or military retirement will be taxed? Think again. In this episode,

Listen to the Full Episode: What does retirement really look like beyond the financials? In this podcast episode, Micah and Floyd discuss what life is

Listen to the Full Episode: Tax season can be overwhelming, but federal employees can stay ahead with the right strategies. In this podcast episode, Micah

Listen to the Full Episode: It’s crucial to evaluate your TSP decisions as you approach retirement. Understanding the various benefits associated with your TSP can

Listen to the Full Episode: Understanding your TSP withdrawal options is essential for a successful retirement. In this podcast episode, Micah and Christian break down

Listen to the Full Episode: Estate planning involves more than just creating a will; it’s about ensuring financial security, protecting your loved ones, and

Listen to the Full Episode: Planning for the future involves understanding what happens to your benefits after you are no longer here. In this podcast

Listen to the Full Episode: Are you considering early retirement under VERA? Before you make a decision that could affect your benefits for years to

Are you a federal employee considering Voluntary Early Retirement Authority (VERA)? This comprehensive guide breaks down eligibility, benefits, and financial impacts, including how VERA affects your pension, health insurance (FEHB), and Thrift Savings Plan (TSP). Learn the key steps to avoid costly mistakes, understand your FERS Special Retirement Supplement, and maximize your retirement benefits.

🎙 Watch our YouTube Podcast for expert insights.

📚 Join our “Retire Right” On-Demand Class to make informed decisions.

Read now to take control of your federal retirement!

What should Federal Employees facing the Fork in the Road do? As a Federal Employee Benefits expert, my primary advice—though not intended to be self-serving—is

https://youtu.be/EQqQhWMzTKs Federal Employees need to know what to anticipate if they choose to accept the Deferred Resignation package issued January 2025 to civilian federal employees.

Listen to the Full Episode: What does a Reduction in Force (RIF) or job change mean for your federal benefits and retirement plans? These transitions

Listen to the Full Episode: What impacts will the latest tax law changes, Social Security projections, and market uncertainties have on your FERS retirement benefits

Listen to the Full Episode: Are you ready to unlock the secrets to a stronger TSP in 2025? In this podcast episode, Christian and John

Listen to the Full Episode: Ready for retirement but still trying to figure out what comes after the paycheck? In this podcast episode, Jamie and

Listen to the Full Episode: How can Qualified Charitable Distributions in Retirement help you give strategically and reduce taxes? In this podcast episode, Christian and

Listen to the Full Episode: Ready to secure your federal retirement? In this podcast episode, Micah and Christian discuss essential steps to secure your federal

Listen to the Full Episode: Navigating federal retirement benefits can be complex, but understanding FERS contribution rates is key. These rates determine your eligibility, pension

Advisory services offered through Shilanski & Associates, Inc., an Investment Adviser doing business as “Plan Your Federal Retirement”. Plan Your Federal Retirement is not employed by the United States Federal Government and does not represent the United States Federal Government. All content on this site if for information purposes only. This website is not personalized investment advice. Securities investing involves risks, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful. Please review our Customer Relationship Summary (Form ADV Part 3) for important information about our services and fees.

Opinions expressed herein are solely those of Shilanski & Associates, Incorporated, unless otherwise specifically cited. Material presented is believed to be from reliable sources, and no representations are made by our firm as to other parties, informational accuracy, or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant, or legal counsel prior to implementation.

Content provided herein is for informational purposes only and should not be used or construed as investment advice or recommendation regarding the purchase or sale of any security. There is no guarantee that any forward-looking statements or opinions provided will prove to be correct. Securities investing involves risk, including the potential loss of principle. There is no assurance that any investment plan or strategy will be successful.

Furthermore, we may utilize artificial intelligence (AI) technologies occasionally to enhance the user experience and improve the efficiency of our services online. The use of AI is designed to support operational activities and is carefully supervised and monitored by our staff to ensure accuracy and compliance with applicable regulations.

Copyright © 2025 Shilanski & Associates, Inc.