“Hi, I am approaching retirement age am starting to gather data. I worked for the VAMC from 1982-1996. I think I have both FERS and CSRS pension benefits- but moved my Thrift Savings to Vanguard. How can I find out exactly what I am eligible for? And how can I file to start collecting? Thank you! Robyn”

Thrift Savings Plan (TSP) After Federal Services

When you leave Federal Service you have several options for your Thrift Savings Plan (TSP). As a Federal Employee, you have multiple aspects as to what makes up your retirement benefits. Amongst them are your FERS Pension, Thrift Savings Plan, and Social Security.

When you leave Federal Service, the benefits that you have earned from contributing to the TSP and Social Security can leave with you.

Because your contributions to the TSP are yours, they are portable once you leave Federal Services and as a former employee, you can transfer those funds to an IRA when you leave Federal Services or simply leave them in the TSP office.

For example, Robyn transferred her TSP account to Vanguard after Federal Services; this does not impact any basic benefits she would/could receive from being a Federal Employee.

What you pay into Social Security and what your federal agency pays both contribute to part of your earnings history. You can review your earning history by logging into your account at ssa.gov. So, if you haven’t created an account online with the Social Security Administration office, jump online and do so! It’s not nearly as painful as you think.

Those are the first two legs of your retirement stool, the third is your FERS Basic Benefit.

As an employee, your payroll deductions are what your agency withholds from your pay; the costs of the Basic Benefit and Social Security. Your agency contributes to both as well. If you meet the eligibility requirements, after you retire you will receive a pension each month for the rest of your life. You will often hear this pension referred to as an annuity benefit.

Robyn moved her TSP to Vanguard. Now the question is does she have any other benefits from her time with the Federal Government?

Checking Federal Services

An important homework assignment that we insist our clients do is request copies of all of their Standard Form 50’s from Federal Service. These forms give a good history of your employment with the Federal Government. Box 30 of your SF-50 lists which retirement system you are in. For each change in your employment, a raise, transfer, step increase, etc., you will have received a new form.

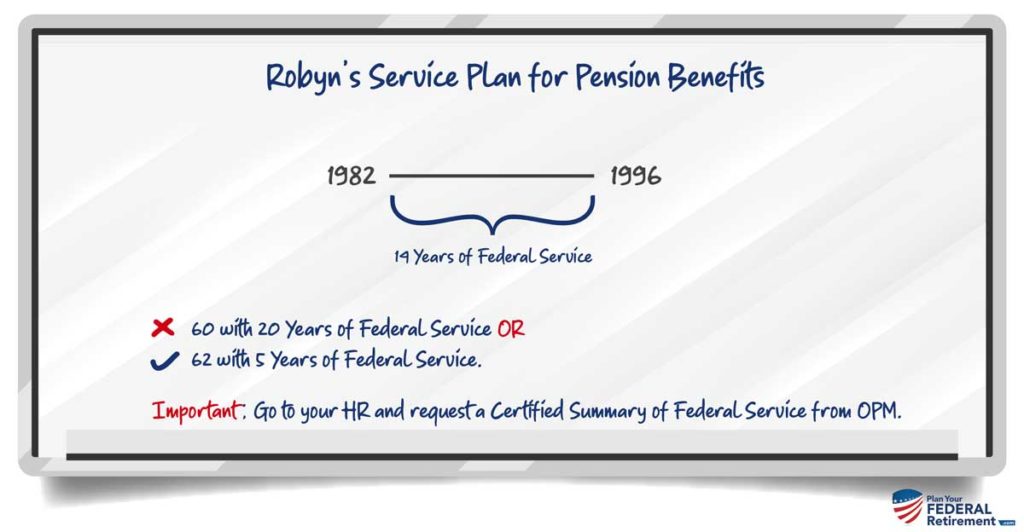

The best place to check your Federal Service eligibility is going to be with the Office of Personnel Management (OPM); especially if you are no longer in Federal Service. You can request a Certified Summary of Federal Service from OPM to provide you with the information on your Federal Employment to make a decision.

You will want to give yourself plenty of lead way to get the information from OPM. In our experience, they are always wonderful to work with but generally, like many agencies, are backlogged. Allow yourself 3 to 6 months to get the information that you need from their offices.

Potentially, you could receive pension benefits from the Federal Government if you had at least 5 years of Federal Service and did not withdrawal your retirement benefits when you left.

In Robyn’s case, she was employed during two periods of time in which there were major changes made to the Federal Retirement System. What Robyn will need to check is to see which retirement system she paid into, CSRS or FERS or… both! That is to say, this is employment with the government – it may not be crystal clear.

CSRS or FERS Retirement Benefits

When Robyn began Federal Service in 1982, the Federal Government was using the Civil Service Retirement System (CSRS) to provide eligible full-time employees with retirement benefits.

From August 1, 1920 until 1984, the CSRS was in effect.

After that, the Federal Employee Retirement System (FERS) replaces the CSRS in 1987.

1984 CSRS Ends.

1987 FERS Begins.

…

Yep, you did your math right; there was a three year gap between Retirement Systems. If a federal employee was hired or fired during this time period, they could elect to make changes to the retirement system they were in.

Robyn is employed with the Federal Government between 1982 and 1996. If she worked for the Federal Government the entire time during this time frame, then she had 14 years of Federal Service. As a result, she could have elected to remain in CSRS or have elected to go under FERS. In order for Robyn to know, she will need a record of her earnings history to see which retirement system she paid into.

Under both CSRS and/or FERS, retirees must be age 60 with 20 years of service or 62 years of age with at least 5 years of Federal Service.

In Robyn’s case, she will need to be at least 62 years of age. If Robyn left her pension benefits in the CSRS or FERS retirement system, she could be eligible for retirement benefits under a Deferred Retirement application.

Deferred Retirement

At your minimum retirement age (MRA) or age 62, you could be eligible for retirement benefits from the Federal Government if you meet their eligibility requirements.

At age 62, to be eligible for a Deferred Retirement you must have been employed for 5 years with the Federal Government.

After you have reached the MRA, you are eligible for a deferred pension if you met specific requirements. Therefore, you must have completed at least 10 years of creditable service, including 5 years of civilian (non-military) to be eligible.

Keep in mind that not all retirement applications are treated equally. Postponed and deferred retirements are not the same application nor will they provide the same benefits.

Health Benefits and Life Insurance Under Deferred Retirement

If you applied for a Deferred Retirement you are not eligible to continue your Federal Employee Health Benefits and/or Federal Employee Group Life Insurance benefits.

For those to continue in retirement, your retirement application will need to be postponed, assuming you met the eligibility requirements

Questions?

We love to receive your questions! Please send us a question that you would like featured in our bi-weekly FERS Federal Fact Check. We love to work through your questions and share the knowledge that we have gained in helping Federal Employees plan for their Financial Futures.

JC Shilanski