“I have two questions about social security. I am 61 and my wife is 58. Let’s say my wife files for social security at age 62 and I wait until 70, if I predecease her before I have filed, and after she has started receiving her own benefits, would she be eligible for any spousal benefit in addition to her own? Secondly, would that also apply if I predecease her after I turn 70?”

FERS Pension and Social Security

As a Federal Employee under the Federal Employee Retirement System (FERS) you are eligible to receive a pension in retirement providing that you meet the rules of eligibility.

Your eligibility for retirement under FERS is based on your age as well as the number of years that you have for creditable services. In some cases, this could also be contingent on whether or not you have reached your Minimum Retirement Age (MRA).

If so, your MRA is based on your date of birth.

If you were born | Your MRA is |

Before 1948 | 55 |

In 1948 | 55 and 2 months |

In 1949 | 55 and 4 months |

In 1950 | 55 and 6 months |

In 1951 | 55 and 8 months |

In 1952 | 55 and 10 months |

In 1953-1964 | 56 |

In 1965 | 56 and 2 months |

In 1966 | 56 and 4 months |

In 1967 | 56 and 6 months |

In 1968 | 56 and 8 mo |

In 1969 | 56 and 10 month |

In 1970 and after | 57 |

Immediate Retirement Eligibility Guidelines

If You Are Age | You Need This Many Years of Service |

62 | 5 |

60 | 20 |

MRA | 30 |

MRA | 10 |

You can retire from Federal Service before achieving 30 years of service. If you choose to retire at your MRA and have at least 10 years of service but less than 30 years of service, you can receive a pension. Your pension will be reduced by 5% per year for every year that you are under the age of 62 – the exception is if you have 20 years of service and your benefit starts when you reach age 60 or later.

FERS Pension and Social Security

As a Federal Employee under FERS you are eligible to receive both the FERS Pension and Social Security Benefits providing you meet the eligibility requirements for both.

While under FERS, you should be paying into both your FERS Benefits and Social Security. To verify that you are, we recommend checking your Leave and Earnings Statement for the last pay period you received income. There you will see that you paid into the FERS Retirement system and had FICA withheld as well.

Your agency also makes a contribution to both of these benefits while you’re working. Under FERS, employees and their agencies each contribute 7.65% of salary to Social Security and 0.8% to the FERS pension fund.

When you retire from FERS, your pension will be calculated by,

Years of Creditable Service X High-3 Salary X Multiple

The multiple used is 1.1% of high-three average earnings for each year of service for those retiring at age 62 with at least 20 years of service and 1% for all other retirements.

Under FERS, you also paid into Social Security. While you work, you and your employer make a contribution to the Social Security fund. Each quarter that you have earned income in which you paid into social security, you earn a credit. You need 40 credits to be eligible for social security benefits – that’s 10 years of employment.

If you stop working before you have enough credits paid into social security, those credits remain as part of your file but you are not eligible for benefits. To receive benefits, you will have to return to work and earn outstanding credits.

To draw social security you have to be minimally age 62. However, drawing at age 62 may not be the most financially prudent choice. You will want to read our article on When to Draw Social Security Benefits before making the decision to draw.

The FERS Supplement is also available for FERS employees who retire with an immediate pension before age 62. The FERS Supplement was designed to fill the gap between what your social security benefits should be at age 62. The FERS Supplement is a wonderful tool to be used by Feds who retire before age 62 but has some limitations that you will want to consider.

Survivors Benefits for Social Security

If you are legally married your spouse is entitled to 100% of their own social security benefits or 50% of yours, whichever is greater.

Social Security While Both Are Living

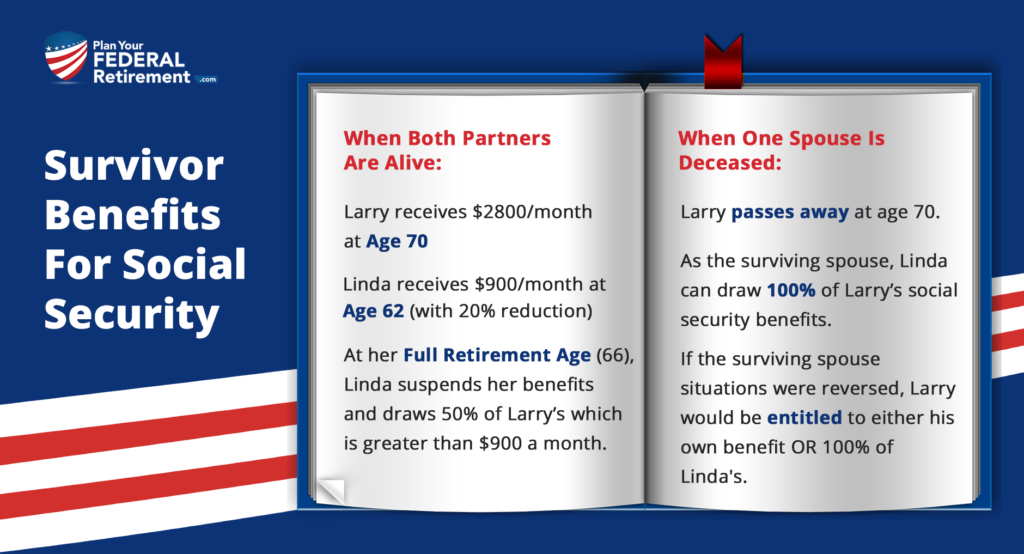

In Larry’s case let’s say that he is going to delay, defer, his social security and he plans to draw it age 70 and will receive $2,800.00 a month.

Larry’s wife, who we will call Linda, has a Full Retirement Age of 66 but she wants to start her social security benefits at age 62. For every year that you draw social security before reaching your full retirement age, there is about a 5% permanent penalty. At age 62, Linda’s social security benefits will be reduced by 20% PERMANENTLY. In our example, let’s say that she is going to receive after her reduction of around $900.00 a month.

Larry and Linda could consider turning her benefit on at age 62 to receive $900.00 a month until she reaches her Full Retirement Age for social security benefits. At her Full Retirement Age, she suspends her benefits and draws 50% of Larry’s which is greater than $900.00 a month.

Social Security While One Spouse is Deceased

In Larry’s case let’s say that he is going to delay, defer, his social security and he plans to draw it age 70 and will receive $2,800.00 a month.

Larry’s wife, who we will call Linda, has a Full Retirement Age of 66 but she wants to start her social security benefits at age 62. For every year that you draw social security before reaching your full retirement age, there is about a 5% permanent penalty. At age 62, Linda’s social security benefits will be reduced by 20% PERMANENTLY. In our example, let’s say that she is going to receive after her reduction of around $900.00 a month.

Larry passes away at age 70.

Linda can continue to receive her own social security benefits at $900.00 a month. Or, as the surviving spouse she can draw 100% of Larry’s social security benefits. Sue’s benefits, the $900.00 goes away entirely.

Similarly, if the surviving spouse situations were reversed, you would be entitled to either your own benefit OR 100% of your deceased spouse, Linda.

We love questions like Larry’s, if you have one that you would like some help with let us know! If you’re interested in how this information applies to your personal situation, we could be happy to schedule a one-on-one consultation with you.