“What happens to your sick leave if you are 63 years and have 28 years of federal service. Thanks for taking this question.”

FERS Sick Leave Rules

As a Federal Employee under FERS, you earn 4 hours of sick leave each pay period, every two weeks. Your sick leave accrues and you can save it year to year. Most Federal Employees choose to allow their sick leave to accumulate so that they can apply it towards retirement service credibility.

In 2009 Congress passed the “NON-FOREIGN AREA RETIREMENT EQUITY ASSURANCE ACT” which changed the manner in which sick leave was allowed to be used towards / for retirement for Federal Employees. Under the Act, Federal employees can now use their sick leave towards years of creditable service for retirement eligibility.

Prior to the NON-FOREIGN AREA RETIREMENT EQUITY ASSURANCE ACT OF 2009, FERS Employees could not use their sick leave towards retirement. This resulted in many employees feeling compelled to use as much of their leave towards the end of their careers as possible.

How sick leave counts towards FERS Retirement

Under FERS, your sick leave counts towards your years of creditable service for retirement eligibility.

Your FERS pension is calculated by taking,

Years of Creditable Service X Hi-Three X Variable

The variable depends on how long your service with the Federal Government was. 1% for most employees and 1.1% if you have over 20 years of service.

You can determine what your years of creditable service are by requesting a Certified Summary of Federal Service SF-3107 from your agency’s Human Resources department.

The request can take several months to complete so we recommend turning it in, in advance. Your FERS Benefits Estimate, while HR’s aim to be as accurate as possible, is not certified by the Office of Personnel Management (OPM).

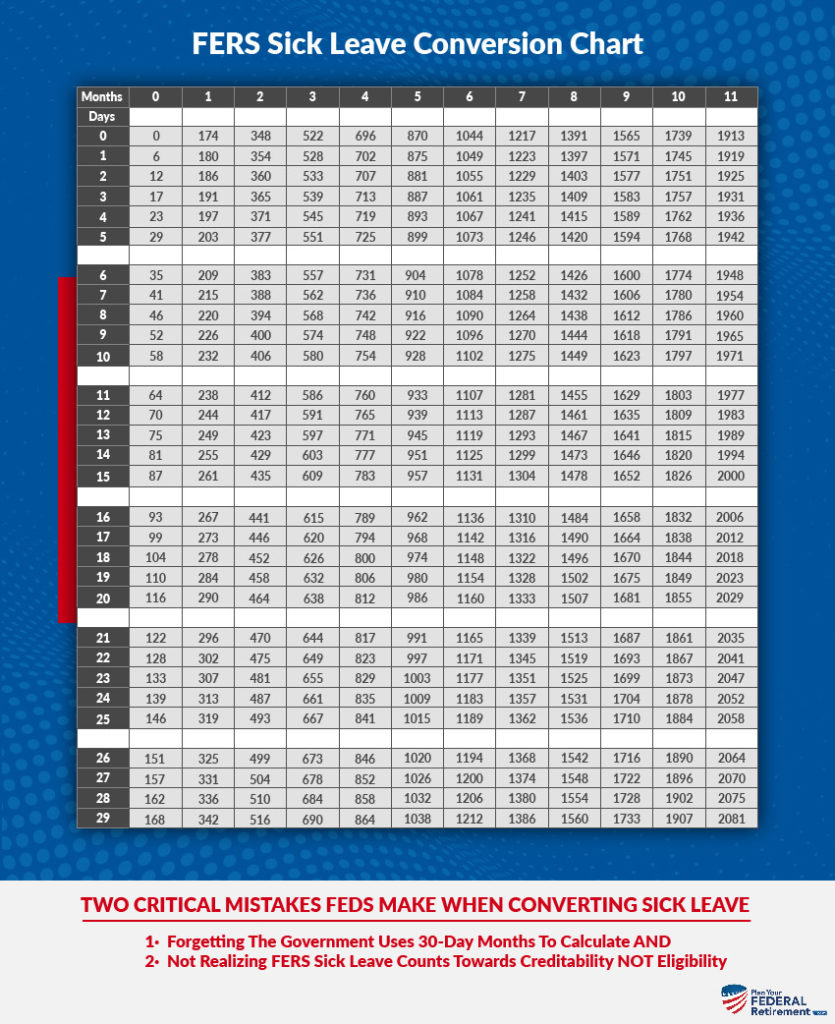

How to Convert Sick Leave | Sick Leave Chart

A lot of the Federal Employees that we meet with get really caught up in calculating the days, months and years of their sick leave because they want to ensure they’re getting the most out of their federal service. Here is what we want you to keep in mind if you find yourself getting granular:

The government only calculates whole months. They assume each calendar month has thirty days. If you miscalculate you could find yourself losing an entire month of creditable sick leave to use in retirement.

Important Distinction on Sick Leave in Retirement

Your sick leave is added to your Years of Creditable Service. However, it IS NOT used to compute your eligibility to retire.

Meaning, you can use your FERS Sick Leave to calculate your pension benefits as it is added to your years of credible service. However, you cannot use sick leave to count towards your years of eligibility.

In order to retire from Federal Service with an unreduced immediate pension, you must meet the eligibility requirements.

“An immediate retirement benefit is one that starts within 30 days from the date you stop working. If you meet one of the following sets of age and service requirements, you are entitled to an immediate retirement benefit:

Age | Years of Service |

62 | 5 |

60 | 20 |

MRA | 30 |

MRA | 10 |

Sick leave does not count towards your years of service for retirement eligibility under FERS.

In Ernest’s case, he is age 63 and has 28 years of creditable service. The first qualification to be eligible for an unreduced immediate pension is age. In Ernest’s case hs achieves that as he is 63 years old. The second requirement is that he must have 5 years of service or, 20 years of service. In Ernest’s case, he has 28 years so he meets those requirements as well.

Ernest now wants to know, with his accumulated sick leave what happens to it when he retires under FERS? Ernest’s sick leave will count towards his years of creditable service for his pension computation.