“I am 60. I plan to work till 70. All bills will be paid off including house sept 2021. House value now 431,000. Tsp 300,000 , 31 years in postal service Should have 41 at 70 years old. Should I stay until 70 or retire sooner? What considerations should I factor in?” -Dave

When is the best time to retire as a Federal Employee?

When you have 20+ years of Federal Service and are eligible for an immediate, unreduced retirement does it make sense to keep working?

One piece of advice that we encourage Federal Employees to follow is to prepare for retirement as soon as they are eligible.

This does not mean stop working, this means structure a financial plan around living off of your anticipated retirement income the soonest that you are eligible to retire.

For example, Dave is age 60 and eligible to retire now. However, he does not have to retire, and kind of sounds like he may enjoy his work with the United States Postal Service. If he wants to keep working until he reaches age 70 he still should prepare financially as if he was going to retire at age 60.

This allows for a financial freedom that might make working additional years more of a choice and less of a “have to” scenario.

If you are financially prepared for retirement and another 2008 Global Financial Crisis or a March 2020 Global Shutdown occurs, you can make an informed decision from a dispassionate (as much as possible) point of view.

Continuing to work then becomes a choice.

Living off of your FERS Pension

When you are about 10 years away from retirement, or closer, you need to start calculating your estimated retirement benefits under FERs.

You can request a benefit estimate from your Human Resources (HR) within your agency.

The estimate is just that – an estimate – it is not a complete audit of your personnel file. When you retire, the Office of Personnel Management (OPM) will audit your entire personnel file to ensure that your years of creditable service are correct.

Too often this is the gravest mistake we see Feds make. They assume that their estimate is 100% accurate because it came from their HR.

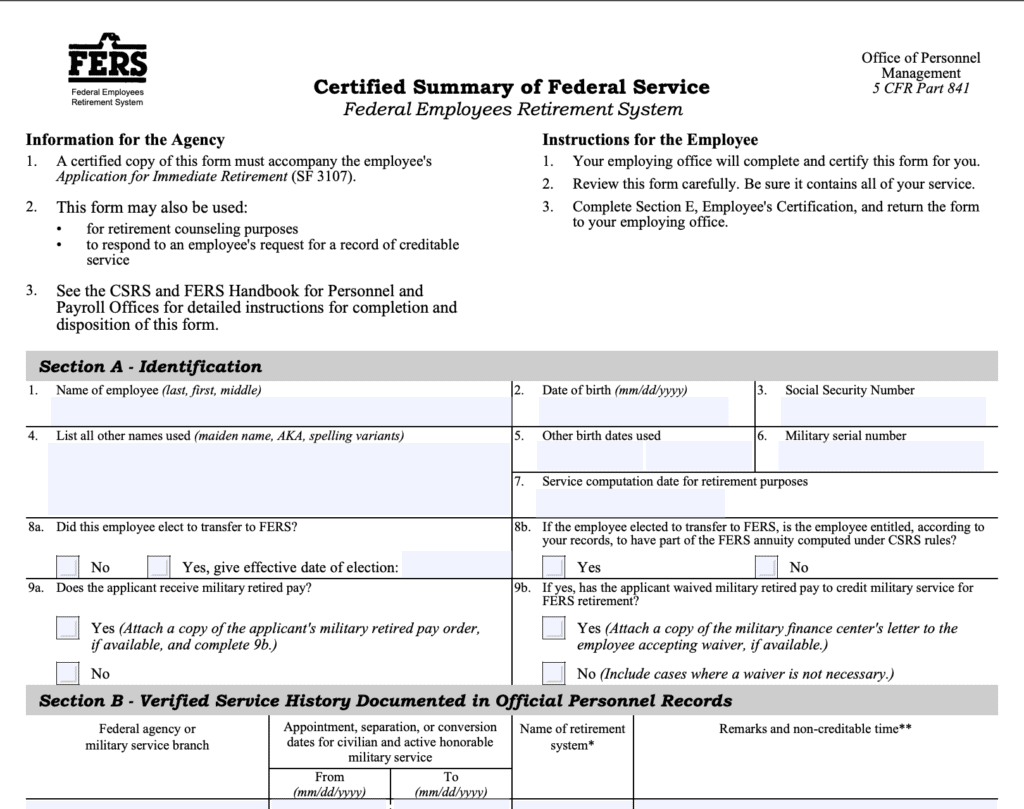

While the ballpark estimate from your HR can give you a good idea of what your anticipated pension will be, you will want to complete a Certified Summary of Federal Service BEFORE you retire – 12 to 18 months prior to retirement if possible – to ensure that the years of service you think you have match what OPM thinks you have.

If your years of creditable service are wrong on your Certified Summary of Federal Service you can work with OPM figure out what happened. This is why we encourage you to complete the Certified Summary of Federal Service BEFORE you retire.

When you have your estimated pension, remember to review the gross number vs the net. The net number is what you want to make your retirement decisions based on.

If you can start living off of your estimated retirement benefits before retiring, you stand a greater probability of having a financially successful retirement.

If you are not able to live off of your retirement benefits, you will want to talk with one of our Financial Advisors about how you can bridge the gap between your pension and your lifestyle. Most people find that they are not able to live off of just their FERS pension so if you also find yourself in this category that’s ok, it’s normal.

How to check your years of creditable service

By completing a Certified Summary of Federal Service form with your Human Resources department you can audit your years of creditable service and ensure that what you think counts towards retirement, actually does.

You can complete a Certified Summary of Federal Service by filling out Form SF 3107 which states that a Federal Employee may request a record of creditable service from time to time.