“I’m about 10 years out from retirement. I’m wanting to stop putting money into the traditional tsp and start a Roth. Is that doable?” – Robin.

Robin, like many federal employees we visit throughout the year, is about 10 years away from wanting to retire under the Federal Employee Retirement System (FERS). Robin is wondering whether or not it makes sense to start putting some of her Thrift Savings Plan (TSP) contributions towards the ROTH-TSP?

We love to talk with Federal Employees about their TSP questions but guess what we love even more than that? Talking with them about taxes!

Understanding your investment choices today and the tax benefits or consequences they have can make or break a retirement plan.

Most federal employees we have visited with have grossly underestimated their taxes in retirement.

We don’t know who started it, but a myth has seemed to circulate widely, and it goes something like this: “When I retire, my taxes will be lower.”

What happens if that is NOT the case? What happens if miscalculating taxes in retirement is the difference between you ending your career with the government and you having to find a job in retirement?

Types of Taxes that Retirees Pay

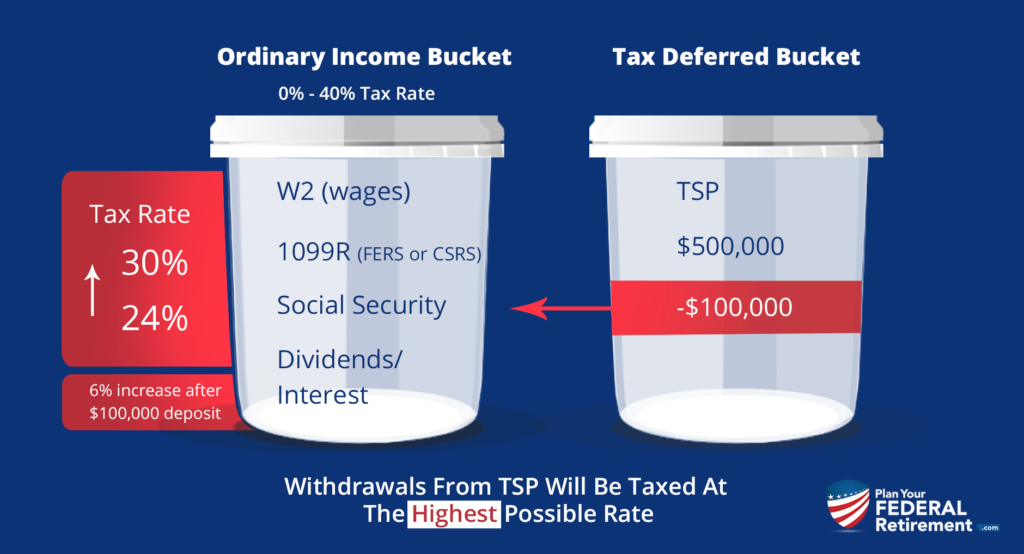

There are 4 Tax Buckets that FERS Retirees need to be aware of.

- Ordinal Income Tax

- Tax-Deferred

- Capital Gains and,

- Tax-Free

Ordinary Income Taxes

Ordinary income is subject to IRS-determined federal tax rates based on your annual earnings, called your “marginal tax rate.” When we talk about the “tax bracket” we are in, we refer to our marginal tax rates.

Your earnings as a Federal Employee are subject to ordinary income tax while you are employed. Each year of your employment under FERS, you receive a W-2 that reports your wages and how much taxes you paid throughout the year and aids the IRS determine your total tax liability.

When you retire from Federal Service, you will no longer receive a W-2. Rather, if you are eligible for the FERS Pension and begin to receive that income, you will receive a 1099-R to report your earnings.

Most of your FERS Pension is subject to ordinary income tax.

What taxes do I pay when I withdraw money from TSP?

What we love about the Thrift Savings Plan (TSP) is its easy-to-use, low cost, and keeps the choices for Federal Employees relatively simple.

Your TSP contributions must be payroll deferred. When you elect to contribute to the TSP, you have two options.

- Traditional TSP and,

- Roth TSP

If you are contributing to the Traditional TSP, your contributions are tax-deferred. Rather than paying the taxes today, you elect to pay them later in life when you withdraw funds from the TSP. You are deferring that tax liability.

Note: your agency’s contributions to the TSP are ALWAYS placed in the tax-deferred account. You cannot request that they are placed in the ROTH-TSP.

If you contribute to the ROTH-TSP, you elect to pay the taxes on these monies today at your current taxable income rate.

However, when you withdraw those funds, they will be tax-free, but that is not even the best part.

The best part of the ROTH-TSP is that not only can you withdraw your contributions tax-free later in retirement, but providing you meet the qualifications, the earnings are not subject to taxes either.

The ROTH-TSP is a powerful tool in your retirement toolbox, no matter where you are in your career.

We encourage federal employees to look at their ten-year tax plan.

We want to debunk the myth that taxes for Federal employees will always be lower in retirement. That is not the case for every federal employee, especially when so many aspects of a FERS retiree are subject to taxation: your FERS pension, your Traditional-TSP withdrawals, and social security, amongst other retirement assets that may be subject to taxation as well.