Are Postponed and Deferred Retirement the same?

Recently, when we met with a group of Federal Employees under the FERS system, they used the words “deferred” and “postponed” interchangeably to talk about electing to retire before they had reached their Minimum Retirement Age (MRA).

A deferred and a postponed retirement under FERS are N-O-T the same.

It is important to understand the difference between the two before you elect one on your pre-retirement paperwork.

If you have followed us online or taken our Route to Retirement course for Federal Employees than you know that we think that your Federal Employee Health Benefit is by far, hands down your greatest benefit as a Federal Employee.

It is such a great benefit, compared to the private sector, that we covet it and spend hours educating people so that they do not do anything to compromise losing that benefit into retirement.

That is why understanding the difference between a postponed and deferred retirement is critical – because without knowing and understanding the difference you could compromise your greatest benefit: FEHB.

Deferred Retirement

To defer something is to put it off until later. As a Federal Employee under FERS, you can elect to defer your pension you may be eligible for a deferred annuity at age 62 or the Minimum Retirement Age (MRA).

Your deferred pension is based on your length of creditable service and your hi-three salary when you separate from service.

To be eligible for a deferred pension (OPM calls your pension an “annuity” but here we will always refer to it as what it is, a pension) you must meet one of two requirements according to OPM:

“You have completed at least 5 years of creditable civilian service, then you are eligible for a deferred annuity beginning the first day of the month after you reach age 62. You have completed at least 10 years of creditable service, including 5 years of civilian service, then you are eligible for a deferred annuity beginning the first day of the month after you reach the Minimum Retirement Age (MRA)*” (https://www.opm.gov/retirement-services/fers-information/types-of-retirement/#url=Deferred-Retirement)

As a FERS Employee, if you completed ten years of creditable service but less than thirty years, you can receive a reduced pension if you draw it before age 62. In this case, your pension will be reduced by 5/12 of one percent for each month that you elect a deferred annuity before your 62nd birthday. This means that your pension will be reduced by 5% per year before you turn age 62.

Example, you are age 59 and elect to receive a reduced pension. There are 3 years before you reach age 62. Each year, your pension is reduced by 5% when you elect to take an early pension. That means 3 years X 5% = 15% reduction in your pension, permanently.

[The exception applies if you have 20 years of creditable service and your annuity begins when you reach age 60.]

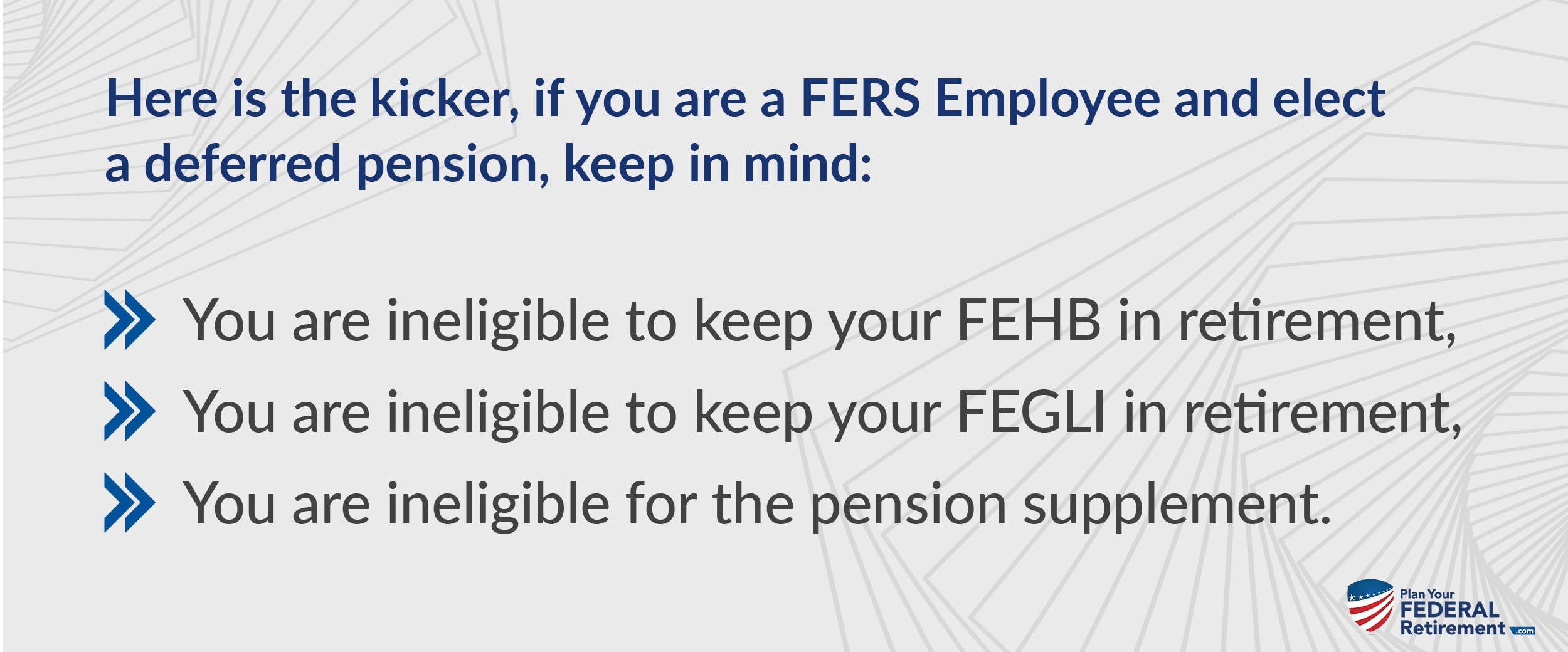

Here is the kicker, if you are a FERS Employee and elect a deferred pension to keep in mind:

- You are ineligible to keep your FEHB in retirement,

- You are ineligible to keep your FEGLI in retirement,

- You are ineligible for the pension supplement.

When you defer your FERS Pension, you will begin to receive your pension based on the length of creditable service that you have. For example,

If you elect a deferred retirement as a FERS Employee who has more than 10 years of creditable service, your pension will begin the first day of the month after you reached your MRA or at a later date that you select on your application for a deferred retirement.

If you elect a deferred retirement as a FERS Employee who has AT LEAST 5 years of creditable service but less than 10 years, you will receive your pension the first month after you reach age 62.

Now let’s explore how a postponed retirement, often referred to as a Voluntary Retirement by OPM, differs.

Postponed Retirement “Voluntary Retirement”

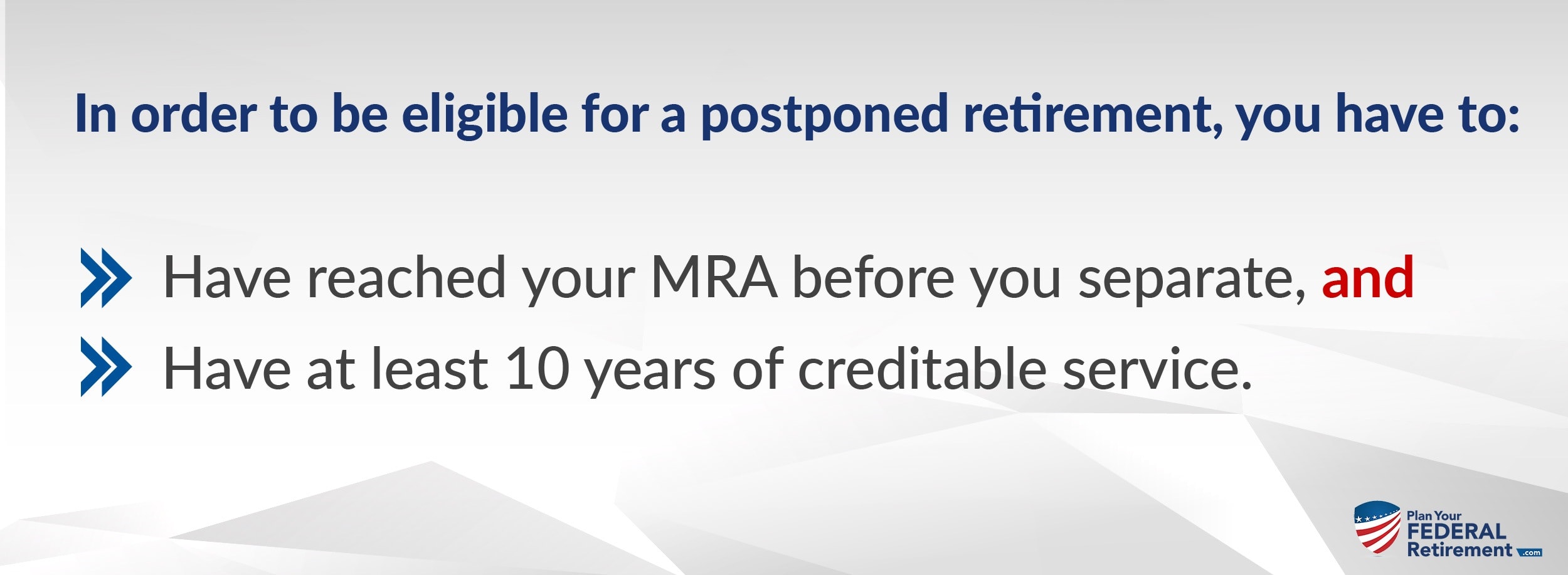

In order to be eligible for a postponed retirement you have to:

- Have reached your MRA before you separate and,

- Have at least 10 years of creditable service.

If you do not achieve these requirements, you are not eligible for a postponed retirement. However, if you elect to postpone your retirement it means that you were eligible for a reduced pension but you are electing to postpone receiving it until you have achieved a certain age. You are allowed to choose to postpone your annuity to any date in the future prior to, two days before your 62nd birthday.

The reason that most FERS who elect to voluntary retire and postpone their pension is to avoid the age reduction penalty. If you elect to postpone your retirement in this fashion, you can resume your greatest benefit – your FEHB.

If you postpone your FERS pension, you can temporarily continue your health benefits for 18 months from the date of your separation. To do this, you have to contact your agency and ensure that you are paying the total premium plus a 2% administration charge. Under a postponed retirement, when your annuity begins on the date you chose – you are eligible to begin your FEHB into retirement providing that you were previously enrolled in FEHB for 5 years when you were employed with the Federal Government. At this time, the Government will resume paying their share of the FEHB premium and you pay your share, just like when you were employed.

Your FEGLI benefit can also resume once in retirement when you are receiving a pension. You will not have FELGI Coverage when you separate service unless you are receiving your pension.

The Long-Term Care Insurance Program for Federal Employees can be enrolled in at any time by Federal Employees, whether you are receiving your pension or not. You are responsible for the premiums.

Which one is better?

That depends on your personal, financial situation. The benefits that you receive under the FERS are only a portion of your overall financial picture. You have to learn and understand how each benefit plays into your financial plan so that when it comes time to make a decision, to defer or postpone your retirement, you are able to do so informed.

We will be diving into these and other nuisances of your retirement system in our FERS Federal Employee Bootcamp soon!