Answering Retirement Questions

If you have questions about your retirement from Federal Service, we can help!

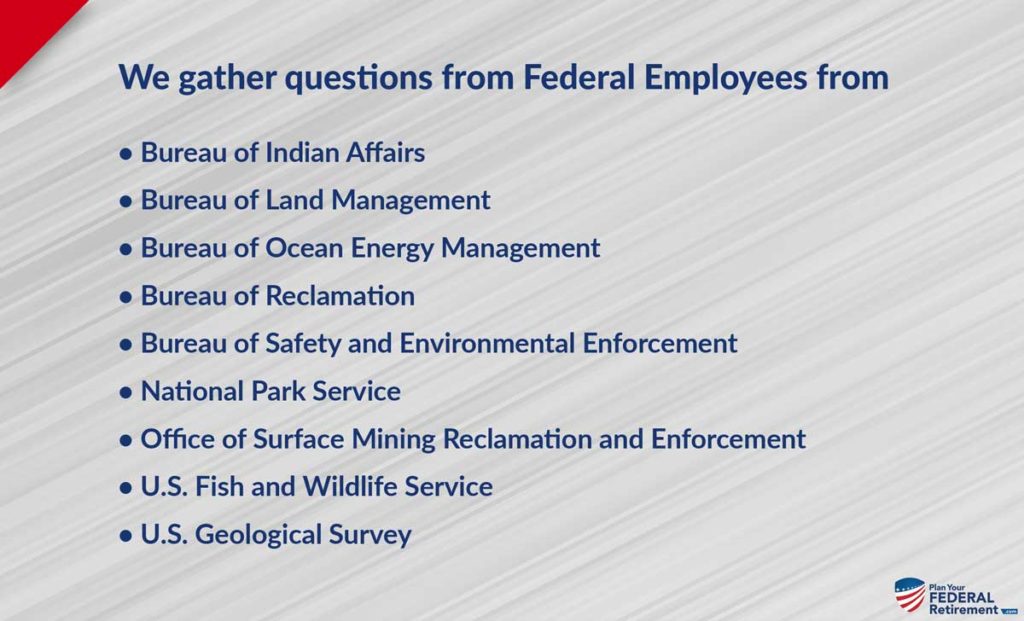

Our FERS Federal Fact Check for Federal Employees who work with the Department of Interior and respective bureaus like NPS, USFWS, NOAA, IHS, BIA, and USGS helps shed light on complex, tough questions that Federal Employees have.

We gather real questions from real Feds who are seeking answers as to how their benefits work.

Questions that often times they have exhausted themselves trying to get answers to from their Human Resource (HR) department and have been unable to.

Twice a month we send out our eZine called, “FERS Federal Fact Check”.

Questions are submitted from REAL Federal Employees and the content is packed with rich, informative information that applies to Federal Employees.

Questions are answered by Financial Advisors who specialize in Federal Employee Benefits.

That is why we have been able to help answer questions from Feds like,

“If one of my priorities is to provide for my spouse after I’m gone and my strategy is to leave my TSP untouched and “will” it to her is that going into the OI bucket of would she get it all. I ask because I’m about a decade older and have a pretty good ROTH IRA that will carry me all the way to 70 where I can start drawing max SS payments. I’ve really enjoyed all your videos and share with many friends, I’m hoping you can answer this question.”

– Mike

“Do I need Medicare Part B if I already have FEHB?”

-Olivia

“Your TSP is an asset that can be given to future generations and your Social Security is not. As the “condition” of Social Security worsens, why is not a good idea to conserve your “willable” asset and start taking your Social Security at age 62? Thanks for all your interest in the Federal Retirees. “

-Jeff

“I plan to retire in the next few months from my agency and take my health insurance with me. I am debating signing up for Medicare Part B, I have Medicare Part A now when I do my understanding is that I can just take my Blue Cross Blue Shield into retirement and pay those co-pays as I do now. Or, I could pay the Medicare Part B premium out of my social security that I am already getting and Medicare becomes primary and BCBS becomes secondary and there should be virtually no out of pocket costs.”

Planning to Retire

Whenever we host a Federal Employee Benefits Class we jokingly ask, “Who loves their job” and the room shoots up with hands.

Next, we ask, “Who would do their job for free if they could?”

Then we wait…

Some hands go down but we know whose hands are going to be staying up, unwavering.

The hands that remain in the air are most frequently from those that work in NPS, USFWS, NOAA, and USGS. These Feds love their jobs!

They are passionate about their commitment to the community and even after decades of Federal Service they are really pleased with their career paths.

But there is a reason that they are going through a retirement class.

No matter how much you love your job you may be at the point in your life where it is time to plan your retirement from Federal Service.

If you are under FERS you do not want to miss the opportunity to receive our FERS Federal Fact Check ezine.

Retirement Systems for Department of Interior Employees

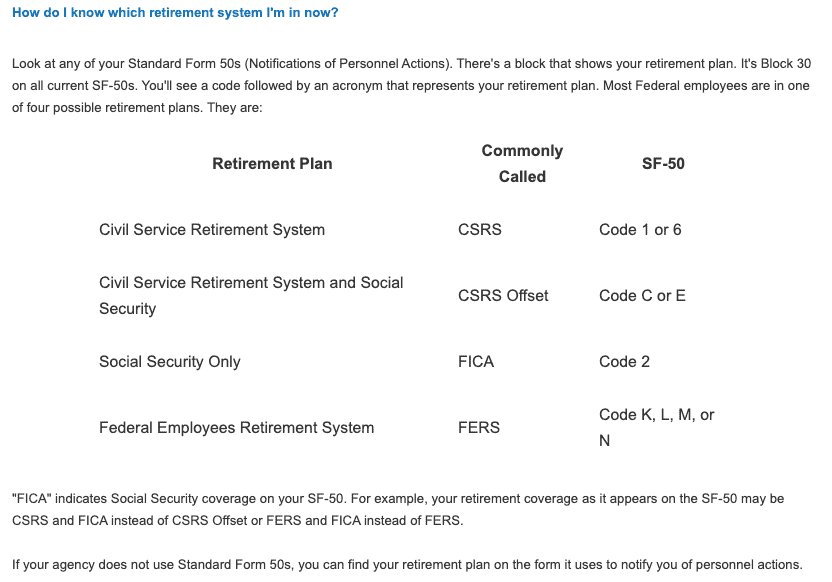

If you were employed with the Department of the Interior (DOI) before January 1, 1987, you may under the Civil Service Retirement System (CSRS), be a CSRS-offset or have elected at that time to change to the Federal Employee Retirement System (FERS).

As a Department of Interior employee, you can determine which retirement system that you are in by following the guide below:

FERS Retirement System for Department of Interior Employees

If you joined Federal Service after January 1, 1987, you were enrolled in the Federal Employee Retirement System known as “FERS”.

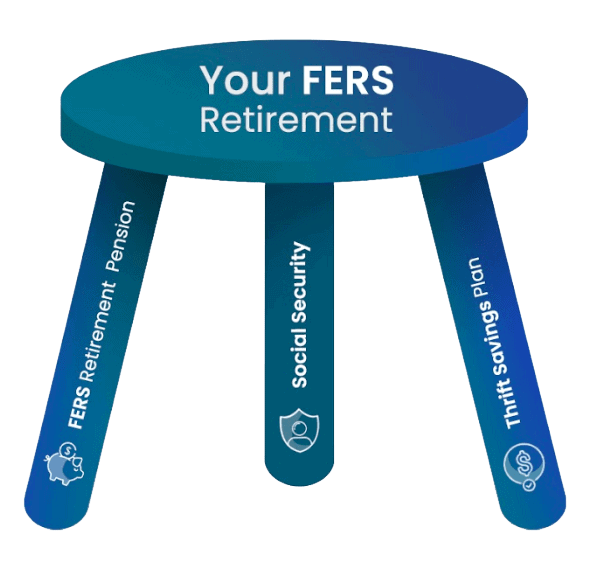

Under the FERS, your retirement is a three-legged stool that consists of your FERS Retirement Pension Income, your Social Security income and your retirement savings like your Thrift Savings Plan.

We can’t wait to send you the FERS Federal Fact Check e-Zine.!