“Always”

Generally, an estimate from your Human Resources (HR) Department on your Federal Employee Retirement System (FERS) benefits is a good source of information for you to begin to plan your retirement.

However, it is your responsibility to ensure that the estimate that you receive from your HR is accurate. Your HR will not know your service better than you. You are the best and most reliable source for knowing when, where and, what you did while employed with the Federal Government. I do not like relying on the words, “always correct” because it leads to a false sense of accuracy.

From working with a lot of Federal Employees, I have seen HR retirement estimates that have been spot on — down to the penny. I have also seen retirement benefit estimates that are wrong — really wrong.

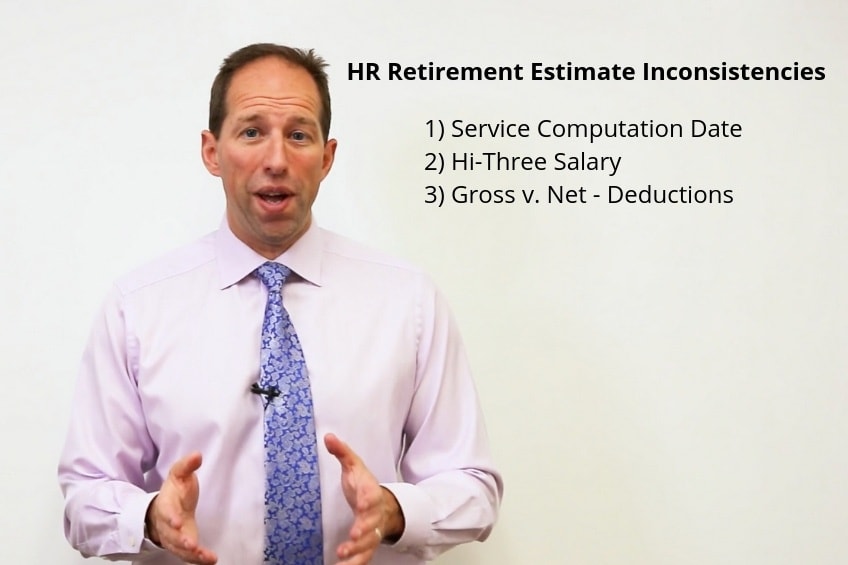

Most Frequent Inconsistencies in HR Retirement Estimates

There are a few common inconsistencies that I see when it comes to a Federal Employee Benefits Estimate, regardless of which agency employs you. That is why I run down a checklist with my clients on what I look for when reviewing their FERS Benefits Estimate.

Service Computation Date

This is the date in which your HR will certify as to your “start” date for benefits when you go to apply for retirement with the Office of Personnel Management (OPM). Your HR does not have malicious intent on trying to get your dates incorrect. They are, however, relying on information that is in your Official Personnel File (OPF). If you have made changes in your careers, like changed jobs or agencies, your OPF had to change with you.

Did you buy back military time that wasn’t applied?

This widens the opportunity for errors, such as mixing up dates. You know your Federal Service history better than anyone.

Hi-Three Salary

Your pension income is based on your creditable years of service and your high three salaries. Your High Three is the mean of the three highest salary years that you have as a FERS. These years generally occur towards the end of your career.

Review your Hi-Three salary and make sure that your numbers are accurate.

Gross v. Net

One of the most common mistakes FERS employees make when calculating their pension income is they base their retirement income off of the gross numbers and not the net.

Your FERS Pension income is subject to Federal Income Taxes but there are other deductions as well that have to be accounted for.

The tax estimate provided on the benefits estimate from HR makes an assumption that this singular pension source serves as your only income source. It does not account for other income sources that you may have as a single or married person. These include retirement accounts, social security, other pensions, etc.

HR retirement estimates for Federal Employees are wonderful resources, but they have to be scrutinized. You alone are the best source of knowing your Federal Service history, your salary, and your taxable income sources. Do not base your retirement decisions off of the wrong figures: your gross v. your net income.