“I plan to retire in the next few months from USPS and take my health insurance with me. I am debating signing up for Medicare Part B and have Medicare Part A now. When I do retire, my understanding is that I can just take my Blue Cross Blue Shield into retirement and pay those co-pays as I do now. Or, I could pay the Medicare Part B premium out of my social security that I am already getting, Medicare becomes primary, BCBS becomes secondary, and there should be virtually no out of pocket costs.”

USPS Post Workers Under the Bargaining Agreement

If you are a member of the America Postal Workers Union, your health insurance premiums are going to change in retirement. As a postal worker, the collective bargaining agreement assists union members with the cost of their health insurance premium. When you retire, your health insurance premiums will be adjusted accordingly; it can be a dramatic change for postal workers.

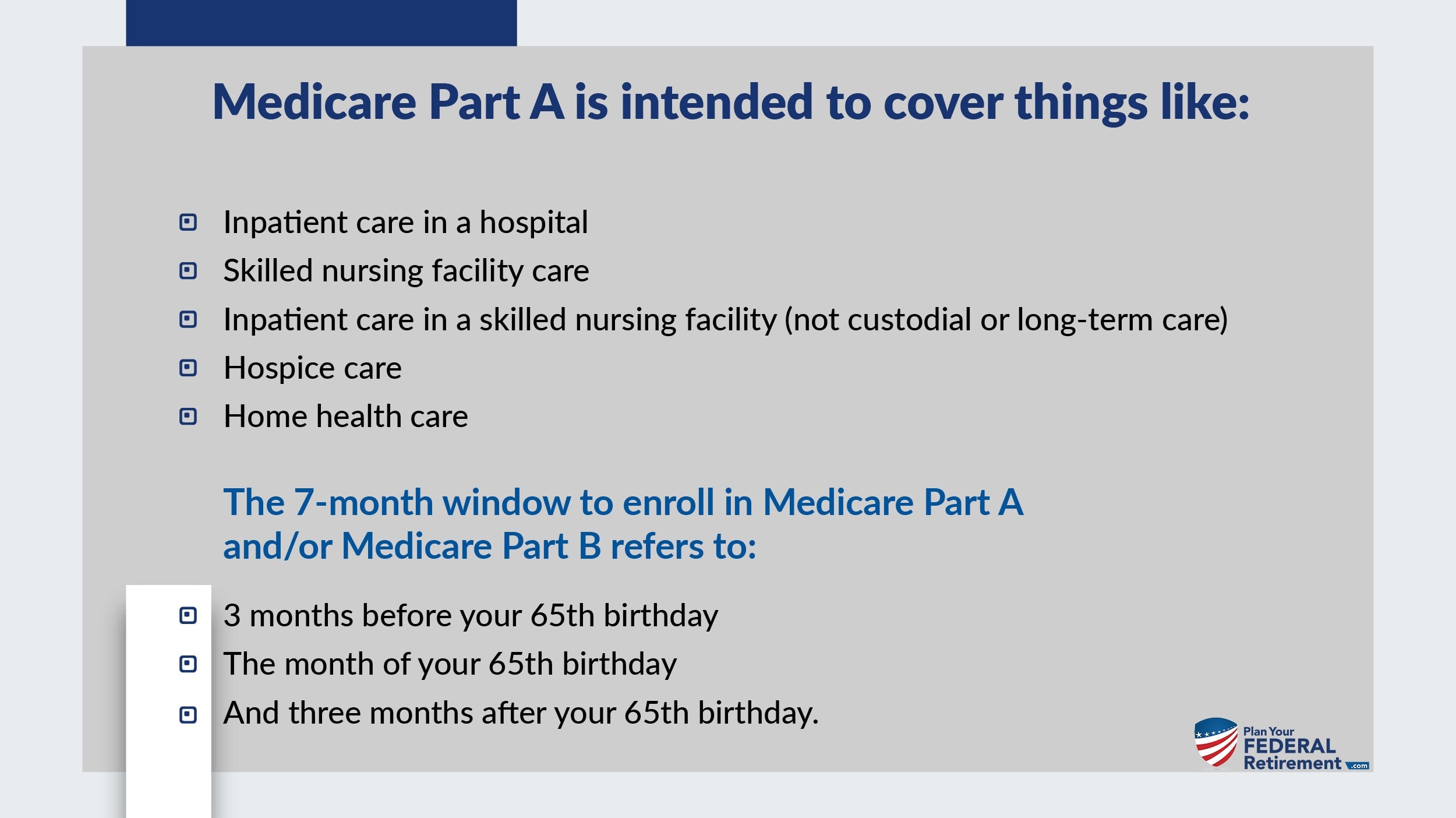

Enrolling in Medicare Part A and/or Part B

When you turn age 65, you have a 7-month window to sign up for Medicare Part A and/or Medicare Part B.

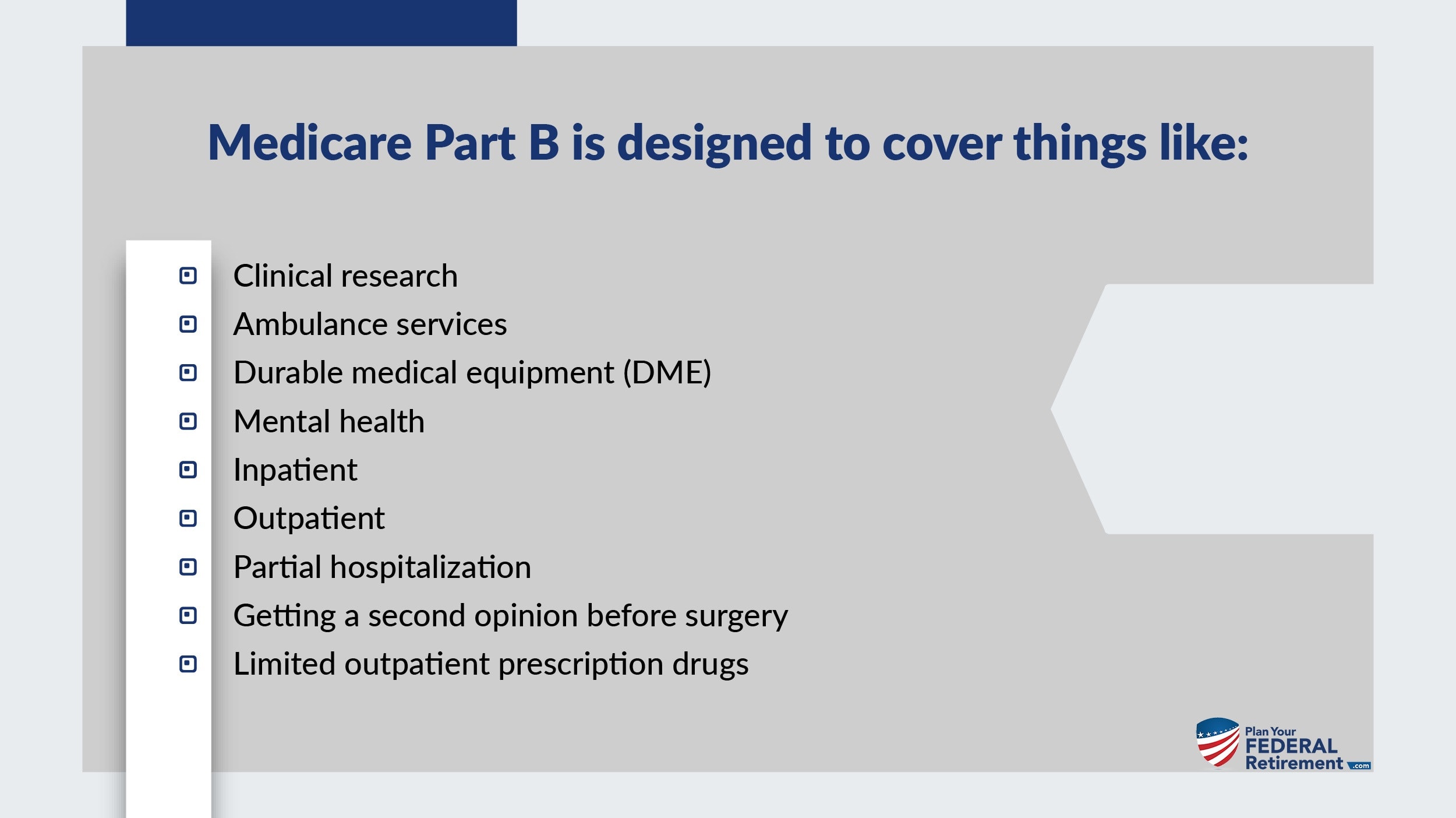

If I have FEHB do I really need Medicare Part B?

Yes. If you enroll in Medicare Part A you should probably enroll in Medicare Part B as well, even if you have FEHB.

Health insurance can change from policy year to policy year. What was once covered under FEHB may change down the line, and that just is not something that you can easily predict.

Choosing not to enroll in Medicare Part B when you are first eligible will result in penalties when you apply during an open enrollment period, later.

For every 12 months that you were eligible to enroll in Medicare Part B but chose not to, there is a 10% penalty.

| Year 1 Penalty: | 10% |

| Year 2 Penalty: | 20% |

| Year 3 Penalty: | 30% |

| Year 4 Penalty: | 40% |

| Year 5 Penalty: | 50% and so on. |

Permanently — This is a permanent penalty.

Think about that for a moment. If you elected to not enroll in Medicare Part B and found out 5 years down the road that FEHB no longer covered something, you may be in a precarious situation.

In this circumstance, if you went back to enroll in Medicare Part B, you would pay a 50% penalty for the rest of your life. Not a one-time penalty — a permanent penalty.

I am working past age 65. When should I enroll in Medicare Part B?

If you are actively employed when you turn age 65, you have 8 months from the date you retire to enroll in Medicare Part A and/or Part B.

As a Federal Employee covered under FEHB, it is important to understand that while your health insurance coverage is fantastic, it is not all-encompassing. You cannot predict changes that may occur to reform in the future, so you want to make an educated decision on what you know today.

Federal Employees Make Mistakes

But YOU Don't Have To

- Forgetting to Check Your Beneficiary Designations

- Expecting Pension Check to Arrive in 30 Days After Retiring

- Not Knowing the Difference Between SCD vs. RSCD

- Completing Retirement Paperwork Incorrectly

- Failing to Prepare Financially for Retirement

- Failing to Understand Tax Consequences

- Getting Bad Advice

Click below and learn how to avoid making them yourself