“If I choose to contribute to the ROTH Component of the TSP, how much can I contribute? Will ROTH TSP Contributions effect my Traditional TSP contributions?” C.

We have witnessed an overwhelming response from people inquiring about how they can effectively use their Thrift Savings Plan (TSP) to help them plan for their financial futures. One of the most frequently asked questions that we receive is regarding how the TSP Traditional and ROTH components work.

C. asks us that very question this week in FERS Federal Fact Check; how much can she contribute and how do the two “accounts” interact. Are there limits to how much you can contribute to the ROTH TSP? and how do those contributions impact others?

Yes, C., there are limits to what can be contributed to the TSP. The limit in the year 2019 is $19,000 with a $6,000 catch up for those ages 50+.

The contributions that you make to the ROTH TSP are aggregate of all other TSP contributions. You cannot exceed the annual limit but how you choose to contribute is up to you. Meaning, you can put $9,500 into the Traditional if you wanted to and $9,500 into the ROTH but the total of the contributions that you make in a year cannot exceed the limit of $19,000 for 2019. Or some variation thereof.

Keep in mind, even if you put 100% of your employee contributions into the ROTH TSP, the Employers contributions are always going to be put in the Traditional TSP.

One clarification that is helpful is to understand that as a FERS Employee, you have one Thrift Savings Plan (TSP). If you choose to participate in the Traditional, ROTH or a combination of both (yes, you can mix and match) that doesn’t mean you have multiple TSP accounts.

What you are electing when you choose Traditional or ROTH components for your contribution is how you want your monies taxed at the time you participate.

Thrift Savings Plan: Pre and Post Tax Components

The Thrift Savings Plan (TSP) is an employer-sponsored retirement account. While working, you are allowed to defer a portion of your income into the TSP; this is done online or through a salary deferral election form.

When you elect to have some of your earning income placed in the TSP you have to decide where your contributions will go; into a Pre or Post Tax account.

The Pre Tax Account is the Traditional component of the TSP.

The After-Tax Account is the ROTH Component of the TSP.

Pre-Tax Account: The first “bucket” is the Traditional element. This allows you to make contributions on a tax-deferred basis. When we defer taxes, that means that we are putting them off until later.

The money that is put in the Traditional TSP is done so on a pre-tax basis. When these funds are withdrawn later, at a qualifying age, they are considered taxable income.

After-Tax Account: The after-tax account is called the “ROTH” TSP. This account was named after Senator Roth who helped pass the legislation allowing monies made to be invested on an after-tax basis to this account.

When you make a contribution to the After-Tax account of your TSP, the ROTH, your funds grow tax-free. You already paid taxes when you made the contribution so when you go to withdraw those funds, once you meet eligibility requirements, they are tax-free.

TSP & ROTH TSP Contribution Limits

Each year the Internal Revenue Code publishes the allowable limits for contributing to retirement accounts.

There are a few categories that you as a FERS Employee should be aware of: Employer-Sponsored and Non-Employer Sponsored.

An Employer Sponsored plan is one in which your Employer receives favorable tax treatment for providing. Employees are incentivized to participate in these plans by providing a “match” contribution and significantly higher contribution limits than in the private sector.

The Thrift Savings Plan (TSP) is an Employer Sponsored plan. This makes the contribution limits much higher than those of an Individual Retirement Account (IRA).

A Non Employer plan is an investment account that you own privately called an Individual Retirement Accounts (IRA). They too have annual limitations as to how much you can contribute. A Non-Employer plan like a ROTH IRA has much lower contribution limitations.

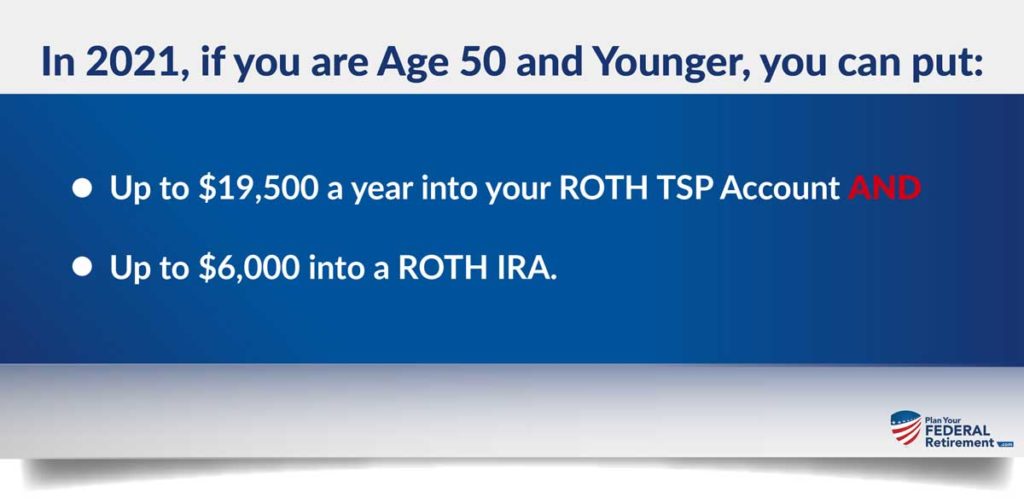

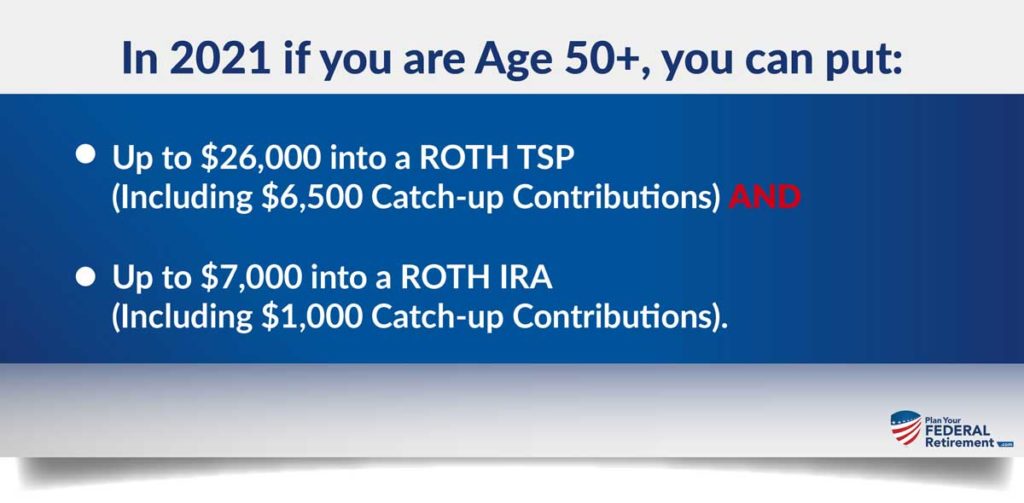

You can have and contribute to both a TSP ROTH and a ROTH IRA each year.

Remember, with an IRA, ROTH IRA, and TSP ROTH you have to reach age 59 1/2 before you can withdraw those funds without penalty. Also, with the ROTH IRA and TSP ROTH, you have to have had the account open for longer than 5 years.

Now that you know how to put money into your TSP, whether it is through the Traditional TSP or the ROTH TSP, let’s look at what taxable consequences are when it is time to withdrawal the monies from either of these accounts.

Thrift Savings Plan Employer Contributions

Employer contributions to the TSP will always made to the Pre-Tax Account.

Even if 100% of the employee’s contributions are made to the ROTH TSP, the Employer’s contributions will be made to the Pre-Tax TSP account.

Thrift Savings Plan Pre-Tax Withdrawals

However, any monies you take out of this account are subject to income taxes. Because this account is made on a pre-tax basis, when funds are withdrawn, taxes will be owed at your ordinary income tax rate.

Thrift Savings Plan After-Tax:

The ROTH has different eligibility rules to withdrawal monies. To take your monies out penalty and tax-free, from the ROTH TSP you have to be:

- Age 59 1/2 AND

- Have had the ROTH TSP open for the last 5 years.

If not, the withdrawal you make is subject to penalty and taxes.

Can You Have Both a Traditional and a ROTH TSP?

Yes; I mentioned earlier that the TSP is one account. However, your contributions go into either the Pre or After-Tax Category based on your elections. You can choose online how you want your monies divided.

You can elect to participate some of your contributions into the Pre and some into the After-tax portions if you should like.

Choosing between Pre and After-Tax Contributions to your TSP is a financial planning question. You want to look at your cash flow first to know what you can tolerate and secondly, at your anticipated tax earnings for the year for your household.

Tax planning is a really critical aspect of financial planning. You will want to assess which makes more sense financially for you to participate in tax savings today or tax savings in the future.