“Micah, love your videos. I’m retired (58 years old) from USPS. Very aggressive in TSP. 40% C, 40% S, and 20% I- I’m down close to 30% from all time high of $675K to 500K now. I’m getting very nervous. Any advice is greatly appreciated. Thanks, Jerrold”

Market Volatility in Your TSP When You're Retired

As a Federal Employee, your retirement consists of three elements: your pension (OPM calls this an annuity), your social security benefits, and your Thrift Savings Plan (TSP).

Of those three, two are predetermined, your pension and your social security benefits, by your contribution and the regulations regarding how your benefits are calculated.

Your TSP though is the part of your retirement benefits determined to be more in your direct control. No, you can’t control market volatility but you can control your allocations, contributions, and distributions.

The fact that the TSP is a significant part of your retirement and something entirely up to you as the account owner to control, can cause many Federal Employees to become nervous or anxious about making the “right decisions” – especially when markets swing significantly one direction or the other.

It sounds like Jerrold is having a lot of this angst.

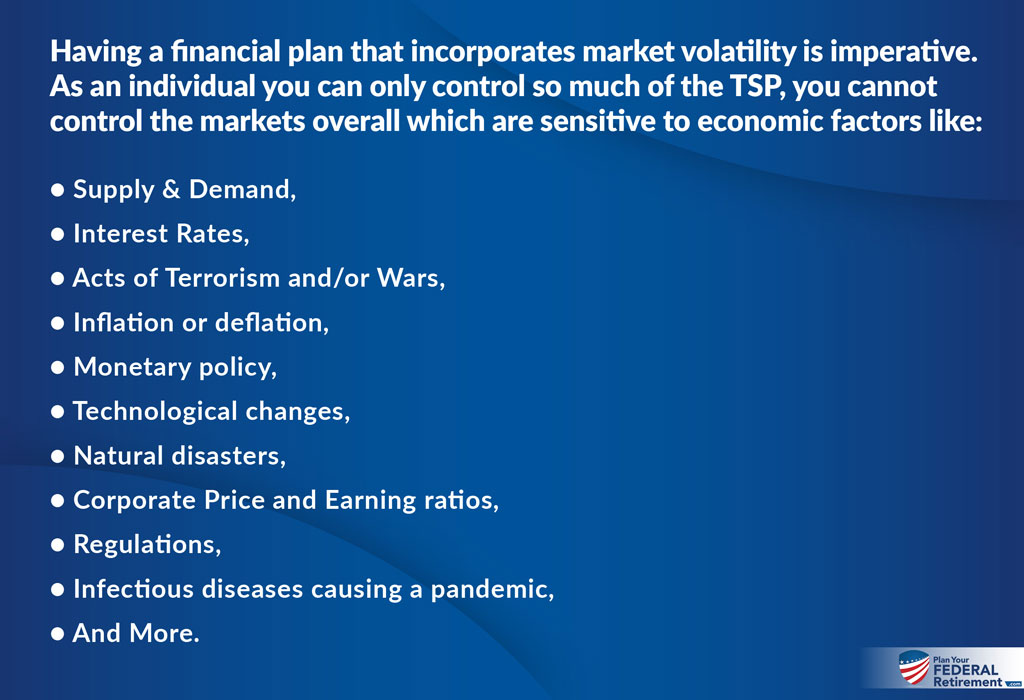

Think about it, in the list above how much are you as an individual able to control?

What you can control is how YOU will react during moments of extreme volatility and this is best done, in our opinion, by developing a financial plan based on your specific needs and circumstances.

Buckets of Money Approach with your TSP

We talk about Buckets of Money in our 3 Critical Concepts Video where we go through these “buckets of money” concept in far greater detail.

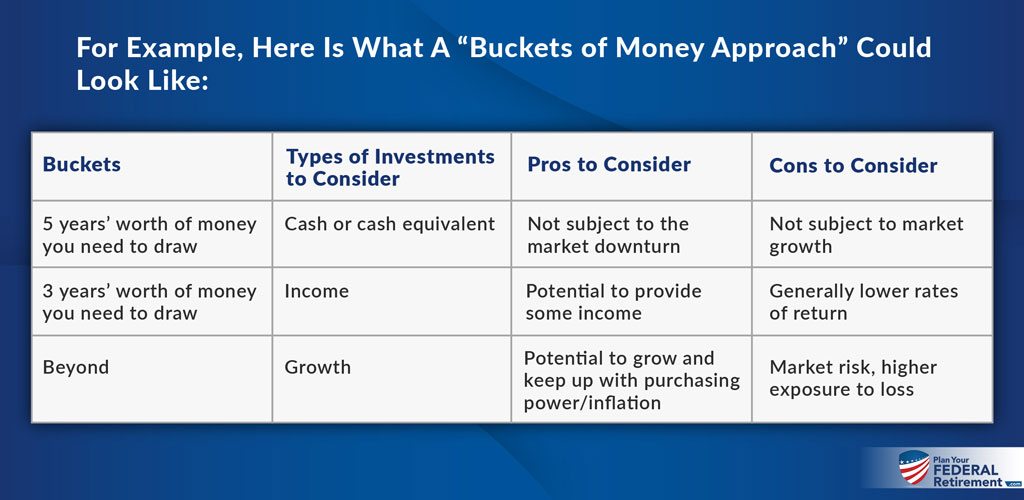

For discussion purposes when it comes to your retirement assets we talk about using various buckets in a strategical manner that aligns with your cash flow needs and your long-term goals.

For example, here an idea of what a “Buckets of Money Approach” could look like:

5 Year Theory

The operative word, theory. This is not a guarantee that markets WILL recover after 5 years, you have to make a plan that is financially right for you and your family.

When markets decline because of devastating events, investors have to rely on the financial plan that they had in place BEFORE the event happened. Making financial decisions from a place of extreme emotion is never a good idea.

That doesn’t mean you don’t monitor and re-evaluate your financial plan but it does mean that you have a plan in place for what you’re going to do WHEN markets decline.

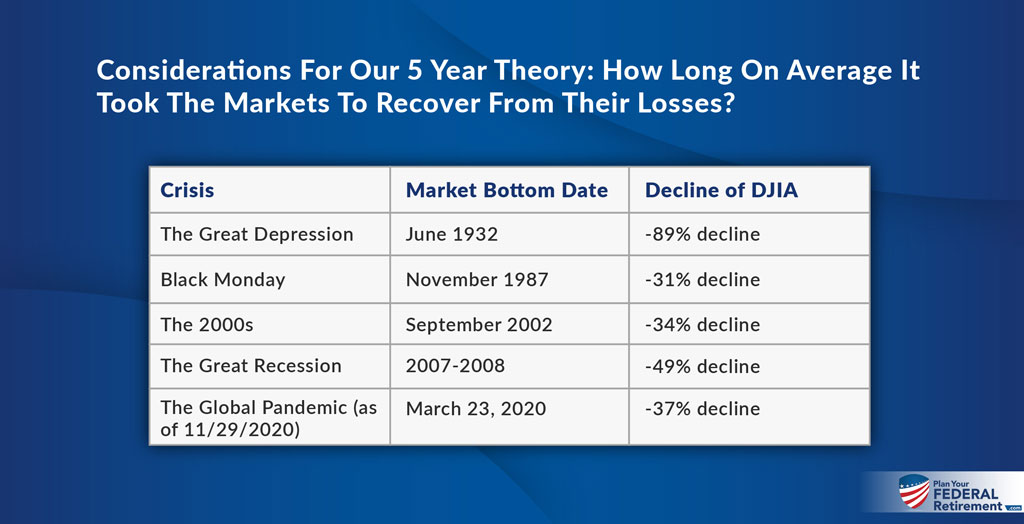

How Many Months Did It Take For The Market To Recover To The Pre-Crisis Peak?

The Great Depression took 25 years to recover, yes – 25 years. However, since then due to advances in technology and monetary policies, we have not experienced such a devastatingly long recovery.

In fact, the Great Recession of 2008 that is perhaps too fresh in the minds of most Federal Employees still, took roughly 4 years to recover from.

In 2020, during the COVID-19 Pandemic that swept across the globe, the DJIA dropped -37% on March 23, 2020.

By May 2020, the same index grew by 30% from its March 23, 2020 lows and continues to recover though unprecedentedly fast.

Had a Federal Employee taken 100% of their TSP and sold it during the bottom of the markets in any one of those crises they were alive for, it could have devastated their long-term retirement planning options. We saw this a lot in 2008 during the Great Recession when many Federal Employees delayed retirement because of extreme losses endured because they couldn’t control the markets and did not have a financial plan in place for how they would react during times of extreme market volatility.

What to do if your TSP is down?

Jerrold, you mentioned that your account is down almost 30% which is causing significant nervousness.

It sounds like you have 100% of your account investment in the markets and are not yet using a “Buckets Approach” to your investment accounts that you plan on using in retirement.

My advice is that you take our 3 Critical Concepts course where we really get down into the details of the Buckets Approach we highlighted here in this article.

It is imperative that before you make any investment decisions, you have a financial plan in place that weighs your risks, objectives, and long-term strategies.

Disclosure

As Financial Planners who specialize in helping Federal EMployees with their benefits and developing financial plans for them and their families, we are licensed to provide financial advice.

We provide recommendations and financial advice on a one-on-one basis.

This is the internet. It is not one-on-one.

While we will be addressing Jerrold’s specific question we will not be talking about individual investments or market performance. We want to keep this broad, neutral, and unspecific.

Markets are volatile and fluctuate often. We recommend working with a financial advisor who can provide you with specific information based on your independent situation.