Avoid Losing Out On Your FERS Benefits

“I recently separated as an attorney from a federal agency at age 61 and ten months. Because I did not have the time to devote towards researching the retirement rules, I hired a consultant, who was formerly employed by my agency’s Division of Human Resources. The consultant advised me that, even though I separated now if I postponed my retirement until age 62, I could take advantage of the higher, 1.1%, percentage in the formula for calculating my annuity.

I ran the proposal for postponement by my agency’s HR and asked them, what if anything, I was missing. They responded only that they disagreed with the consultant’s calculation of the number of days of unused sick leave but attributed that to a possible software malfunction. They did not disagree with the proposal to separate now but to postpone retirement to age 62 to obtain the 10 % bonus.

I separated age 61 and ten months and commenced preparing my retirement package only to find out from your website and, then, OPM’s, that I did not qualify for the bonus because I was under age 62. I estimate that I have lost about $400.00 per month for the rest of my life.

Any thoughts for redress? Also, where might I find a lawyer to look further into this matter?” – Katherine

Bad Advice

Oh, Katherine, I cannot tell you how hearing about your experience makes our hearts hurt. We often hear about FERS employees who do not know how to navigate the Federal Employee Retirement System and make decisions that permanently impact them because they just simply did not know about their options or understand their FERS Benefits. When this happens it saddens us because we understand how complex the Federal Employee Retirement System can be but when we hear that someone recognized the complexity and hired a professional to help them and that advice just simply wasn’t good advice – that physically pains us.

Would you believe that even here in Anchorage, Alaska we have come across “consultants” who were formally employed as Human Resource (HR)personnel with various agencies and provide retirement advice like this, to FERS Employees, for a fee. We have worked with some really, really good HR people who really knew the ins and outs of the FERS Retirement system but more often than not, we work with ones that do not fully comprehend the financial ramifications of the advice that they provide people with. The same can be said for some financial professionals we have met that claim to work in the Fed space and know about your retirement benefits but are really just trying to sell you more life insurance.

We are adamant about understanding what the professional that you are hiring is and what they specialize in. We believe the term “advisor” or “retirement counselor” is thrown around too liberally and does not help you, the client, fully understand what that person specializes in.

If you are wondering what we are, we are financial planners who specialize in helping federal employees. That is what we do.

Sorry, Katherine, you hit a nerve and got us on our soapbox. We are pained to know that you tried to make every consideration to get the advice that you needed by hiring someone and simply just got bad advice from someone that did not understand the rules.

Or better yet, someone that didn’t understand the exceptions to the rules.

Our Rules On Exceptions

Document and support.

When we help a Federal Employee retire from Federal Service under an exception to a rule, like a postponed retirement, we want documentation of everything.

This means we want you to obtain a copy of your Official Personnel File (OPF) and then the rules from the benefits handbook provided by the Office of Personnel Management (OPM) that outlines the rules and exceptions.

OPM is phenomenal about following the rules from our experience but that does not mean that you do not have to sometimes have a guided conversation about what those rules are. We always recommend referring to OPM’s publications directly for clarity.

No matter who you are working with the advice that they give you when it comes to your Federal Employee Benefits should be supported by published documentation from OPM.

“In my experience,” or, “This is how it is done…” is not good enough. Not even if it comes from your HR. We want references to the publication, page, and line because if something goes awry that is what we will reference. FERS Handbook, Benefit Announcement Letter (BAL) – those are acceptable references to the rules of eligibility for your FERS Benefits.

Katherine, indulge us as we go through this from a 30,000-foot perspective before we dial down more into your specific question. This way those joining us, and especially those that may be considering retiring under similar circumstances can understand a little more about how the FERS Postponed Retirement process works and – what can go wrong.

When you look at the FERS Retirement system, the rules on being eligible to retire from Federal Service seem rather straight forward according to the Office of Personnel Management (OPM):

Immediate Retirement

“An immediate retirement benefit is one that starts within 30 days from the date you stop working. If you meet one of the following sets of age and service requirements, you are entitled to an immediate retirement benefit:

| Age | Years of Service |

|---|---|

| 62 | 5 |

| 60 | 20 |

| MRA | 30 |

| MRA | 10 |

If you retire at the MRA with at least 10, but less than 30 years of service, your benefit will be reduced by 5 percent a year for each year you are under 62, unless you have 20 years of service and your benefit starts when you reach age 60 or later.

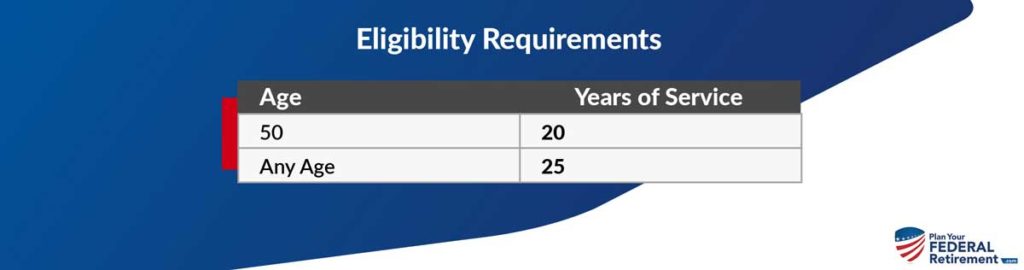

Early Retirement

The early retirement benefit is available in certain involuntary separation cases and in cases of voluntary separations during a major reorganization or reduction in force. To be eligible, you must meet the following requirements:

That all seems rather straight forward. You need to meet the age and service criteria to be eligible to retire.

But what about the exceptions? If you are considering retiring from FERS before you meet a certain age and time in the service parameter outlined above?

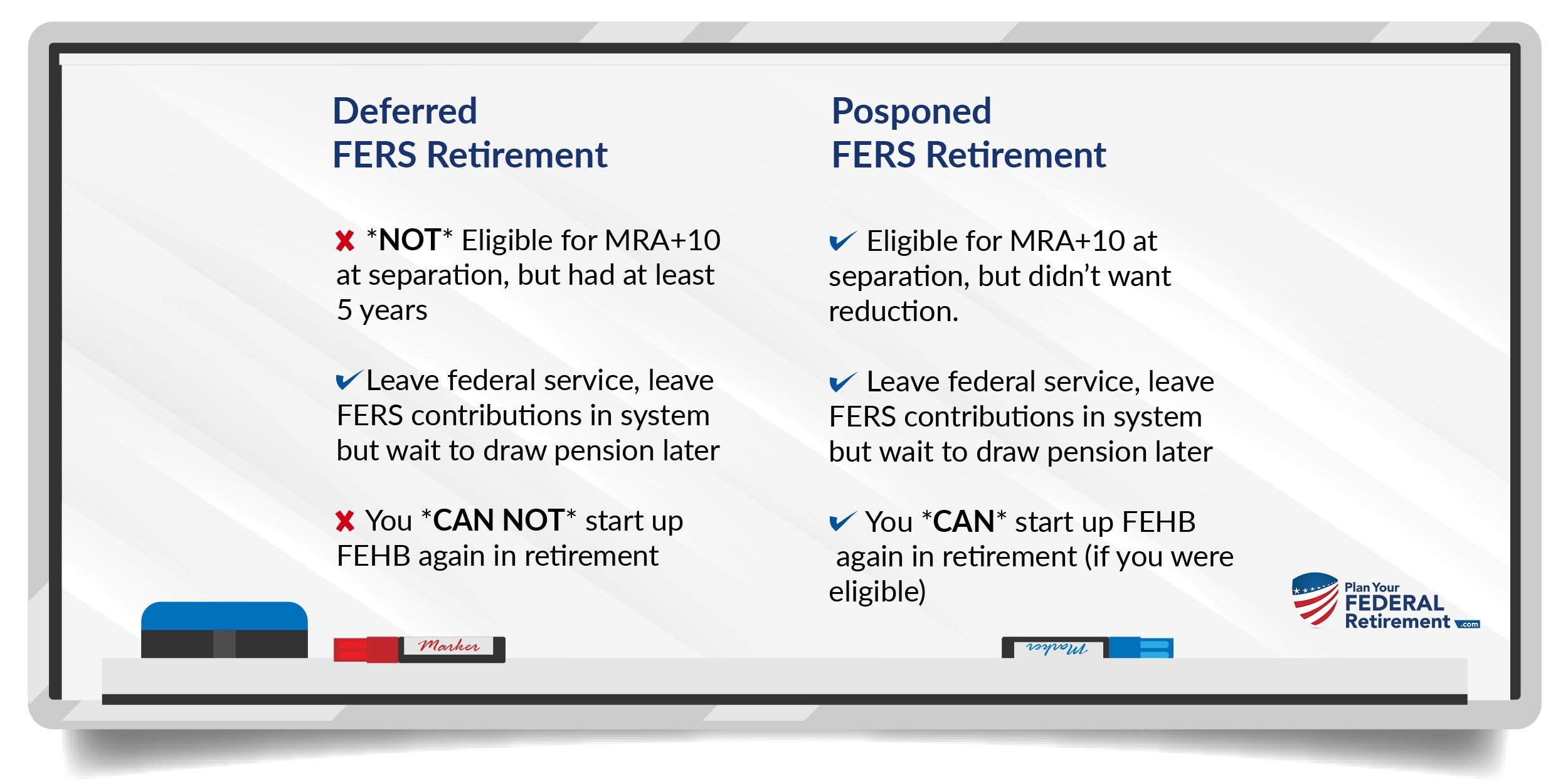

Assuming that you are not filing a Disability Retirement, which is another beast in and of itself, you have two choices to leave Federal Service before being eligible for an immediate annuity: Postpone your retirement or defer your retirement. ” (opm.gov)

They sound like a similar concept but they are totally two different animals.

FERS Bonus Retirement

When you meet the rules of eligibility for receiving a FERS pension (which OPM calls an “annuity”) your pension calculation is based on your Hi-Three and credible service using a 1% multiple.

But what about this FERS Bonus? What some Feds call the “FERS Bonus Retirement” which is what Katherine is referring to, is an extra 10% in retirement income because the multiple that OPM will use to calculate your retirement is 1.1%

Here is how.

If you retire at age 62 with at least 20 years of Federal Service you get a special retirement calculation for your pension – the FERS Bonus Retirement.

Note the requirements for the FERS Bonus: age 62 and with at least 20 years of creditble service.

Not age 61 and 10 months.

At age 61 and 10 months, Katherine elected to separate from Federal Service and chose to do so under a postponed retirement.

Post-Poned vs. Deferred Retirement

We go into the big differences between a postponed vs. a deferred retirement system here.

We will skim over the topic here just so that you can understand what choices that Katherine was making at the time but won’t go into it otherwise so that we can get into Katherine’s question more extensively.

Katherine chose to postpone her retirement because she had met her Minimum Retirement Age, had more than 10 years of creditable service and wanted to be able to leave Federal Service and resume Federal Employee Health Benefits (FEHB) in retirement.

When Katherine hired her “retirement consultant” who was a former HR person, she asked if there was anything that she should consider by leaving service at 61 and 10 months.

What a great time to mention that if Katherine were to work another 2 months she would qualify for the FERS Retirement Bonus calculation.

Katherine estimates that she lost out on $400 a month, which is $4,800 a year. If Katherine you are currently age 63 and you have a normal life expectancy of say… 88 years of age that is… well, let’s just stop here.

Not sure the math on this would make you feel any better. Instead, let’s look at solutions.

Solutions

Now we understand the costly mistake that bad advice on a FERS Postponed retirement caused so what options does Katherine have?

Well, Katherine, you could consider looking at getting rehired for a few months in any federal full-time position. I know that doesn’t sound ideal but if you are missing a few months, could going through the hassle of getting rehired be worth it?

We have not had clients do this before but it is an option that you could explore.

As for attorneys in this subject matter, we don’t have a specific point of contact that would be helpful regrettably.

As for recourse with the retirement counselor, I am not certain that a former HR Person has any fiduciary responsibility when they provide advice because they are skirting just outside the realm of providing financial advice normally.

We really wish that we could provide you, Katherine, with solid advice on how to rectify this situation but aside from seeing if you are eligible to resume employment under Federal Service we just aren’t sure what else can be done to provide you with the clear way to rectify having missed out on the FERS Retirement Bonus when you elected a postponed retirement.

Read through our 7 Retirement Mistakes to know what problems you might encounter and how to solve them.

Questions

If you have questions about your Federal Employee Benefits, please let us know. When you submit your question you might be featured on FERS Federal Fact Check where we help Federal Employees understand more about their FERS Benefits.

JC Shilanski