“I am a widow of a retired service member and receive military survivor annuity and VA pension based on my husband’s service connected death. I am a current Federal employee and plan to retire December 2022 at age 62. Would I be able to collect social security based on my widow status at age 62 and defer collection of my own social security until full retirement age or later?

Another question I have is in regards to what happens my TSP if I die. I am not remarried and my two adult daughters are my beneficiaries, neither with TSP accounts of their own. What is the best course of action for lessening the tax burden for my heirs and protecting the money I’ve saved in TSP?” -Hellen

What is the best way to take your social security income as a Federal Employee?

After listening to our podcast, Plan Your Federal Retirement, Helen was inspired to ask us questions about what strategy would be best for her to take social security benefits as a widow.

As Helen prepares for retirement, she wants to ensure that she is optimizing every strategy possible for financial success, and knowing the rules to each of her benefits, and how the survivor components work as well, is going to be critical for Helen to understand before she retires come December.

As a widow, Helen could turn on her widow survivor benefits with the Social Security Administration as early as when Helen turns age 60, but should she?

The reason that Helen should consider not turning on social security widow benefits immediately, is that there are earning limitations to receiving social security benefits. She should consider working with her Federal Employee Financial Advisor to see if delaying drawing widow benefits until she retires at age 62 makes the most financial sense while allowing her own benefits to be delayed.

Social Security Survivor Benefits

If you are a widow, widower, or dependent of an eligible worker then you may be entitled to Social Security benefits as soon as you are as young as age 60.

When a spouse dies, the funeral home is normally responsible for reporting the death to the Social Security Administration. Once that happens, the survivor should complete an application for survivor benefits promptly and turn it into the Social Security Administration’s office.

A widow or widower is entitled to 100% of the social security benefits of their deceased spouse under this provision. The social security administration’s office is going to refer to this as an “insurance benefit” but this should not be confused with traditional life insurance purchased through a private plan or through an employer. Your social security benefits will NOT be offset by any life insurance your spouse may have had.

The Social Security Administration will refer to your spouse’s social security benefits as their “primary insurance amount (PIA).”

PIA is the benefit that a person would have received if he or she was receiving social security benefits at their normal retirement age. Their normal retirement age is contingent on their date of birth. The Social Security Administration’s office will let you know what that benefit is once you complete the survivor application.

Social Security Special Lump-Sum Death Payment

There is a Special Lump-Sum Death Payment that the Social Security office will pay the survivor. The amount is $255.00 and is not used to offset any additional benefits that you may be entitled to.

Should I Draw Widow Social Security Benefits or Take My Own?

Contingent on the financial situation of the widow or widower, if they’re working or not, a survivor may consider strategizing to drawn survivor benefits from social security and allow their own benefits to delaying.

A widow or widower can draw social security survivor benefits when they reach age 60 and they are entitled to draw 100% of their deceased spouse’s benefits.

This is a great time to sit down with your Federal Employee Financial Advisor and determine if it makes financial sense to drawn survivor social security benefits at age 60 and allow your own benefits to be deferred until you reach your full retirement age or age 70.

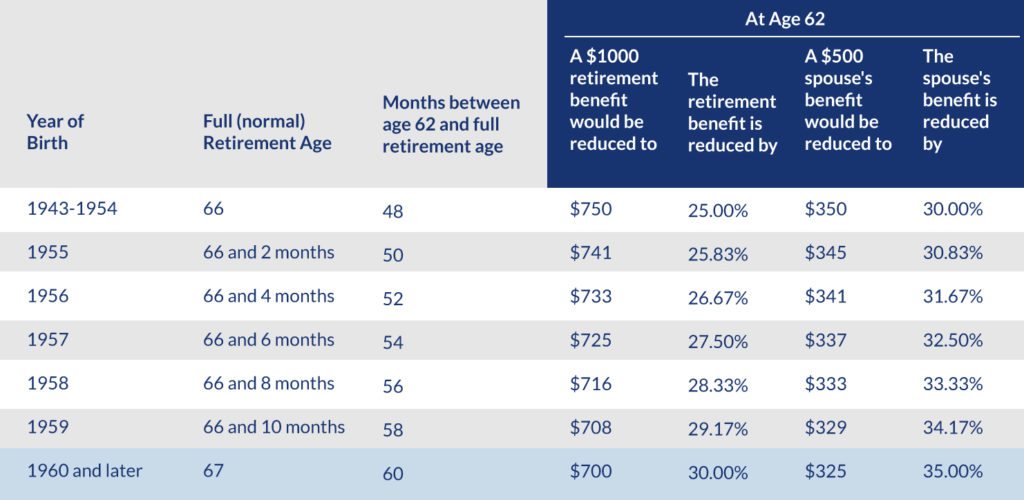

You can draw your own social security benefits at your fill retirement age which is contingent on the year of your birth.

Full Retirement and Age 62 Benefit By Year Of Birth

Or, you can defer your social security benefits until age 70. If you defer your benefits under social security then you receive an increase in your benefits for each year that you delay drawing them.