New legislation means that Hawaii COLA is being phased out, and Locality Pay is being phased in.

Federal Employees in Non-Foreign Areas are now being transitioned from receiving COLA to Locality Pay. This change is taking place in 2010, 2011, and 2012.

Locality Pay is being phased in, and COLA is being phased out. But there will be some amount of COLA left over, even after the full Locality rate for Hawaii is phased in.

The ‘left over’ COLA pay is supposed to help offset the additional taxes you’ll be paying with Locality Pay. The Federal COLA Locality Adjustment does affect the take home pay for Federal Employees.

Learn more about hidden tax increases for Federal Employees in Hawaii and Other Non-Foreign Areas

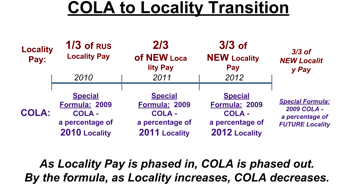

Below is a graphic showing how Locality Pay is phased in. First at 1/3 of the RUS rate in 2010, then 2/3 of Hawaii’s new Locality Rate in 2011, and at the full Hawaii Locality Pay rate in 2012.

The Non-Foreign Area Retirement Equity Assurance Act of 2009 is the legislation that governs the timeline for the change from COLA to Locality Pay.

There’s a lot more to know about the transition from COLA to Locality pay. It’s important to know that it affects your…

- Take Home Pay

- Your Taxes

- …and Your Federal Retirement

Learn more about how the transition from COLA to Locality works.

Hawaii COLA Locality Pay Rates

Before the transition, there were two different COLA rates in Hawaii, depending on which county you worked in. One rate for County of Hawaii COLA, another rate for COLA in all the other Counties (Honolulu, Maui, Kauai, and Kalawao Counties).

The 2009 COLA rates were frozen. The County of Hawaii COLA rate was frozen at 18%. The COLA rate for the other Counties was frozen at 25%. These frozen COLA rates play into the formula of the transition to Locality Pay.

While there were two different COLA rates, now there is just one Locality Pay Rate for the entire state of Hawaii. In 2011, the Locality Rate for Hawaii was set at 16.51%.

Below you can see two examples, depending on where you work.

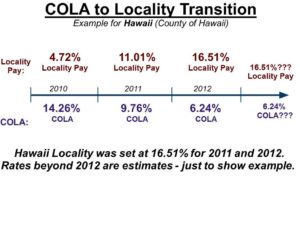

The first example shows the transition for Federal Employees in the County of Hawaii.

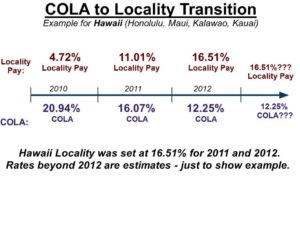

The second example shows the numbers for Honolulu, Maui, Kauai and Kalawao Counties.

Keep in mind the numbers beyond 2012 are just estimates. But it should give you a good idea of how the transition from COLA to Locality works.

Here are the Hawaii COLA and Locality rates for 2010, 2011 and 2012…

County of Hawaii COLA and Locality Rates…

Counties of Honolulu, Maui, Kalawao and Kauai COLA and Locality Rates…

Is a Lower Locality Rate Bad?

Some people may look at the new Locality Rate for Hawaii and get frustrated because 16.51% is lower than the COLA rates of 18% and 25%. Is this a bad thing?

Not necessarily. The transition from COLA to Locality Pay allows you to keep a portion of your COLA. With a lower Locality Rate, it means that you’ll have a larger portion of tax-free COLA left over.

The key differences between COLA and Locality Pay revolve around taxes and your federal retirement. COLA doesn’t count towards your High 3 Salary, but it is tax-free. Locality Pay is taxable, but it *does* count towards your High-3 for CSRS or FERS Retirement.

There is a special rule for Federal Employees who are retiring by the end of 2012 where you have the option to ‘buy back’ your COLA and have it count as Locality Pay.

Click here to learn more about how COLA and Locality Pay affect your Federal Retirement