We have had a tremendous amount of questions from Federal Employees about participating in ROTHs, whether it be in the TSP or the private sector using a ROTH IRA.

Tax planning is a critical component of your financial plan so we want to make sure that we are getting the fundamentals correct. Let’s start by discussing definitions so we understand what the rules of each are.

Key Definitions

Contributions:

This is your money that you are investing in your retirement account. To make a contribution to a retirement account, you and your spouse must have earned income.

Earned Income for Retirement Account Contributions:

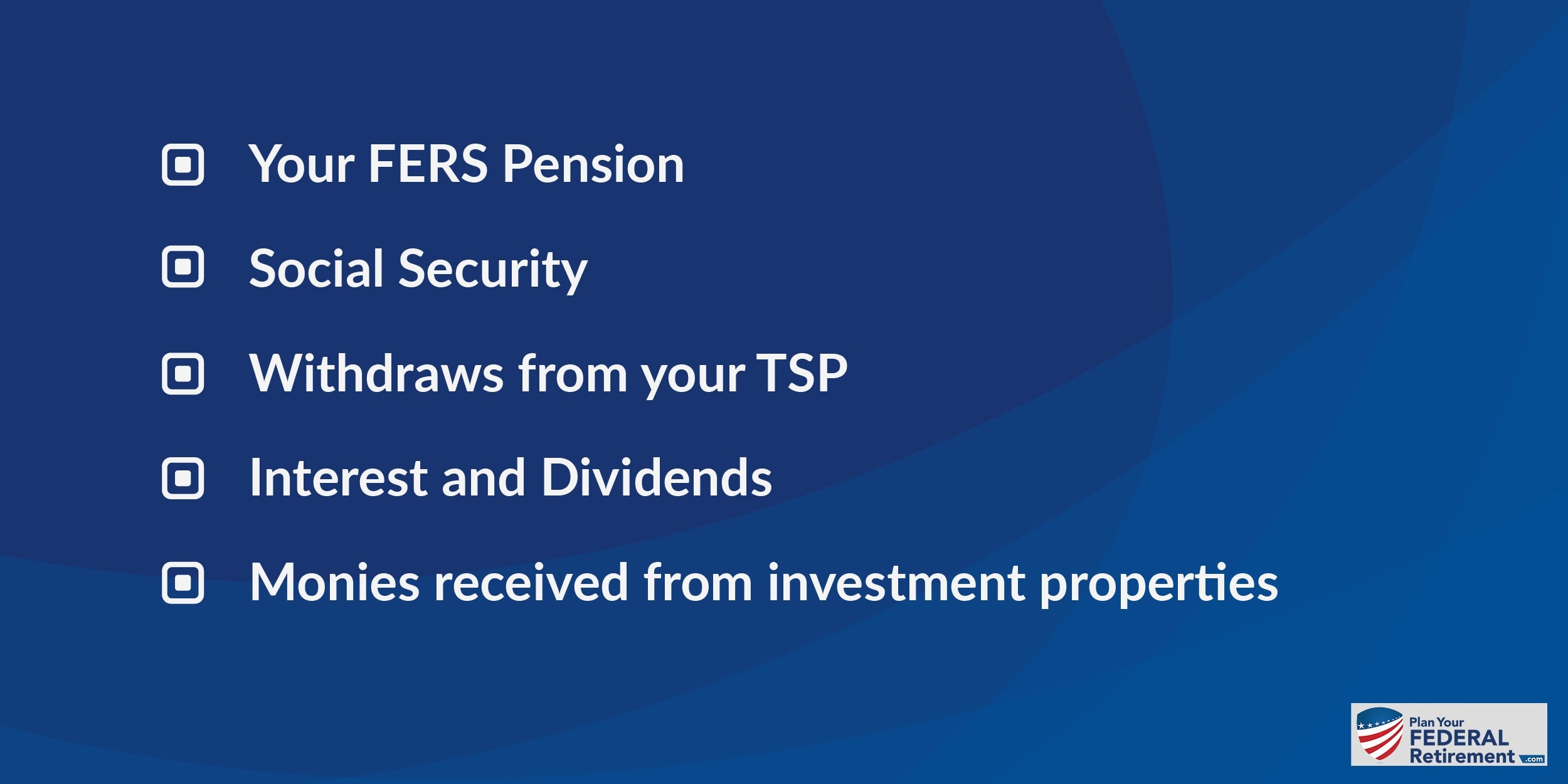

Money earned from paid work. This includes wages, salaries, tips —whatever monies come from active employment. Perhaps even more importantly, what does not count as earned income? Retirement income like:

Those are amongst the top disqualifying earned income sources for Federal Employees when it comes to determining contributions to retirement accounts.

If you are trying to find precise, clear information, you want to really narrow down the question that you are asking and more importantly, why you are asking.

In this case, we believe that Kim is trying to find the definite rules for ROTH contribution limits from earned income. In that case, we would trust few sources.

Sources for Precise Eligibility Rules for ROTH Contribution Limits

The definitive source for answering income qualifications for contributions to a retirement account will always be the Internal Revenue Service.

Now, reading tax code is not always “fun” for people but we will say that the IRS has made tremendous strides in updating their website to be more user friendly and at least provide helpful context to understanding the tax codes.

IRAHELP.com offers another great source for retirement qualifications. This is a private sector page hosted by Ed Slott. Slott provides in-depth information about retirement accounts and taxation.

Your retirement planning is too important for guess work. As a Federal Employee you have unique benefits and really want to ensure that you take time to get good, quality information and ask questions.