“I was looking at my LES I noticed the FERS Retirement on deductions section is a different “year to date” amount from the FERS Retirement under “Benefits Paid by Government For you” section on the LES. Why is that? and Which one do i actually go by?” – James

Understanding Your Leave & Earning Statement (LES)

The LES is a comprehensive statement of your leave and earnings showing entitlements, deductions, allotments, leave information, tax withholding information, Thrift Savings Plan (TSP) and benefits paid by the agency that you work for as a Federal Employee.

Federal Employees can access their LES statements by logging into their agency portal or, by accessing www.employeeexpress.gov

Your LES is available every pay period and should be reviewed frequently to ensure that it is accurate and up to date. Notifying your agency of potential errors on your LES, as soon as possible allows them the opportunity to correct those issues. Employees who wait several pay periods before noticing an error could find that the matter is difficult to resolve.

When it comes to understanding what you are contributing to your retirement and what your agency is, you need to review your FERS Retirement withholdings block.

Calculating FERS Contributions Made by You and Your Agency on your LES

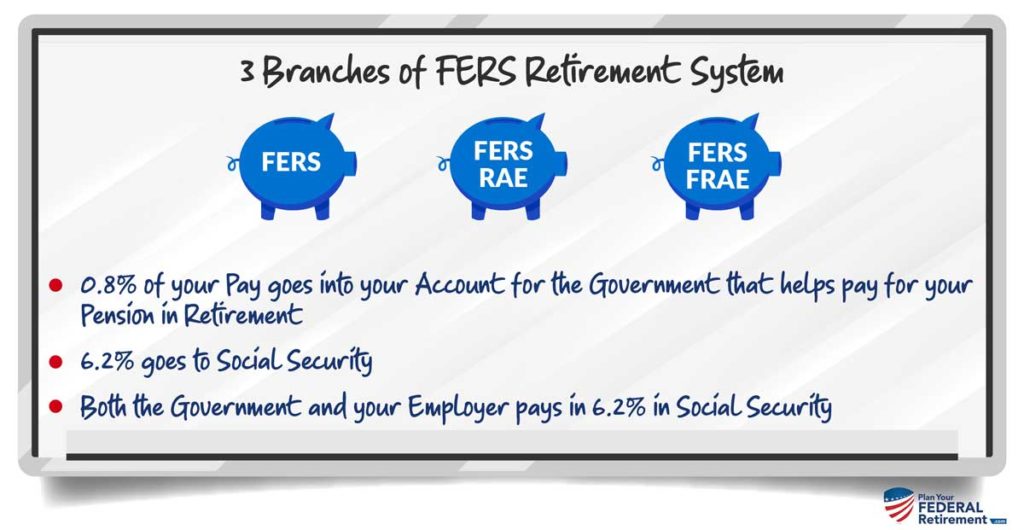

As a Federal Employee under FERS, you are putting in 0.8% of your pay into the FERS Retirement system.

Most Feds under FERS put in 0.8% of basic pay for FERS basic benefits.

The agency that you are employed by will contribute around 10.7% or more to FERS.

These contributions are put into the Federal Employee Retirement System in a general account.

When you, as a retiree, receive your pension income (the government likes to call this an “annuity” but in the world of finance, that can mean different things so we like to call it what it is – your pension) your retirement income is based on your contributions over your working history.

The FERS basic benefit provides retirement, disability, and survivor benefits and may be reduced for early retirement or to provide survivor protection.

Now, even though you are only contributing 0.8% and your agency is contributing 10.7% has ALMOST NOTHING to do with how your pension is calculated. Rather, these numbers can help you determine the taxable portion of your pension in reitrement but cannot help you determine what your pension is going to be.

The FERS pension basic benefit is computed based on your length of service and the highest average basic pay you earned during any 3 consecutive years of service (know as the “high-3” average pay).

Generally, the FERS basic benefit is 1% of your high-3 average pay times your years of creditable service.

Example on how to calculate your Hi-Three can be found here.

Once you have your pension calculated, the amount that you paid in throughout your working years (the 0.8%) will not be taxable because you have already paid taxes on those contributions.

Your SCD on your LES

Your LES will state your Service Computation Date.

One of the BIGGEST mistakes that we see Federal Employees make when they go to retire is thinking that their Service Computation Date is the date that will be used for retirement calculations.

It is not.

Your SCD is used to calculate leave.

Your Retirement Service Computation Date (RSCD) is the date that your agency and more importantly, the Office of Personnel Management (OPM) will use to calculte your retirement.

These dates are not the same often. Especially if you have moved agencies throughout your career, had part time work, a break in service or any other period in whch you were not paying into the FERS System.

(pppsstt… NPS we are looking at you – really critical here because the greatest number of errors we see come from NPS workers with lots of intermittent time throughout their working history).

Social Security Deductions

As a Federal Employee under the FERS, you also get to participate in Social Security providing that your earning history allows.

Each pay period, your pay is deducted by 7.65% for social security withholdings.

Your employer, the agency that you work for, also pays in 7.65% of your salary towards your social security benefit.

These funds go to the Social Security Administration ultimately to pay social security benefits.

At age 62, providing you meet all criteria necessary to apply, you are first eligible to apply for social security at a significantly reduced rate. If your minimum retirement age (MRA) is younger than age 62 and you are considering apply for social security early, please make sure you read our articles about how this decision can have severe financial ramifications on your retirement.

Medicare Withholdings

All Federal civilian workers are covered by Medicare Part A (The Hospital Insurance Program for Seniors) and contribute 1.45% of their salaries to that program, which you will see deducted on your Leave and Earnings Statement.

At age 65 you become eligible to enroll in Medicare. For most people, Part A has no cost associated with it. However, there are several other “parts” to Medicare that do have a cost.

Evaluating whether or not to keep your Federal Employee Health Benefits (FEHB) is something that we help our clients through during the retirement planning process. Your health benefits as a Federal Employee are your greatest benefits so make sure that if you are considering dropping this coverage you have really, really think about it.

Determine your Retirement Service Computation Date

Your Retirement Service Computation Date (RSCD) is what OPM is going to use to base your retirement off of.

You will not find your RSCD on your LES.

Your RSCD can be requested from your Agency’s Human Resource Department directly.

It is a good idea to review this date and ensure your calculating your retirement off of the correct information in your Official Personnel File – because the government will be.

We seen the mistakes that people (and even some professionals!) can make, and we want to help you avoid them. Click the button below to learn more.

7 CRITICAL MISTAKES

Federal Employees make

✗ Forgetting to check your beneficiary designations

✗ Expecting pension check to arrive in 30 days after retiring

✗ Not knowing the difference between SCD vs. RSCD

✗ Completing retirement paperwork incorrectly

✗ Failing to prepare financially for retirement

✗ Failing to understand tax consequences

✗ Getting bad advice

Click the button below and learn how to avoid these mistakes while planning YOUR retirement